This version of the form is not currently in use and is provided for reference only. Download this version of

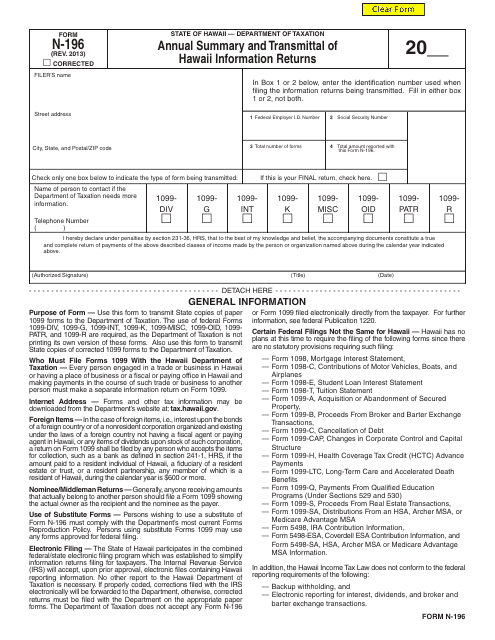

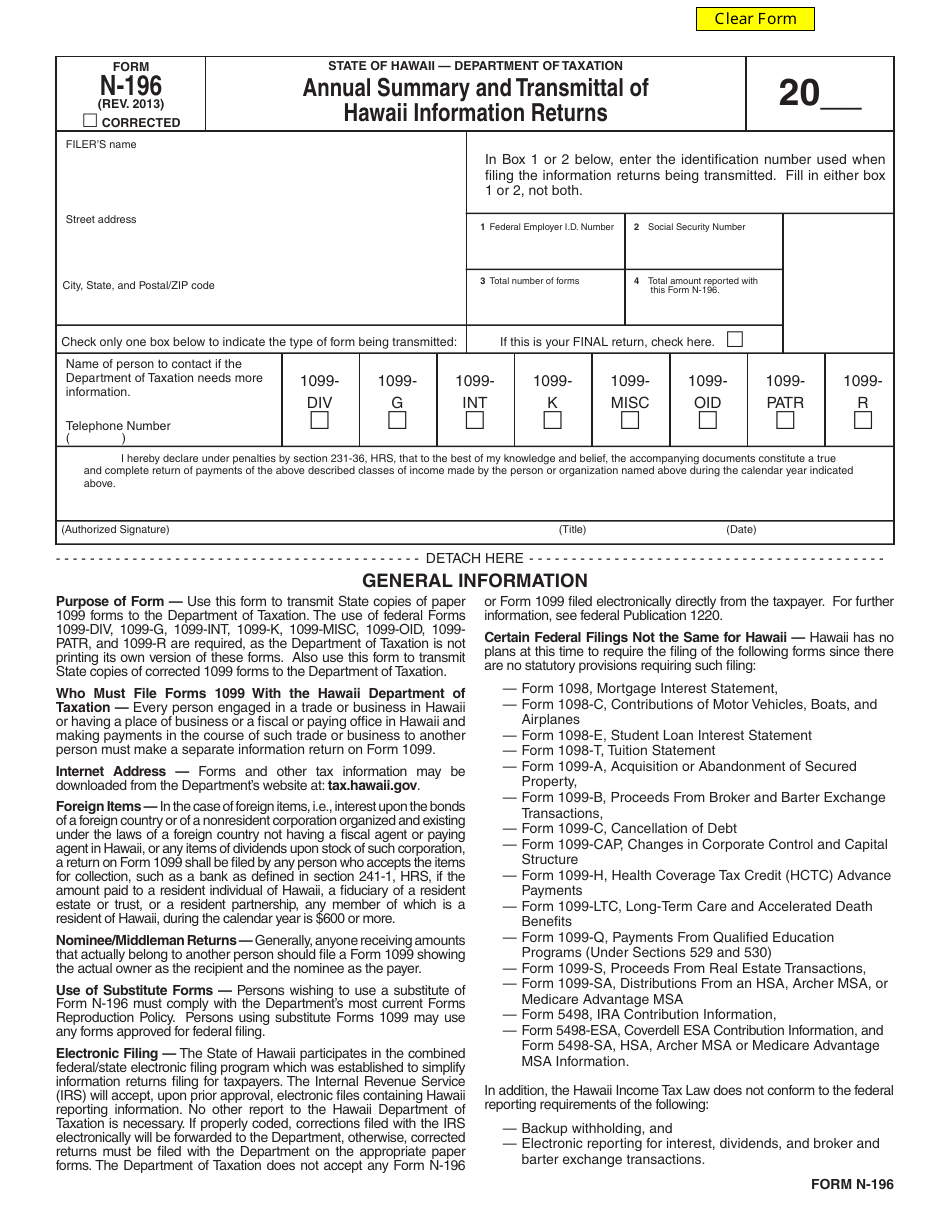

Form N-196

for the current year.

Form N-196 Annual Summary and Transmittal of Hawaii Information Returns - Hawaii

What Is Form N-196?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-196?

A: Form N-196 is the Annual Summary and Transmittal of Hawaii Information Returns.

Q: Who needs to file Form N-196?

A: Any person or entity who is required to file Hawaii information returns (such as Form N-15, N-QCTA, N-QCT, N-342, or N-848) must file Form N-196 to transmit those returns to the Hawaii Department of Taxation.

Q: What information is required on Form N-196?

A: Form N-196 requires you to provide information such as your name, address, federal employer identification number (FEIN), total number of returns being transmitted, and total amount of taxes withheld.

Q: When is the deadline to file Form N-196?

A: Form N-196 must be filed by February 28th of the year following the calendar year in which the returns were required to be filed.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-196 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.