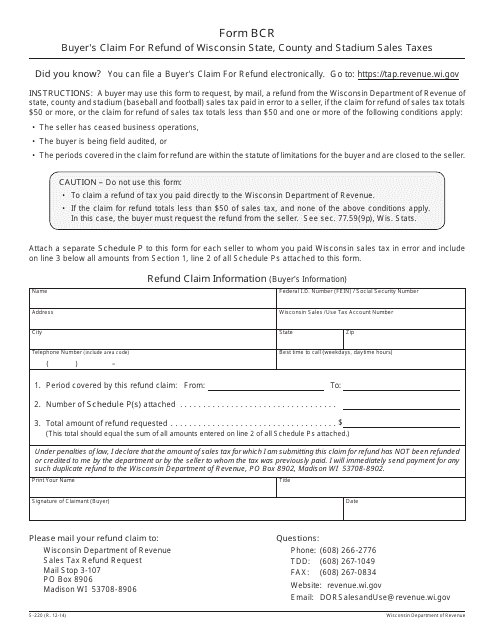

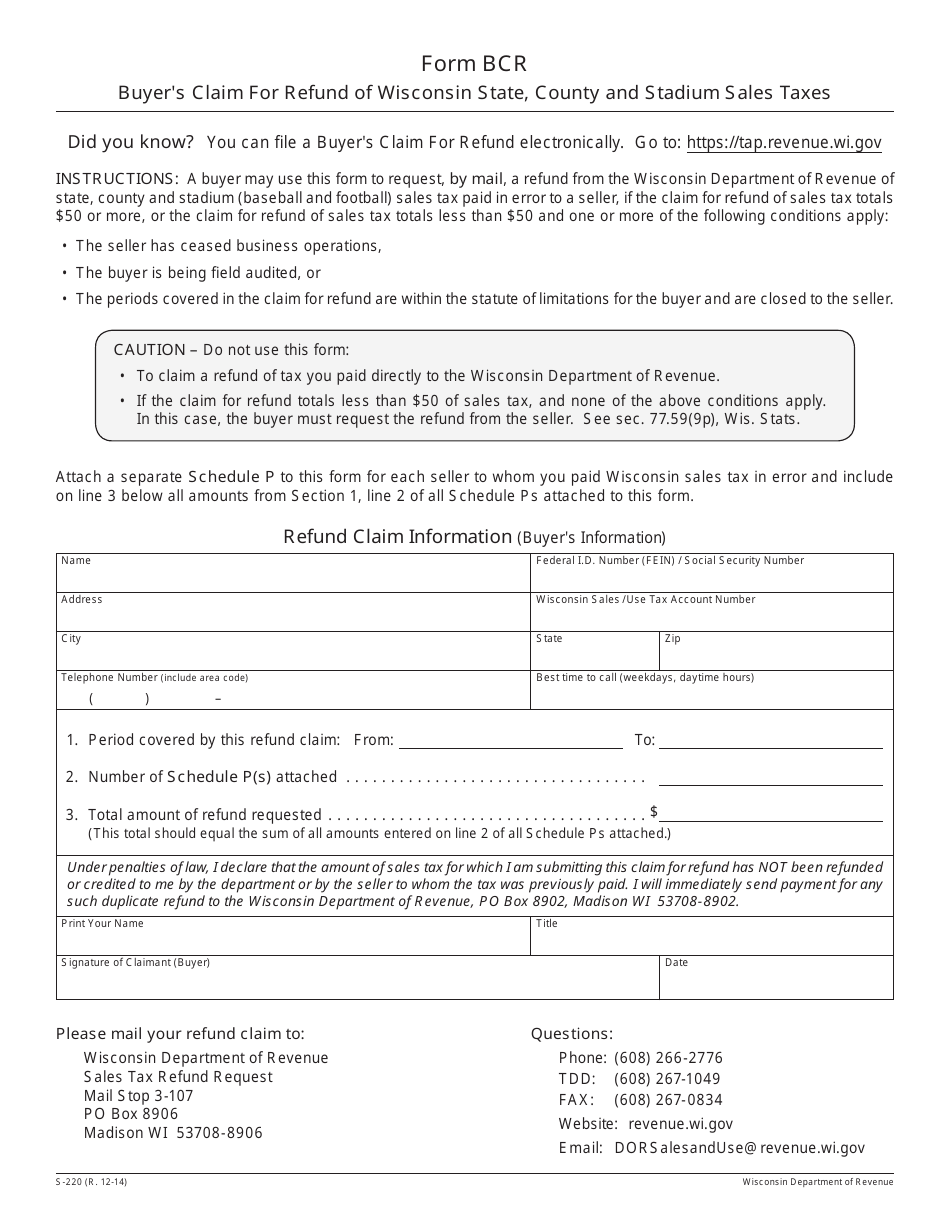

Form S-220 (BCR) Buyer's Claim for Refund of Wisconsin State, County and Stadium Sales Taxes - Wisconsin

What Is Form S-220 (BCR)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-220 (BCR)?

A: Form S-220 (BCR) is the Buyer's Claim for Refund of Wisconsin State, County and Stadium Sales Taxes.

Q: Who can use Form S-220 (BCR)?

A: This form can be used by buyers who want to claim a refund of Wisconsin State, County and Stadium Sales Taxes.

Q: What is the purpose of Form S-220 (BCR)?

A: The purpose of this form is to claim a refund of sales taxes paid in Wisconsin.

Q: Which taxes can be refunded using Form S-220 (BCR)?

A: Form S-220 (BCR) can be used to claim refunds of Wisconsin State, County and Stadium Sales Taxes.

Q: How do I fill out Form S-220 (BCR)?

A: You should follow the instructions provided on the form to properly fill it out.

Q: Can I claim a refund for sales taxes paid in other states?

A: No, Form S-220 (BCR) is specifically for claiming refunds of sales taxes paid in Wisconsin.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S-220 (BCR) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.