This version of the form is not currently in use and is provided for reference only. Download this version of

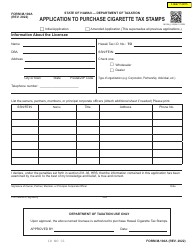

Form M-103

for the current year.

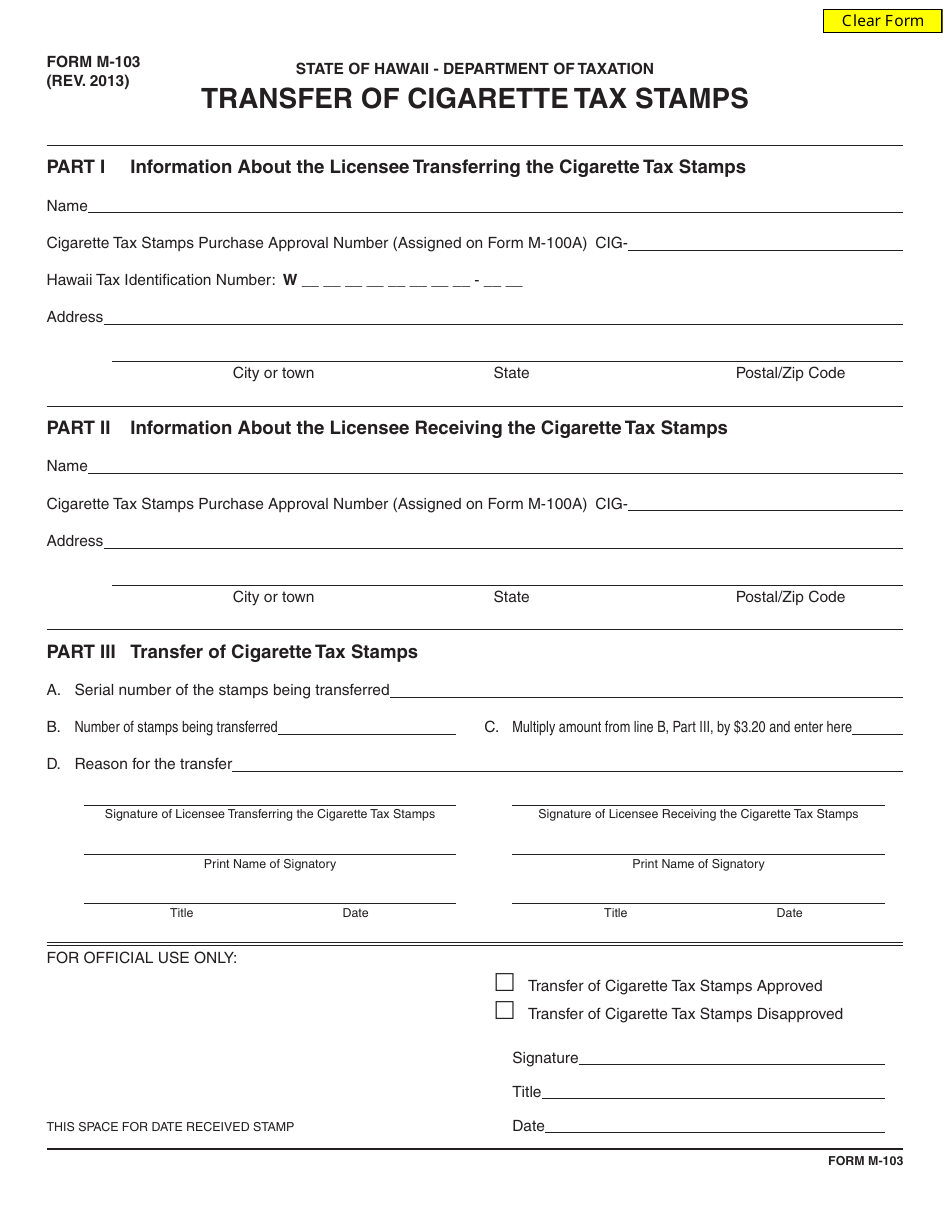

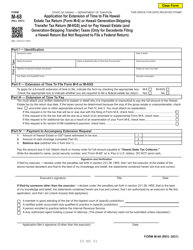

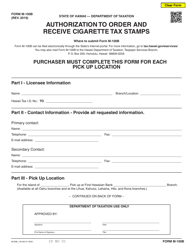

Form M-103 Transfer of Cigarette Tax Stamps - Hawaii

What Is Form M-103?

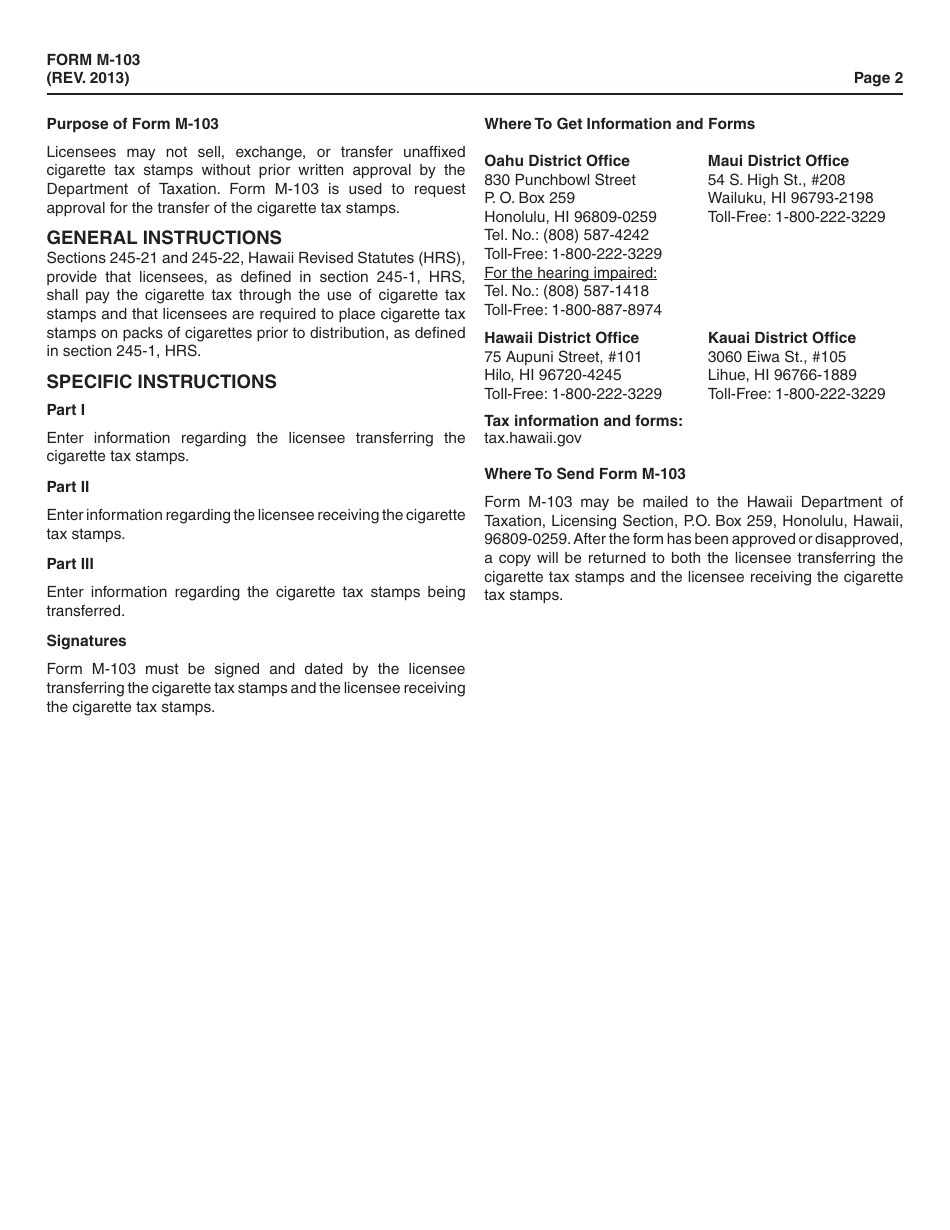

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

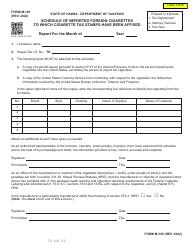

Q: What is Form M-103?

A: Form M-103 is a form used for the transfer of cigarette tax stamps in Hawaii.

Q: What is the purpose of Form M-103?

A: The purpose of Form M-103 is to document the transfer of cigarette tax stamps in Hawaii.

Q: Who needs to fill out Form M-103?

A: Anyone involved in the transfer of cigarette tax stamps in Hawaii needs to fill out Form M-103.

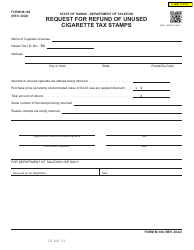

Q: Is there a deadline for filing Form M-103?

A: Yes, the deadline for filing Form M-103 is specified by the Hawaii Department of Taxation.

Q: Are there any fees associated with filing Form M-103?

A: There may be fees associated with filing Form M-103. Please consult the Hawaii Department of Taxation for more information.

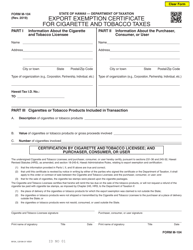

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-103 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.