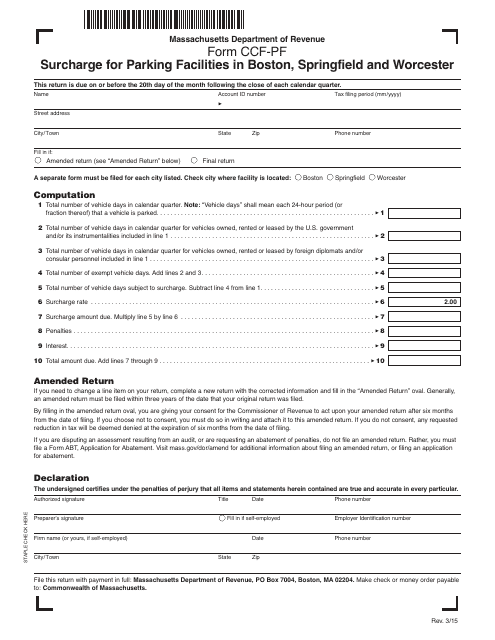

Form CCF-PF Surcharge for Parking Facilities in Boston, Springfield and Worcester - Massachusetts

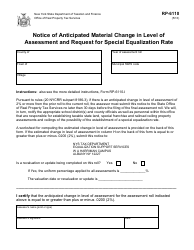

What Is Form CCF-PF?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CCF-PF Surcharge?

A: The CCF-PF Surcharge is a surcharge imposed on parking facilities in Boston, Springfield, and Worcester, Massachusetts.

Q: Which cities in Massachusetts does the surcharge apply to?

A: The surcharge applies to parking facilities in Boston, Springfield, and Worcester.

Q: What is the purpose of the CCF-PF Surcharge?

A: The purpose of the surcharge is to fund the Commonwealth Transportation Fund.

Q: How much is the CCF-PF Surcharge?

A: The surcharge is $3 per day for parking spaces that are used for 24 hours or less, and $5 per day for spaces that are used for more than 24 hours.

Q: Who is responsible for collecting the surcharge?

A: Parking facility operators are responsible for collecting the surcharge from customers.

Q: What happens to the collected surcharge?

A: The collected surcharge is remitted to the Massachusetts Department of Revenue, who then transfers the funds to the Commonwealth Transportation Fund.

Q: Are there any exemptions to the CCF-PF Surcharge?

A: Yes, certain types of parking facilities, such as government-owned facilities, are exempt from the surcharge.

Q: When did the CCF-PF Surcharge go into effect?

A: The surcharge went into effect on January 1, 2022.

Q: Is the CCF-PF Surcharge applicable to residential parking?

A: No, the surcharge does not apply to residential parking spaces.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CCF-PF by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.