This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-104

for the current year.

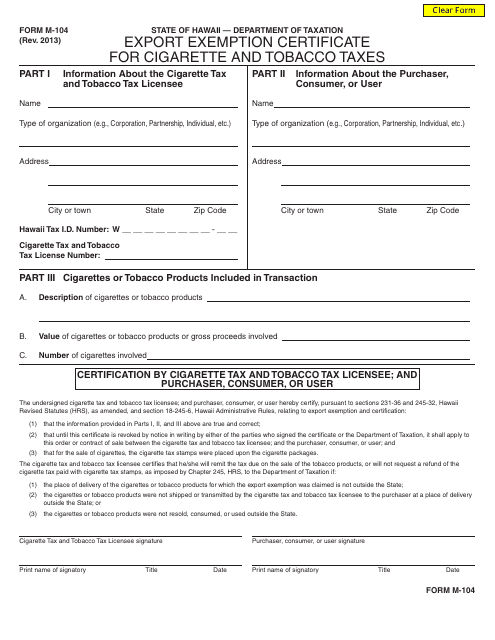

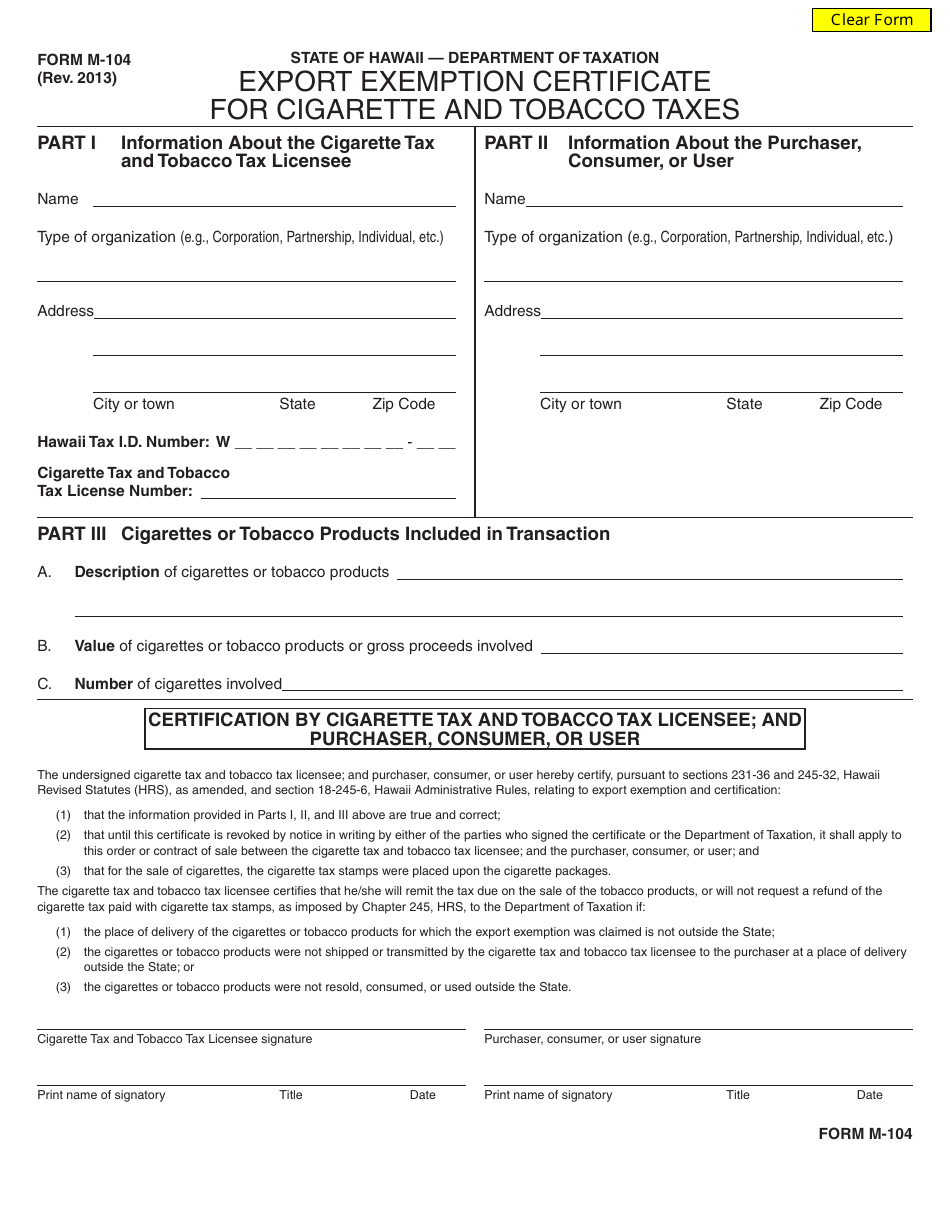

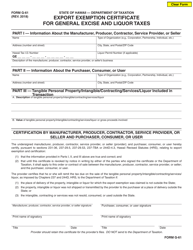

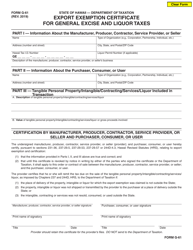

Form M-104 Export Exemption Certificate for Cigarette and Tobacco Taxes - Hawaii

What Is Form M-104?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-104?

A: Form M-104 is the Export Exemption Certificate for Cigarette and Tobacco Taxes in Hawaii.

Q: What is the purpose of Form M-104?

A: The purpose of Form M-104 is to claim an exemption from cigarette and tobacco taxes when exporting these products from Hawaii.

Q: Who should use Form M-104?

A: Anyone who intends to export cigarettes and tobacco products from Hawaii should use Form M-104.

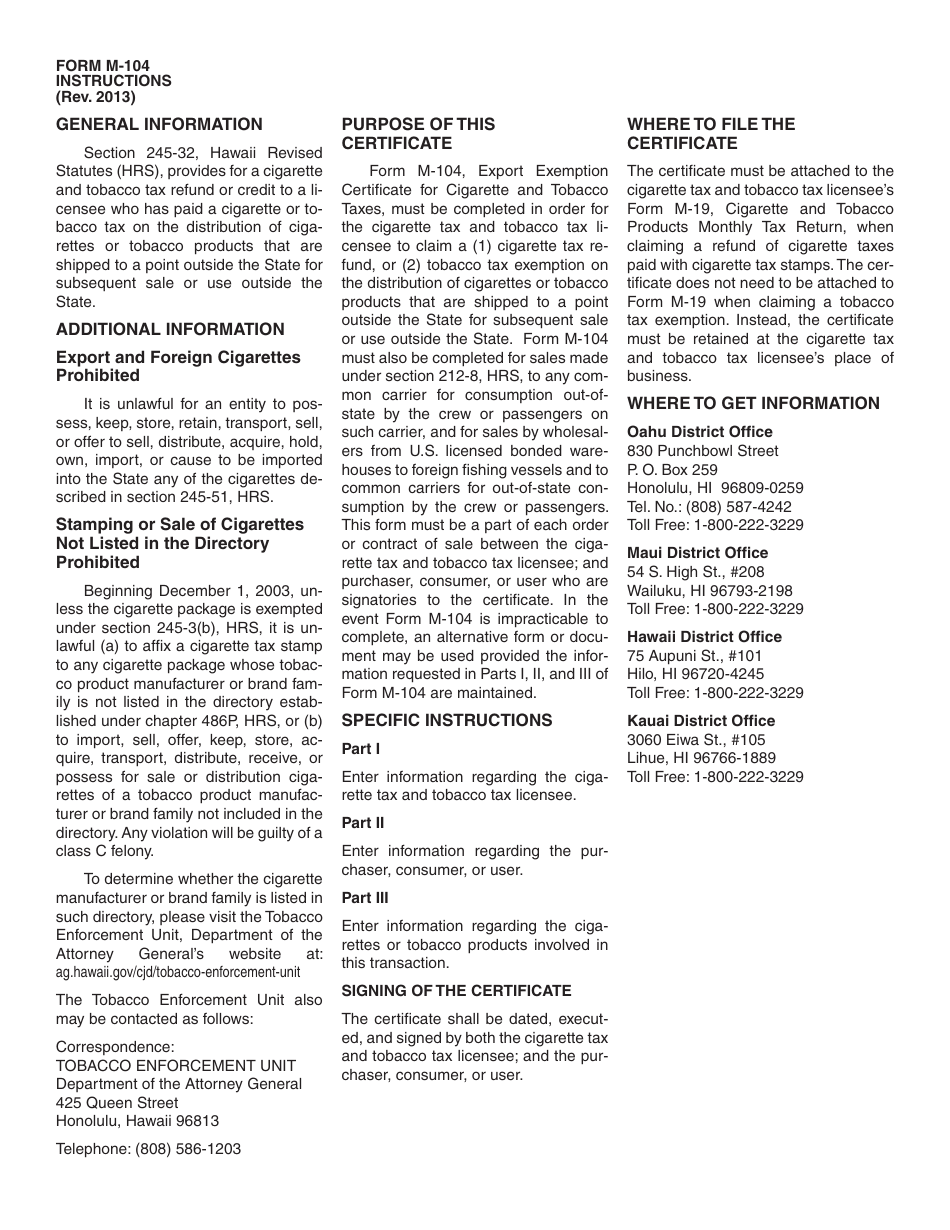

Q: Are there any requirements to qualify for the exemption?

A: Yes, there are specific requirements that must be met to qualify for the exemption. These requirements can be found in the instructions for Form M-104.

Q: What should I do with completed Form M-104?

A: Completed Form M-104 should be provided to the Hawaii Department of Taxation when exporting cigarettes and tobacco products.

Q: Are there any penalties for misuse of Form M-104?

A: Yes, misusing Form M-104 or providing false information may result in penalties and legal consequences.

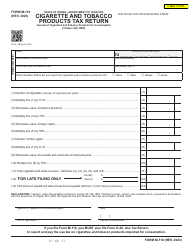

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-104 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.