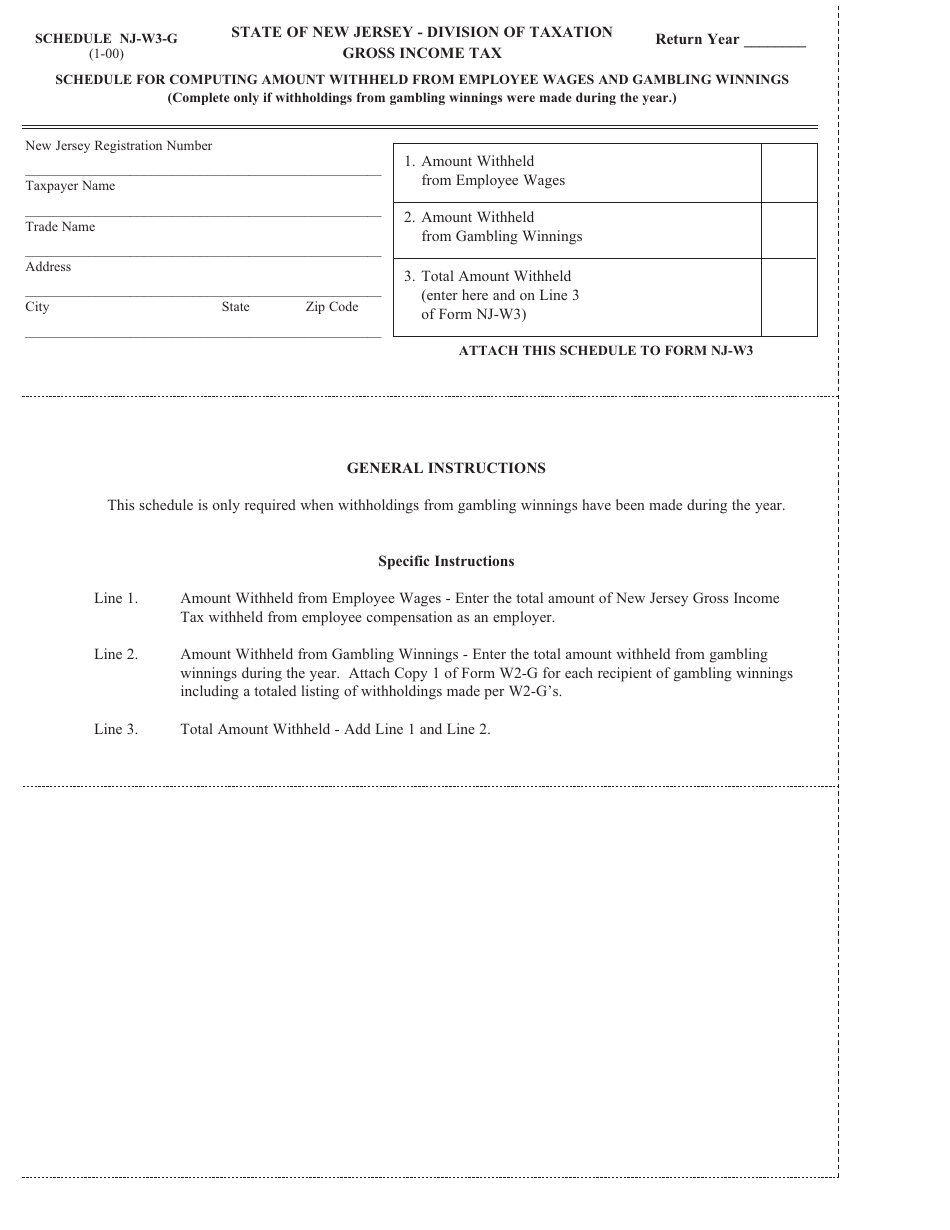

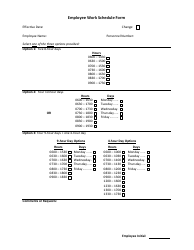

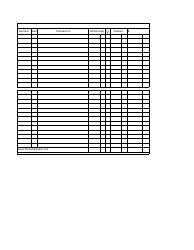

Schedule NJ-W3-G Schedule for Computing Amount Withheld From Employee Wages and Gambling Winnings - New Jersey

What Is Schedule NJ-W3-G?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NJ-W3-G Schedule?

A: The NJ-W3-G Schedule is a schedule used in New Jersey to calculate the amount to be withheld from employee wages and gambling winnings.

Q: Who uses the NJ-W3-G Schedule?

A: Employers and gambling establishments in New Jersey use the NJ-W3-G Schedule to determine the amount to withhold from wages and winnings.

Q: What does the NJ-W3-G Schedule calculate?

A: The NJ-W3-G Schedule calculates the amount of tax to be withheld from employee wages and gambling winnings in New Jersey.

Q: How is the NJ-W3-G Schedule used?

A: Employers and gambling establishments fill out the NJ-W3-G Schedule based on the employee's wages or the amount won in gambling, and use it to determine the withholding amount.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NJ-W3-G by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.