This version of the form is not currently in use and is provided for reference only. Download this version of

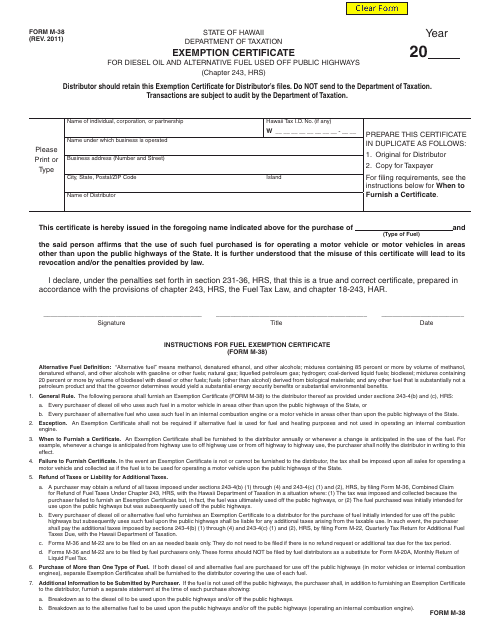

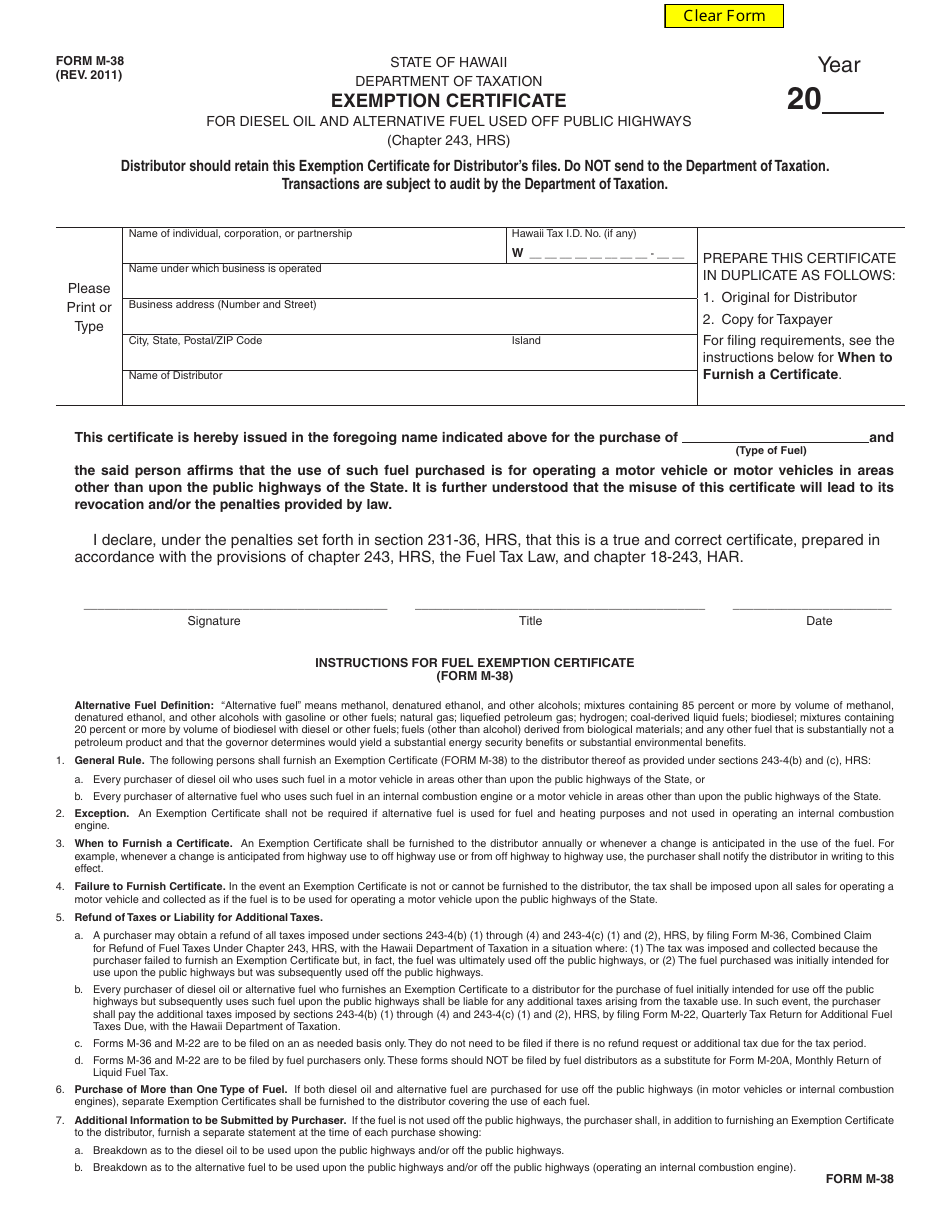

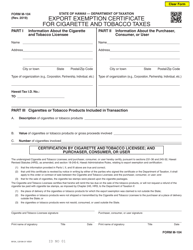

Form M-38

for the current year.

Form M-38 Exemption Certificate for Diesel Oil and Alternative Fuel Used off Public Highways - Hawaii

What Is Form M-38?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-38?

A: Form M-38 is an Exemption Certificate for Diesel Oil and Alternative Fuel Used off Public Highways in Hawaii.

Q: What is the purpose of Form M-38?

A: The purpose of Form M-38 is to claim exemption from the diesel fuel tax for fuel used off public highways in Hawaii.

Q: Who is eligible to use Form M-38?

A: Anyone who uses diesel oil or alternative fuel off public highways in Hawaii is eligible to use Form M-38.

Q: What is the deadline for filing Form M-38?

A: Form M-38 must be filed annually on or before April 20th.

Q: Do I need to include any supporting documentation with Form M-38?

A: Yes, you need to include copies of invoices or receipts for the purchase of the diesel oil or alternative fuel.

Q: Is there a penalty for late filing of Form M-38?

A: Yes, there is a penalty for late filing of Form M-38. The penalty is $100 or 10% of the tax due, whichever is greater.

Q: Can I claim a refund for diesel oil or alternative fuel used off public highways in Hawaii?

A: No, you cannot claim a refund for diesel oil or alternative fuel used off public highways in Hawaii. The exemption is only available through Form M-38.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-38 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.