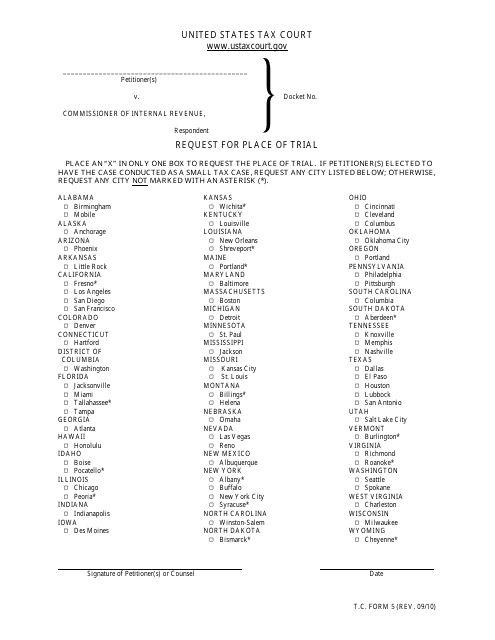

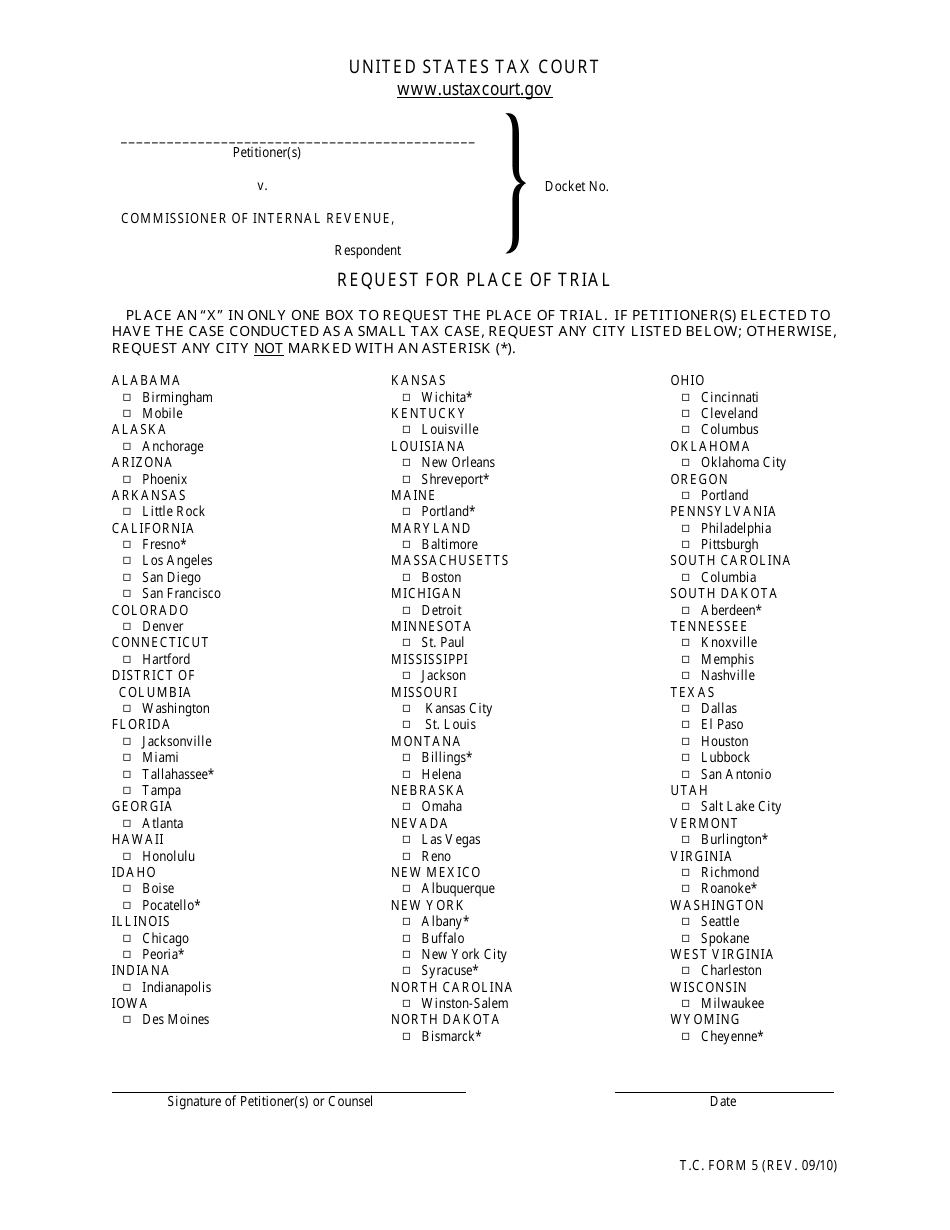

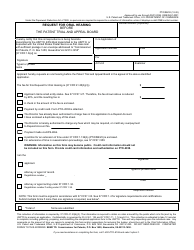

T.C. Form 5 Request for Place of Trial

What Is T.C. Form 5?

This is a legal form that was released by the United States Tax Court on September 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 5?

A: T.C. Form 5 is a Request for Place of Trial form.

Q: What is the purpose of T.C. Form 5?

A: The purpose of T.C. Form 5 is to request a specific place for the trial of a case.

Q: Who fills out T.C. Form 5?

A: The form is typically filled out by the plaintiff or the defendant in a legal case.

Q: Do I need to file T.C. Form 5?

A: If you want to request a specific place for your trial, then you need to file T.C. Form 5.

Q: Is there a deadline for filing T.C. Form 5?

A: The court may have specific deadlines for filing T.C. Form 5. It is important to check with the court to ensure timely submission.

Q: What happens after I file T.C. Form 5?

A: After you file T.C. Form 5, the court will review your request and make a decision regarding the place of trial.

Q: Can the other party object to my request on T.C. Form 5?

A: Yes, the other party has the right to object to your request for a specific place of trial.

Q: What should I do if I receive an objection to my request on T.C. Form 5?

A: If you receive an objection, you may need to attend a hearing or follow other procedures as directed by the court.

Q: Can I change my request after filing T.C. Form 5?

A: The court may allow you to amend your request for place of trial, but it is important to consult with the court for their specific rules and requirements.

Form Details:

- Released on September 1, 2010;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 5 by clicking the link below or browse more documents and templates provided by the United States Tax Court.