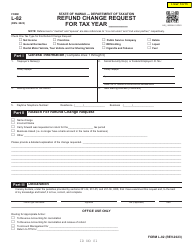

This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-106

for the current year.

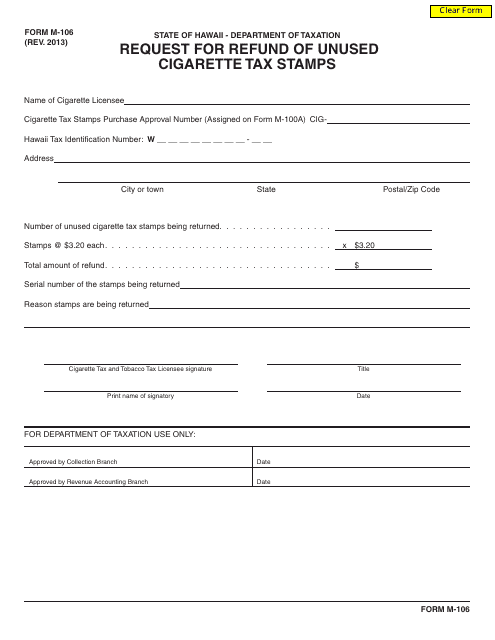

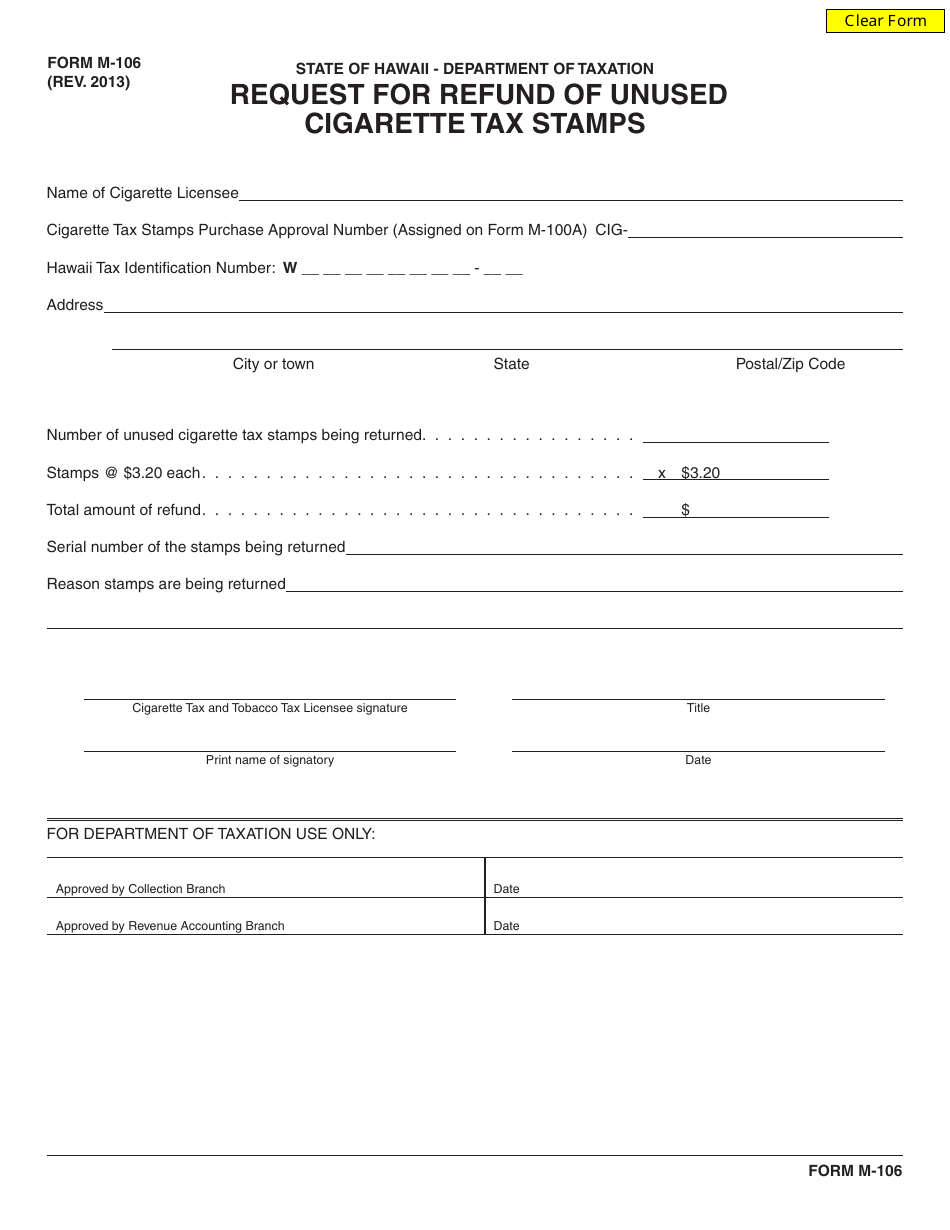

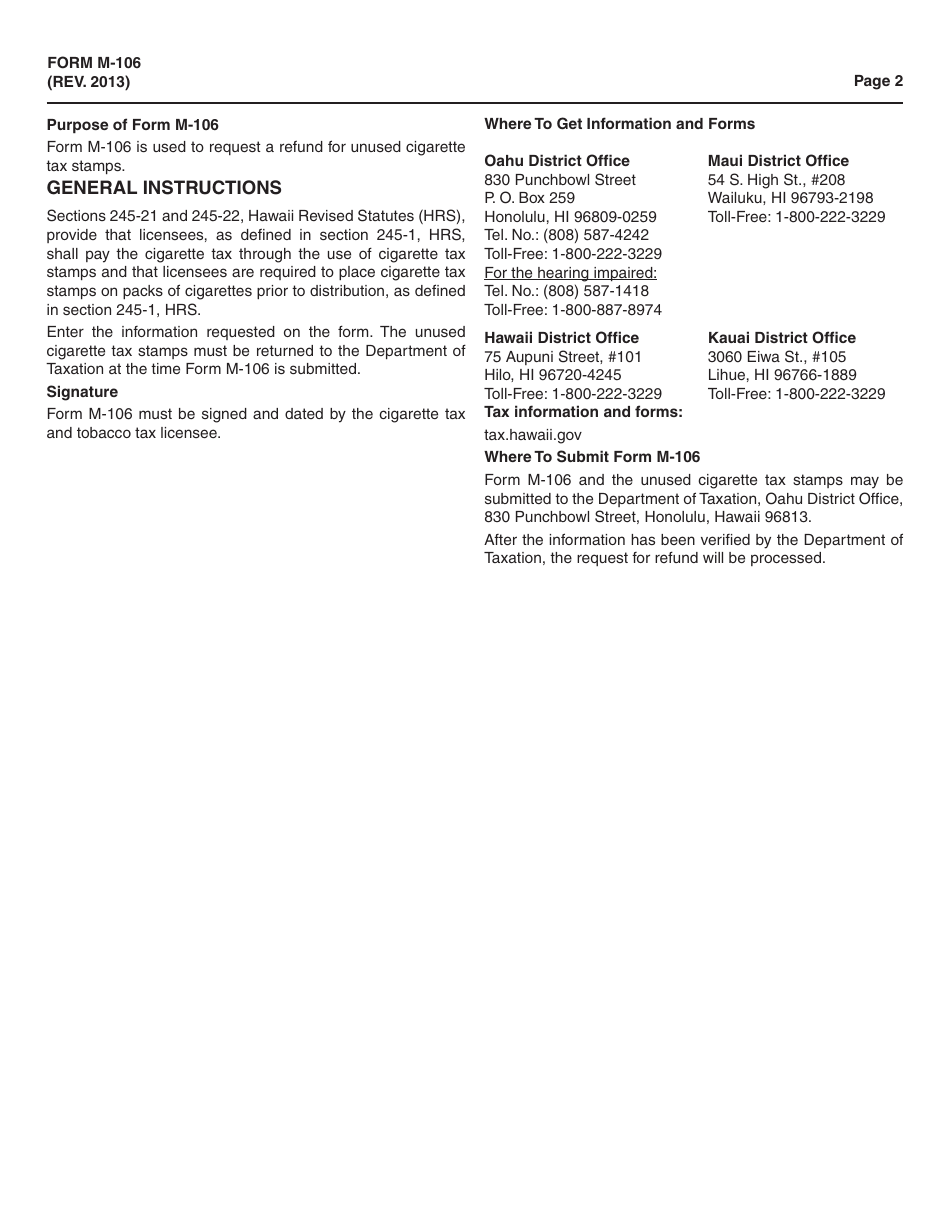

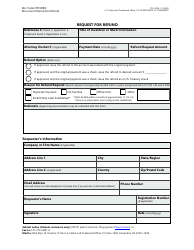

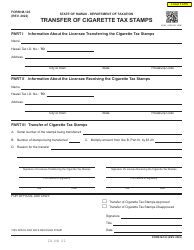

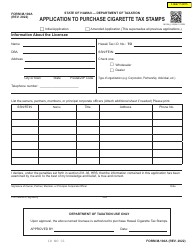

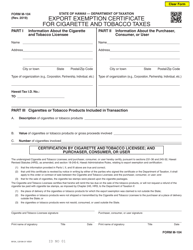

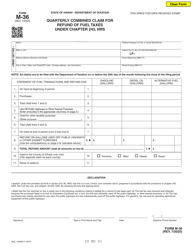

Form M-106 Request for Refund of Unused Cigarette Tax Stamps - Hawaii

What Is Form M-106?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-106?

A: Form M-106 is a request for refund of unused cigarette tax stamps in Hawaii.

Q: Who can use Form M-106?

A: Anyone who has unused cigarette tax stamps in Hawaii can use Form M-106 to request a refund.

Q: What is the purpose of Form M-106?

A: The purpose of Form M-106 is to refund the value of unused cigarette tax stamps in Hawaii.

Q: How do I fill out Form M-106?

A: You can fill out Form M-106 by providing your personal information, the amount and type of unused cigarette tax stamps, and the reason for the refund request.

Q: Is there a deadline for submitting Form M-106?

A: Yes, Form M-106 must be submitted within one year from the date of purchase of the unused cigarette tax stamps.

Q: How long does it take to process a refund request using Form M-106?

A: It may take up to six weeks for the Hawaii Department of Taxation to process a refund request submitted using Form M-106.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-106 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.