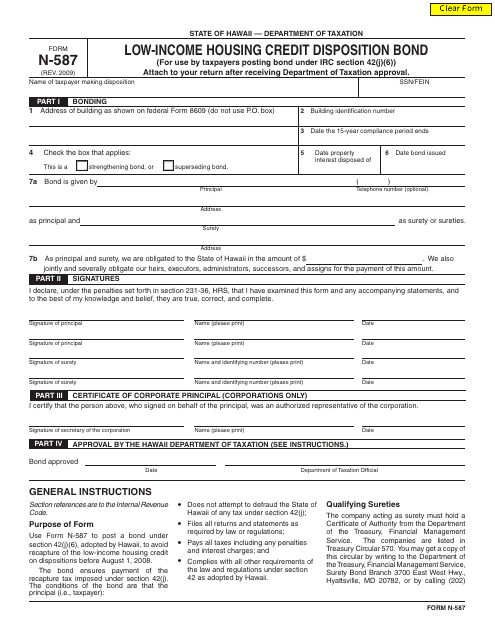

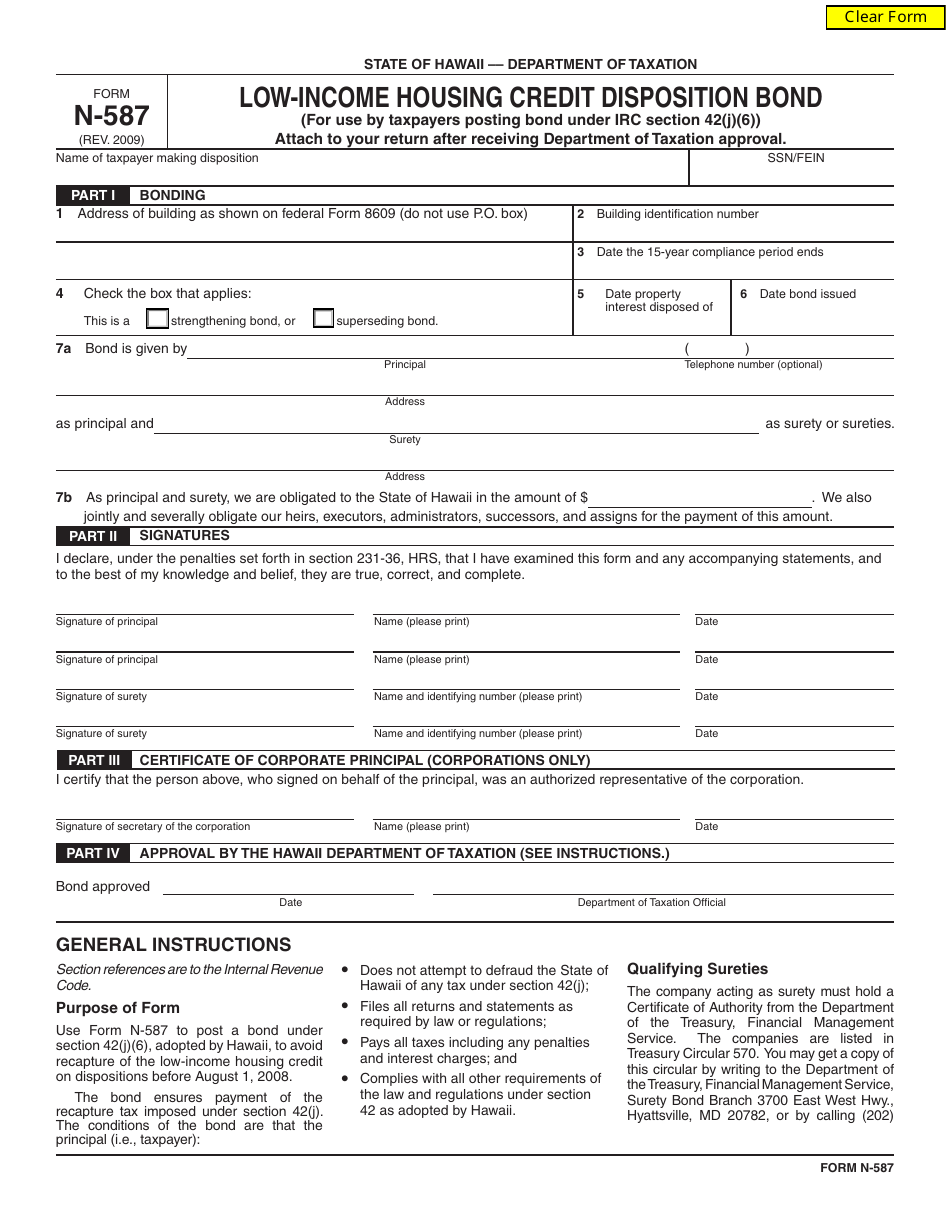

Form N-587 Low-Income Housing Credit Disposition Bond - Hawaii

What Is Form N-587?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form N-587?

A: Form N-587 is the Low-Income Housing Credit Disposition Bond form specifically for Hawaii.

Q: What is the purpose of form N-587?

A: The purpose of form N-587 is to report the disposition of low-income housing credit.

Q: Who needs to file form N-587?

A: Anyone who has claimed the low-income housing credit in Hawaii and has disposed of the property needs to file form N-587.

Q: What information is required on form N-587?

A: Form N-587 requires information about the low-income housing property, the borrower, and the disposition of the property.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-587 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.