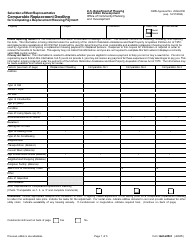

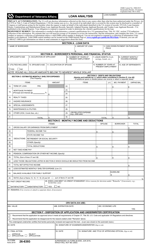

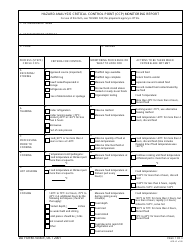

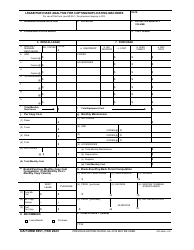

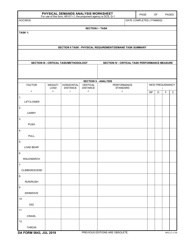

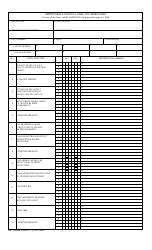

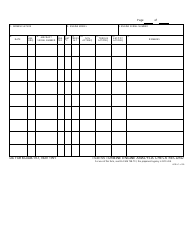

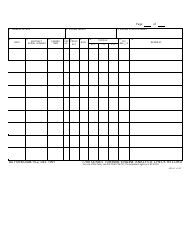

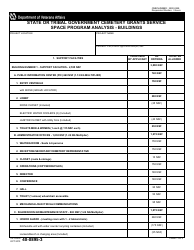

Form A-1 Comparable Sales Analysis Form - New Jersey

What Is Form A-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

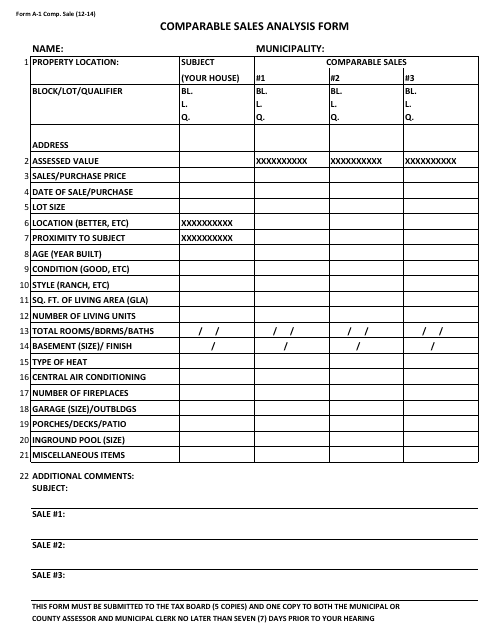

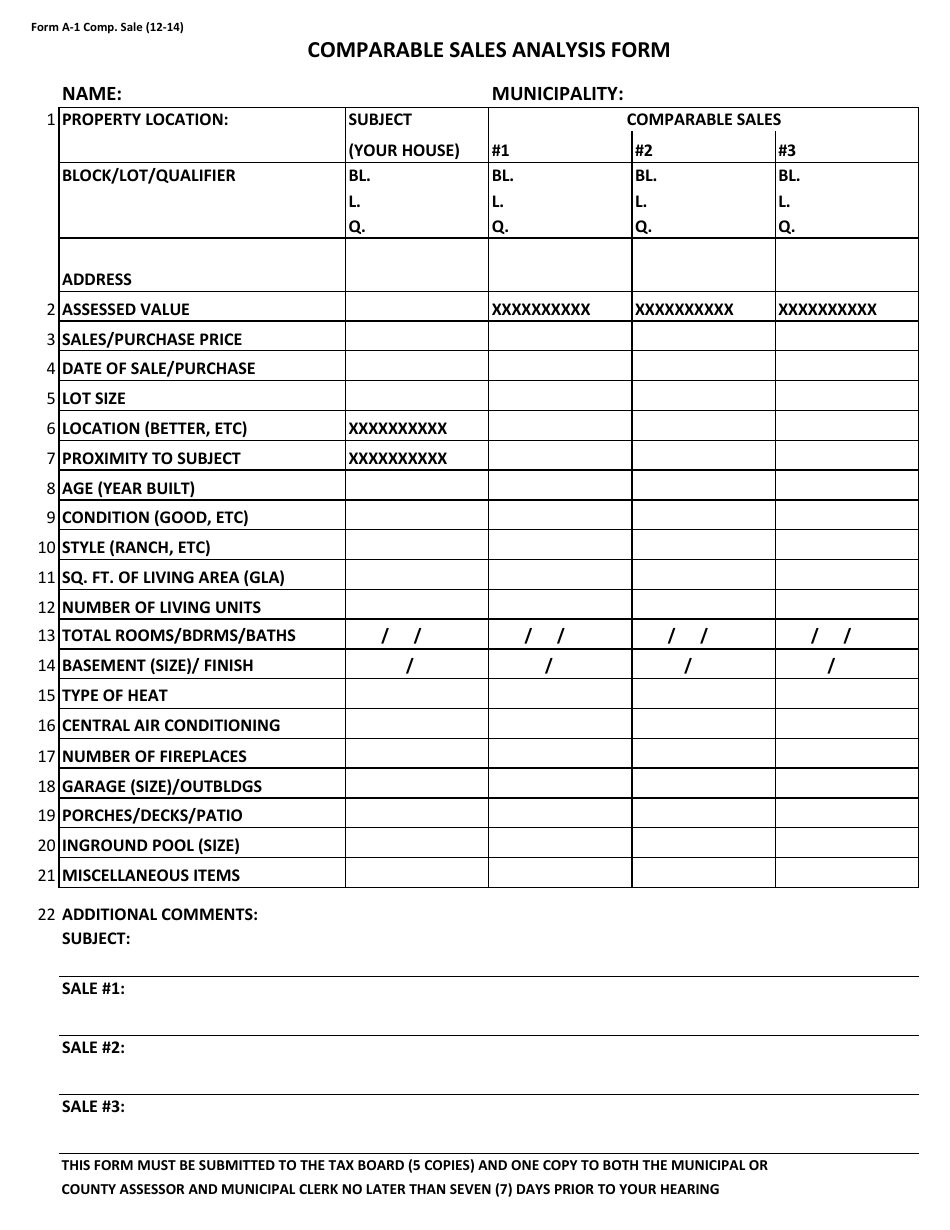

Q: What is Form A-1?

A: Form A-1 is a Comparable Sales Analysis form used in New Jersey.

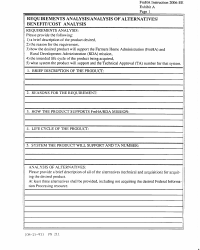

Q: What is the purpose of Form A-1?

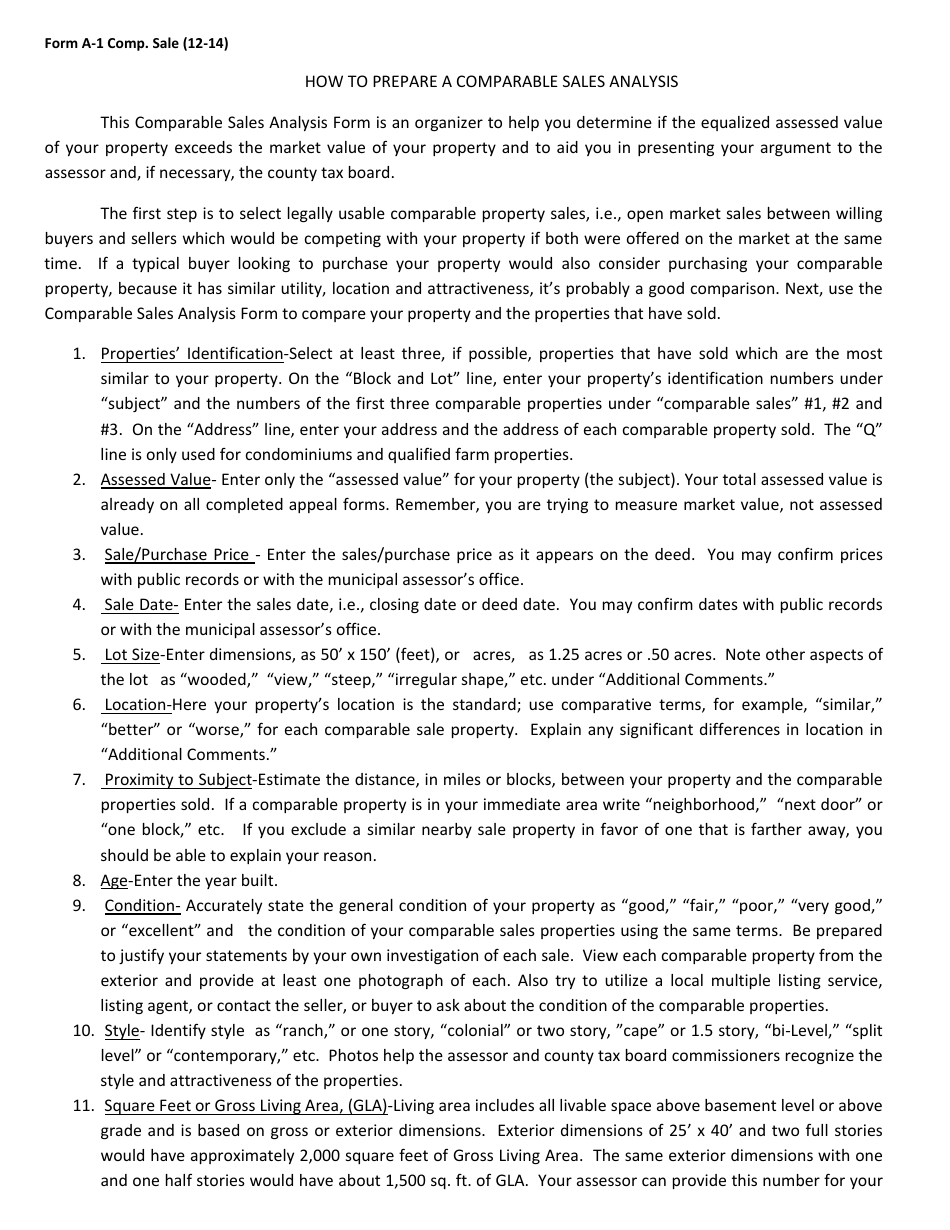

A: The purpose of Form A-1 is to document comparable sales data for a property.

Q: Who uses Form A-1?

A: Real estate professionals, appraisers, and property tax assessors use Form A-1.

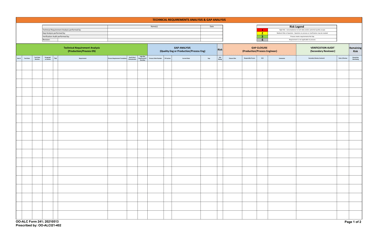

Q: What information is recorded on Form A-1?

A: Form A-1 records information about recent sales of comparable properties, including sale price, sale date, and property details.

Q: Why is Form A-1 important?

A: Form A-1 is important because it provides data on comparable sales that can be used to determine the value of a property.

Q: Is Form A-1 specific to New Jersey?

A: Yes, Form A-1 is specific to New Jersey and is used in the state for property valuation purposes.

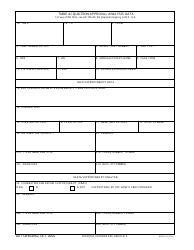

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.