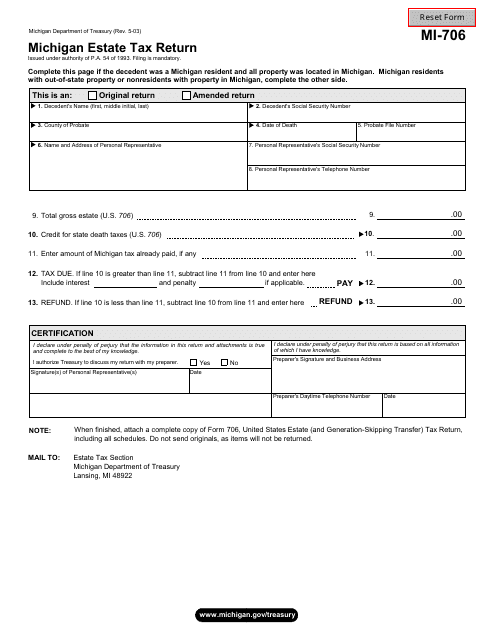

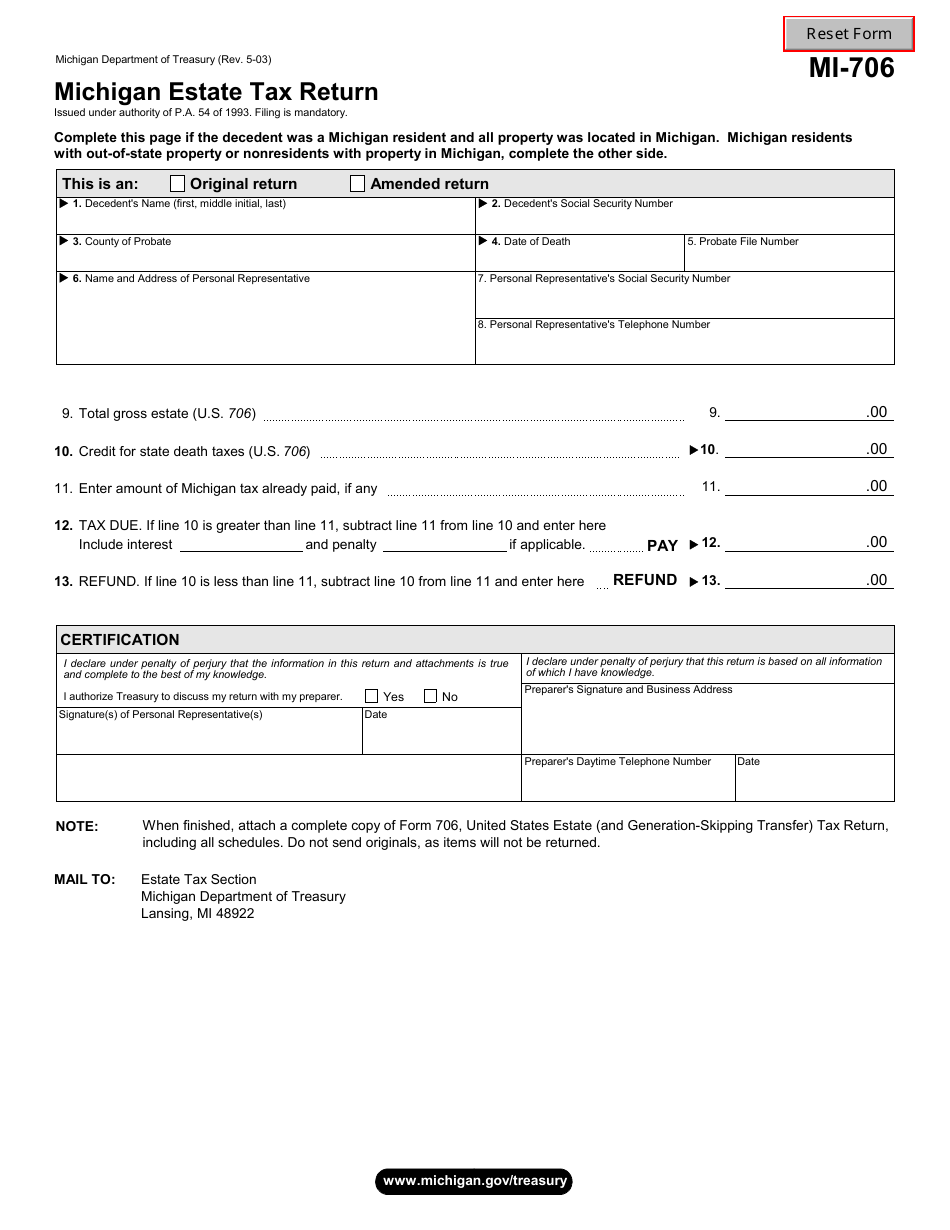

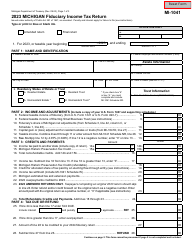

Form MI-706 Michigan Estate Tax Return - Michigan

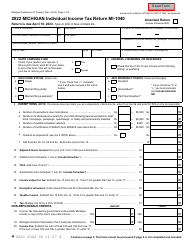

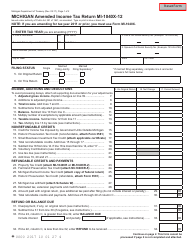

What Is Form MI-706?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-706?

A: Form MI-706 is the Michigan Estate Tax Return. It is used to report and pay estate taxes owed to the state of Michigan.

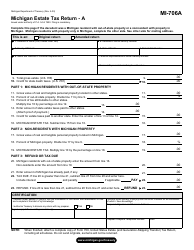

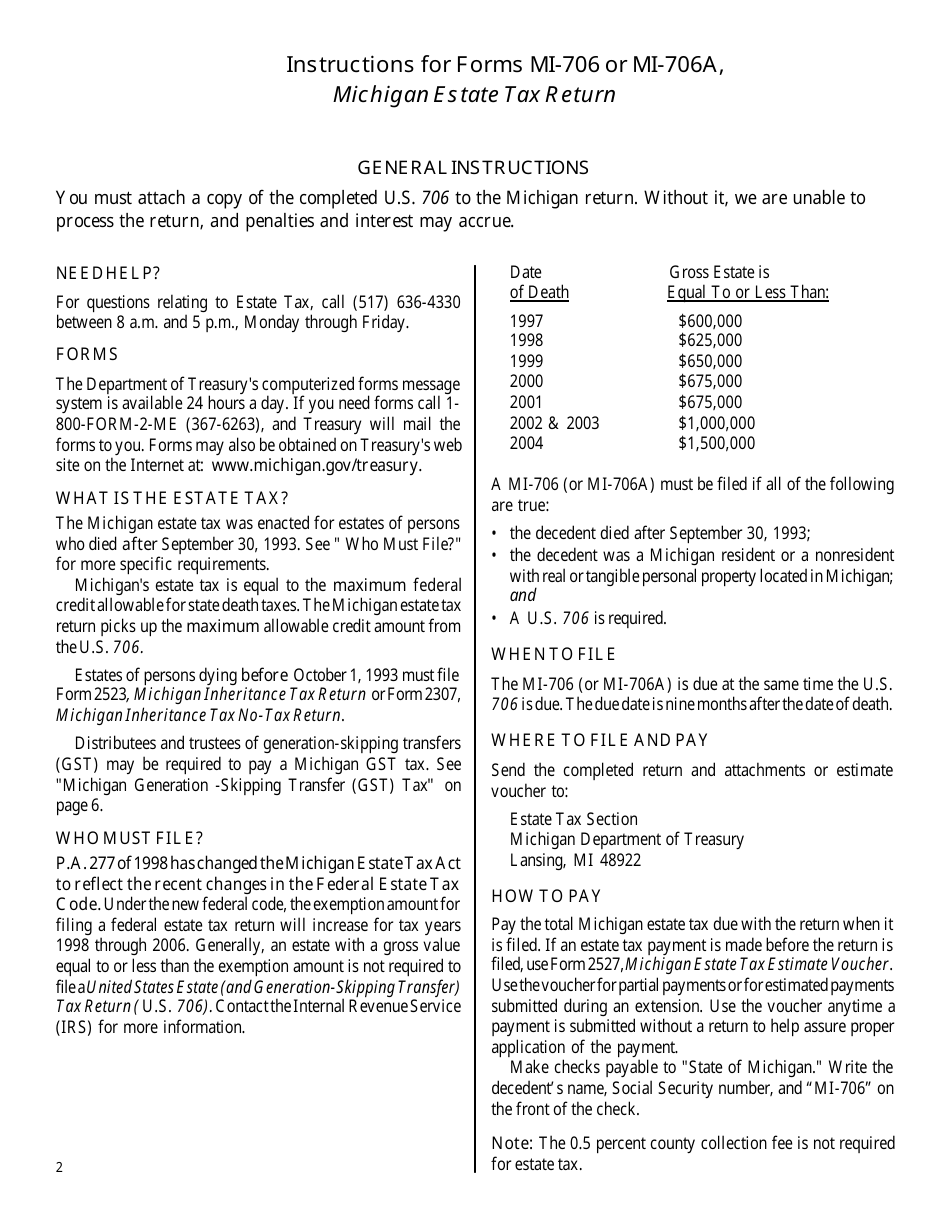

Q: Who needs to file Form MI-706?

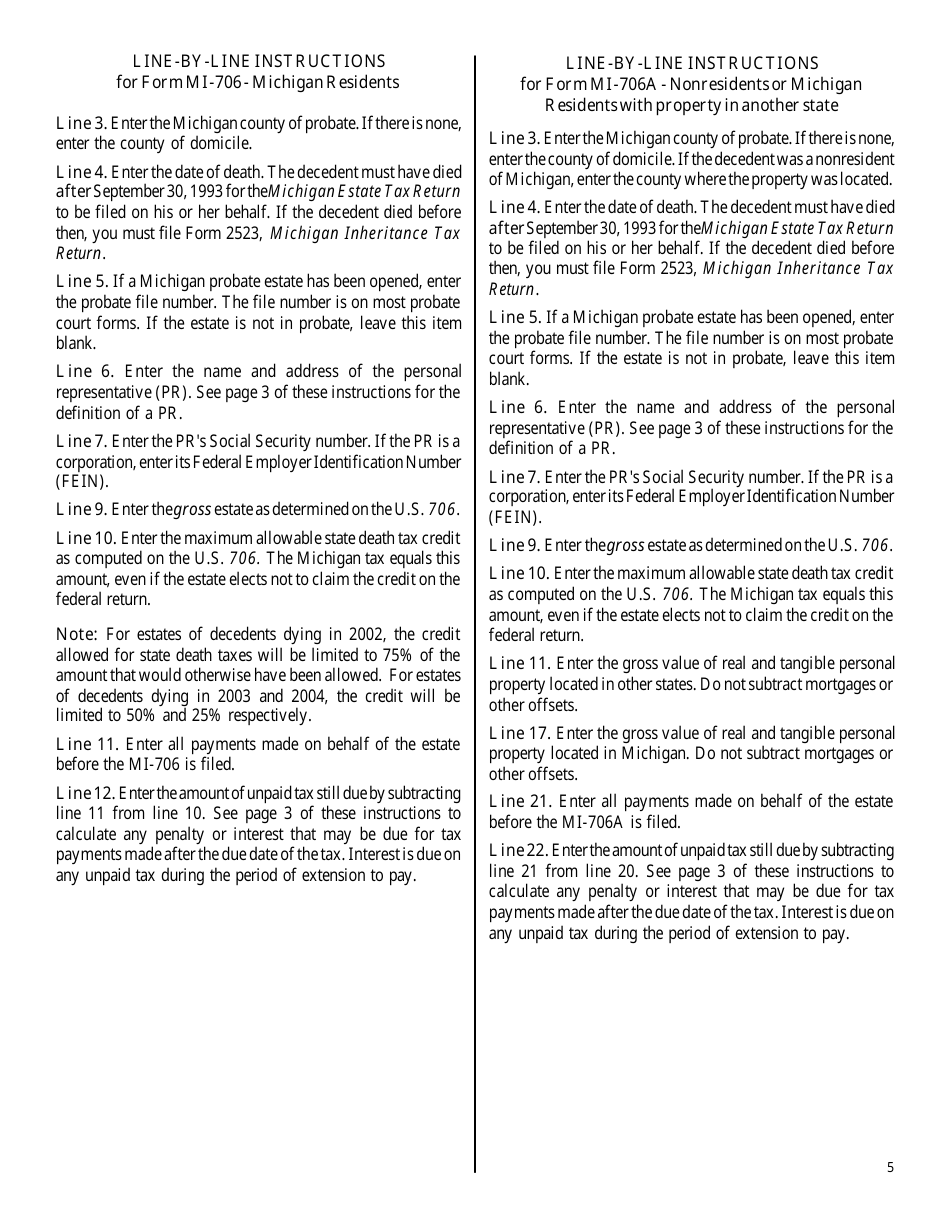

A: Form MI-706 must be filed by the executor or personal representative of an estate if the decedent's gross estate exceeds the Michigan estate tax exemption amount.

Q: What is the Michigan estate tax exemption amount?

A: The Michigan estate tax exemption amount is $5.49 million for individuals who died in 2021.

Q: When is the deadline to file Form MI-706?

A: The deadline to file Form MI-706 is within nine months after the decedent's date of death.

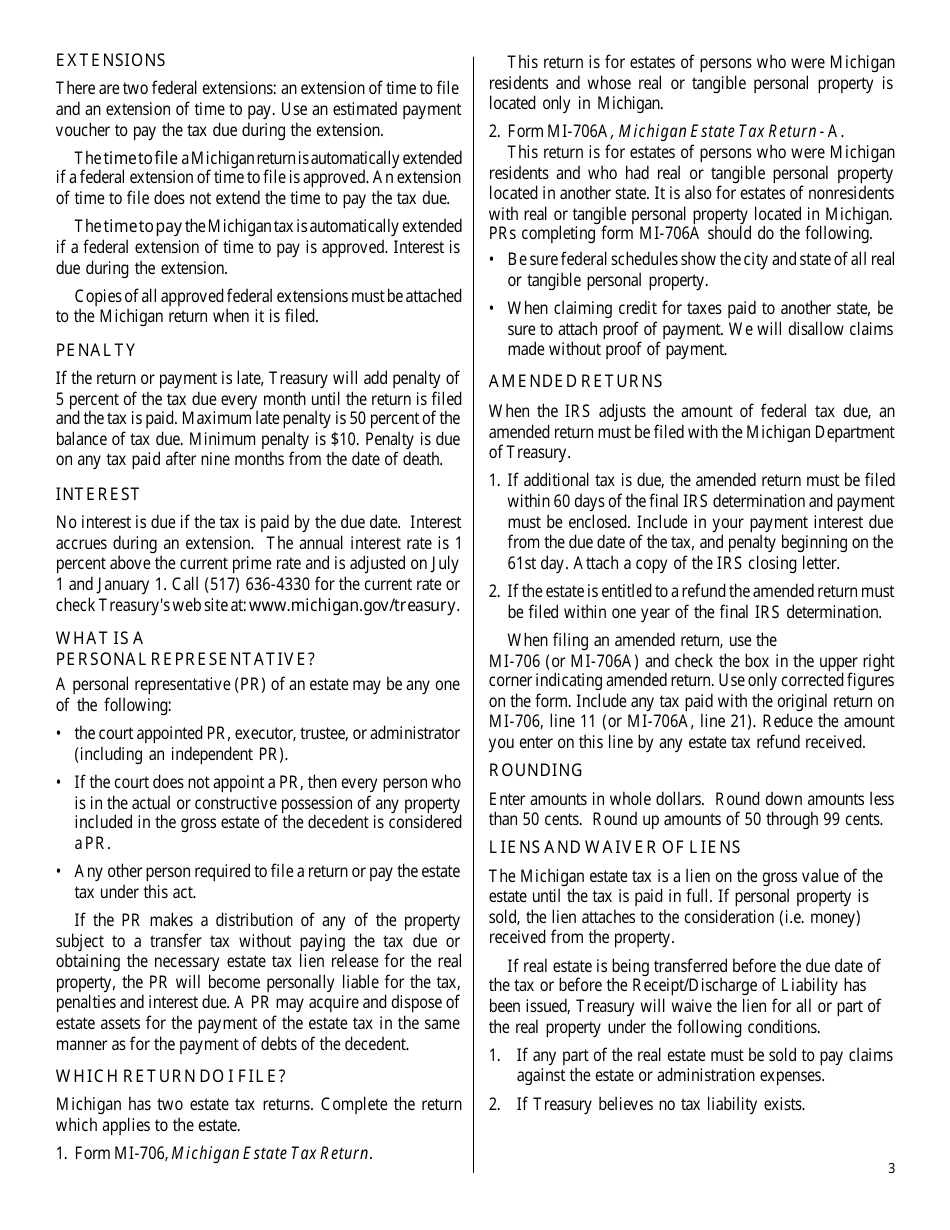

Q: Are there any extensions available for filing Form MI-706?

A: Yes, you may request a six-month extension to file Form MI-706 by filing Form MI-1041EXT.

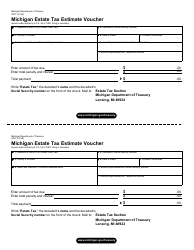

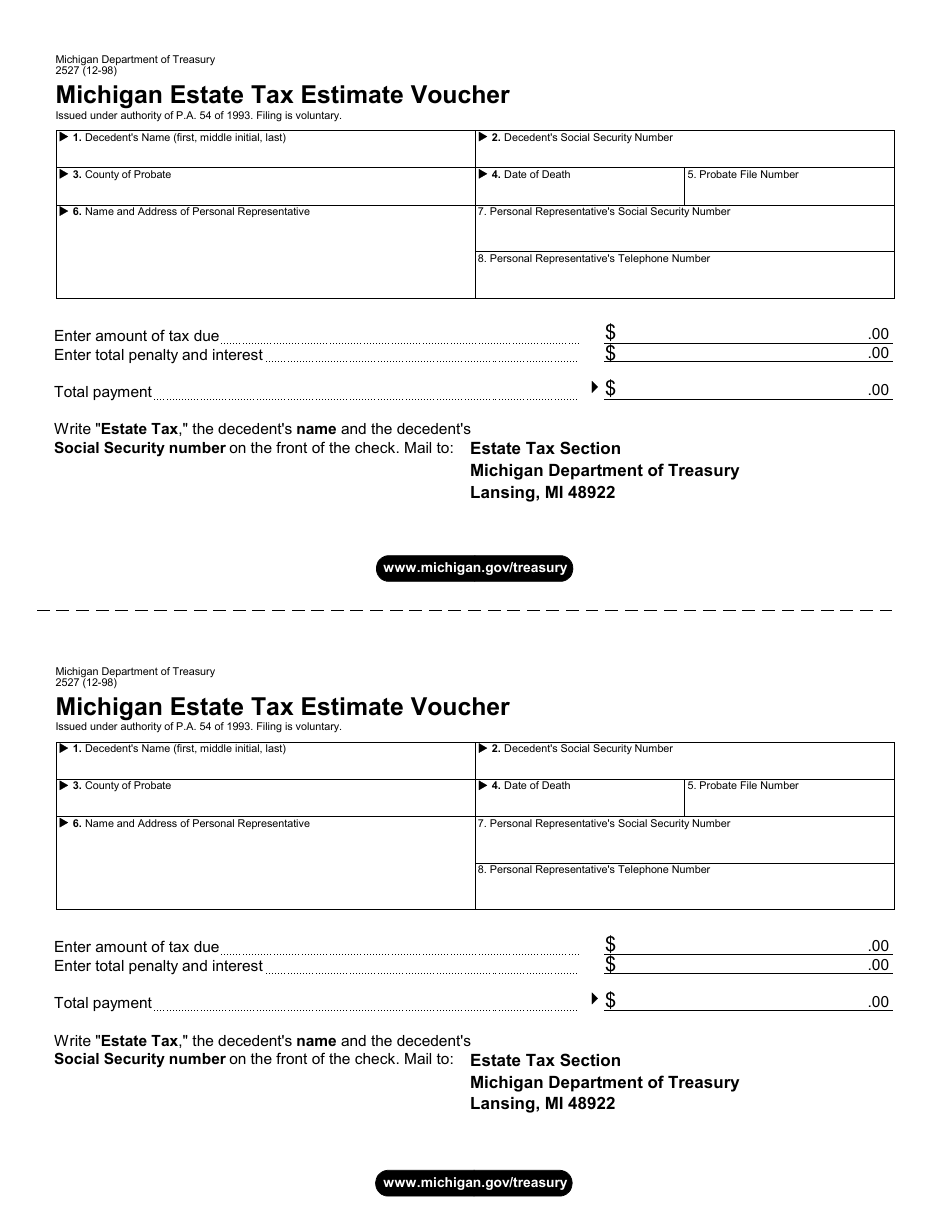

Q: How do I pay the estate taxes owed on Form MI-706?

A: The payment of estate taxes owed can be made by check or electronically through the Michigan Department of Treasury's e-Payments system.

Q: Are there any penalties for late filing or payment of estate taxes?

A: Yes, there are penalties for late filing or payment of estate taxes, including interest charges on the unpaid amount.

Q: Do all estates need to file Form MI-706?

A: No, estates that fall below the Michigan estate tax exemption amount are not required to file Form MI-706.

Q: Can I get help with filling out Form MI-706?

A: Yes, you can seek assistance from a tax professional or an attorney who specializes in estate tax matters.

Form Details:

- Released on May 1, 2003;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-706 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.