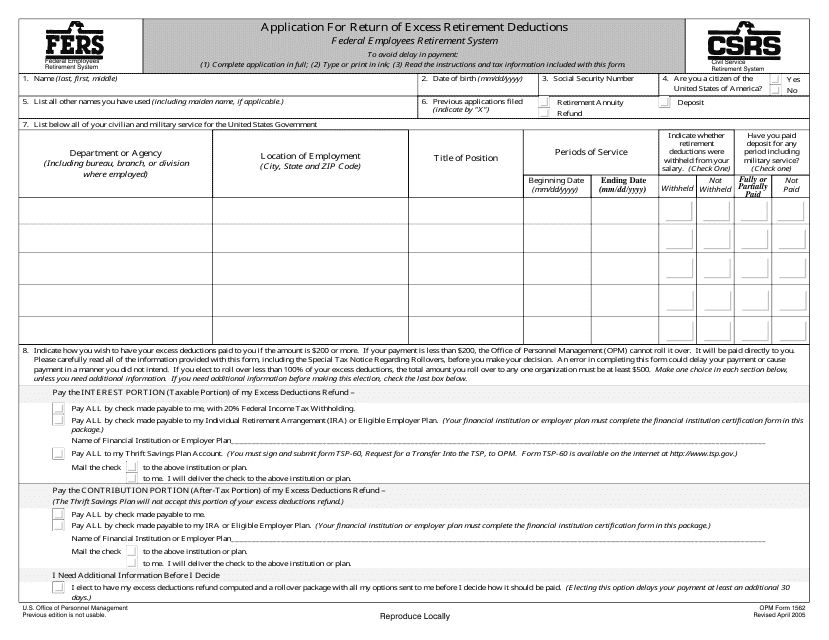

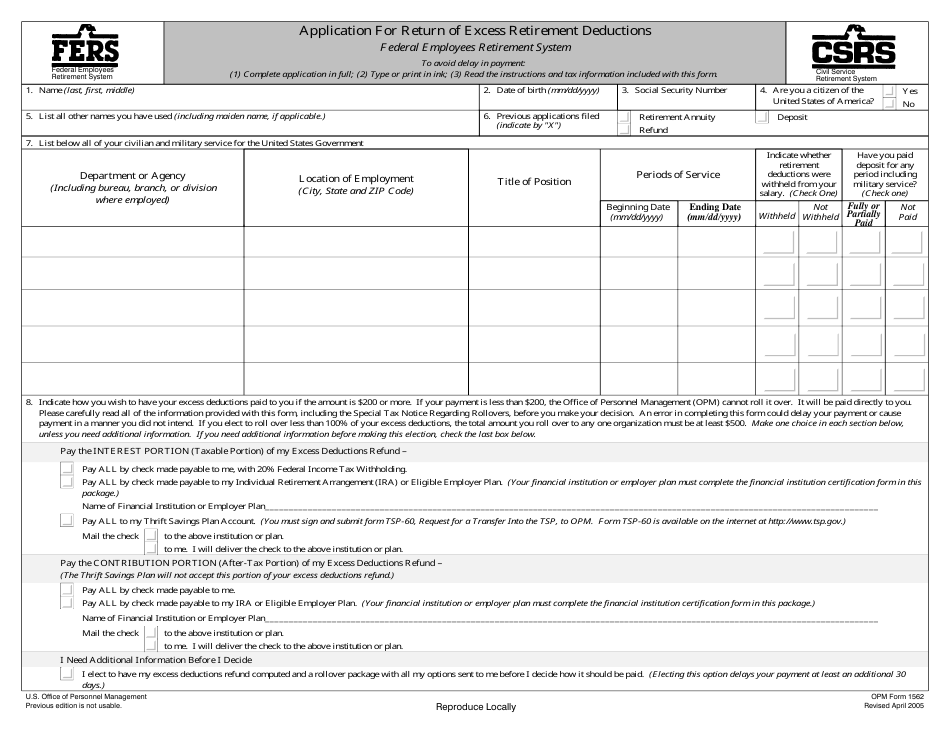

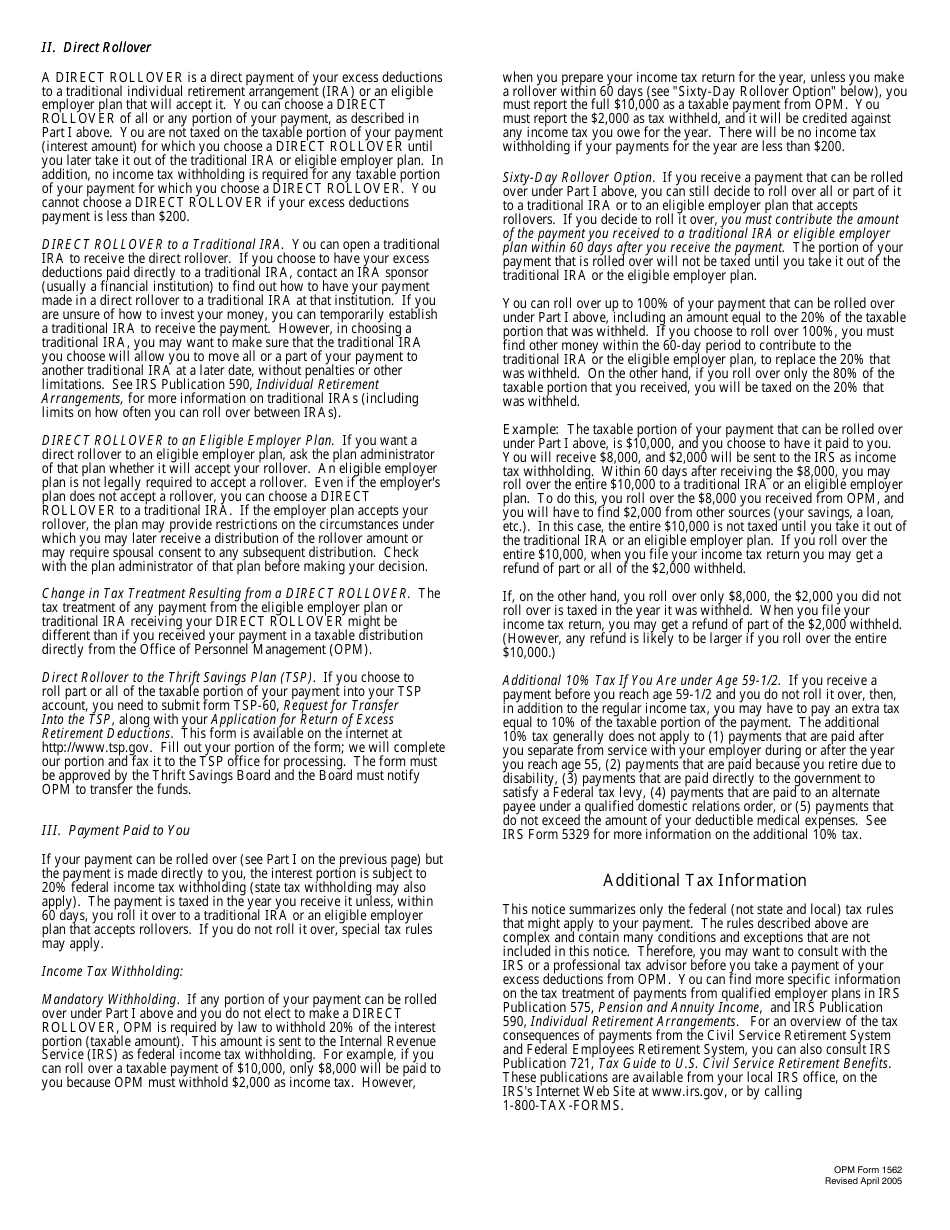

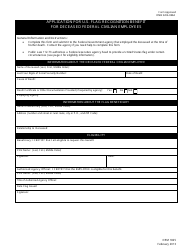

OPM Form 1562 Application for Return of Excess Retirement Deductions

What Is OPM Form 1562?

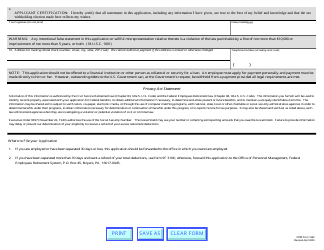

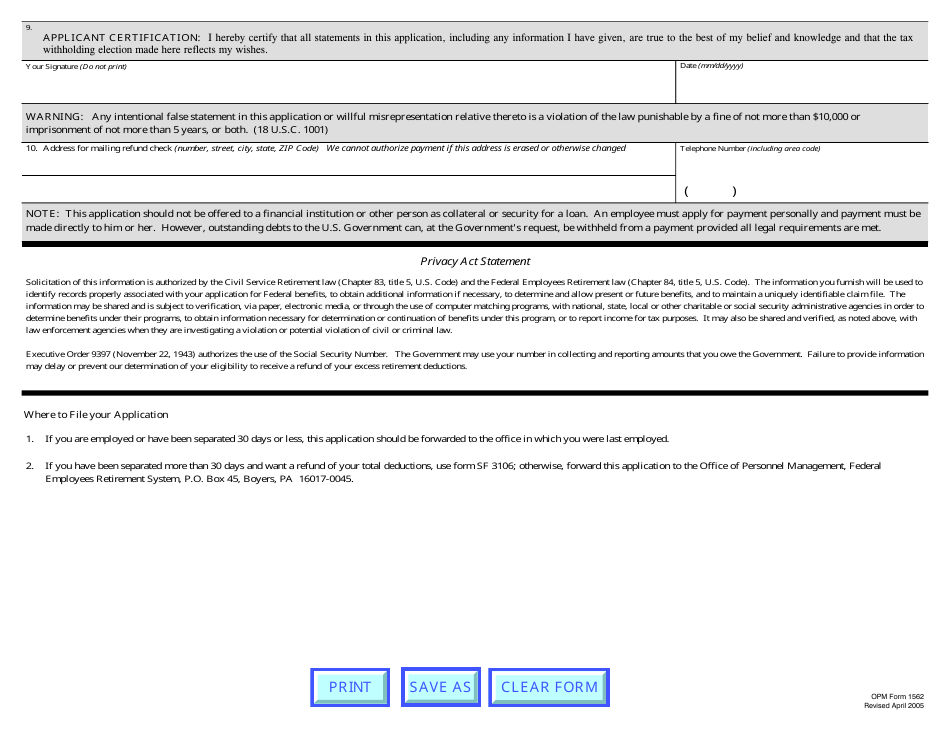

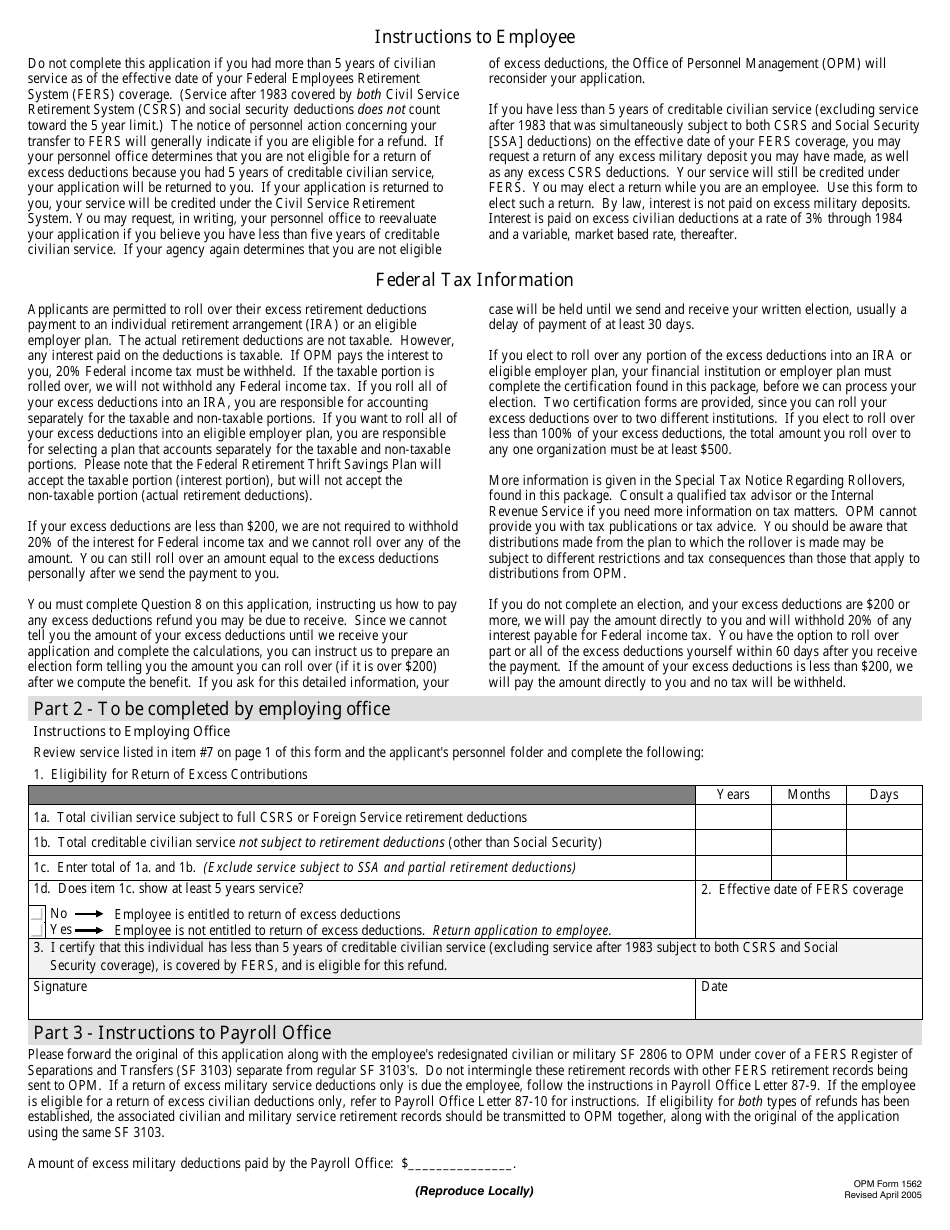

This is a legal form that was released by the U.S. Office of Personnel Management on April 1, 2005 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OPM Form 1562?

A: OPM Form 1562 is the Application for Return of Excess Retirement Deductions.

Q: What is the purpose of OPM Form 1562?

A: The purpose of OPM Form 1562 is to request the return of excess retirement deductions.

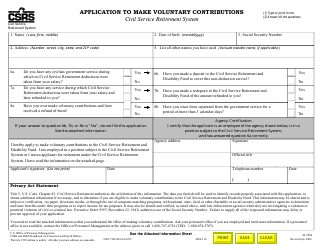

Q: Who can use OPM Form 1562?

A: Federal employees who have excess retirement deductions can use OPM Form 1562.

Q: How do I submit OPM Form 1562?

A: OPM Form 1562 can be submitted to the Office of Personnel Management (OPM) by mail or fax.

Q: What information is required on OPM Form 1562?

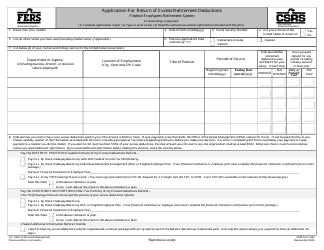

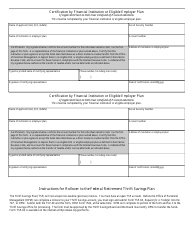

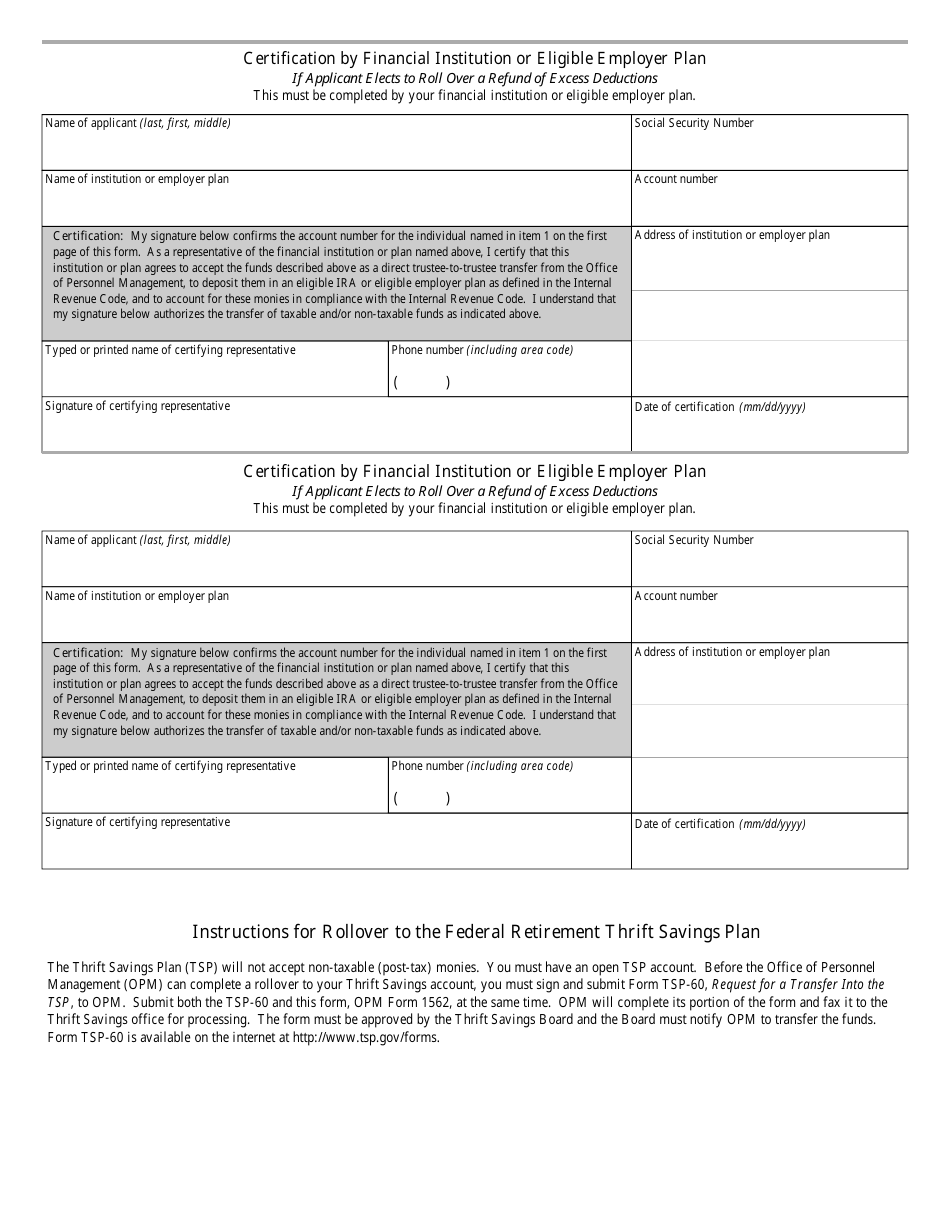

A: OPM Form 1562 requires information such as personal details, retirement system information, and details about the excess retirement deductions.

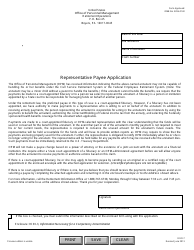

Q: When should I use OPM Form 1562?

A: OPM Form 1562 should be used when you have excess retirement deductions that need to be returned.

Q: Is there a deadline for submitting OPM Form 1562?

A: There is no specific deadline mentioned for submitting OPM Form 1562, but it is recommended to submit it as soon as possible after discovering the excess retirement deductions.

Q: Are there any fees associated with submitting OPM Form 1562?

A: There are no fees associated with submitting OPM Form 1562.

Form Details:

- Released on April 1, 2005;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OPM Form 1562 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.