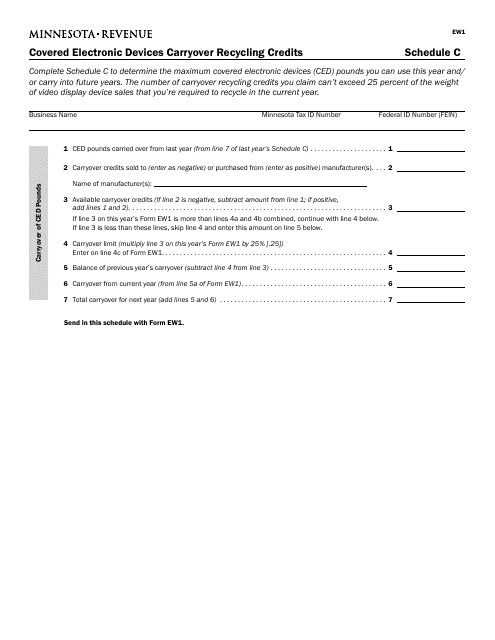

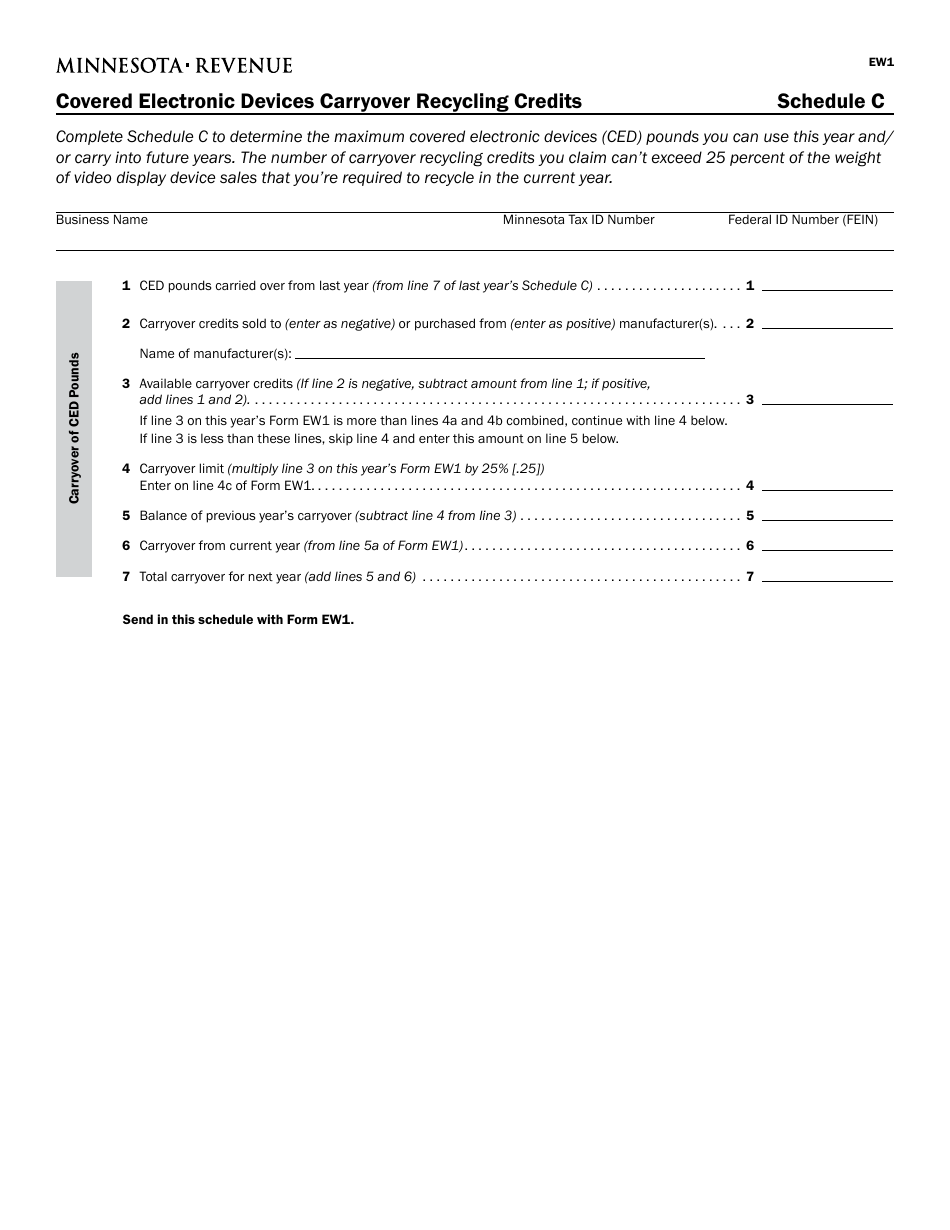

Form EW1 Schedule C Covered Electronic Devices Carryover Recycling Credits - Minnesota

What Is Form EW1 Schedule C?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EW1 Schedule C?

A: Form EW1 Schedule C is a form used in Minnesota to claim carryover recycling credits for covered electronic devices.

Q: What are covered electronic devices?

A: Covered electronic devices include televisions, computers, laptops, tablets, and other similar devices.

Q: What are carryover recycling credits?

A: Carryover recycling credits are credits earned for recycling covered electronic devices in previous years that can be applied to reduce recycling fees.

Q: How do I claim carryover recycling credits?

A: You can claim carryover recycling credits by completing Form EW1 Schedule C and submitting it with your tax return.

Q: Can I carry over unused credits to future years?

A: Yes, unused carryover recycling credits can be carried over to future years and applied to reduce recycling fees.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EW1 Schedule C by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.