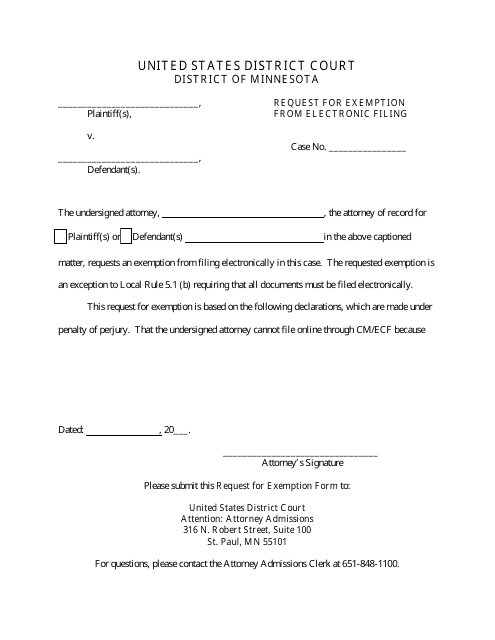

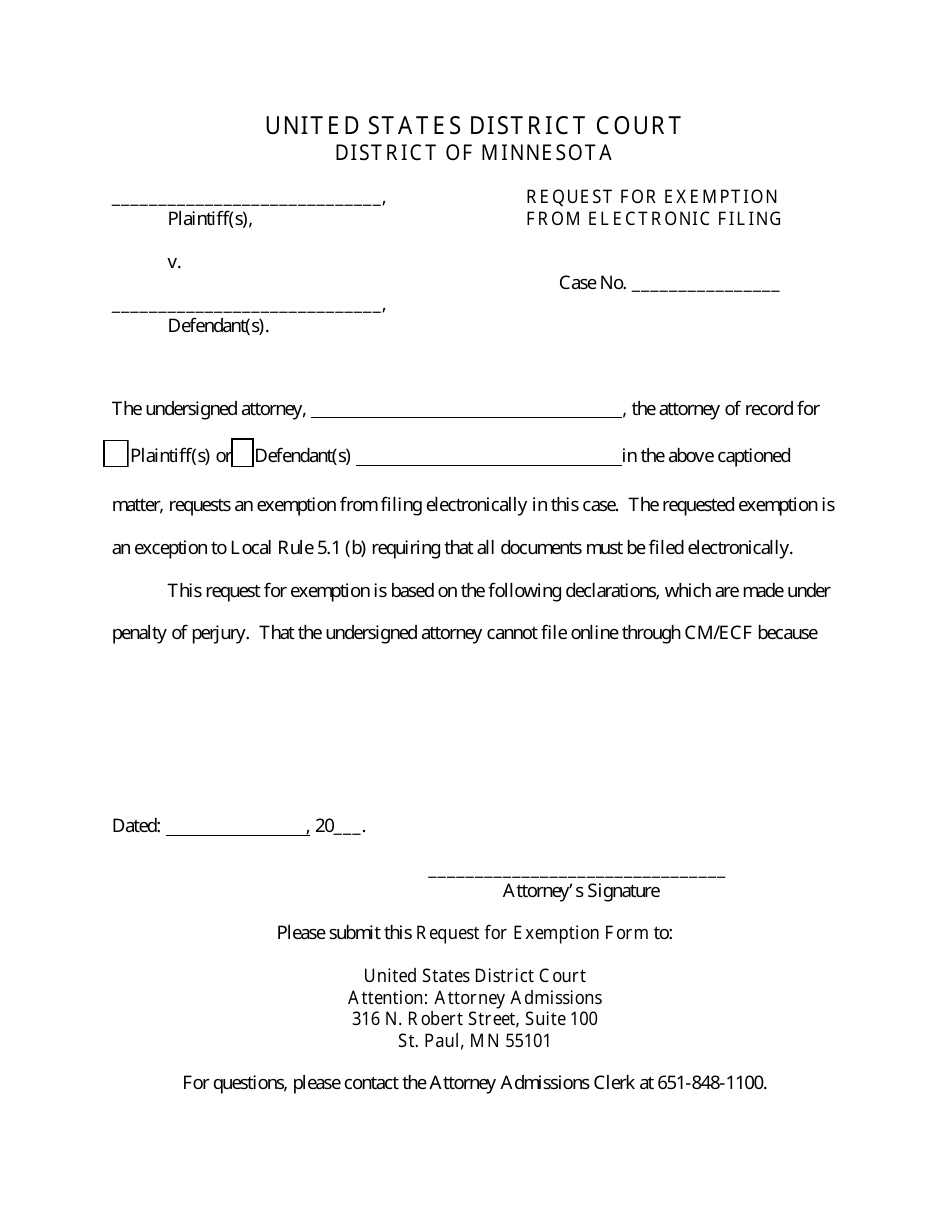

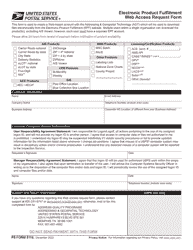

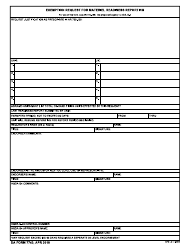

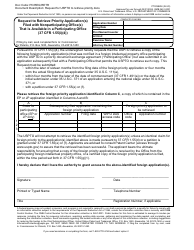

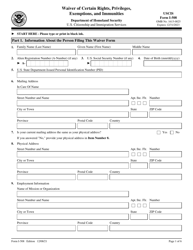

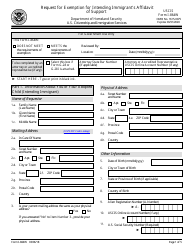

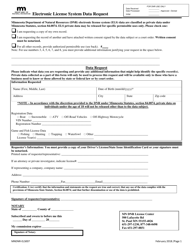

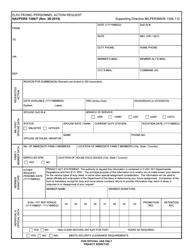

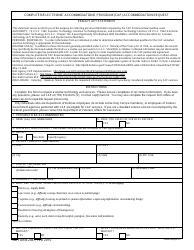

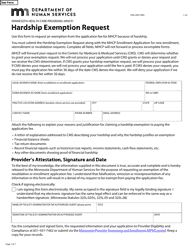

Request for Exemption From Electronic Filing - Minnesota

Request for Exemption From Electronic Filing is a legal document that was released by the Minnesota Judicial Branch - a government authority operating within Minnesota.

FAQ

Q: What is a Request for Exemption From Electronic Filing?

A: A Request for Exemption From Electronic Filing is a formal request to be excused from filing electronically in the state of Minnesota.

Q: Who can submit a Request for Exemption From Electronic Filing?

A: Any individual or entity required to file electronically in Minnesota can submit a request for exemption if they have a valid reason for not being able to comply with the electronic filing requirement.

Q: What is the purpose of filing electronically in Minnesota?

A: Electronic filing is the preferred method of filing in Minnesota as it allows for faster processing, reduces paperwork, and enhances data accuracy.

Q: What are some valid reasons for requesting an exemption from electronic filing?

A: Valid reasons for requesting an exemption may include hardship, technical limitations, or other compelling circumstances that prevent the individual or entity from filing electronically.

Q: Is there a deadline for submitting a Request for Exemption From Electronic Filing?

A: The deadline for submitting a request may vary, so it is important to refer to the guidelines provided by the Minnesota Department of Revenue or consult with a tax professional.

Q: What happens after submitting a Request for Exemption From Electronic Filing?

A: The Minnesota Department of Revenue will review the request and determine whether the exemption is approved or denied. The individual or entity will be notified of the decision.

Q: Can a granted Request for Exemption From Electronic Filing be revoked?

A: In some cases, the granted exemption may be subject to review and could be revoked if the circumstances that justified the exemption change.

Q: Are there any consequences for not filing electronically in Minnesota without an approved exemption?

A: Failure to comply with the electronic filing requirement in Minnesota may result in penalties and delays in processing.

Form Details:

- The latest edition currently provided by the Minnesota Judicial Branch;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Judicial Branch.