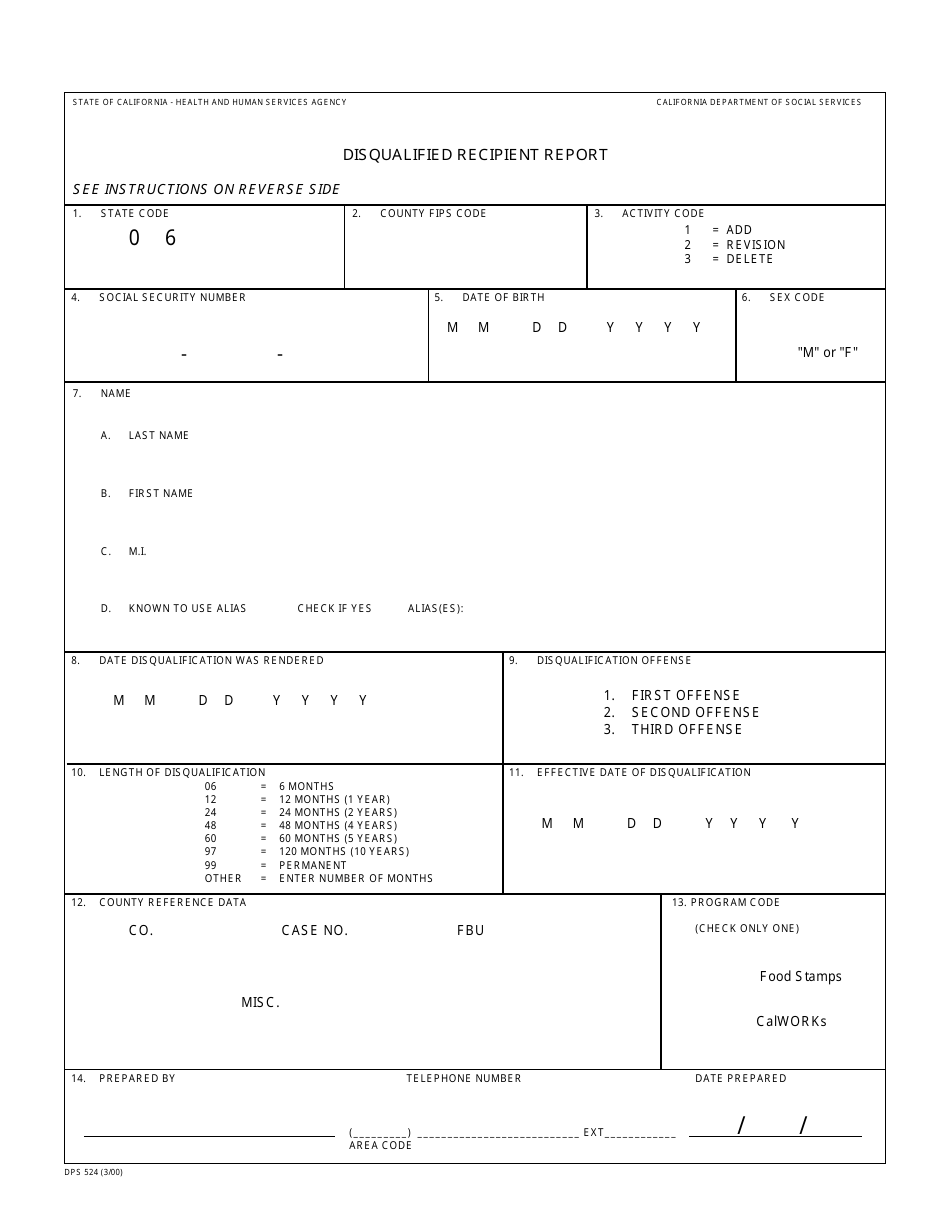

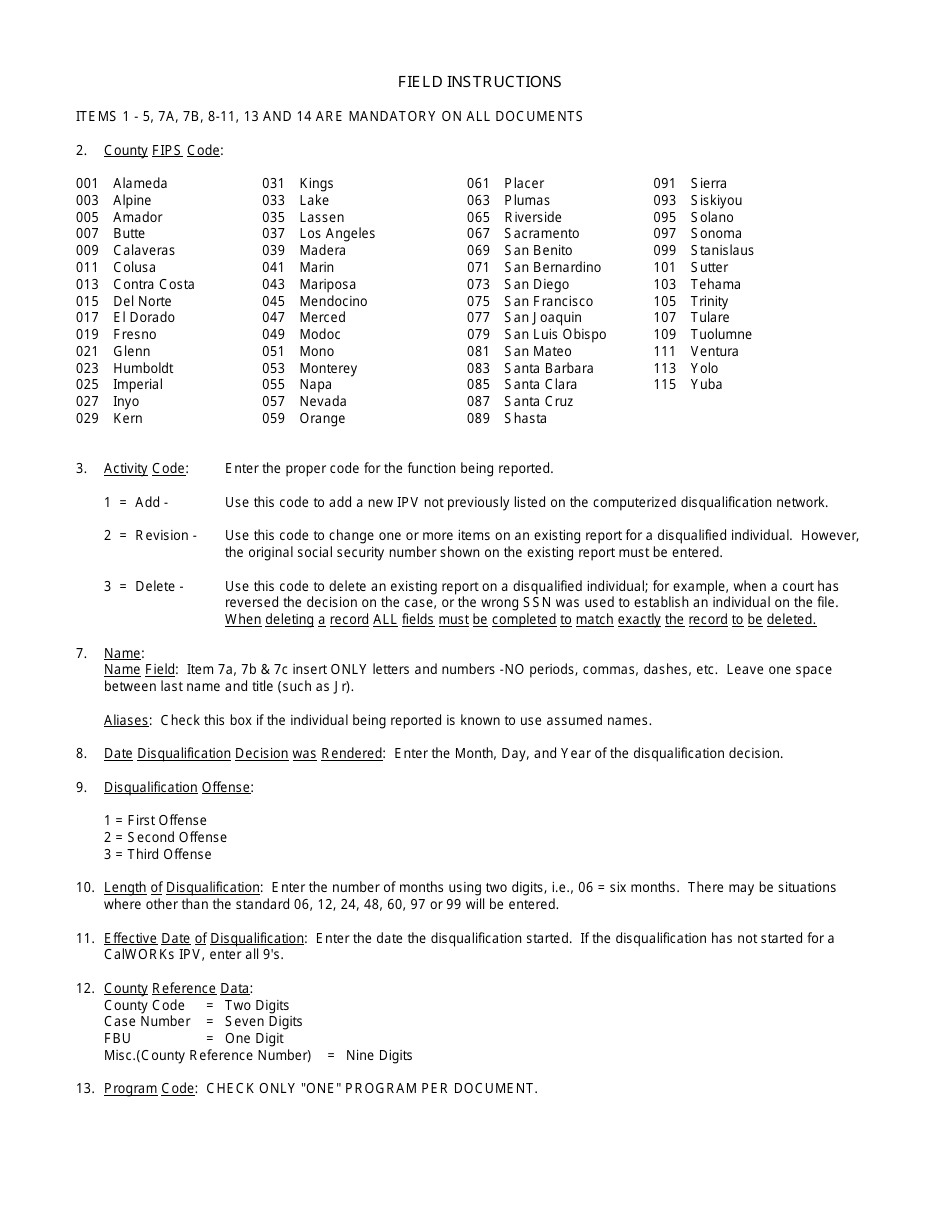

Form DPS524 Disqualified Recipient Report - California

What Is Form DPS524?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DPS524?

A: Form DPS524 is the Disqualified Recipient Report in California.

Q: Who is required to file Form DPS524?

A: Certain entities in California are required to file Form DPS524 if they have recipients who have been disqualified from receiving state funds.

Q: What is the purpose of filing Form DPS524?

A: The purpose of filing Form DPS524 is to report recipients who have been disqualified from receiving state funds and to provide information about the disqualification.

Q: When is Form DPS524 due?

A: Form DPS524 is due annually on a specific date, typically specified by the California Department of Public Social Services. It is important to check the specific due date for each year.

Q: How can Form DPS524 be filed?

A: Form DPS524 can be filed electronically or by mail. The filing method may vary depending on the requirements set by the California Department of Public Social Services.

Q: Are there any penalties for not filing Form DPS524?

A: Yes, there may be penalties for not filing Form DPS524 or for filing it late. It is important to comply with the filing requirements and deadlines to avoid penalties.

Form Details:

- Released on March 1, 2000;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DPS524 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.