Tax Experience Worksheet - Oregon

Tax Experience Worksheet is a legal document that was released by the Oregon Board of Accountancy - a government authority operating within Oregon.

FAQ

Q: What is the purpose of the Tax Experience Worksheet?

A: The purpose of the Tax Experience Worksheet is to help Oregon residents gather information for their state tax return.

Q: Who should use the Tax Experience Worksheet?

A: Any Oregon resident who is required to file a state tax return should use the Tax Experience Worksheet.

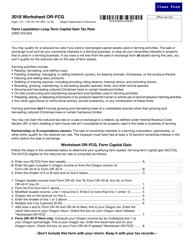

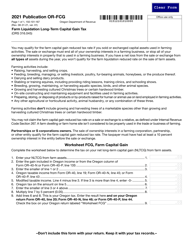

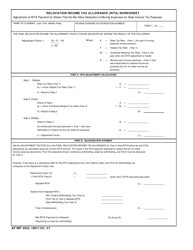

Q: What information should be included in the Tax Experience Worksheet?

A: The Tax Experience Worksheet should include details about your income, deductions, and credits.

Q: Can I use the Tax Experience Worksheet for federal taxes?

A: No, the Tax Experience Worksheet is specifically designed for Oregon state taxes and should not be used for federal tax returns.

Q: Is the Tax Experience Worksheet mandatory?

A: While the use of the Tax Experience Worksheet is not mandatory, it is recommended to ensure that you have all the necessary information for your state tax return.

Q: Can I submit the Tax Experience Worksheet with my tax return?

A: No, the Tax Experience Worksheet is not to be submitted with your tax return. It is only meant to help you gather information.

Q: What should I do with the completed Tax Experience Worksheet?

A: Once you have completed the Tax Experience Worksheet, you should use the information gathered to accurately fill out your Oregon state tax return.

Q: Are there any deadlines for using the Tax Experience Worksheet?

A: There are no specific deadlines for using the Tax Experience Worksheet. However, you should complete it before the deadline for filing your Oregon state tax return.

Q: Can I use the Tax Experience Worksheet for multiple years?

A: The Tax Experience Worksheet is designed for a specific tax year. You should use the appropriate version for the year you are filing your state tax return.

Form Details:

- Released on October 1, 2015;

- The latest edition currently provided by the Oregon Board of Accountancy;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Board of Accountancy.