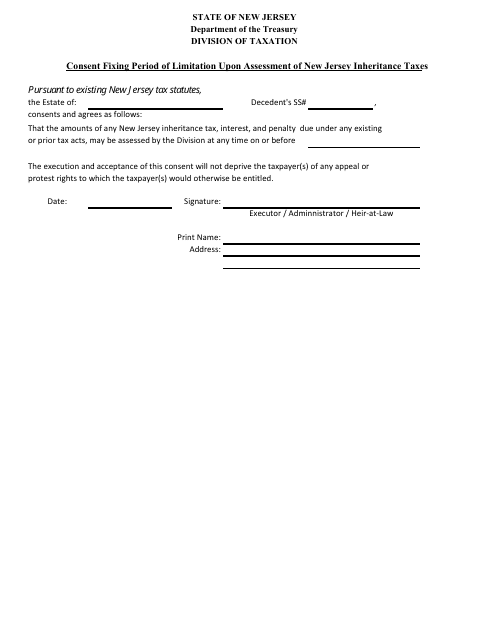

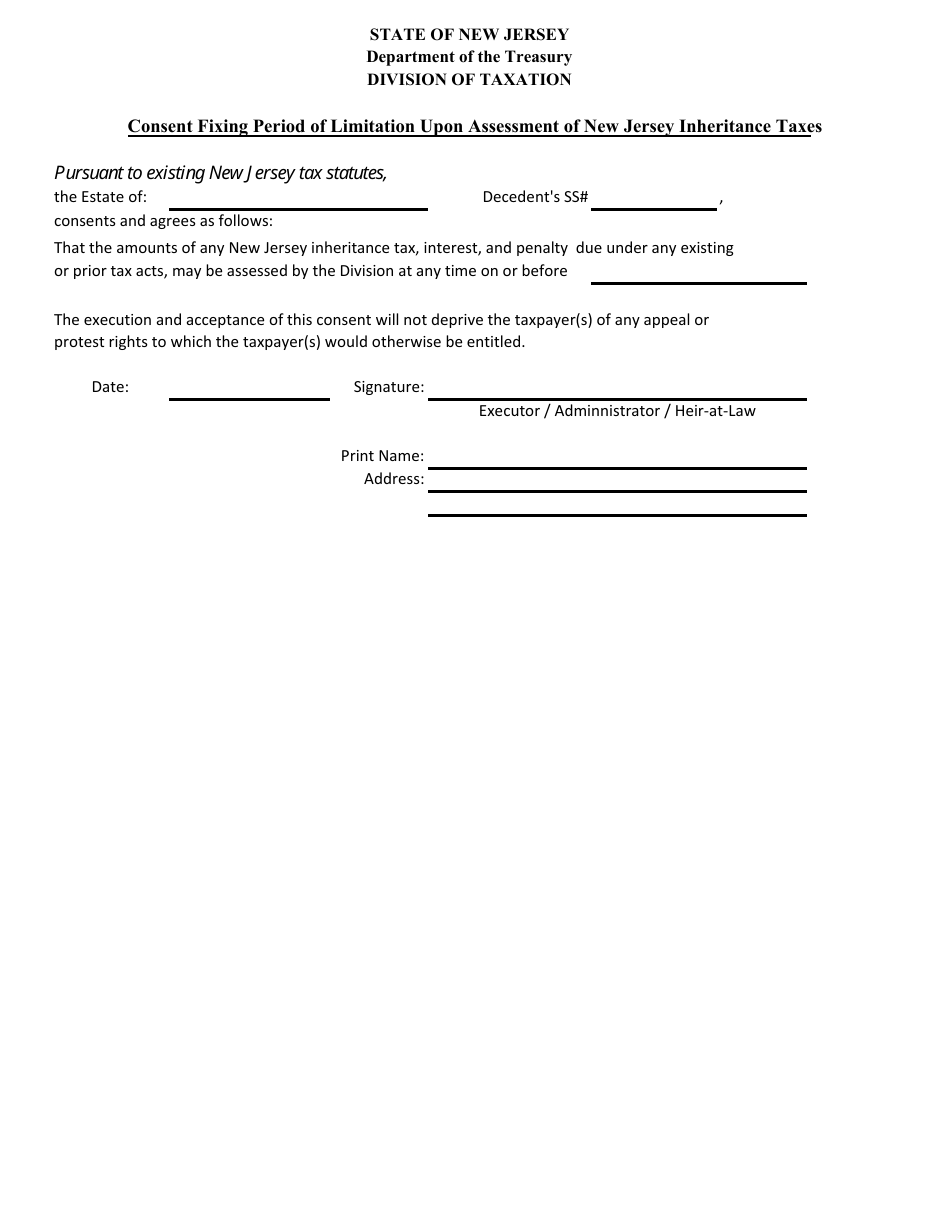

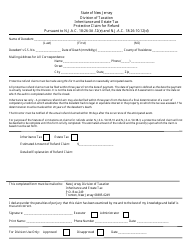

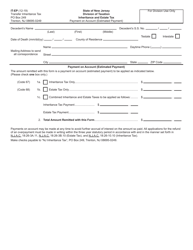

Consent Fixing Period of Limitation Upon Assessment of New Jersey Inheritance Taxes - New Jersey

Consent Fixing Period of Limitation Upon Assessment of New Jersey Inheritance Taxes is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

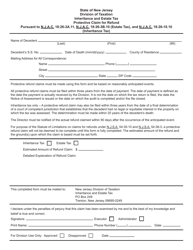

Q: What is the consent fixing period of limitation upon assessment of New Jersey inheritance taxes?

A: The consent fixing period of limitation upon assessment of New Jersey inheritance taxes is 4 years.

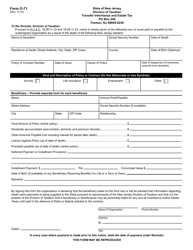

Q: What are New Jersey inheritance taxes?

A: New Jersey inheritance taxes are taxes imposed on the transfer of property or assets upon someone's death.

Q: Who is responsible for paying New Jersey inheritance taxes?

A: The executor or administrator of the deceased person's estate is responsible for paying New Jersey inheritance taxes.

Q: Are all estates subject to New Jersey inheritance taxes?

A: No, only estates valued at or above a certain threshold are subject to New Jersey inheritance taxes.

Q: Can the consent fixing period of limitation upon assessment of New Jersey inheritance taxes be extended?

A: Yes, under certain circumstances the consent fixing period of limitation upon assessment of New Jersey inheritance taxes can be extended.

Form Details:

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.