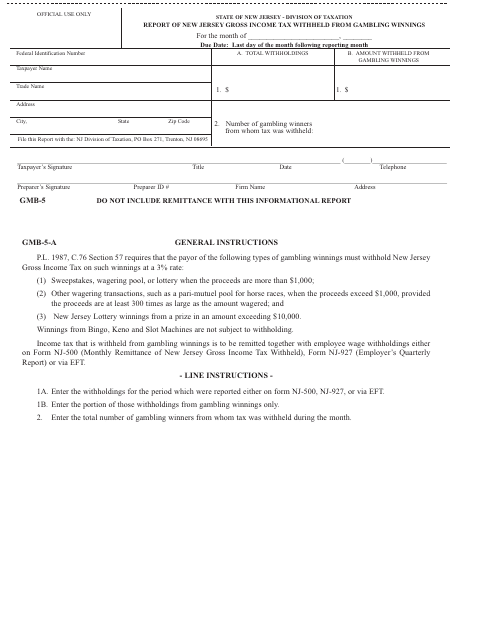

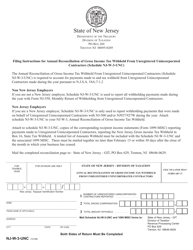

Form GMB-5 Report of New Jersey Gross Income Tax Withheld From Gambling Winnings - New Jersey

What Is Form GMB-5?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GMB-5?

A: GMB-5 is a form used to report New Jersey Gross Income Tax withheld from gambling winnings.

Q: Who needs to use Form GMB-5?

A: Form GMB-5 is used by gambling establishments that withhold New Jersey Gross Income Tax from gambling winnings.

Q: What is the purpose of Form GMB-5?

A: The purpose of Form GMB-5 is to report the amount of New Jersey Gross IncomeTax withheld from gambling winnings.

Q: What information is required on Form GMB-5?

A: Form GMB-5 requires the gambling establishment to provide the total amount of New Jersey Gross Income Tax withheld from gambling winnings.

Q: How often should Form GMB-5 be filed?

A: Form GMB-5 should be filed quarterly, on or before the last day of the month following the end of the quarter.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GMB-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.