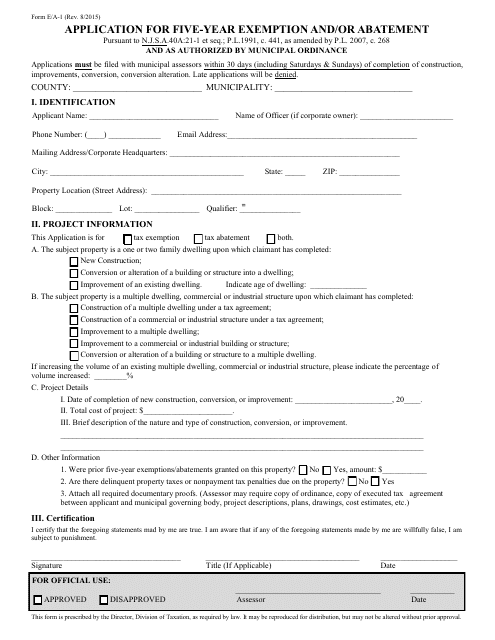

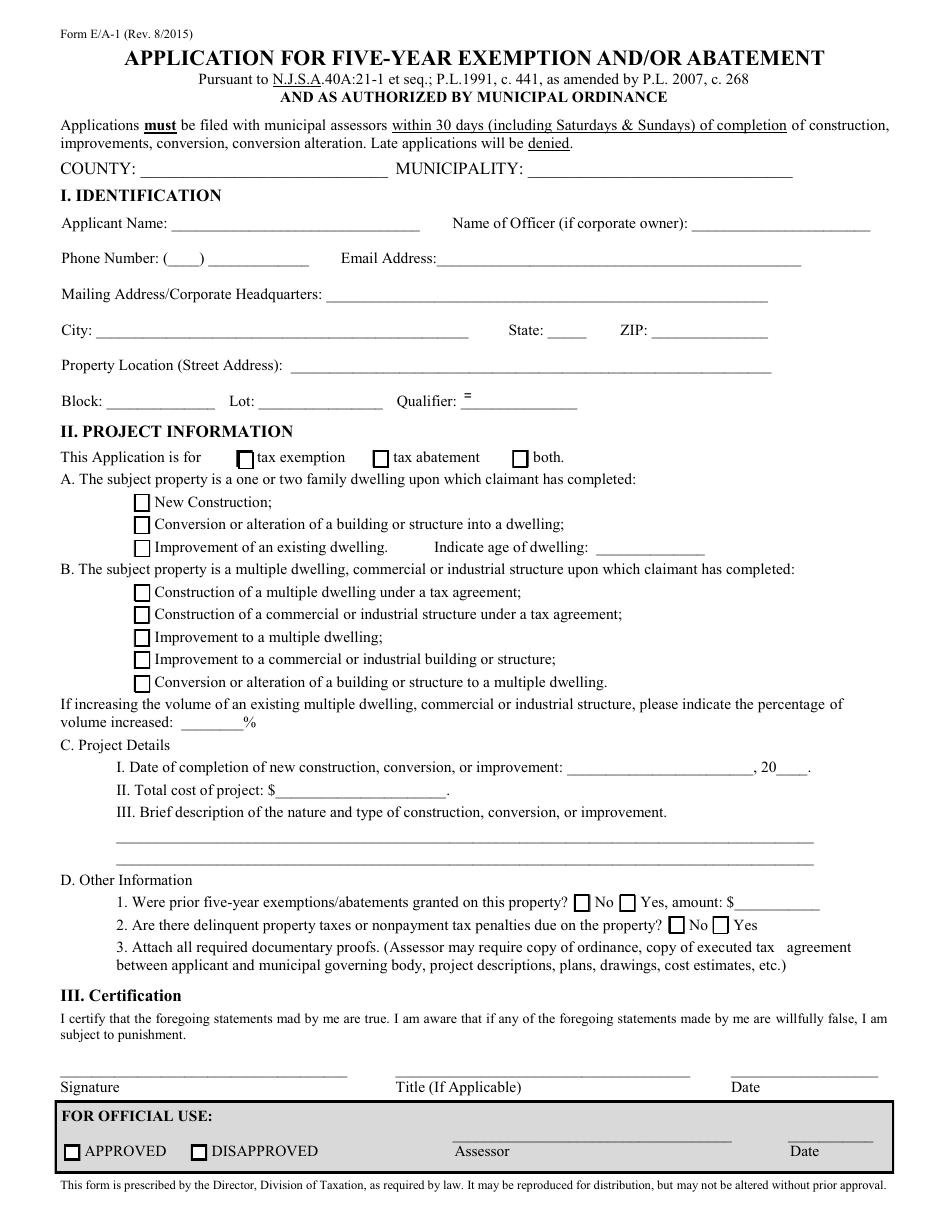

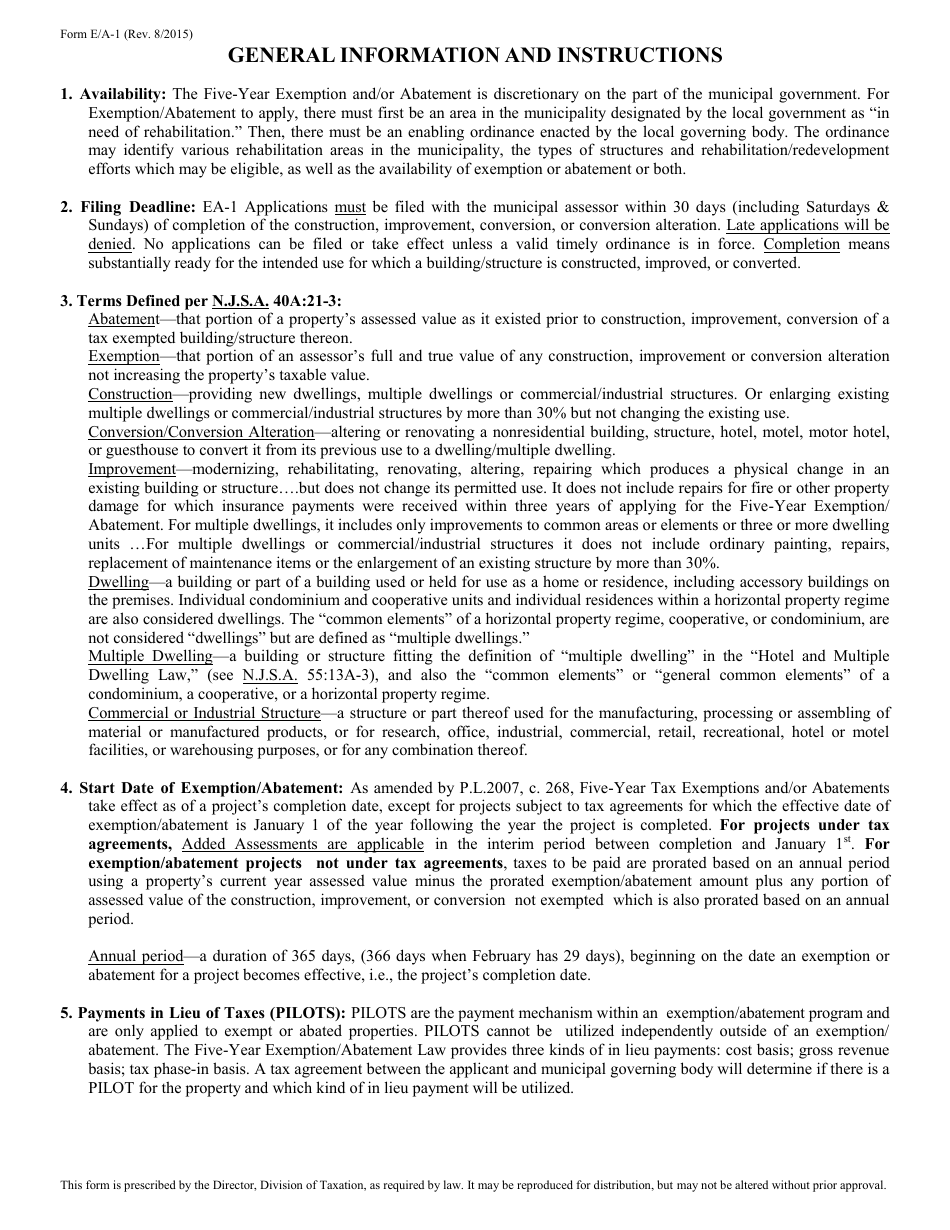

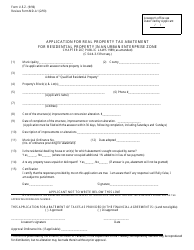

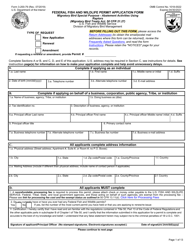

Form E / A-1 Application for Five-Year Exemption and / or Abatement - New Jersey

What Is Form E/A-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E/A-1?

A: Form E/A-1 is an application for a five-year exemption and/or abatement in New Jersey.

Q: What is the purpose of Form E/A-1?

A: The purpose of Form E/A-1 is to apply for a tax exemption or abatement for a period of five years in New Jersey.

Q: Who needs to fill out Form E/A-1?

A: Property owners or developers who are seeking a tax exemption or abatement in New Jersey must fill out Form E/A-1.

Q: What information is required on Form E/A-1?

A: Form E/A-1 requires information about the property, the applicant, and the proposed project that is seeking the exemption or abatement.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E/A-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.