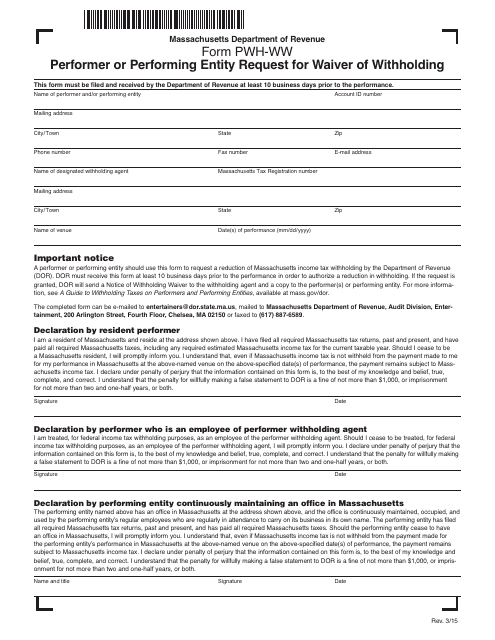

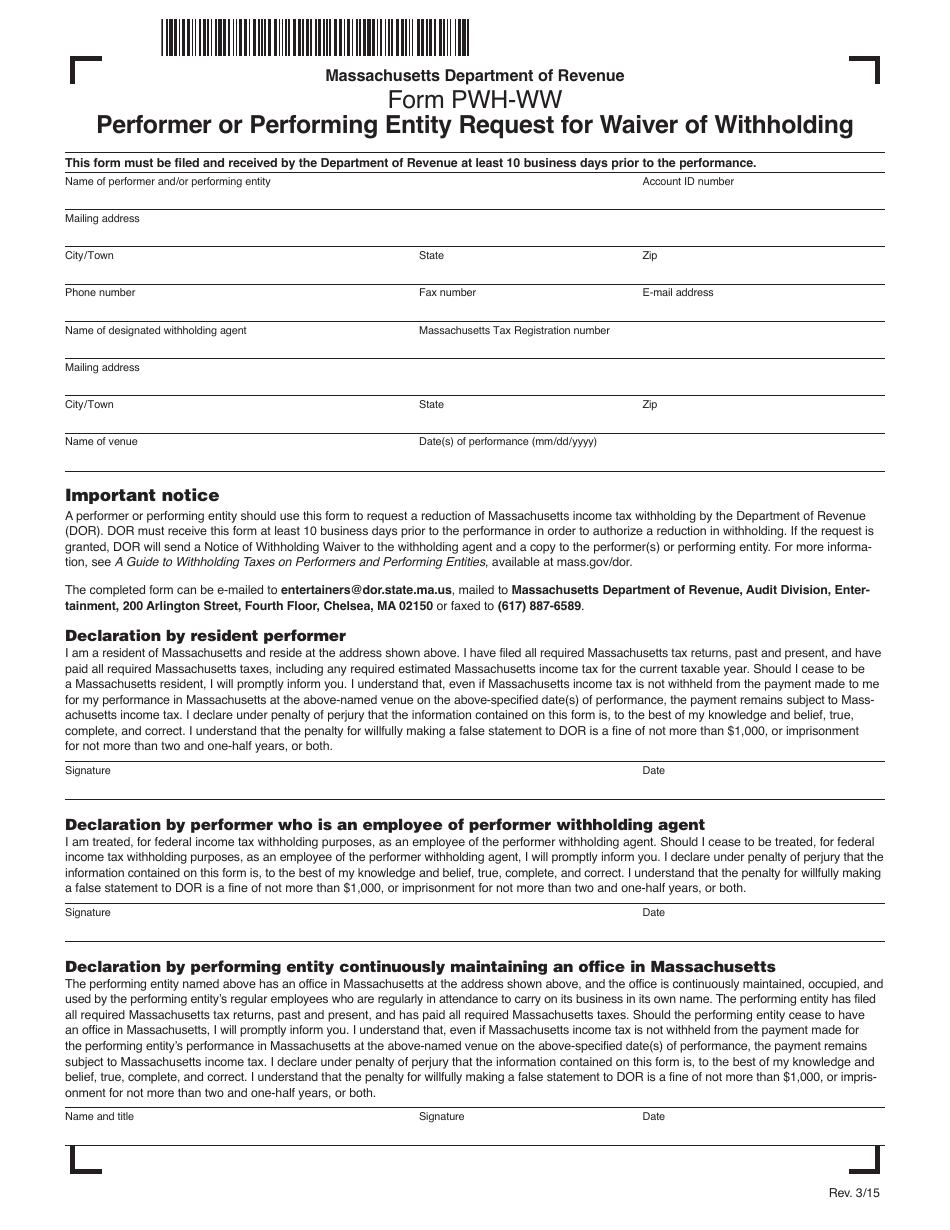

Form PWH-WW Performer or Performing Entity Request for Waiver of Withholding - Massachusetts

What Is Form PWH-WW?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PWH-WW?

A: Form PWH-WW is a request for waiver of withholding for performers or performing entities in Massachusetts.

Q: Who can use the Form PWH-WW?

A: The Form PWH-WW is for use by performers or performing entities in Massachusetts who are seeking a waiver of withholding.

Q: What is withholding?

A: Withholding is the process of deducting taxes from an individual's income and remitting it to the government.

Q: Why would someone want a waiver of withholding?

A: Someone may want a waiver of withholding if they believe they meet certain criteria that exempt them from having taxes withheld from their income.

Q: What information is required on the Form PWH-WW?

A: The Form PWH-WW requires information such as the performer's or performing entity's name, address, and federal identification number, as well as details about the performance and the amount of income to be paid.

Q: What happens after I submit the Form PWH-WW?

A: After submitting the Form PWH-WW, the Massachusetts Department of Revenue will review the request and determine whether a waiver of withholding is approved or denied.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PWH-WW by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.