This version of the form is not currently in use and is provided for reference only. Download this version of

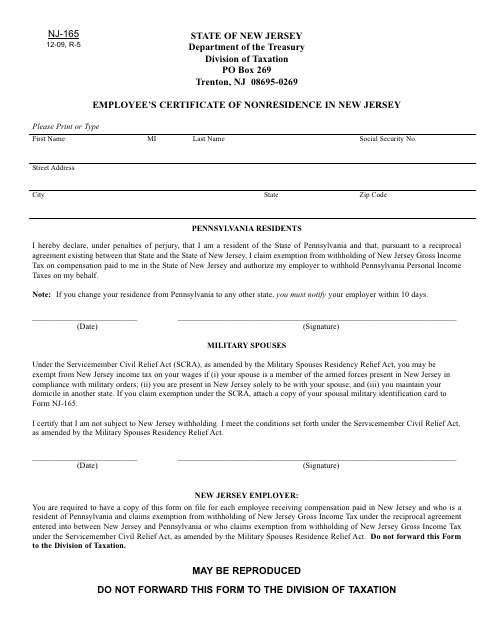

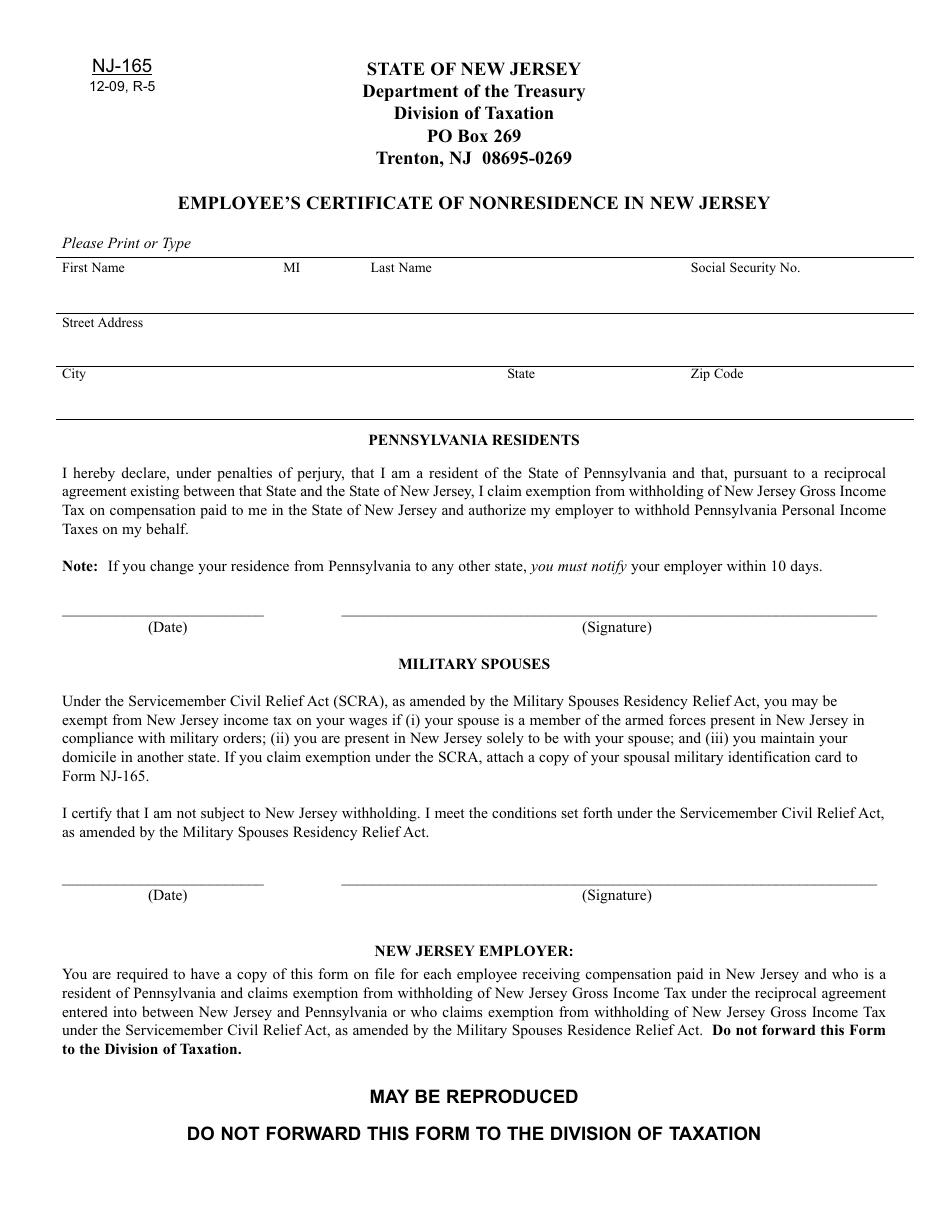

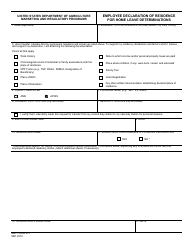

Form NJ-165

for the current year.

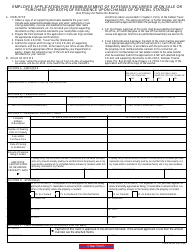

Form NJ-165 Employee's Certificate of Non-residence in New Jersey - New Jersey

What Is Form NJ-165?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-165?

A: Form NJ-165 is the Employee's Certificate of Non-residence in New Jersey.

Q: Who needs to fill out Form NJ-165?

A: Form NJ-165 must be filled out by employees who are non-residents of New Jersey but work in the state.

Q: When is Form NJ-165 used?

A: Form NJ-165 is used to certify that an employee is a non-resident of New Jersey and is not subject to New Jersey income tax withholding.

Q: What information is required on Form NJ-165?

A: Form NJ-165 requires the employee's personal information, employer information, and certification of non-residence.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-165 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.