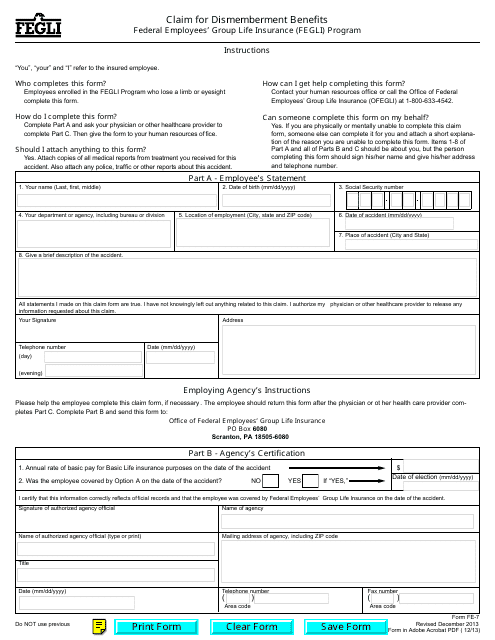

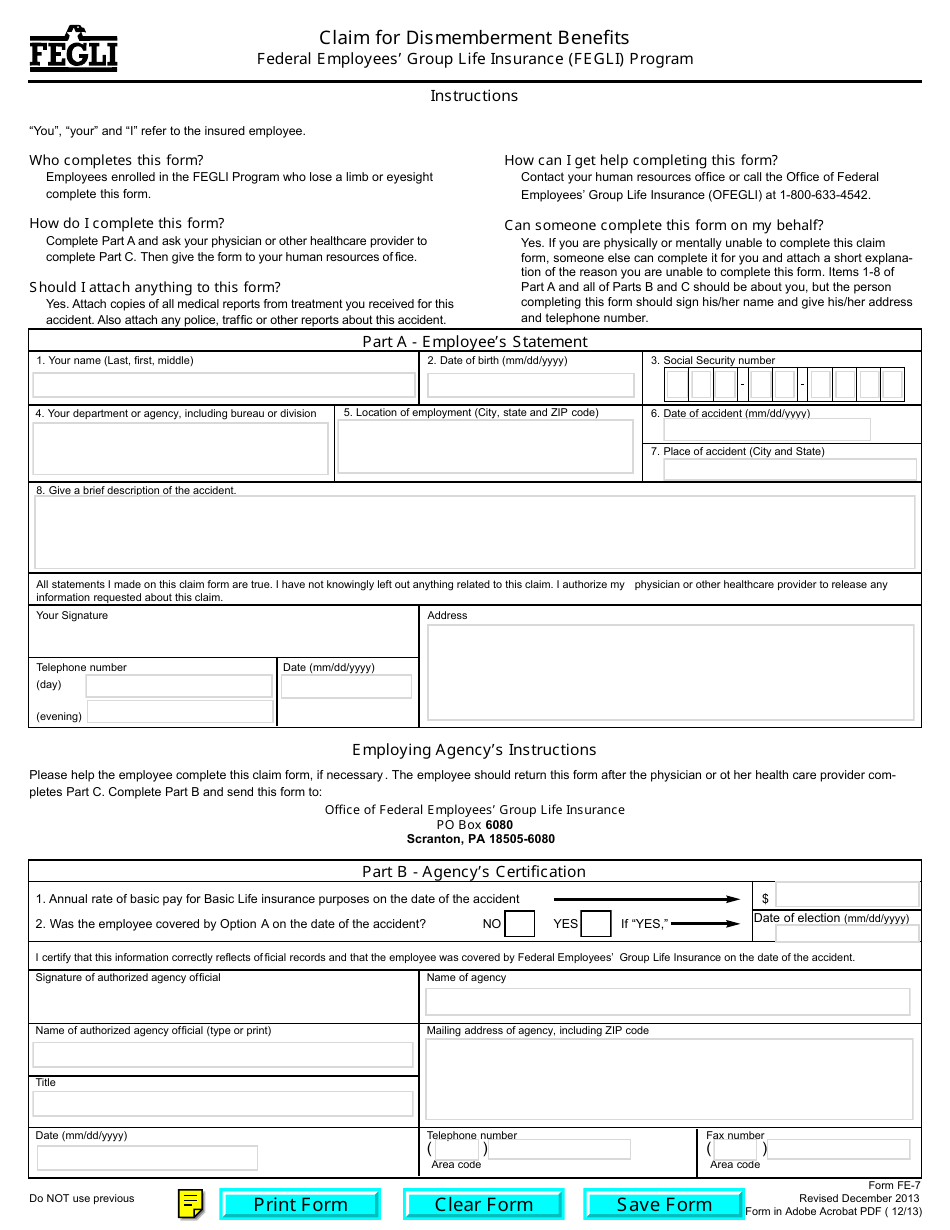

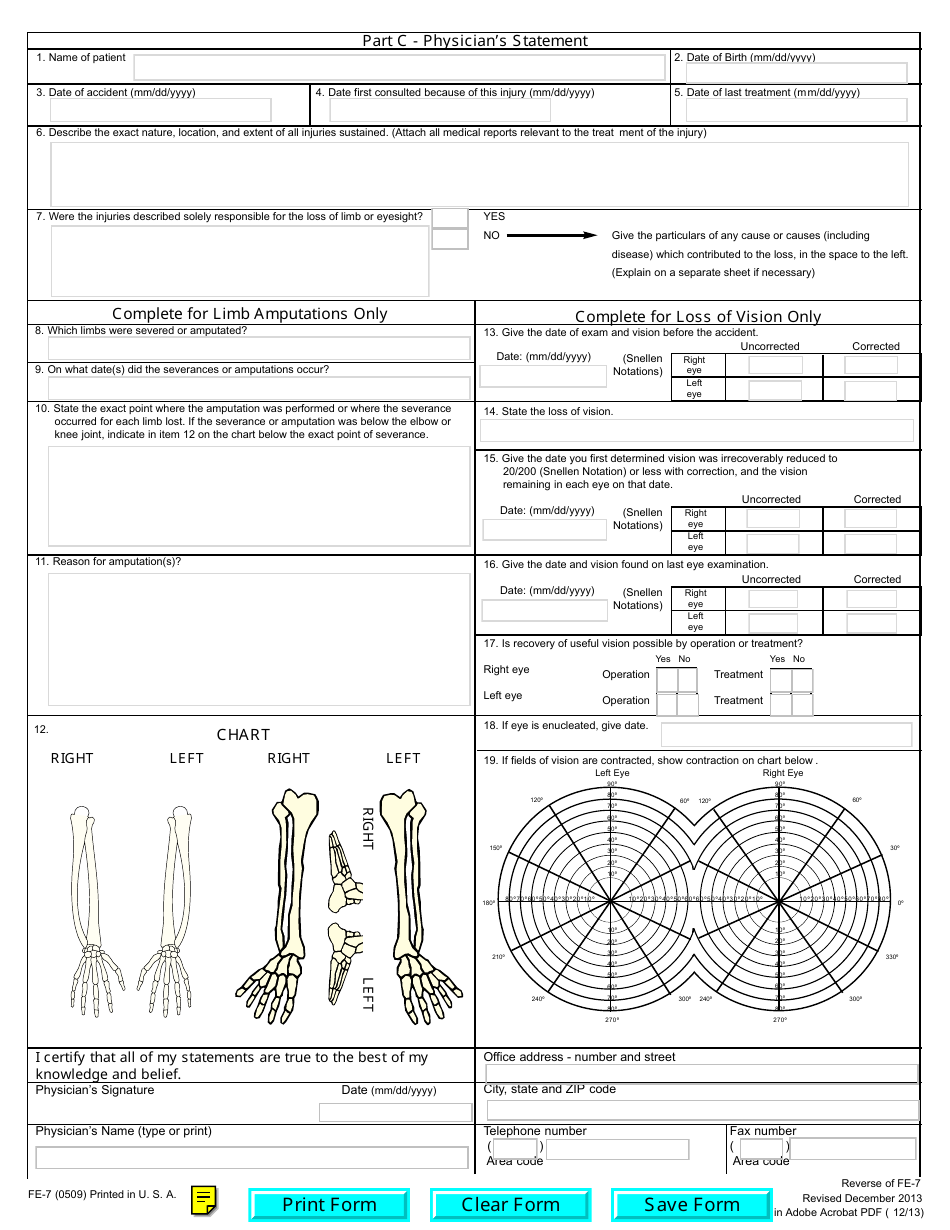

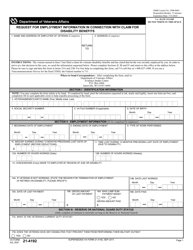

OPM Form FE-7 Claim for Dismemberment Benefits

What Is OPM Form FE-7?

This is a legal form that was released by the U.S. Office of Personnel Management on December 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OPM Form FE-7?

A: OPM Form FE-7 is a claim form for dismemberment benefits.

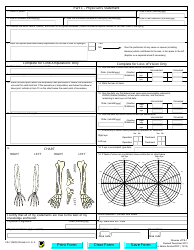

Q: What are dismemberment benefits?

A: Dismemberment benefits are compensation provided in case of loss or impairment of certain body parts due to an accident.

Q: Who is eligible to claim dismemberment benefits?

A: Federal employees, including members of the Armed Forces, and their eligible dependents are eligible to claim dismemberment benefits.

Q: What should I do after completing OPM Form FE-7?

A: After completing OPM Form FE-7, you should submit it to the Office of Personnel Management (OPM) for processing.

Q: Are dismemberment benefits taxable?

A: No, dismemberment benefits are generally not taxable.

Q: What happens if my claim for dismemberment benefits is approved?

A: If your claim for dismemberment benefits is approved, you will receive compensation based on the specific body part that is lost or impaired.

Q: What should I do if my claim for dismemberment benefits is denied?

A: If your claim for dismemberment benefits is denied, you may have the option to appeal the decision or seek further assistance from the Office of Personnel Management (OPM).

Form Details:

- Released on December 1, 2013;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OPM Form FE-7 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.