This version of the form is not currently in use and is provided for reference only. Download this version of

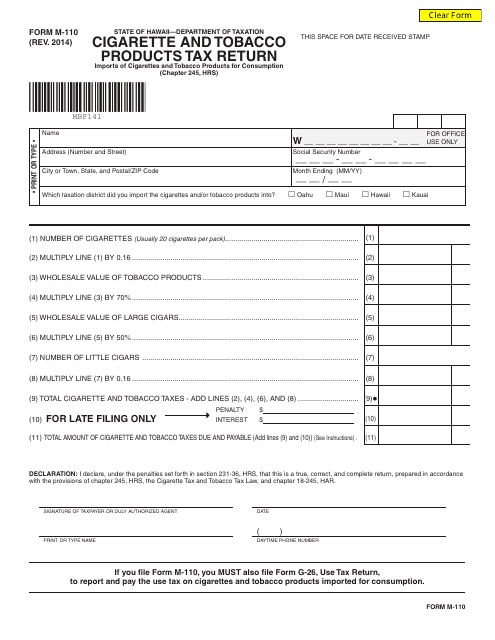

Form M-110

for the current year.

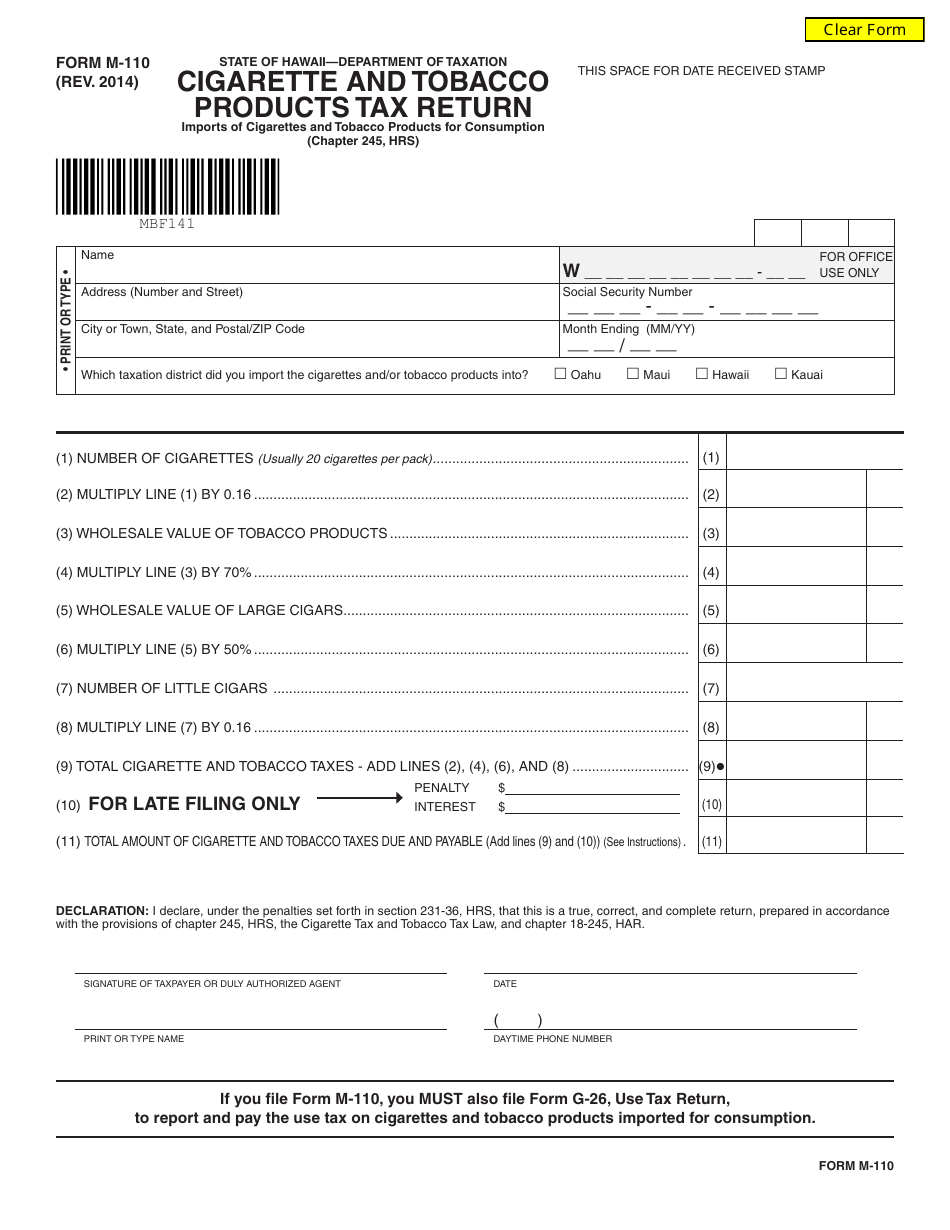

Form M-110 Cigarette and Tobacco Products Tax Return - Hawaii

What Is Form M-110?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-110?

A: Form M-110 is the Cigarette and Tobacco Products Tax Return used in Hawaii.

Q: Who needs to file Form M-110?

A: Any business engaged in the sale of cigarettes or tobacco products in Hawaii needs to file Form M-110.

Q: What is the purpose of Form M-110?

A: Form M-110 is used to report and pay the cigarette and tobacco products tax due to the State of Hawaii.

Q: When is Form M-110 due?

A: Form M-110 is due on or before the 20th day of the month following the applicable reporting period.

Q: Are there any penalties for not filing Form M-110?

A: Yes, failure to file Form M-110 or pay the tax due may result in penalties and interest.

Q: What other documents and records do I need to keep when filing Form M-110?

A: You should keep copies of sales invoices, purchase invoices, and other records related to the sale and purchase of cigarettes and tobacco products.

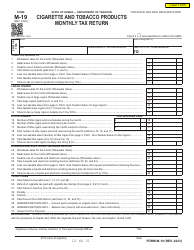

Q: Is there any exemption or credit available on Form M-110?

A: Hawaii provides exemptions and credits for certain sales, such as sales to duty-free shops or sales for export.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-110 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.