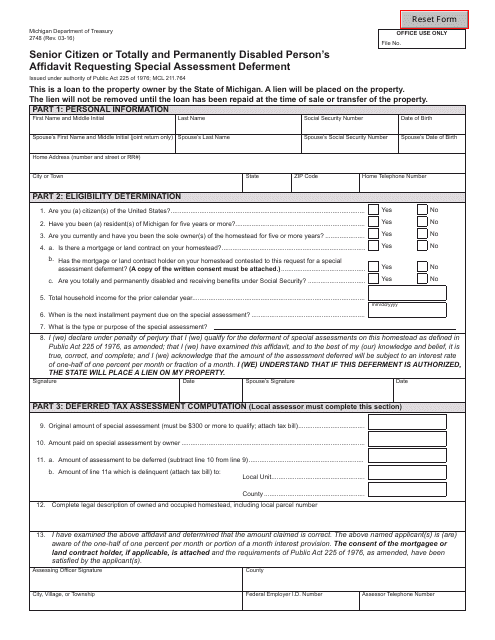

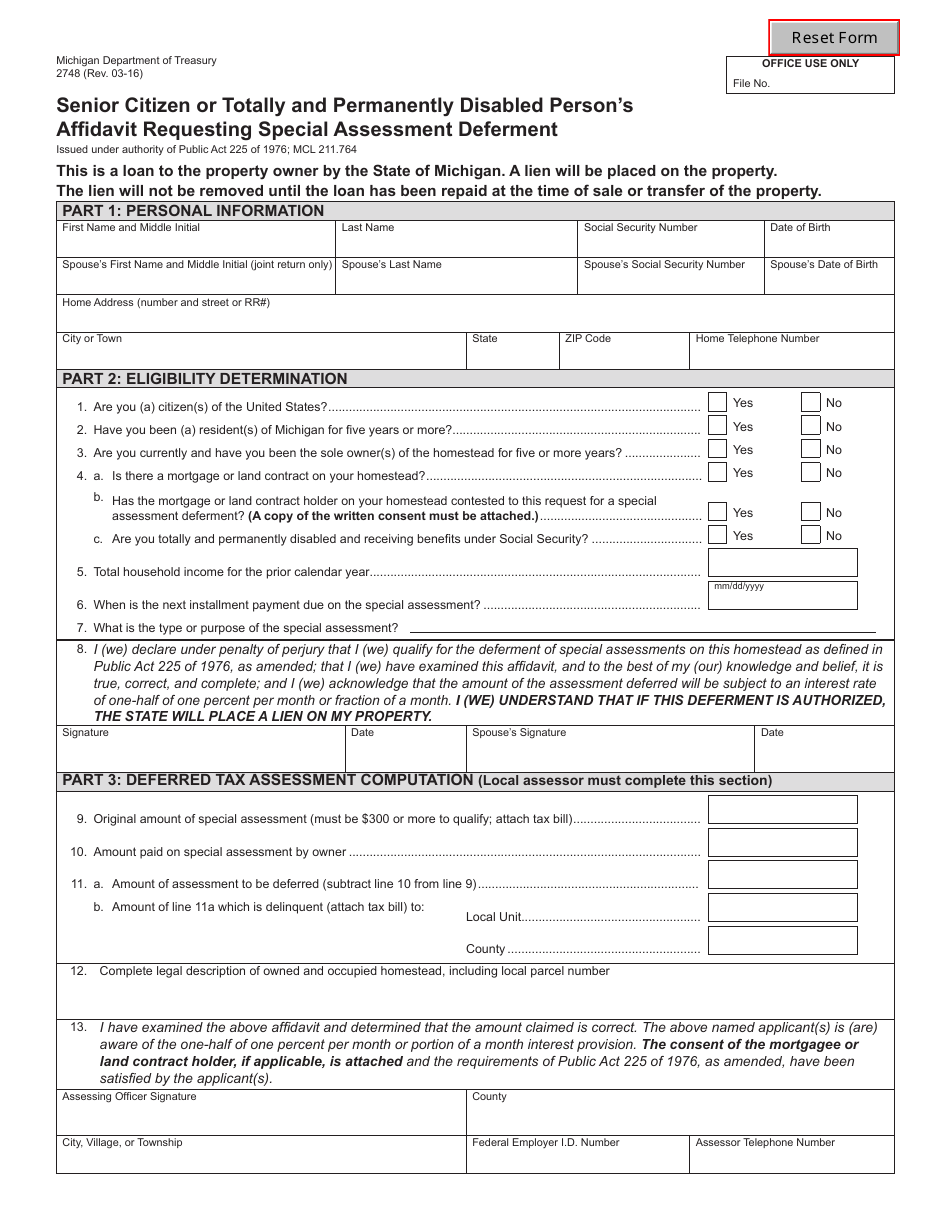

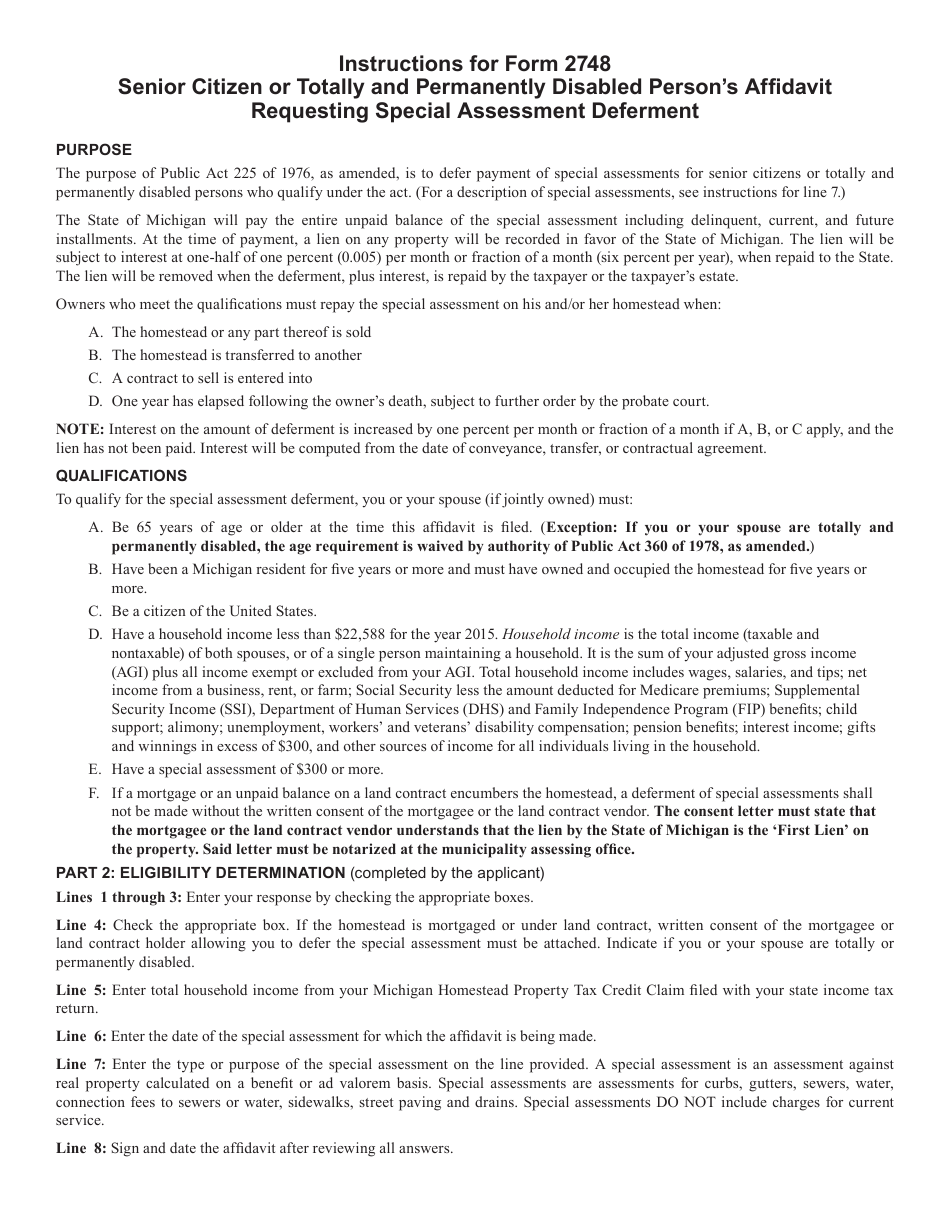

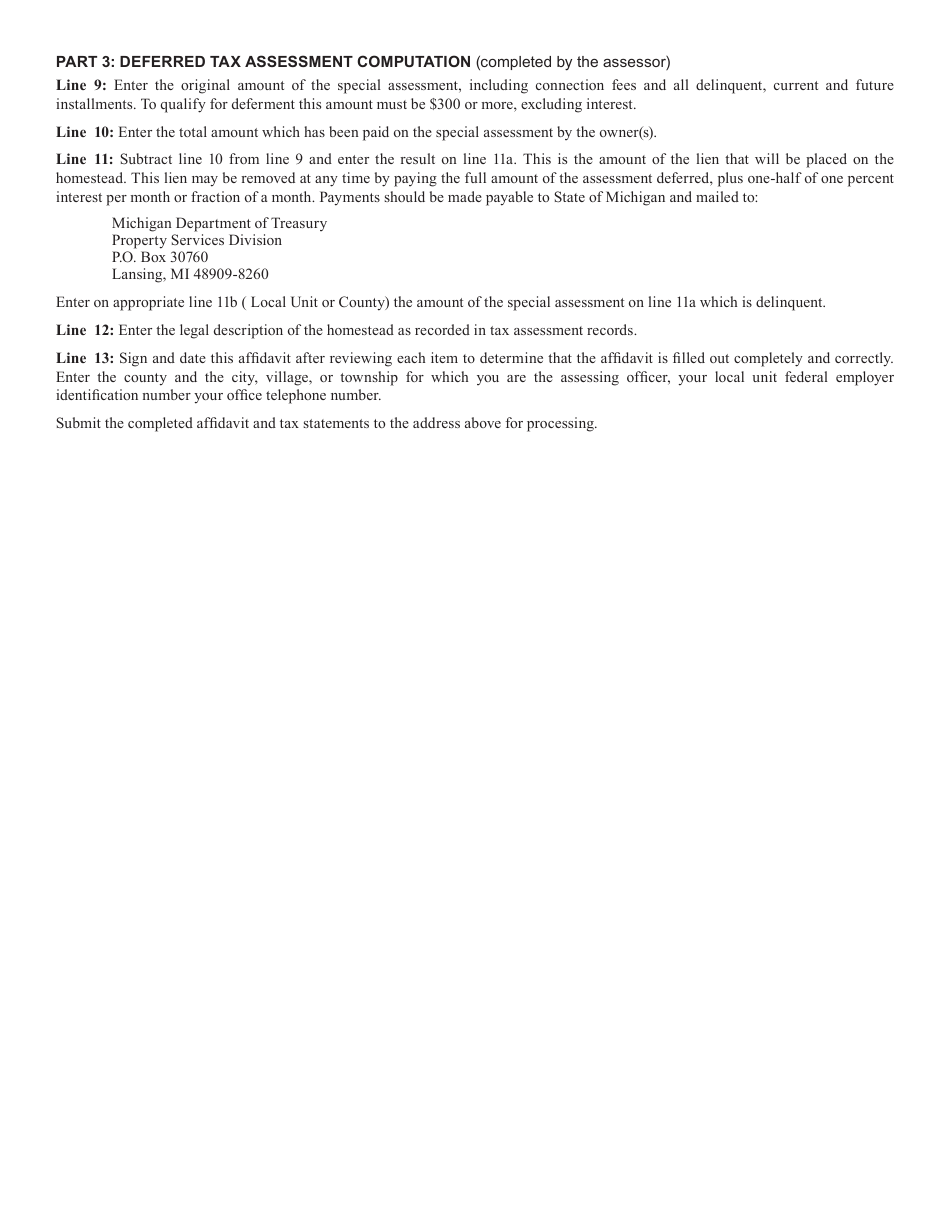

Form 2348 Senior Citizen or Totally and Permanently Disabled Person's Affidavit Requesting Special Assessment Deferment - Michigan

What Is Form 2348?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2348?

A: Form 2348 is the Senior Citizen or Totally and Permanently Disabled Person's Affidavit Requesting Special Assessment Deferment in Michigan.

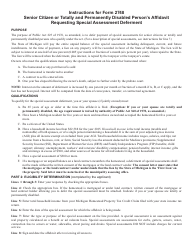

Q: Who is eligible to use Form 2348?

A: Senior citizens or individuals who are totally and permanently disabled in Michigan are eligible to use Form 2348.

Q: What is the purpose of Form 2348?

A: The purpose of Form 2348 is to request a special assessment deferment for senior citizens or disabled individuals in Michigan.

Q: What does a special assessment deferment mean?

A: A special assessment deferment means that the payment of certain property taxes can be postponed for eligible senior citizens or disabled individuals.

Q: Are there any requirements for using Form 2348?

A: Yes, there are certain requirements for using Form 2348, such as meeting age or disability criteria and having a certain income level.

Q: What should I do after completing Form 2348?

A: After completing Form 2348, you should submit it to your local assessor's office along with any required documentation.

Q: Can I use Form 2348 for properties located outside of Michigan?

A: No, Form 2348 is specific to properties located in Michigan.

Q: Are there any deadlines for submitting Form 2348?

A: Yes, Form 2348 should be submitted to the assessor's office by May 1st of the year for which the special assessment deferment is being requested.

Q: What happens if my application for special assessment deferment is approved?

A: If your application is approved, you will receive a deferment of payment for the specified special assessment on your property.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2348 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.