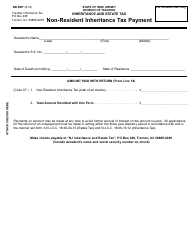

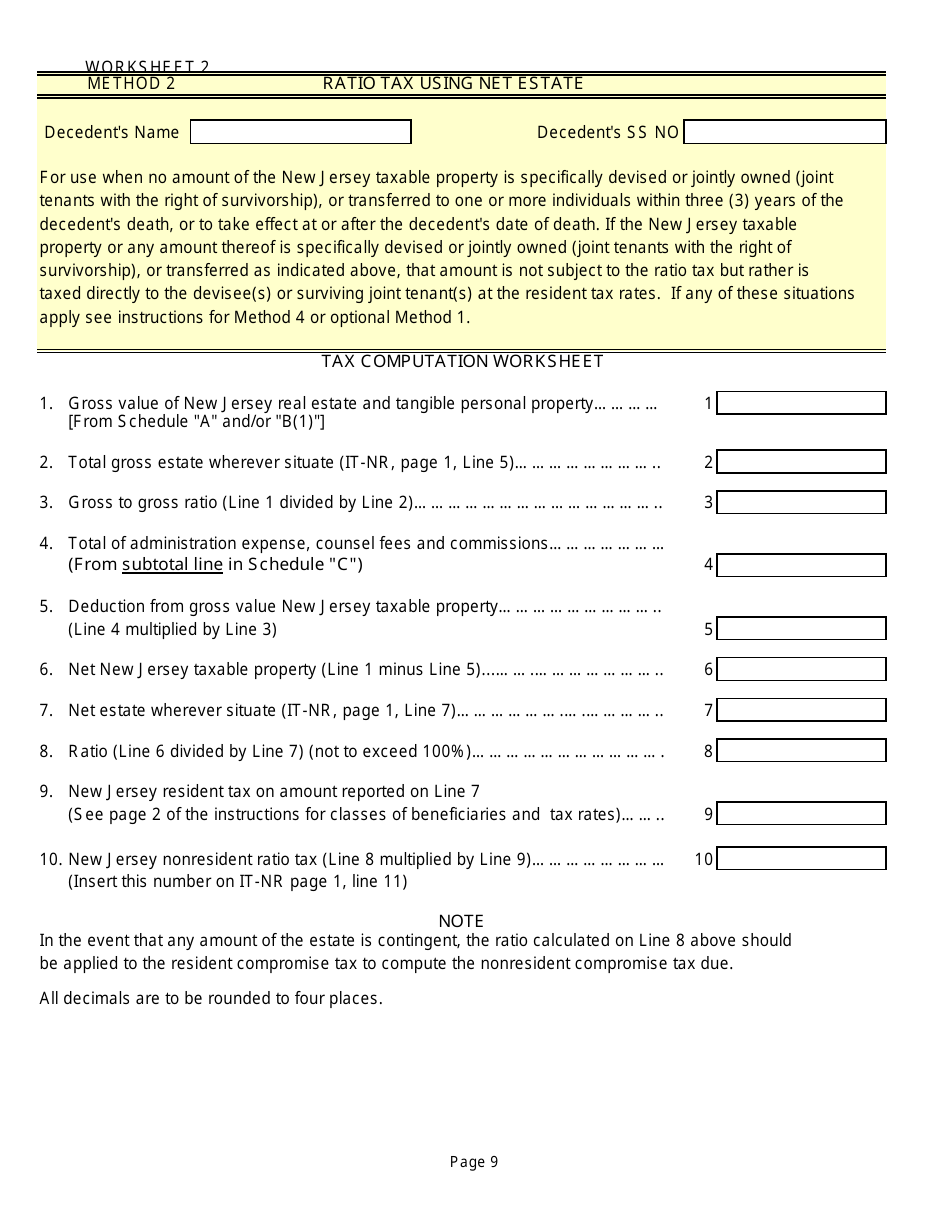

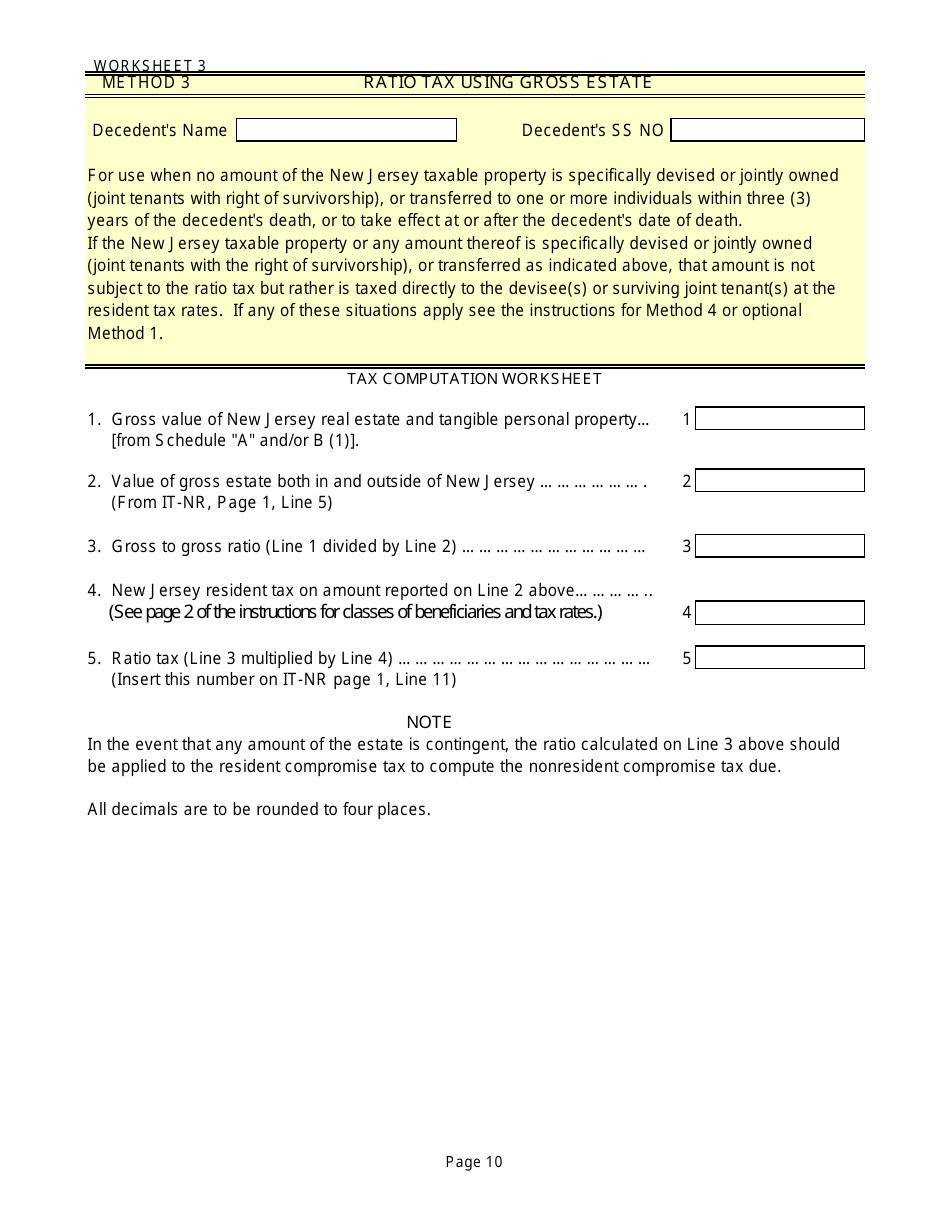

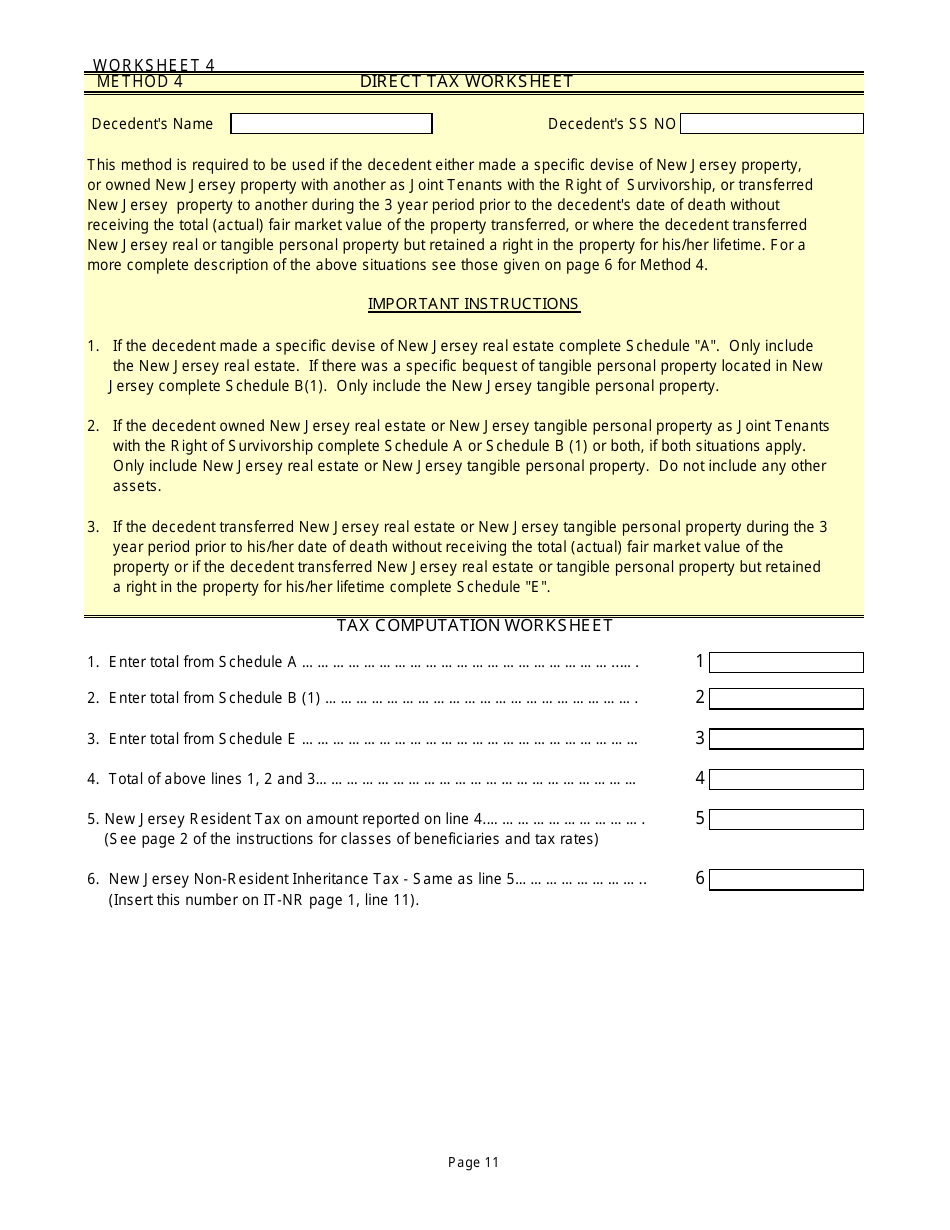

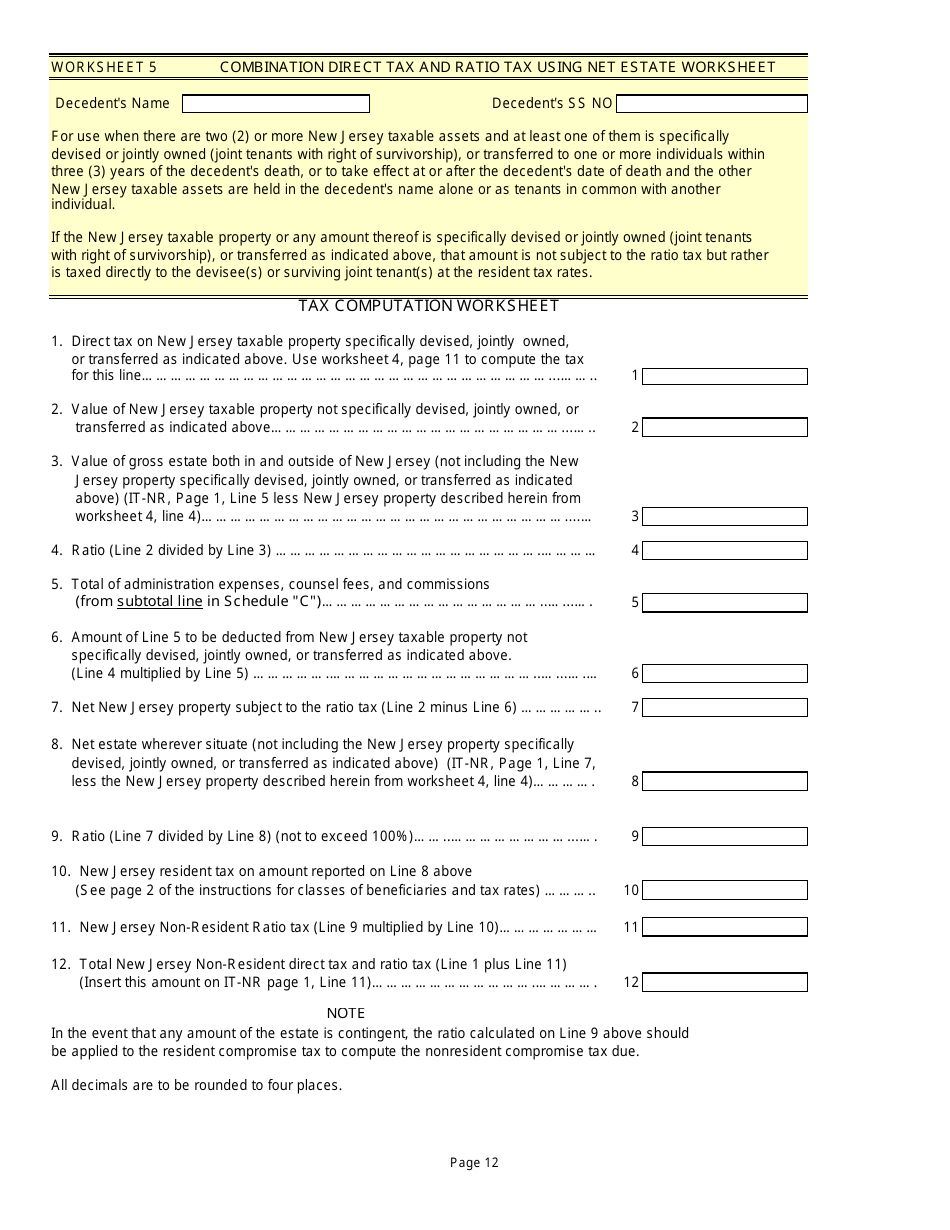

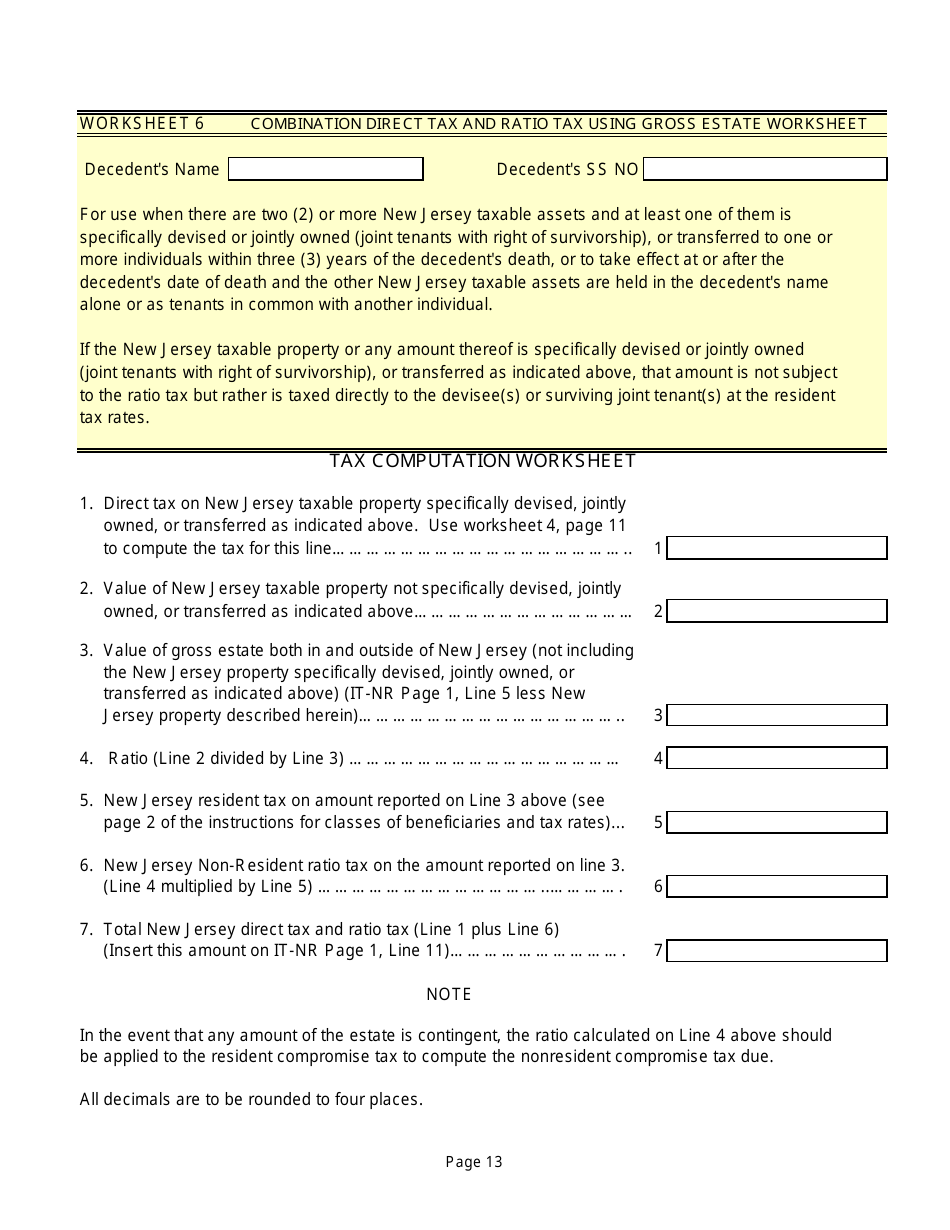

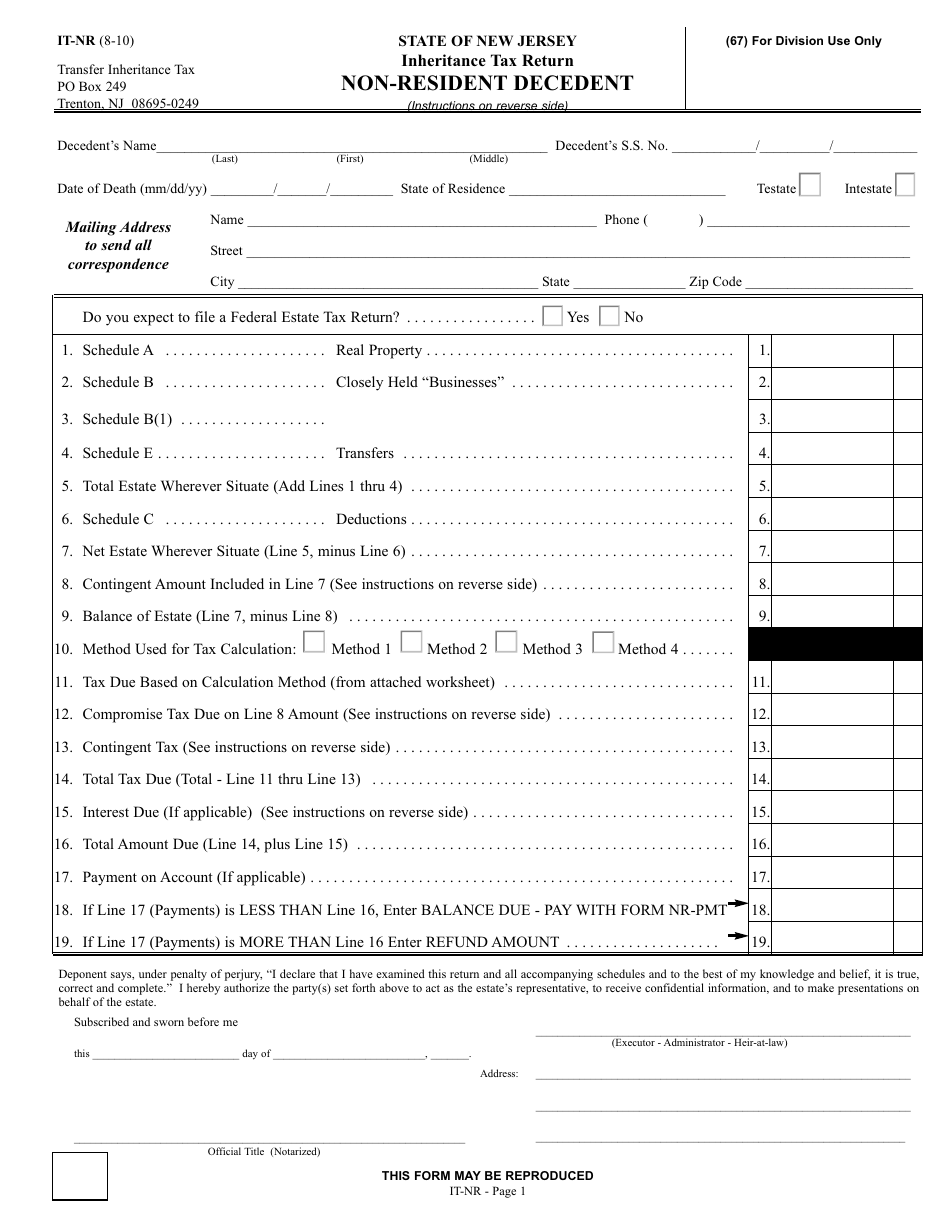

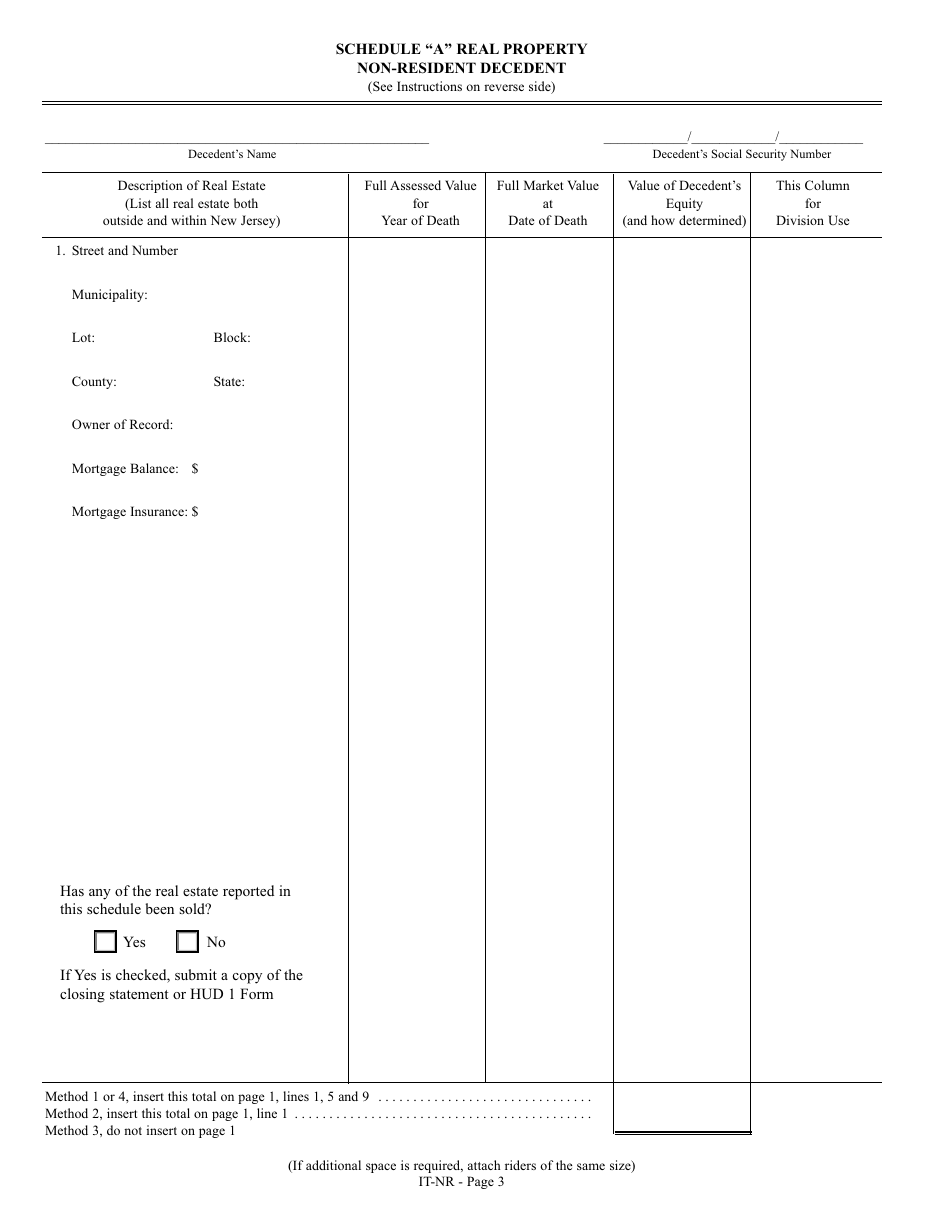

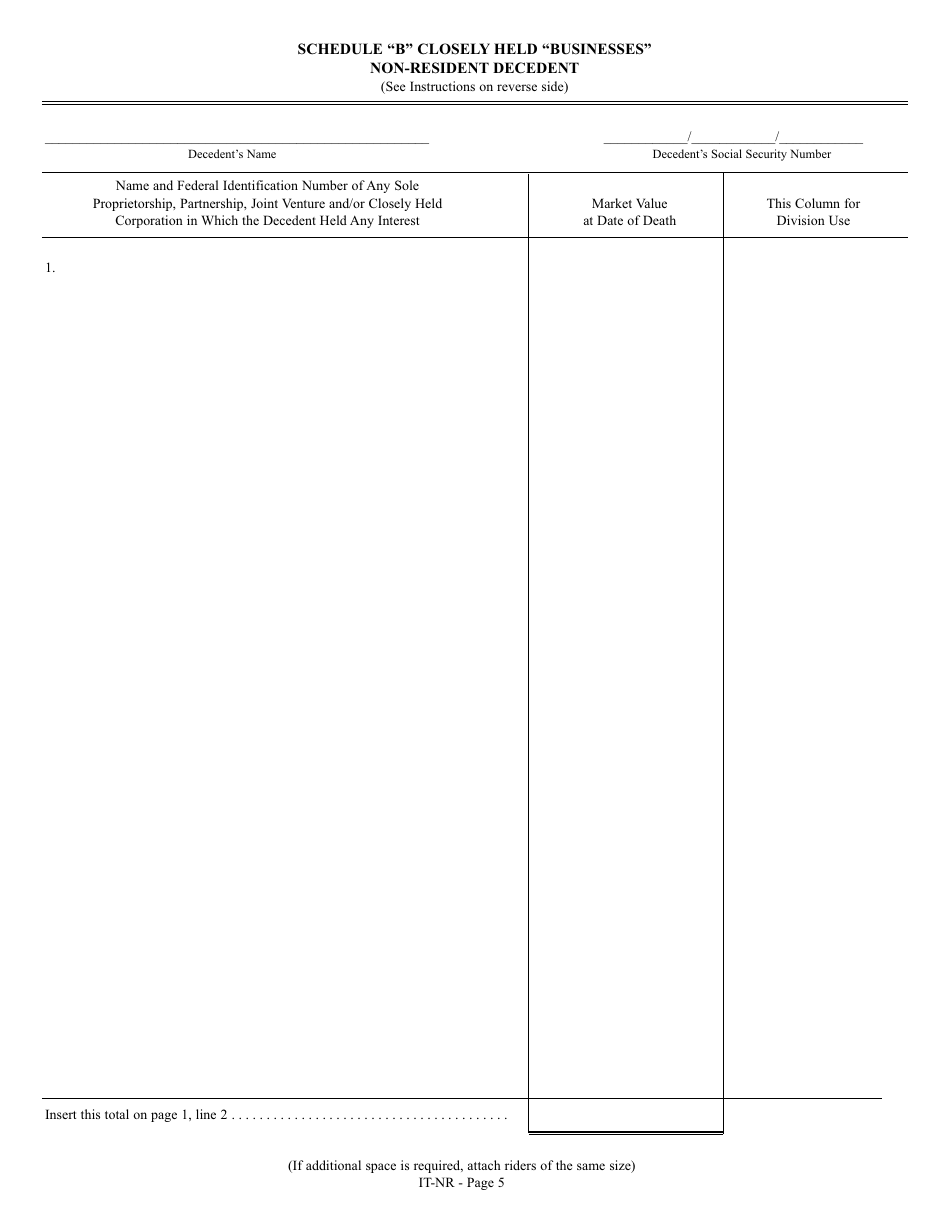

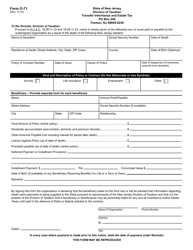

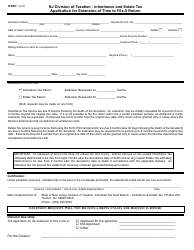

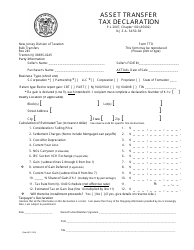

Form IT-NR Transfer Inheritance Tax Non-resident Decedent - New Jersey

What Is Form IT-NR?

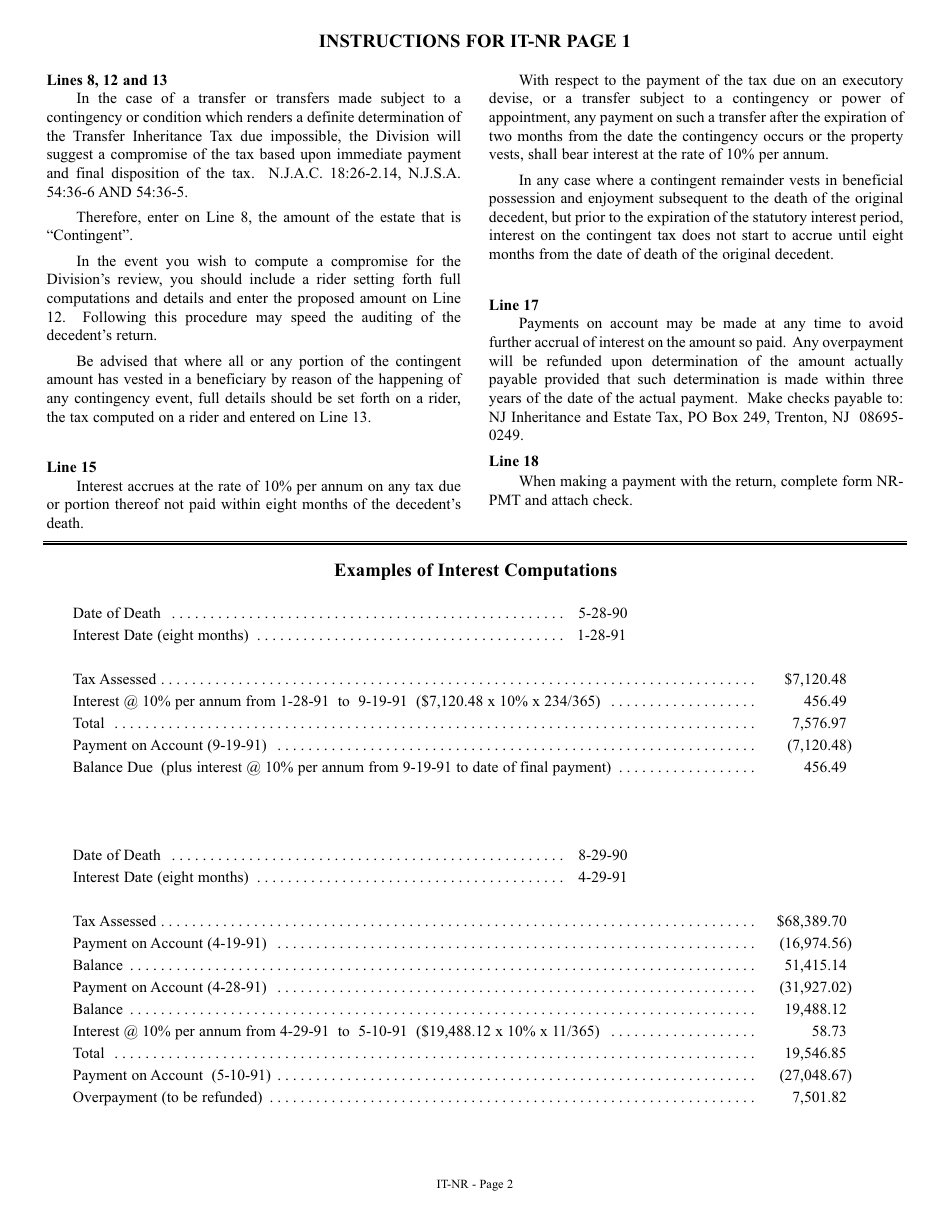

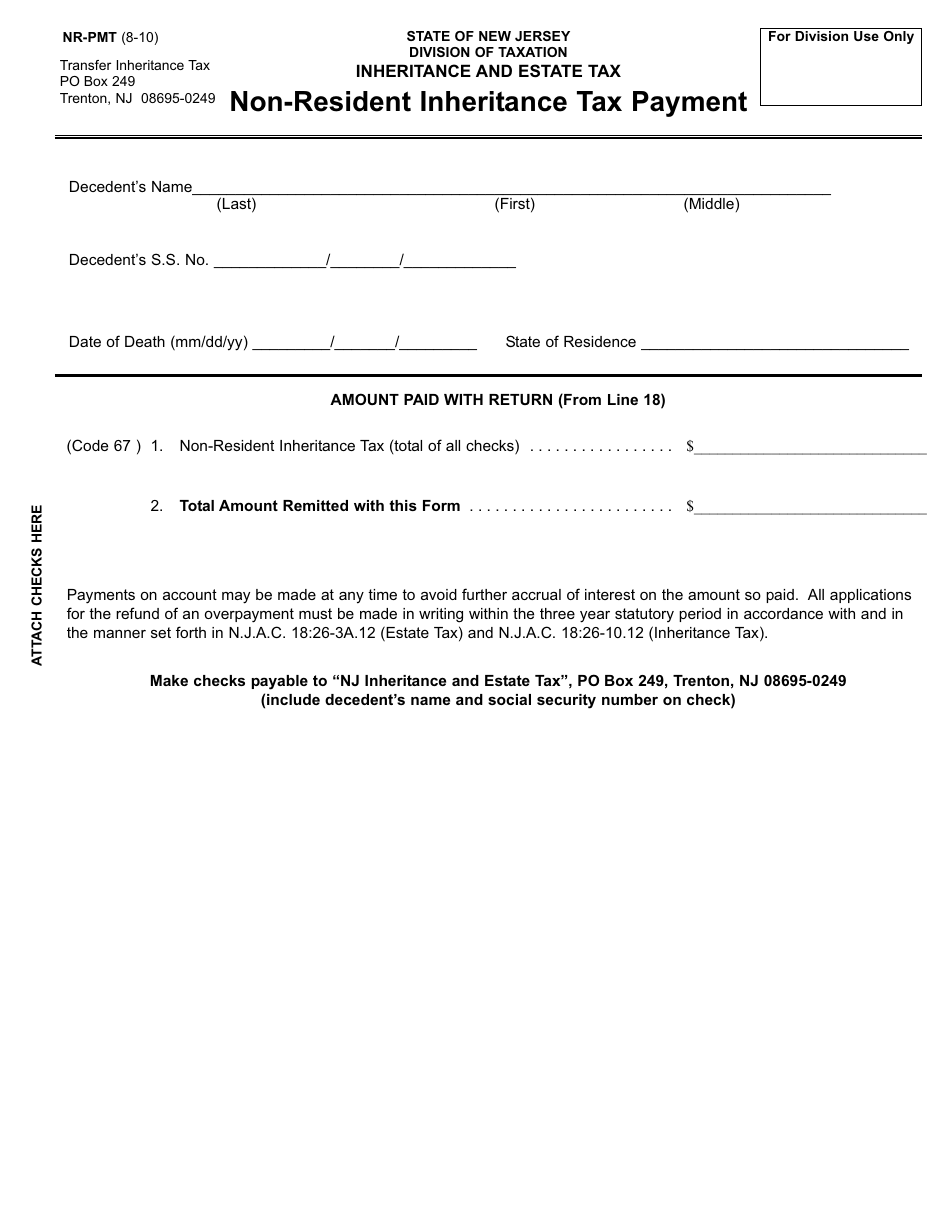

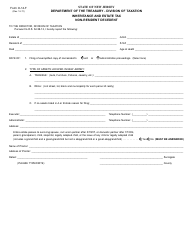

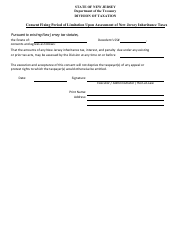

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-NR?

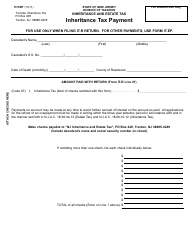

A: Form IT-NR is a tax form used for the Transfer Inheritance Tax for a non-resident decedent in New Jersey.

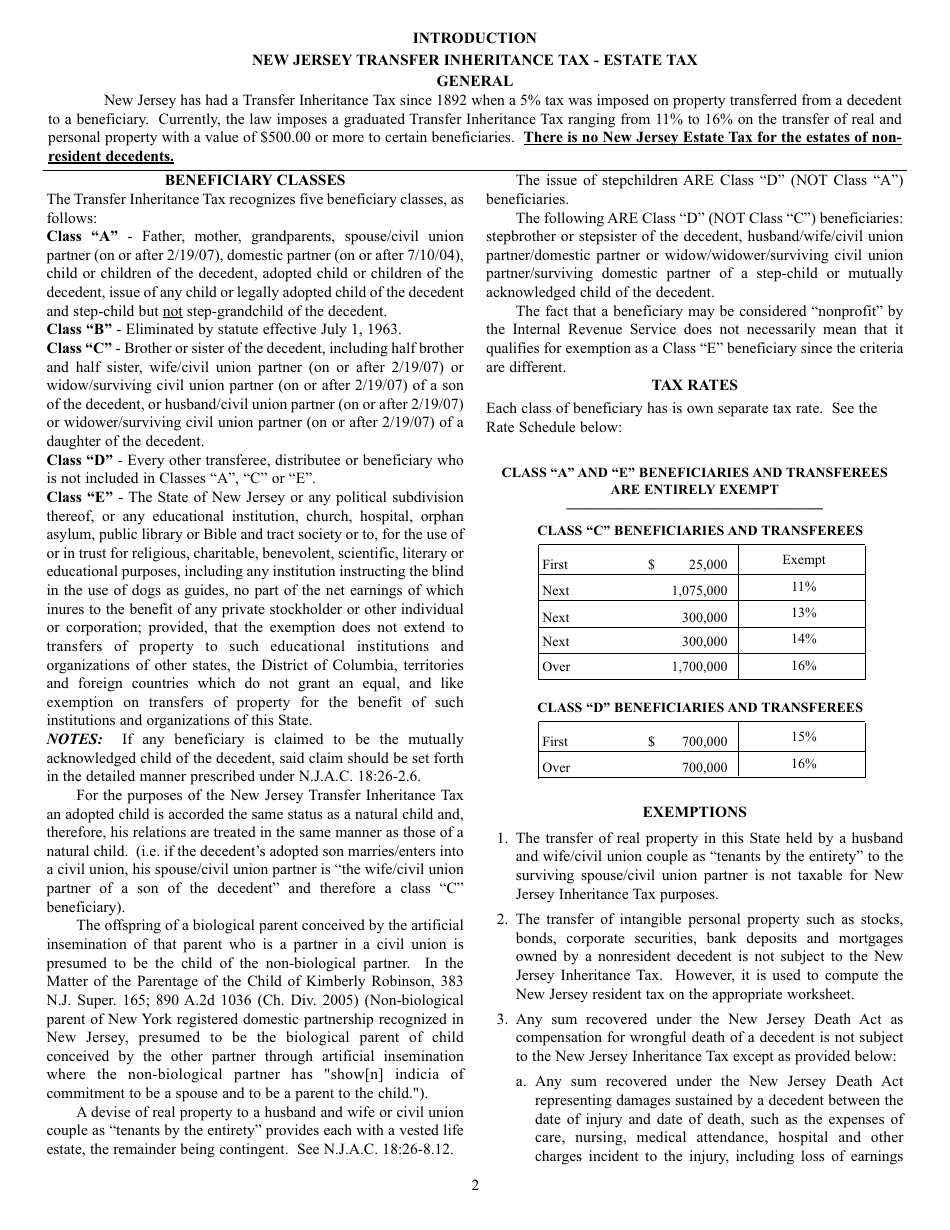

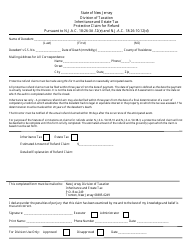

Q: What is the Transfer Inheritance Tax?

A: Transfer Inheritance Tax is a tax imposed on the transfer of property from a decedent to a beneficiary.

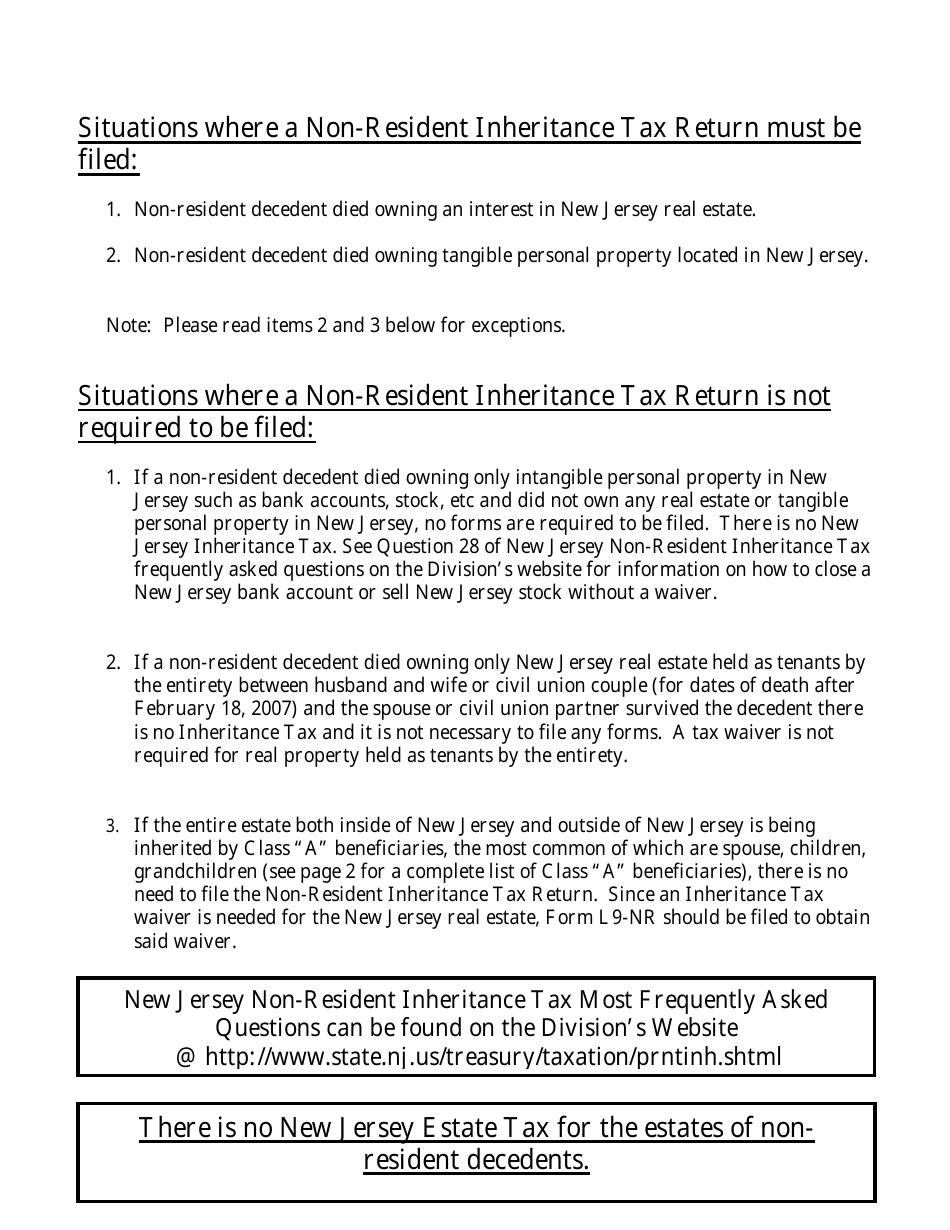

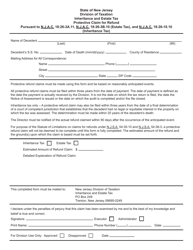

Q: Who needs to file Form IT-NR?

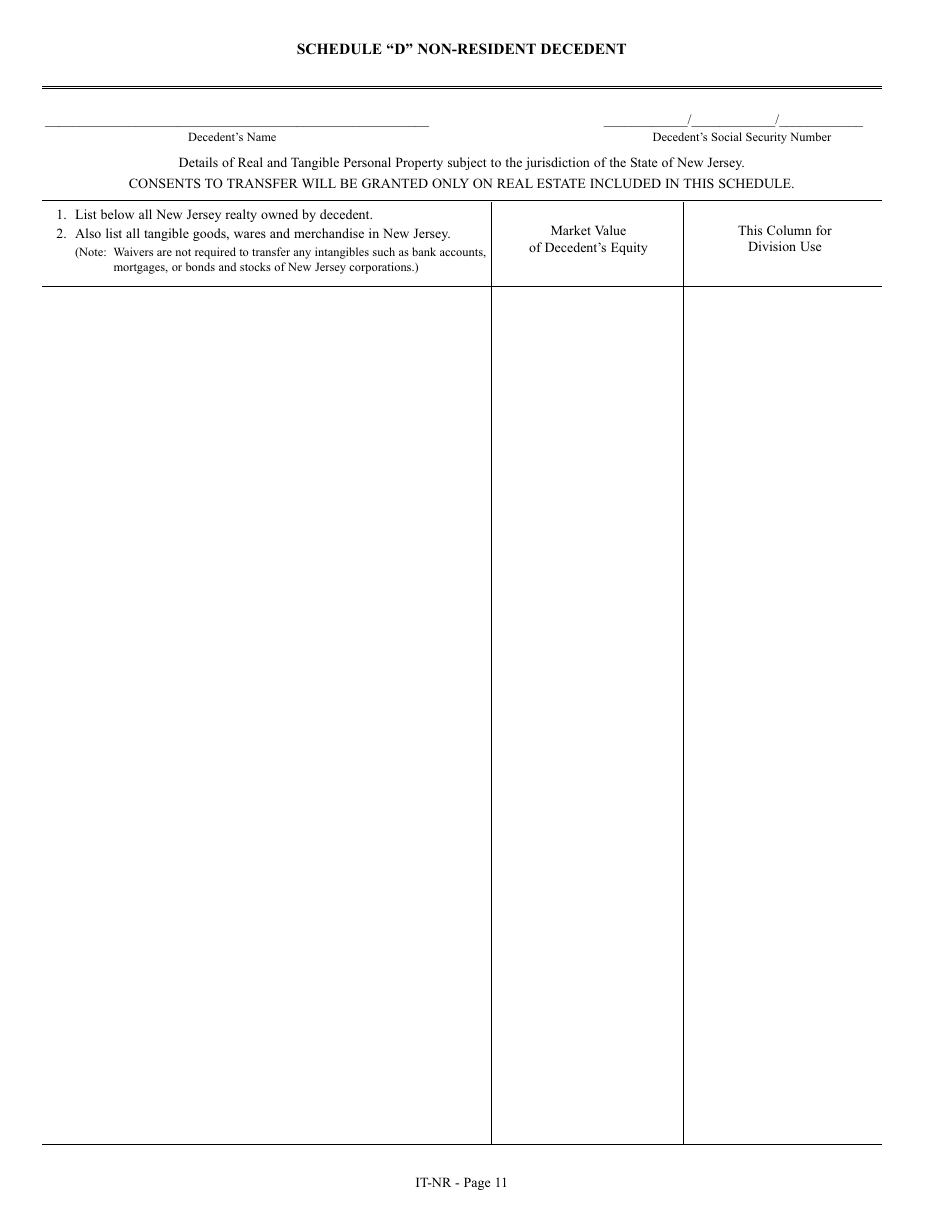

A: Form IT-NR needs to be filed by the executor or administrator of the estate of a non-resident decedent who owned property in New Jersey.

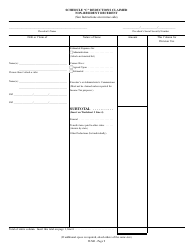

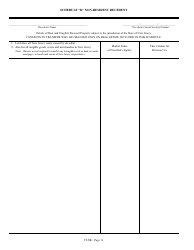

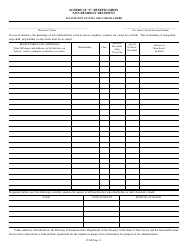

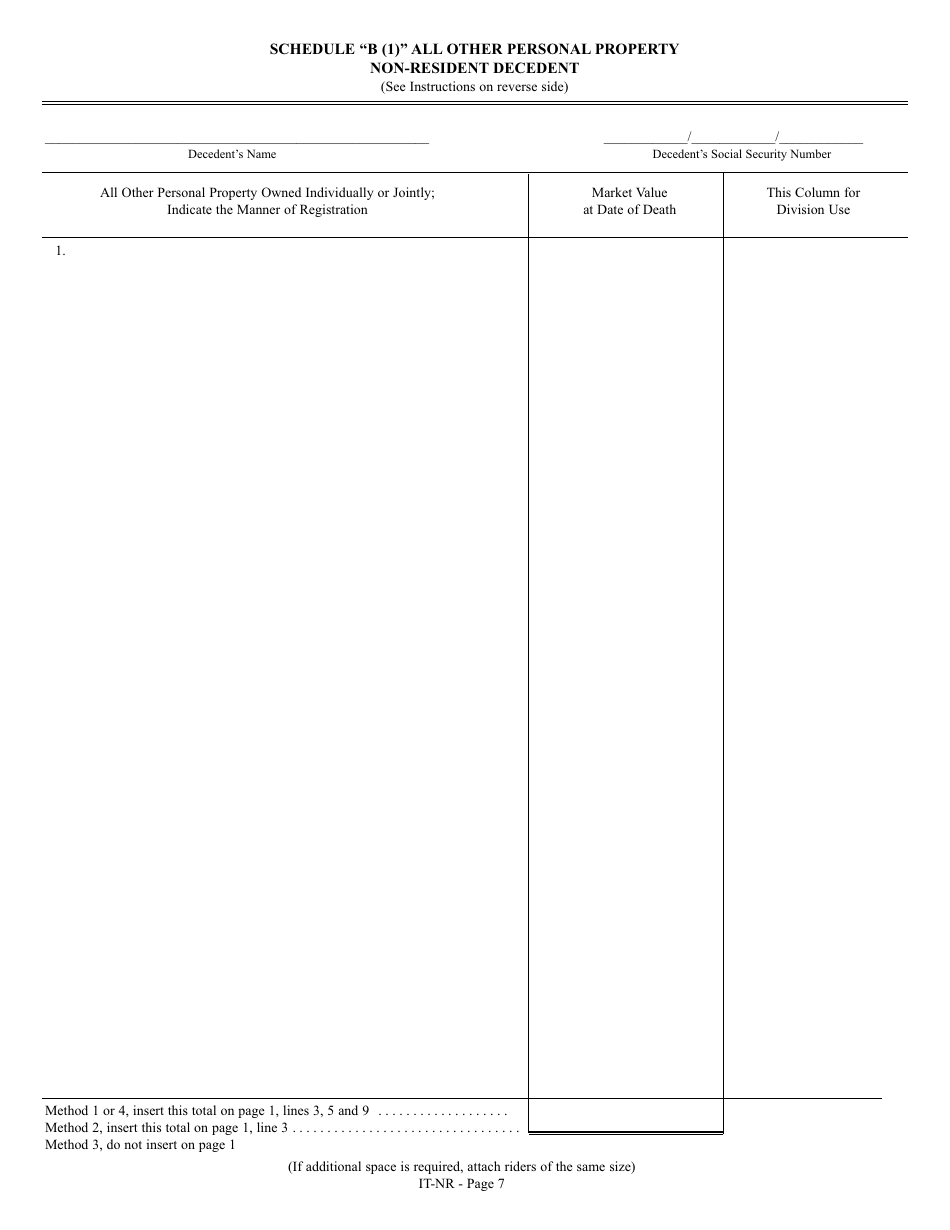

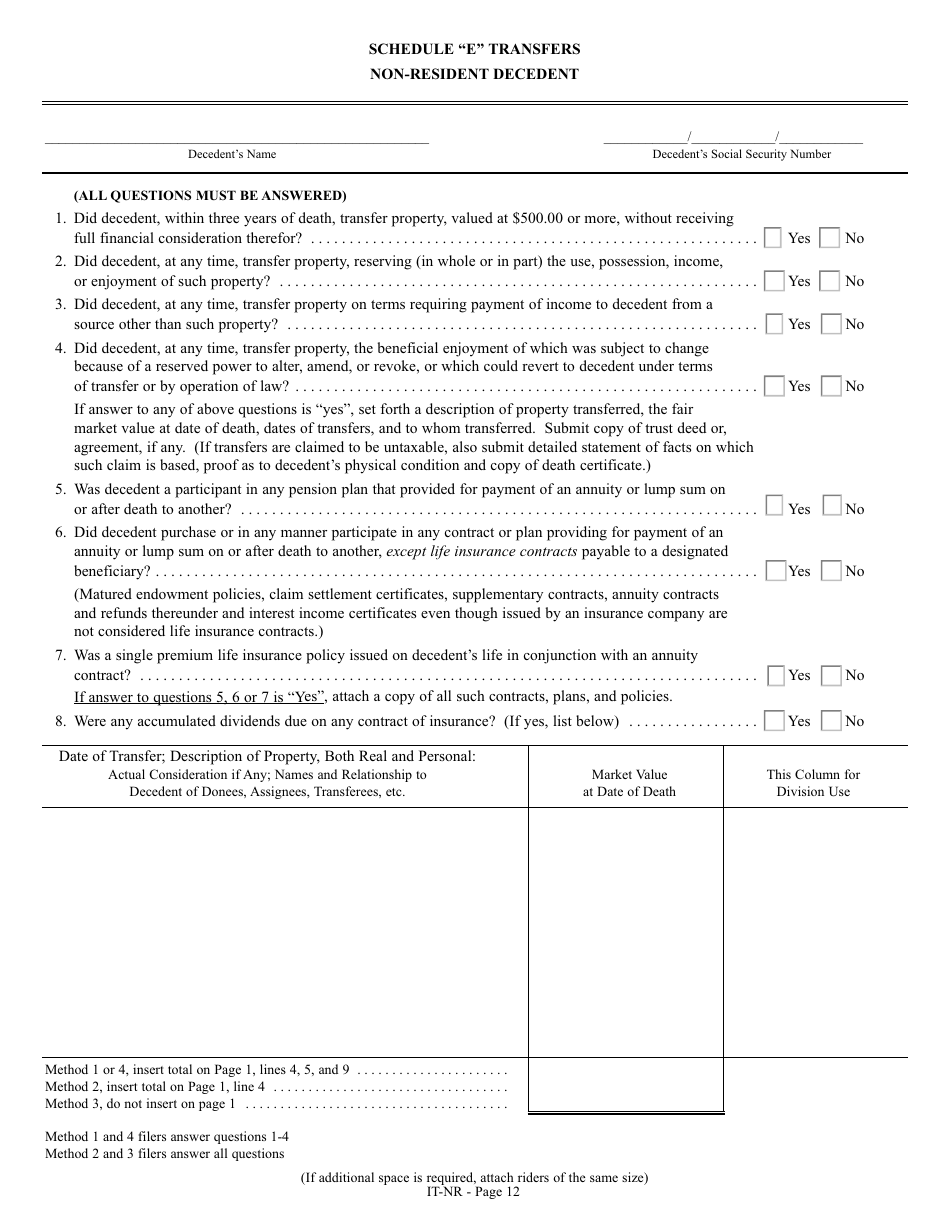

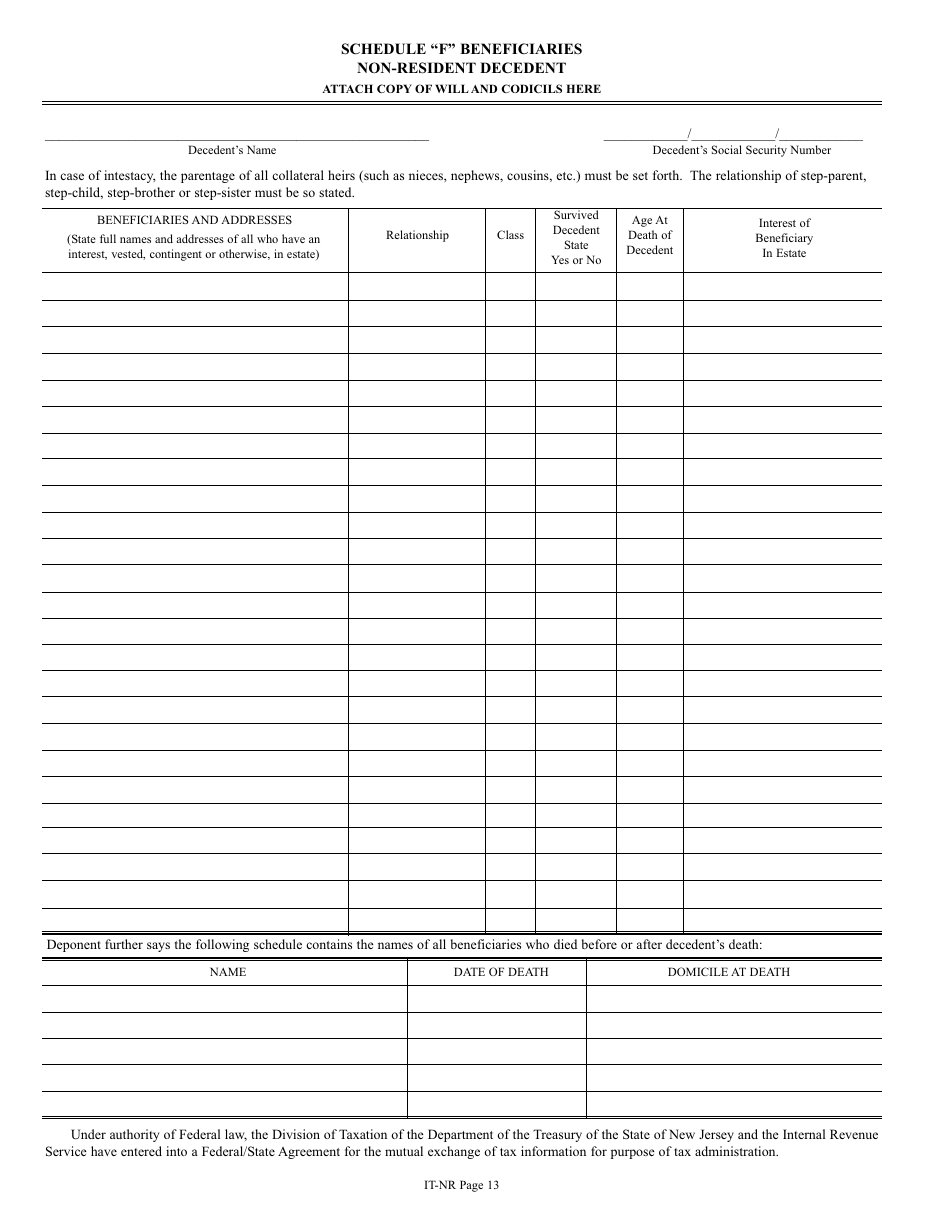

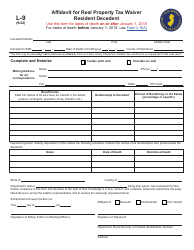

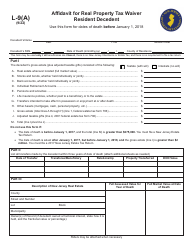

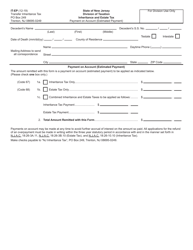

Q: What information is required on Form IT-NR?

A: Form IT-NR requires information about the decedent, the estate, and the beneficiaries.

Q: When is Form IT-NR due?

A: Form IT-NR is due within 8 months after the decedent's death.

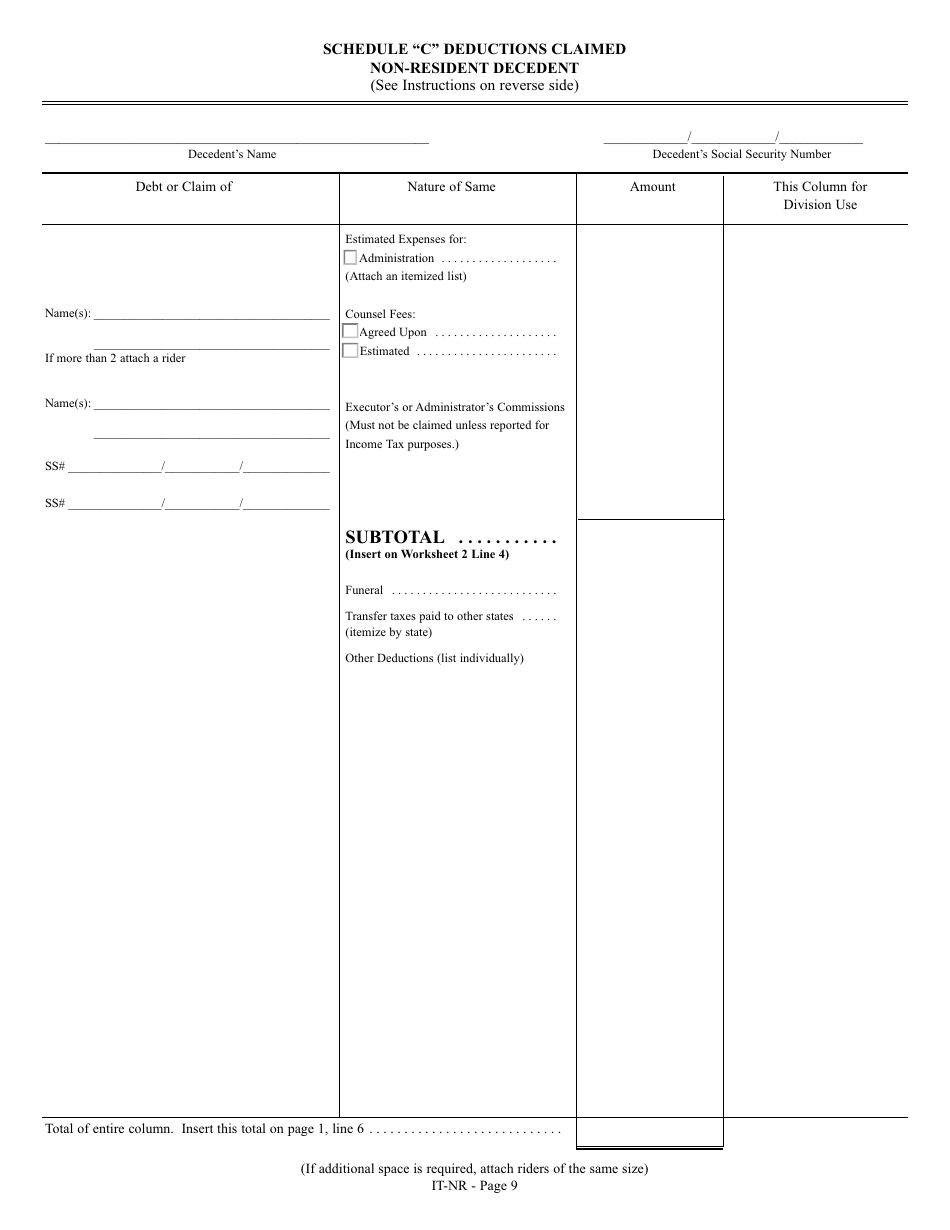

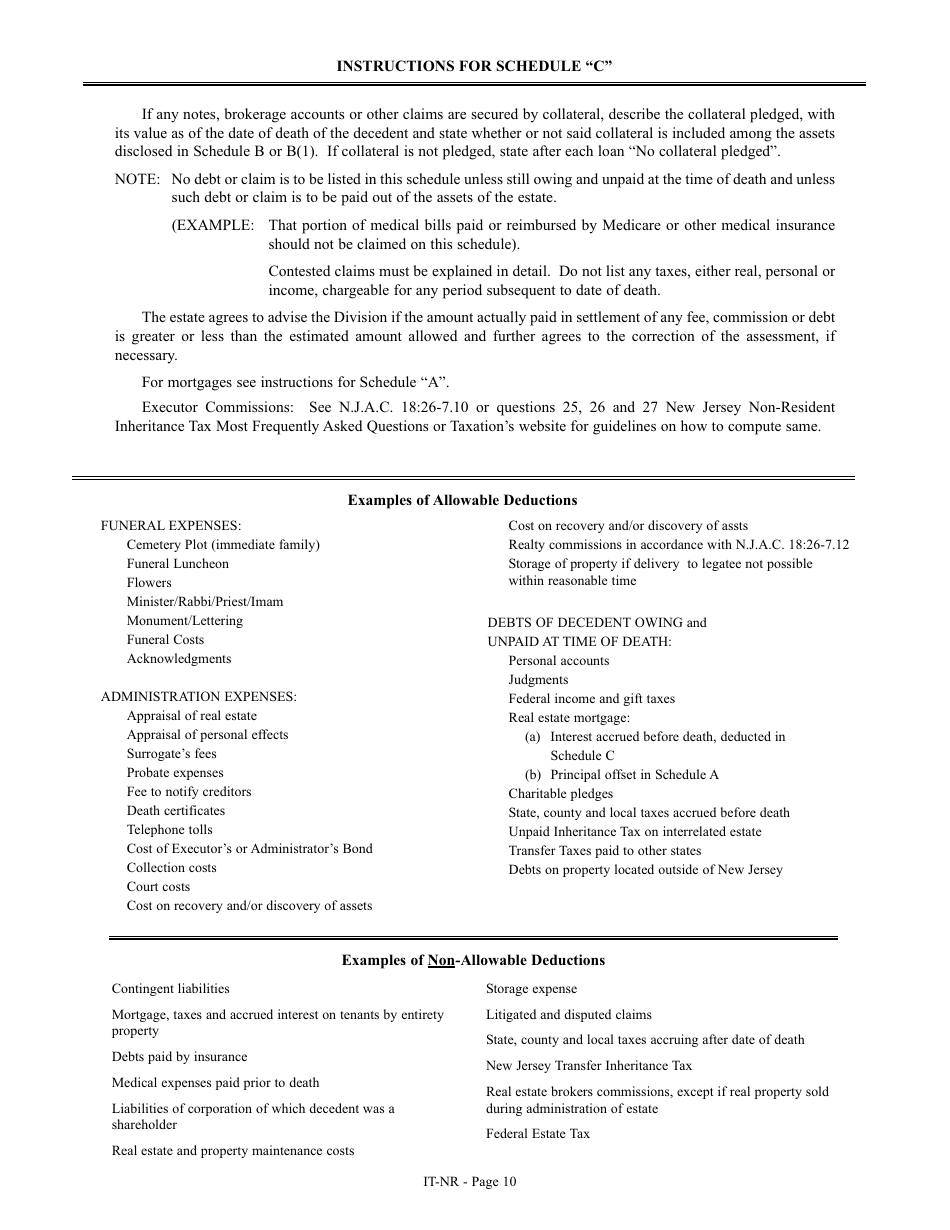

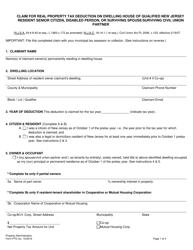

Q: Are there any exemptions or deductions available for the Transfer Inheritance Tax?

A: Yes, there are exemptions and deductions available based on the relationship of the beneficiary to the decedent.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-NR by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.