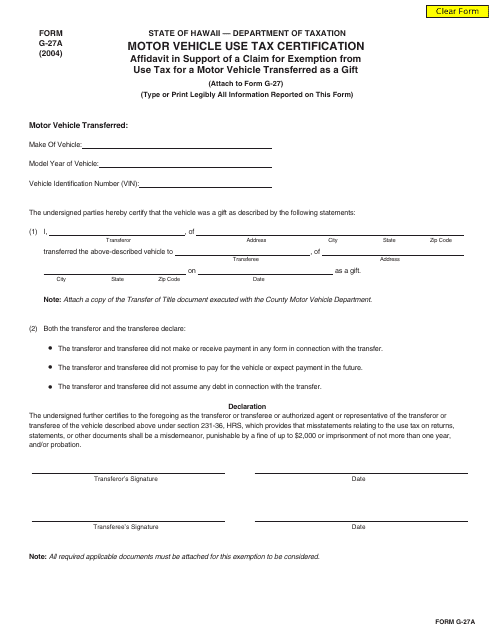

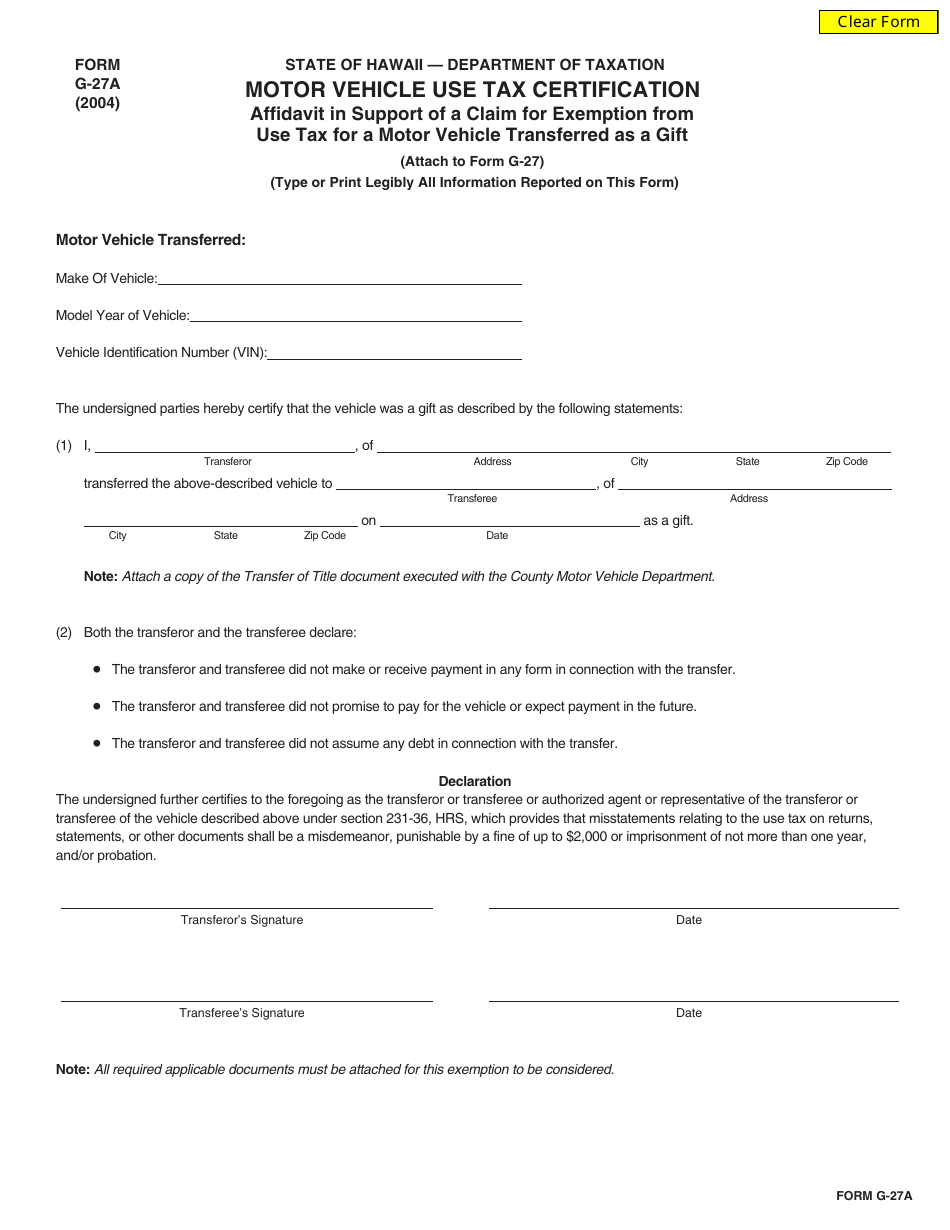

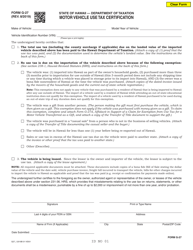

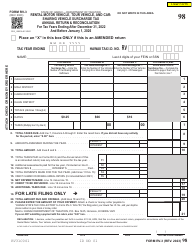

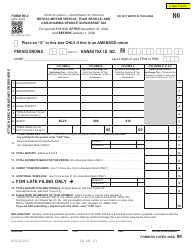

Form G-27A Motor Vehicle Use Tax Certification - Affidavit in Support of a Claim for Exemption From Use Tax for a Motor Vehicle Transferred as a Gift - Hawaii

What Is Form G-27A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-27A?

A: Form G-27A is an affidavit used in Hawaii to support a claim for exemption from use tax for a motor vehicle transferred as a gift.

Q: What is the purpose of Form G-27A?

A: The purpose of Form G-27A is to certify that a motor vehicle was transferred as a gift and is exempt from use tax.

Q: Who needs to fill out Form G-27A?

A: The person who received the motor vehicle as a gift and is claiming an exemption from use tax needs to fill out Form G-27A.

Q: Is Form G-27A specific to Hawaii?

A: Yes, Form G-27A is specific to Hawaii and is used to claim an exemption from use tax in the state.

Q: Are there any fees or costs associated with Form G-27A?

A: There are no fees or costs associated with submitting Form G-27A.

Q: What documents are required to be submitted with Form G-27A?

A: Along with Form G-27A, you may be required to submit proof of the gift transaction, such as a bill of sale or gift letter.

Q: What is the deadline for submitting Form G-27A?

A: Form G-27A should be submitted within 30 days of the transfer of the motor vehicle.

Q: What happens after I submit Form G-27A?

A: After submitting Form G-27A, the Hawaii Department of Taxation will review your application and determine if you qualify for the exemption from use tax.

Form Details:

- Released on January 1, 2004;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-27A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.