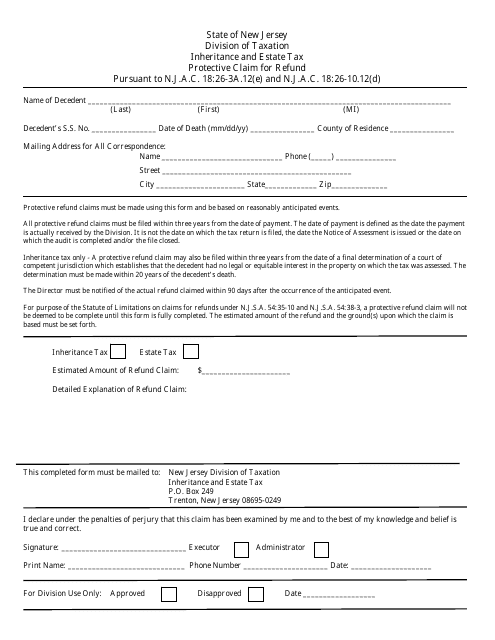

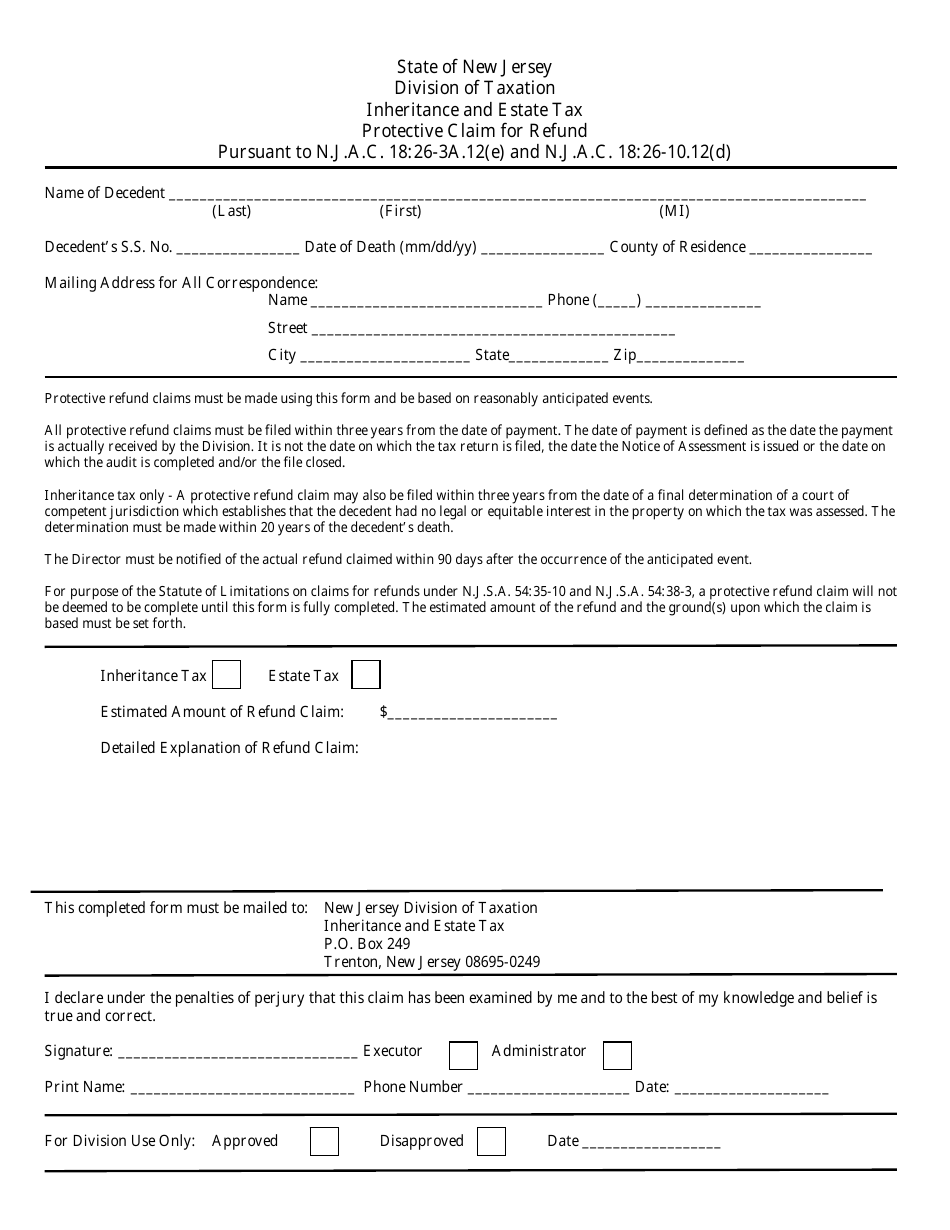

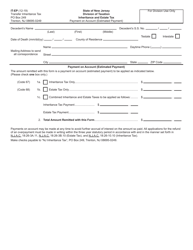

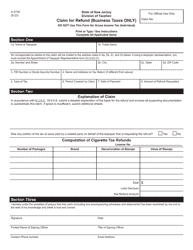

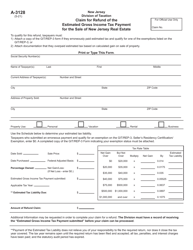

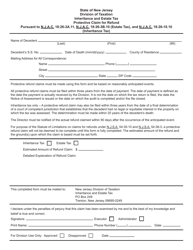

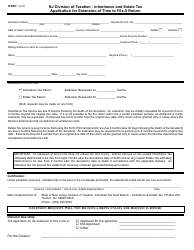

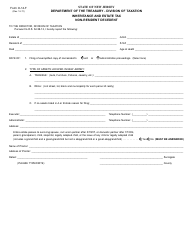

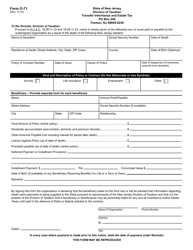

Inheritance and Estate Tax Protective Claim for Refund - New Jersey

Inheritance and Estate Tax Protective Claim for Refund is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is an Inheritance and Estate Tax Protective Claim for Refund?

A: An Inheritance and Estate Tax Protective Claim for Refund is a claim filed by a taxpayer to protect their right to a refund in case there is a change in the tax law or a court decision that may result in a refund.

Q: Who can file an Inheritance and Estate Tax Protective Claim for Refund in New Jersey?

A: Any taxpayer who paid New Jersey inheritance or estate taxes and believes they may be entitled to a refund if there is a change in the tax law or a court decision can file an Inheritance and Estate Tax Protective Claim for Refund.

Q: Why would someone file an Inheritance and Estate Tax Protective Claim for Refund?

A: Someone would file an Inheritance and Estate Tax Protective Claim for Refund to protect their right to a refund in case there is a change in the tax law or a court decision that may result in a refund.

Q: How is an Inheritance and Estate Tax Protective Claim for Refund filed in New Jersey?

A: An Inheritance and Estate Tax Protective Claim for Refund can be filed by completing and mailing Form IT-CLAIM to the New Jersey Division of Taxation.

Q: Are there any time limits for filing an Inheritance and Estate Tax Protective Claim for Refund?

A: Yes, the claim must be filed within three years from the date the tax was paid or two years from the date the tax was finally determined, whichever is later.

Form Details:

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.