This version of the form is not currently in use and is provided for reference only. Download this version of

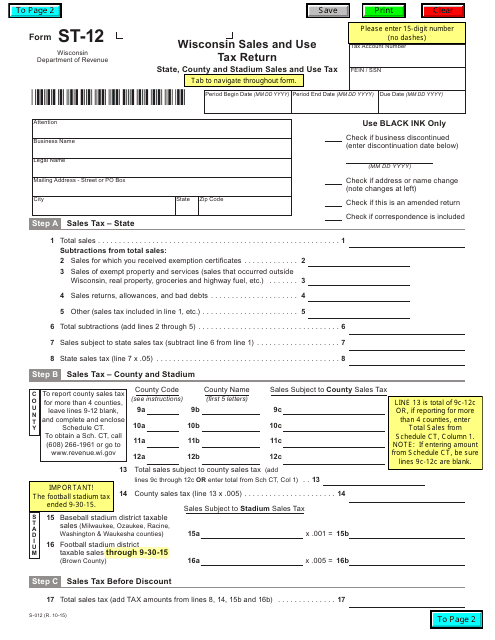

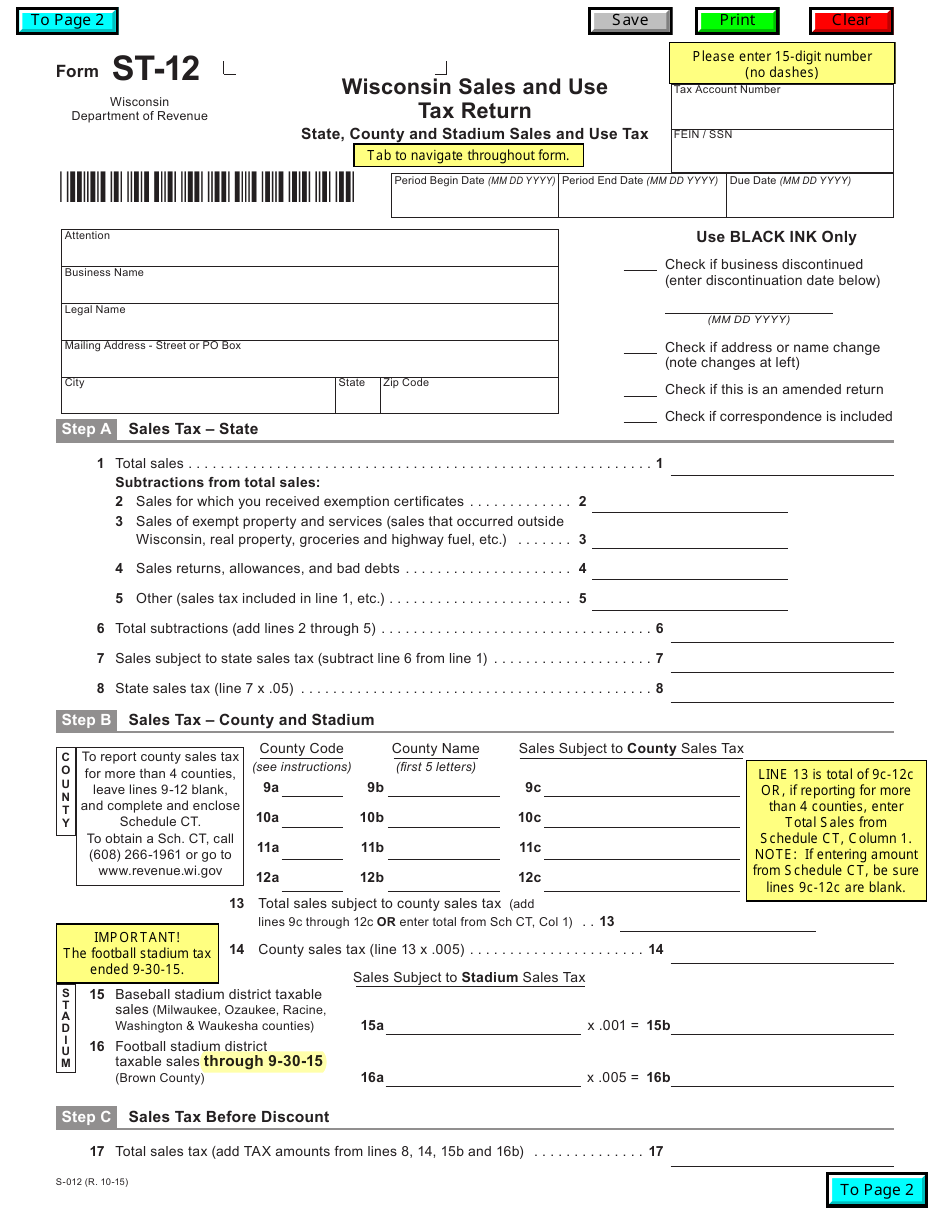

Form ST-12

for the current year.

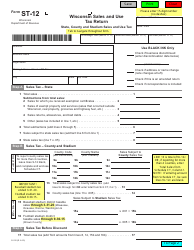

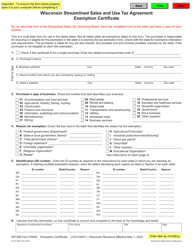

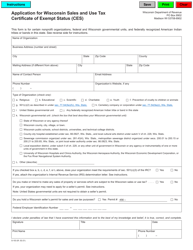

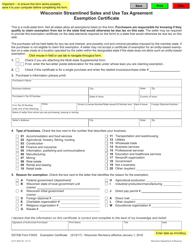

Form ST-12 Wisconsin Sales and Use Tax Return - Wisconsin

What Is Form ST-12?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-12?

A: Form ST-12 is the Wisconsin Sales and Use Tax Return.

Q: Who needs to file Form ST-12?

A: Businesses registered for sales and use tax in Wisconsin need to file Form ST-12.

Q: What taxes does Form ST-12 cover?

A: Form ST-12 covers sales tax and use tax in Wisconsin.

Q: When is Form ST-12 due?

A: Form ST-12 is due on the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form ST-12?

A: Yes, there are penalties for not filing Form ST-12 or for filing late.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-12 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.