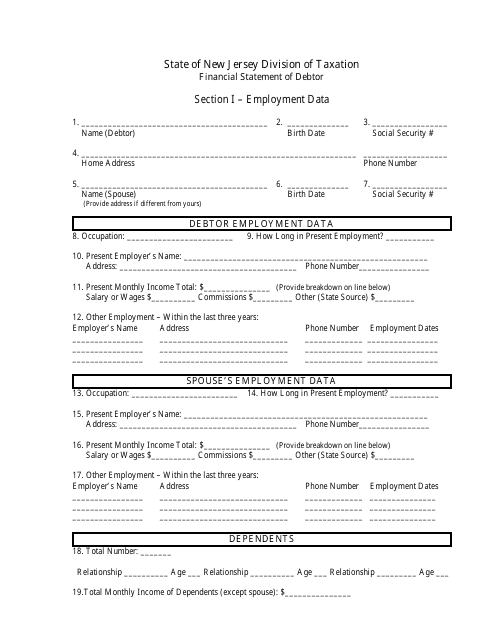

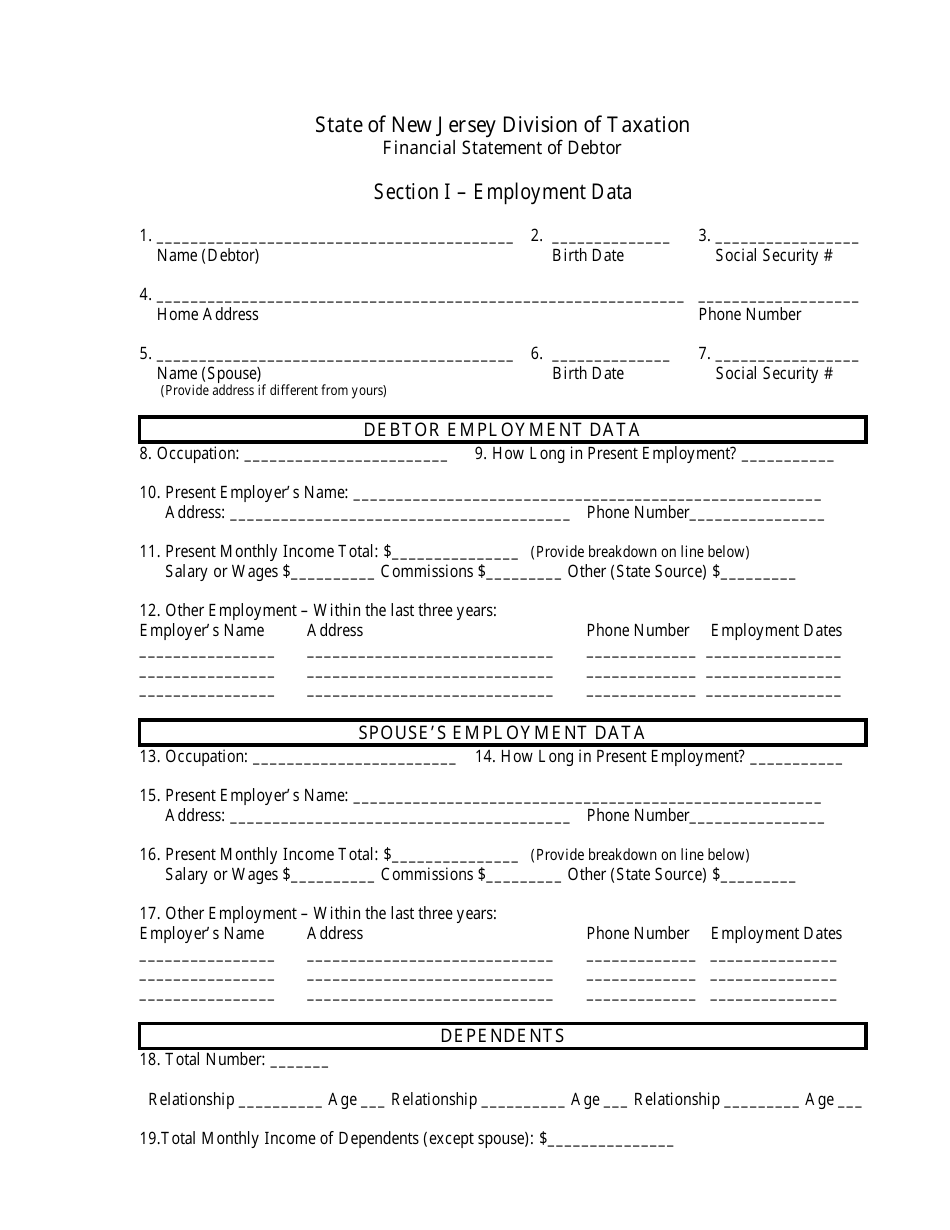

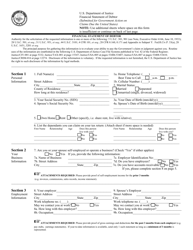

Financial Statement of Debtor - New Jersey

Financial Statement of Debtor is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is a financial statement of debtor?

A: A financial statement of debtor is a document that provides information about an individual or company's financial condition.

Q: Why is a financial statement of debtor important?

A: A financial statement of debtor is important because it helps creditors and other interested parties assess the financial health and creditworthiness of the debtor.

Q: Who prepares a financial statement of debtor?

A: The debtor usually prepares a financial statement, which may be requested by creditors or used in legal proceedings.

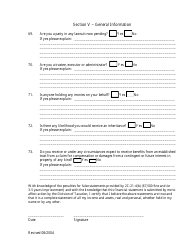

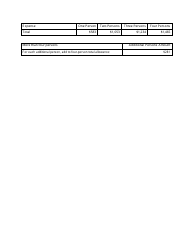

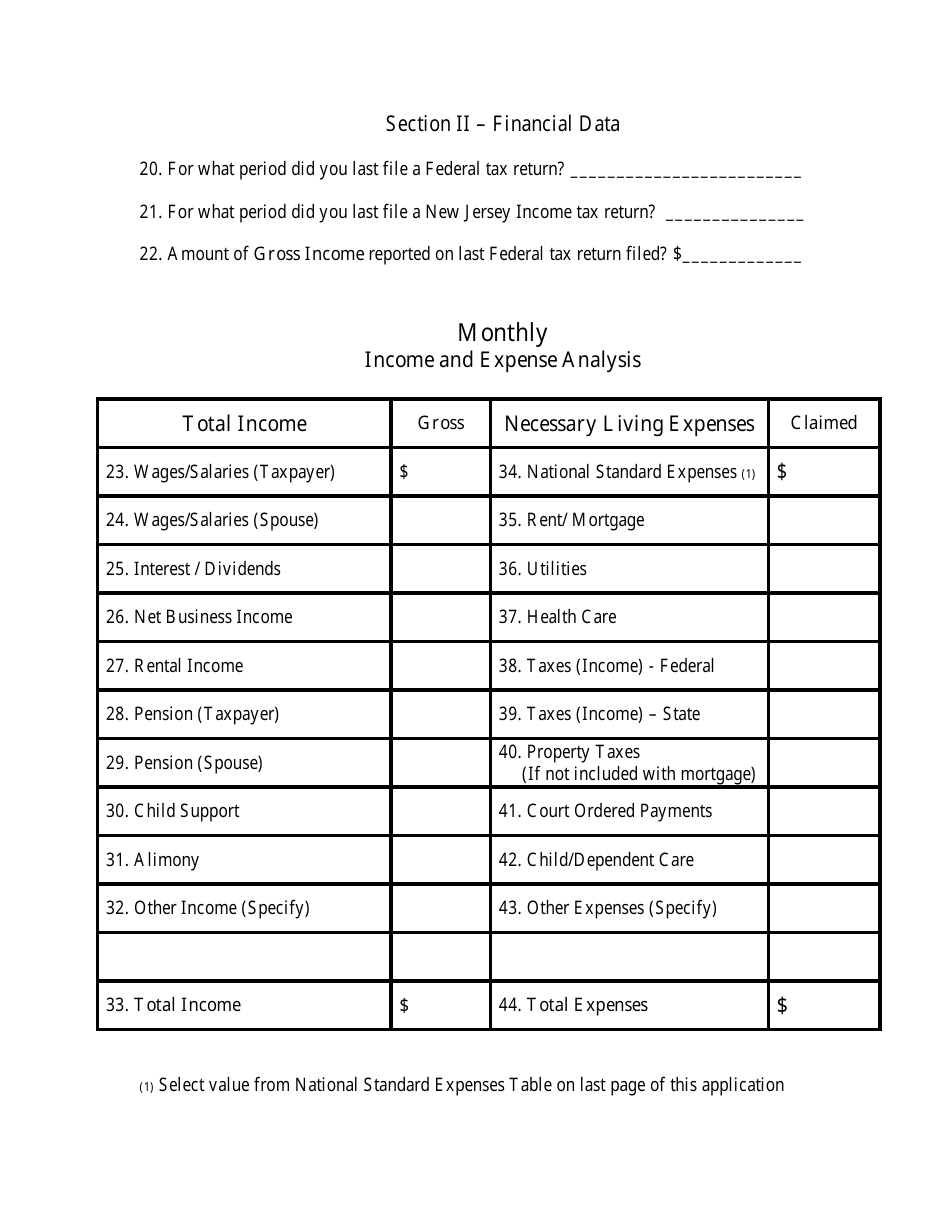

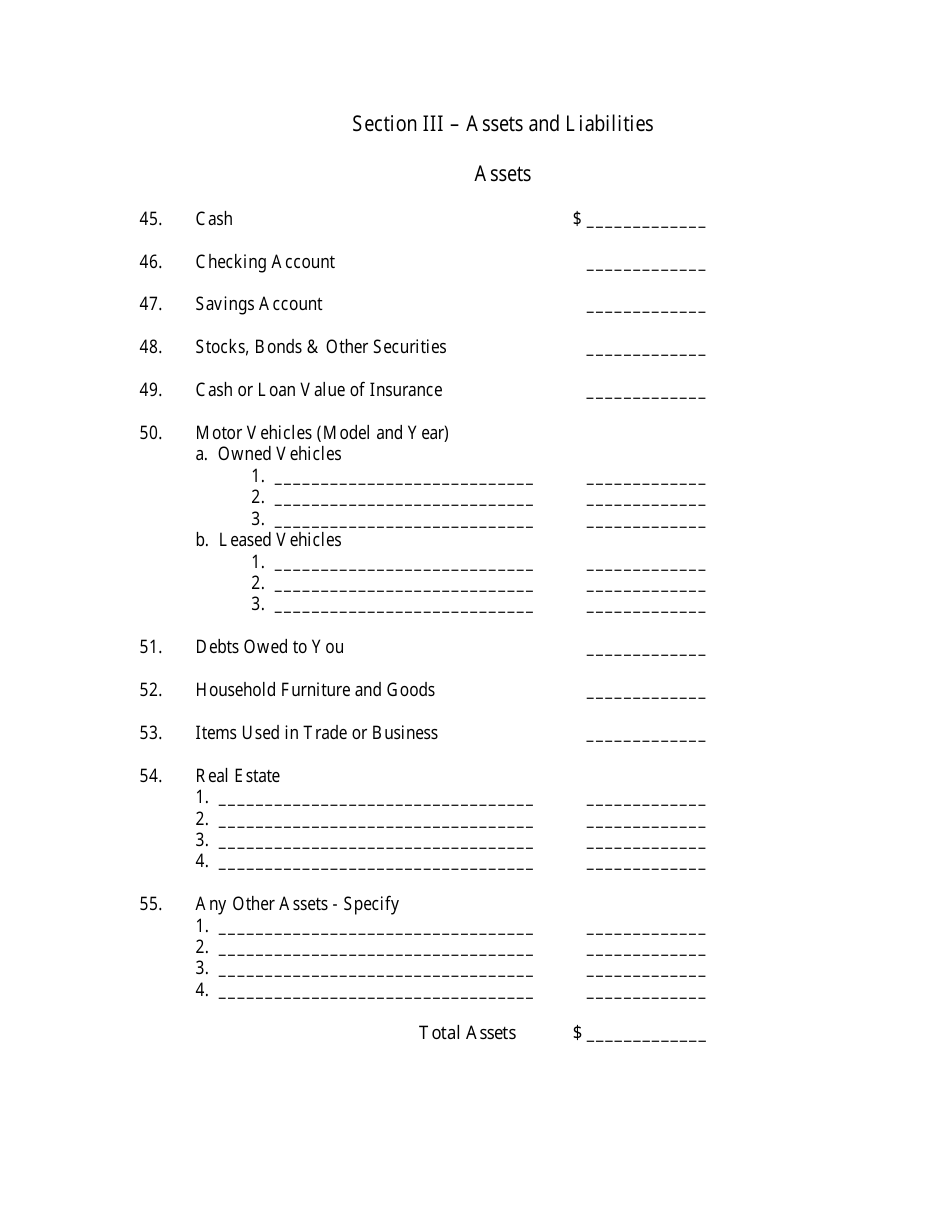

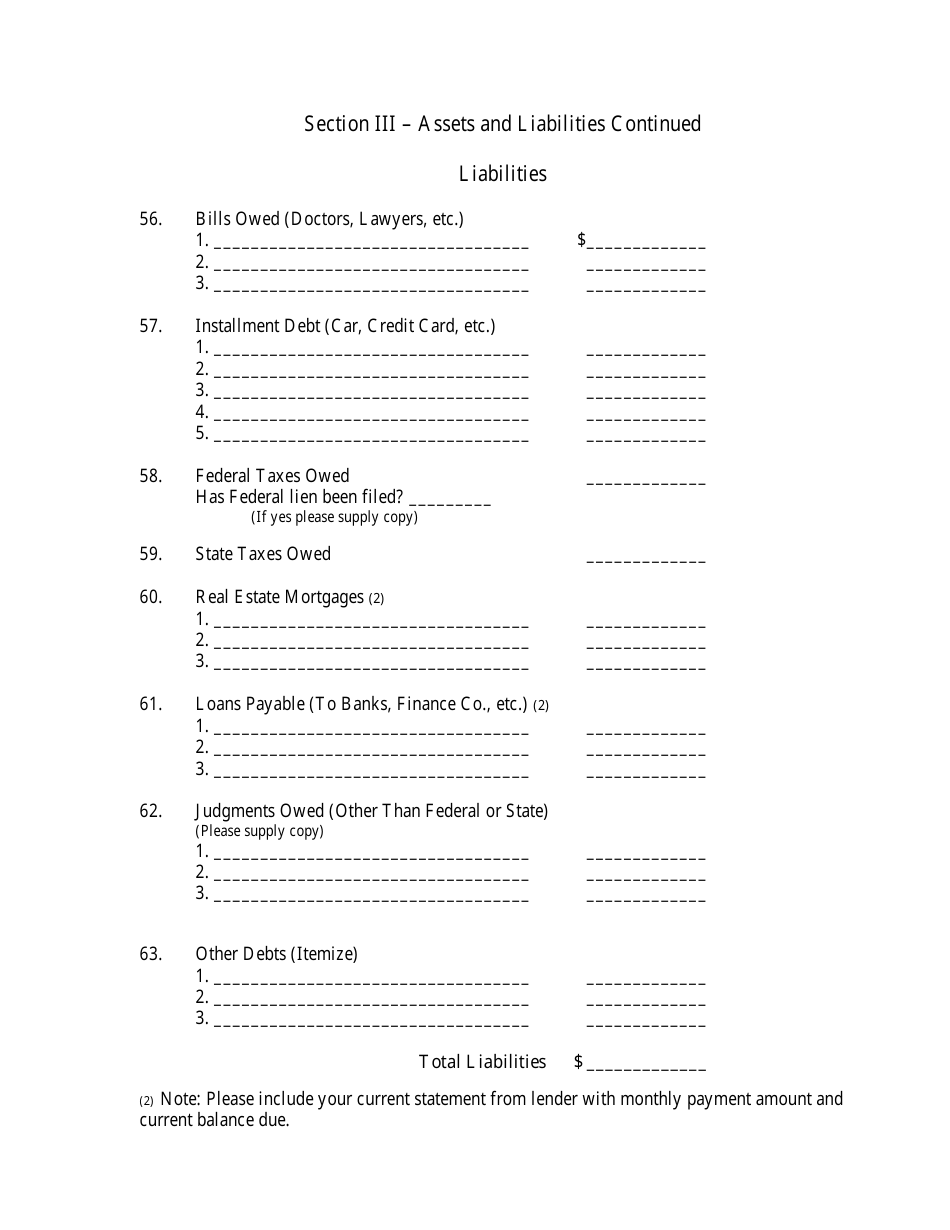

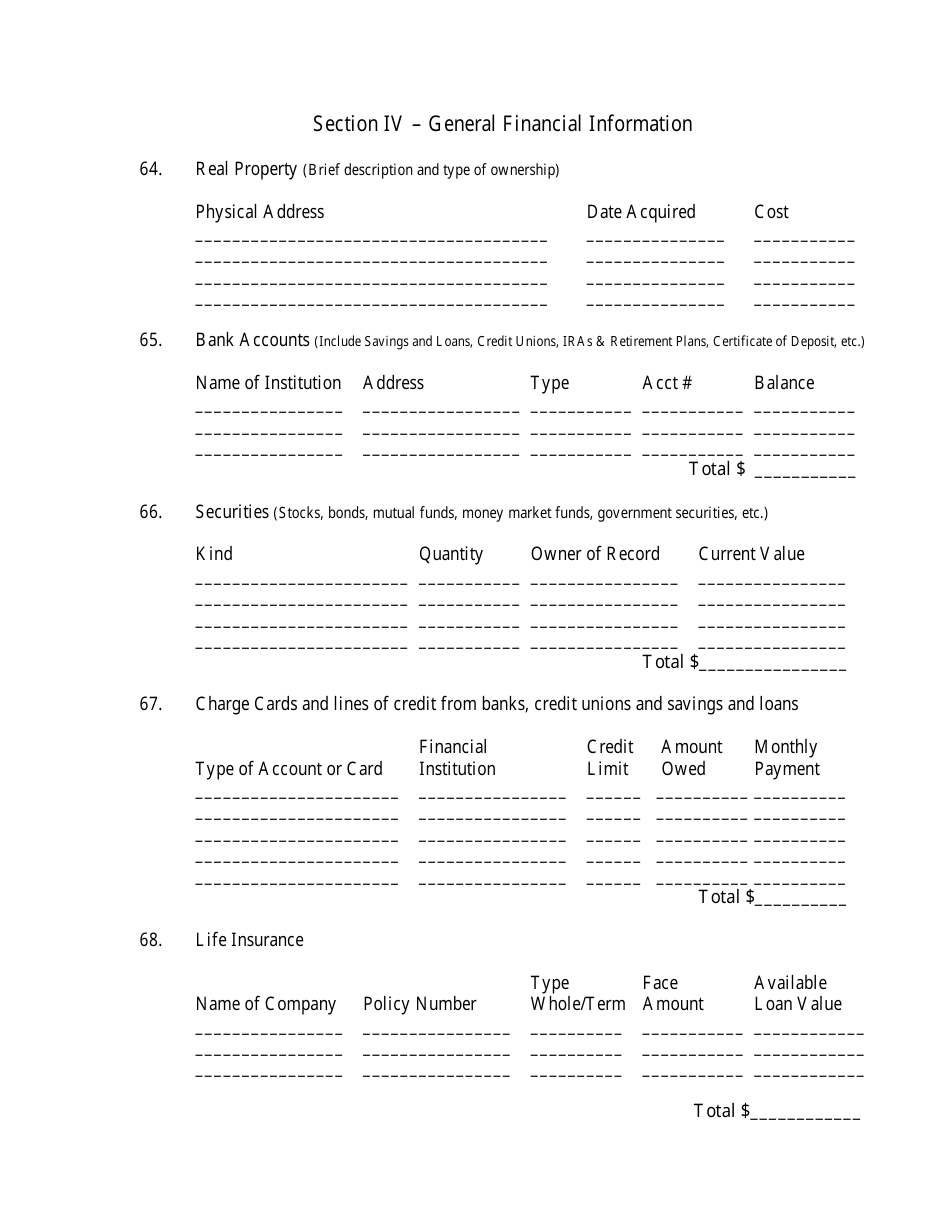

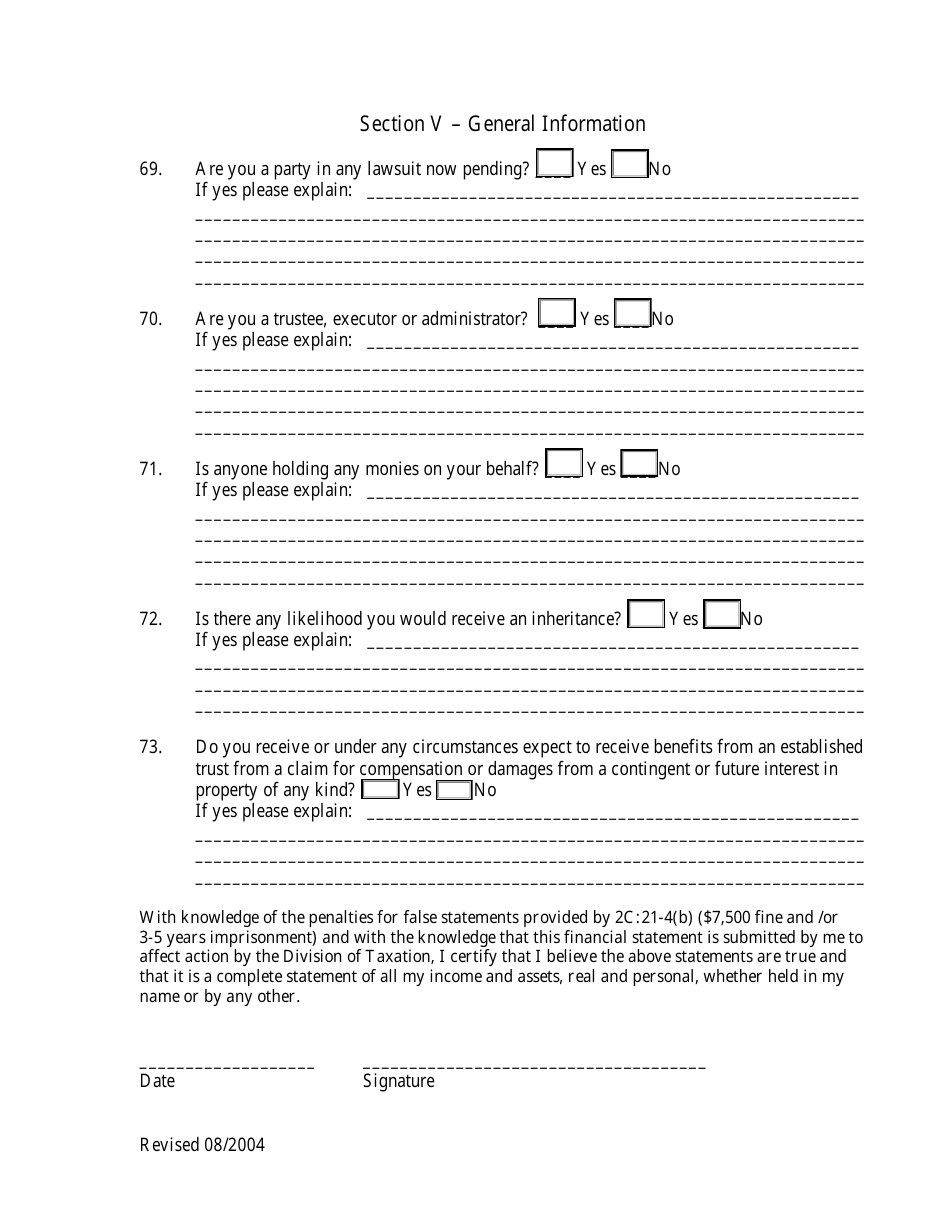

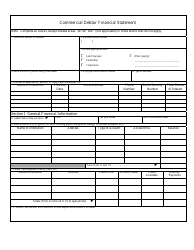

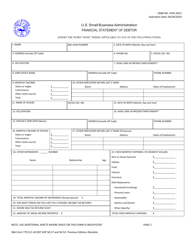

Q: What information is included in a financial statement of debtor?

A: A financial statement of debtor typically includes details about the individual or company's assets, liabilities, income, expenses, and net worth.

Q: How can a financial statement of debtor be used by creditors?

A: Creditors can use a financial statement of debtor to evaluate the debtor's ability to repay a loan or meet their financial obligations.

Q: Are financial statements of debtors public records?

A: Financial statements of debtors are not typically public records, but they may be disclosed in certain circumstances like bankruptcy proceedings.

Q: What is the difference between a financial statement and a credit report?

A: A financial statement provides a snapshot of a debtor's financial condition, while a credit report provides a detailed history of the debtor's credit activity and payment history.

Form Details:

- Released on August 1, 2004;

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.