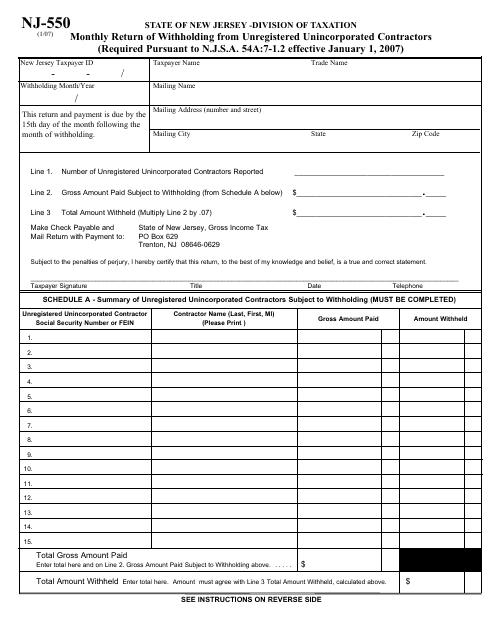

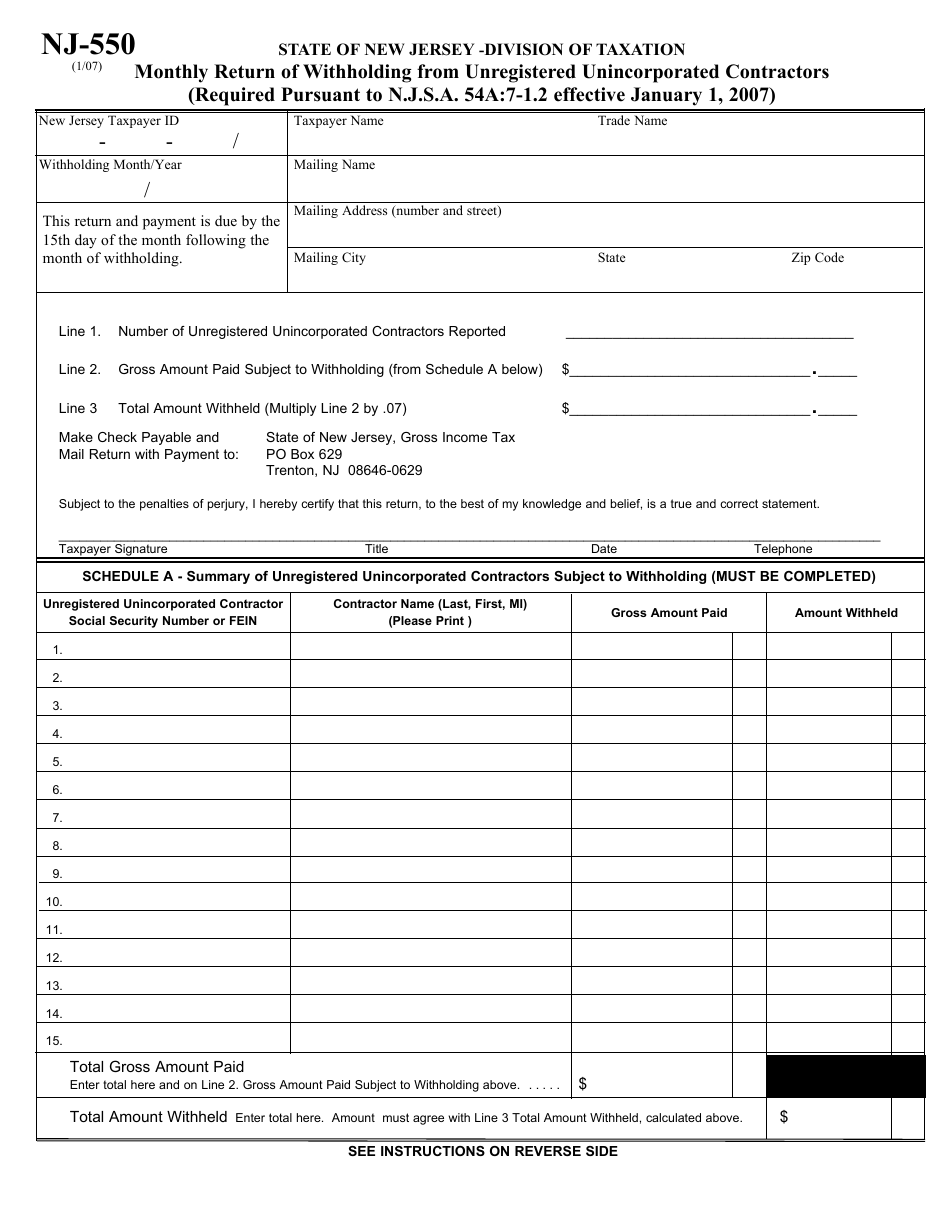

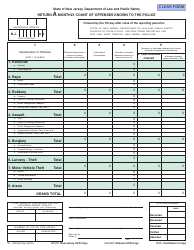

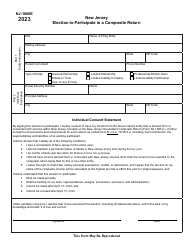

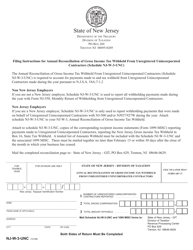

Form NJ-550 Monthly Return of Withholding From Unregistered Unincorporated Contractors - New Jersey

What Is Form NJ-550?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-550?

A: Form NJ-550 is the Monthly Return of Withholding From Unregistered Unincorporated Contractors used in the state of New Jersey.

Q: Who needs to file Form NJ-550?

A: Any employer in New Jersey who makes payments to unregistered unincorporated contractors and is required to withhold New Jersey Gross Income Tax must file Form NJ-550.

Q: What is the purpose of Form NJ-550?

A: The purpose of Form NJ-550 is to report and remit the amount of gross income tax withheld from payments made to unregistered unincorporated contractors.

Q: How often is Form NJ-550 filed?

A: Form NJ-550 is filed on a monthly basis.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-550 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.