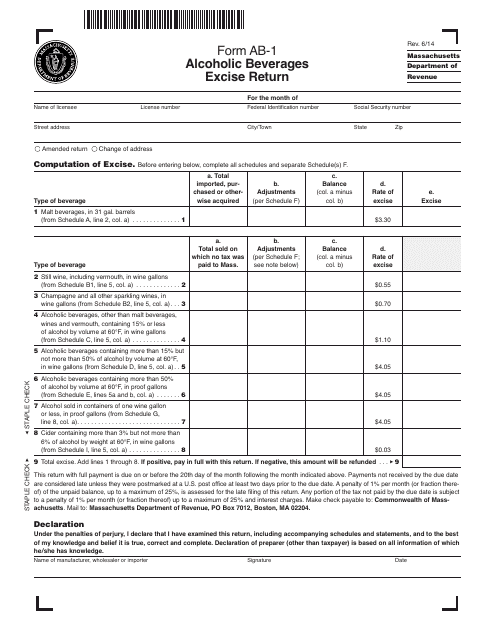

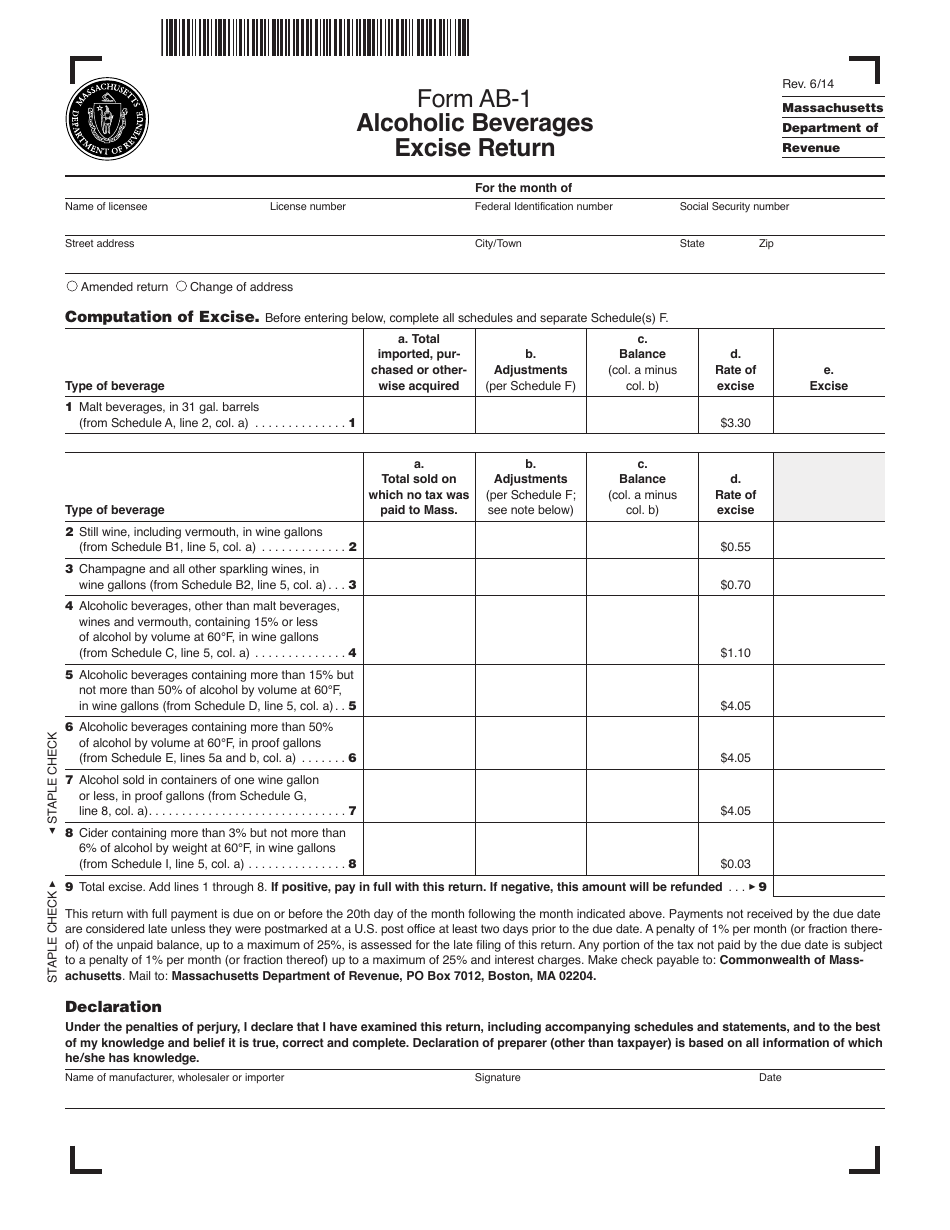

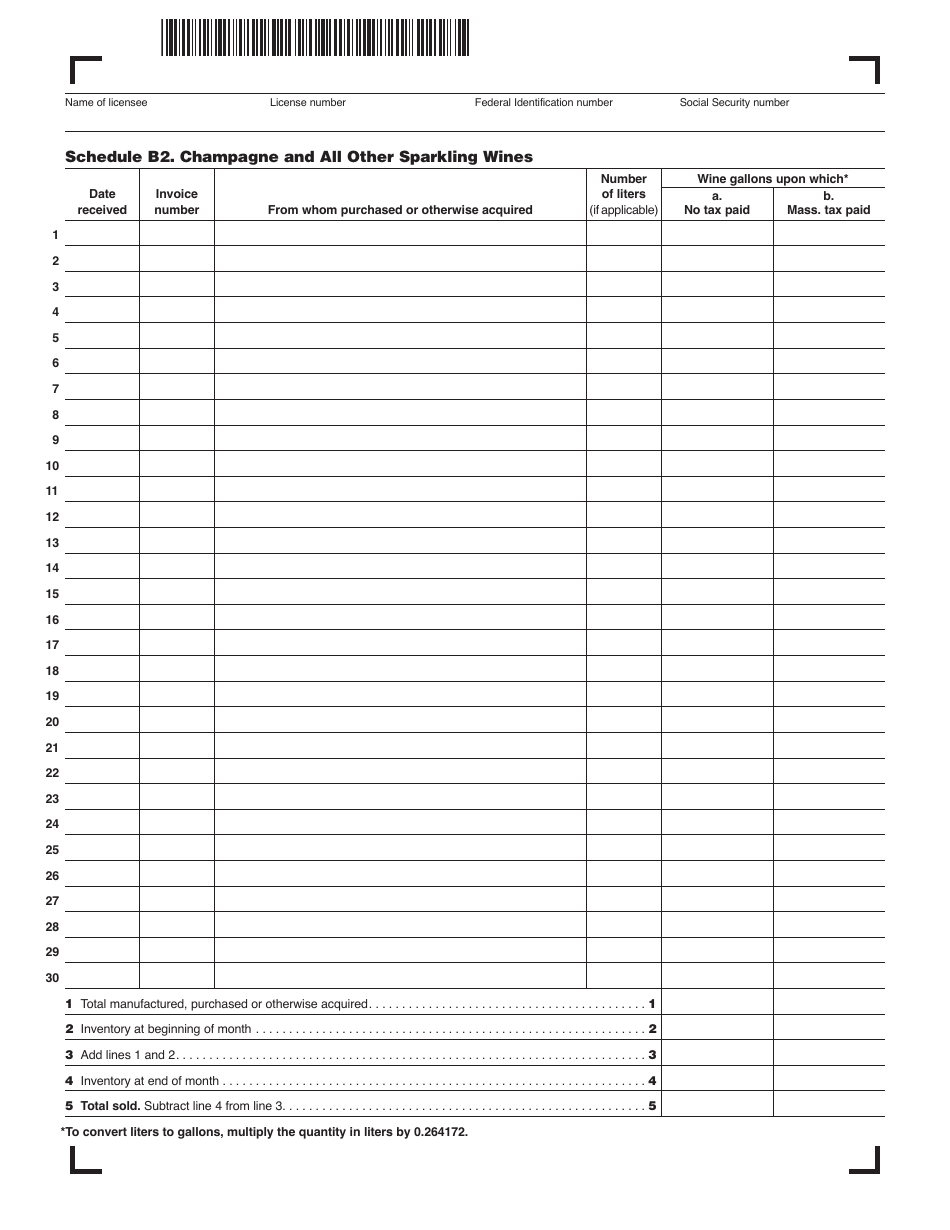

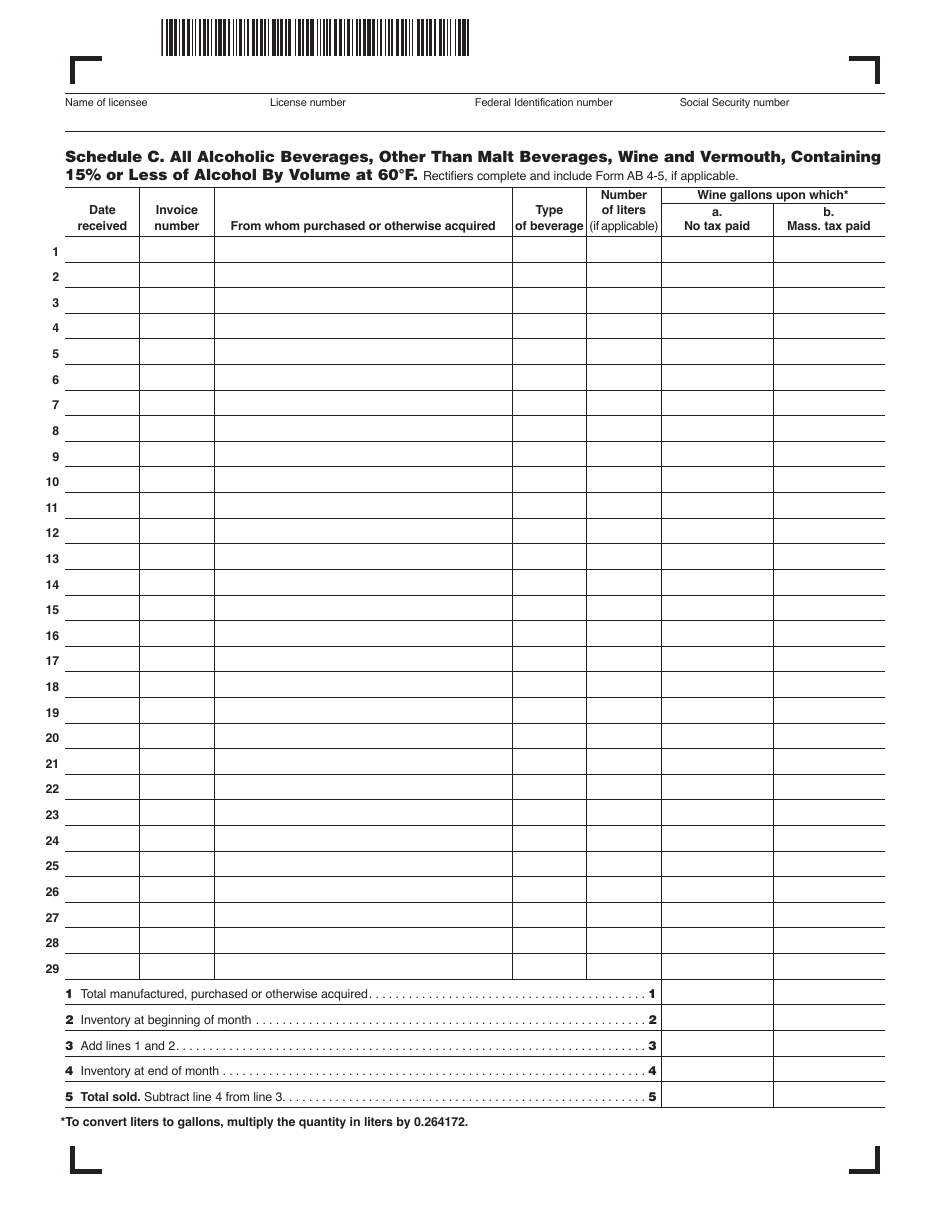

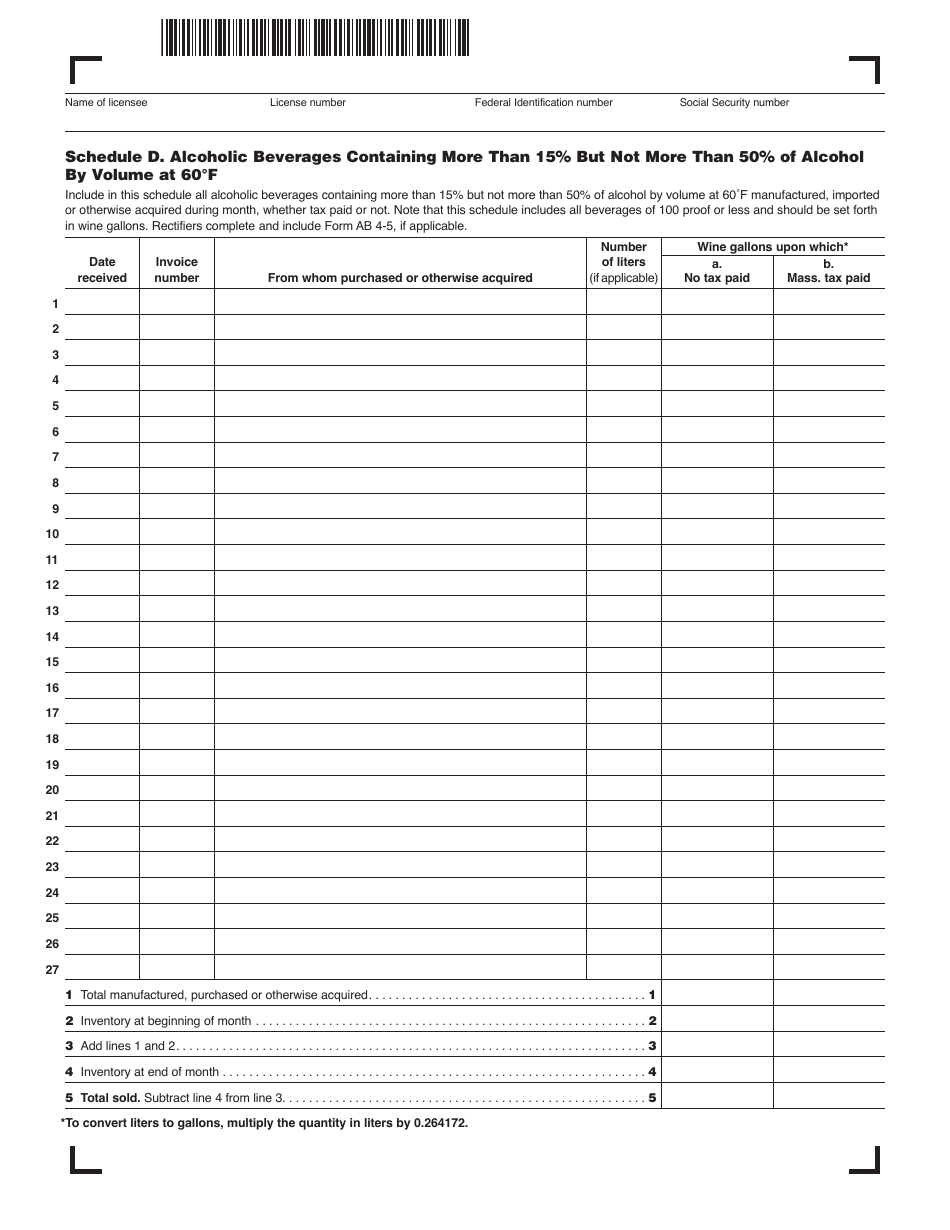

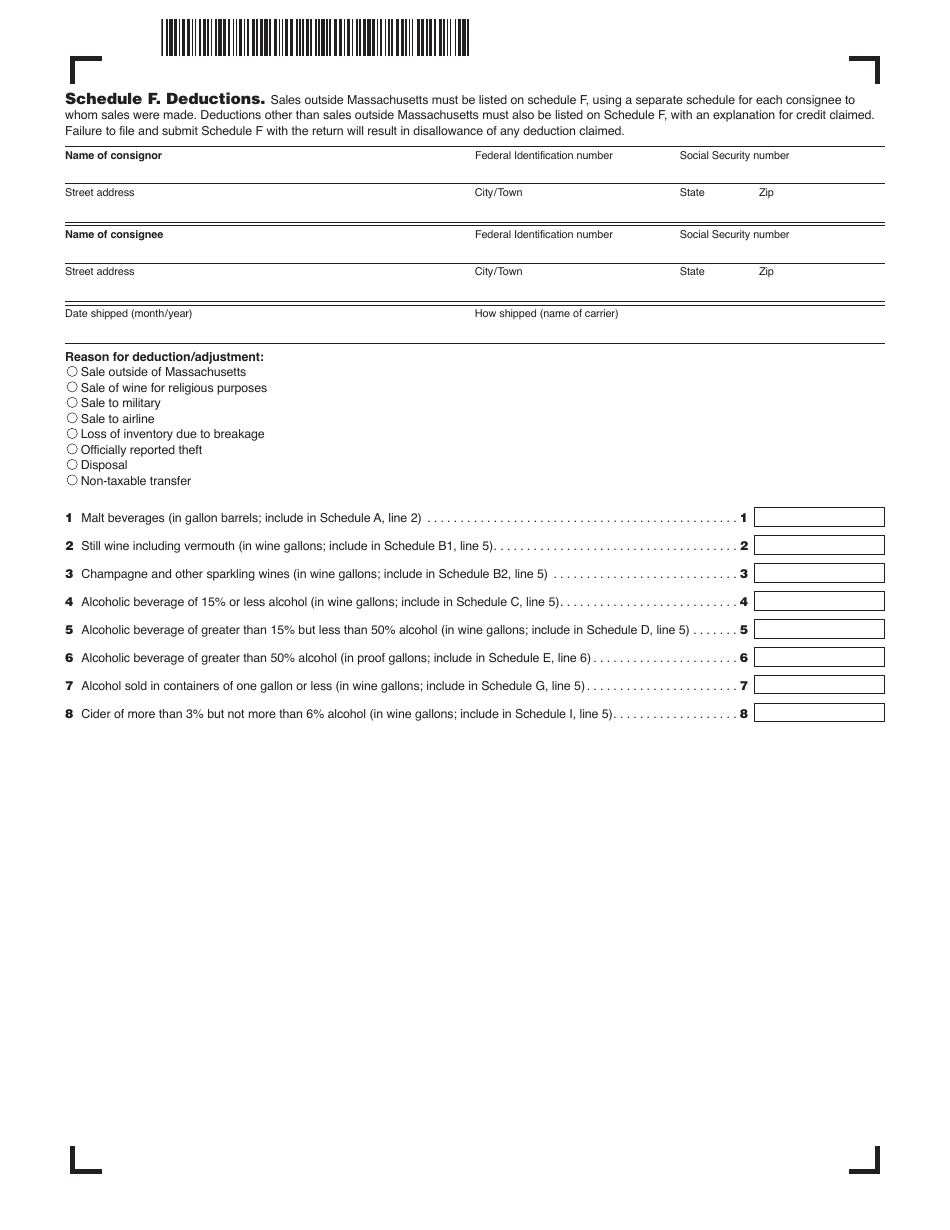

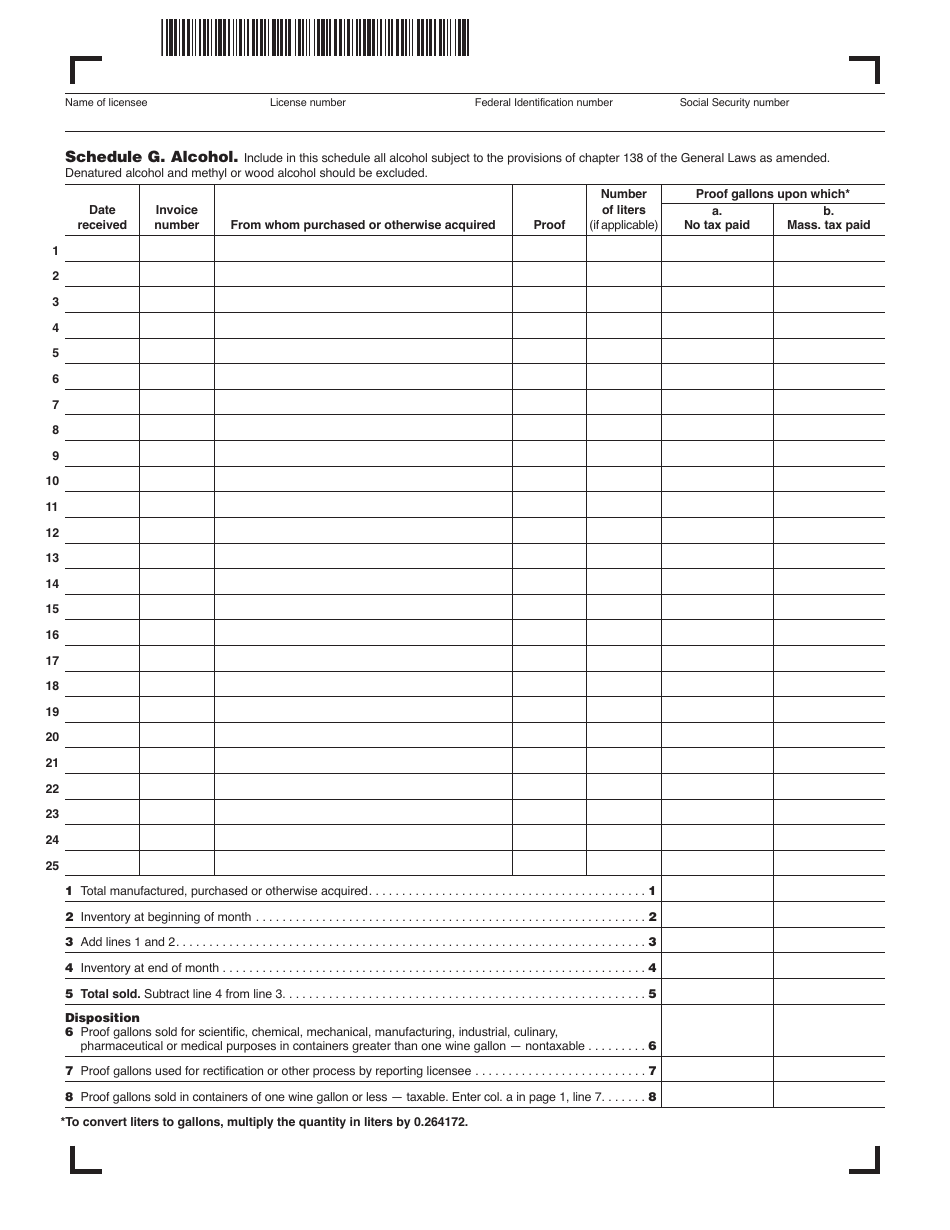

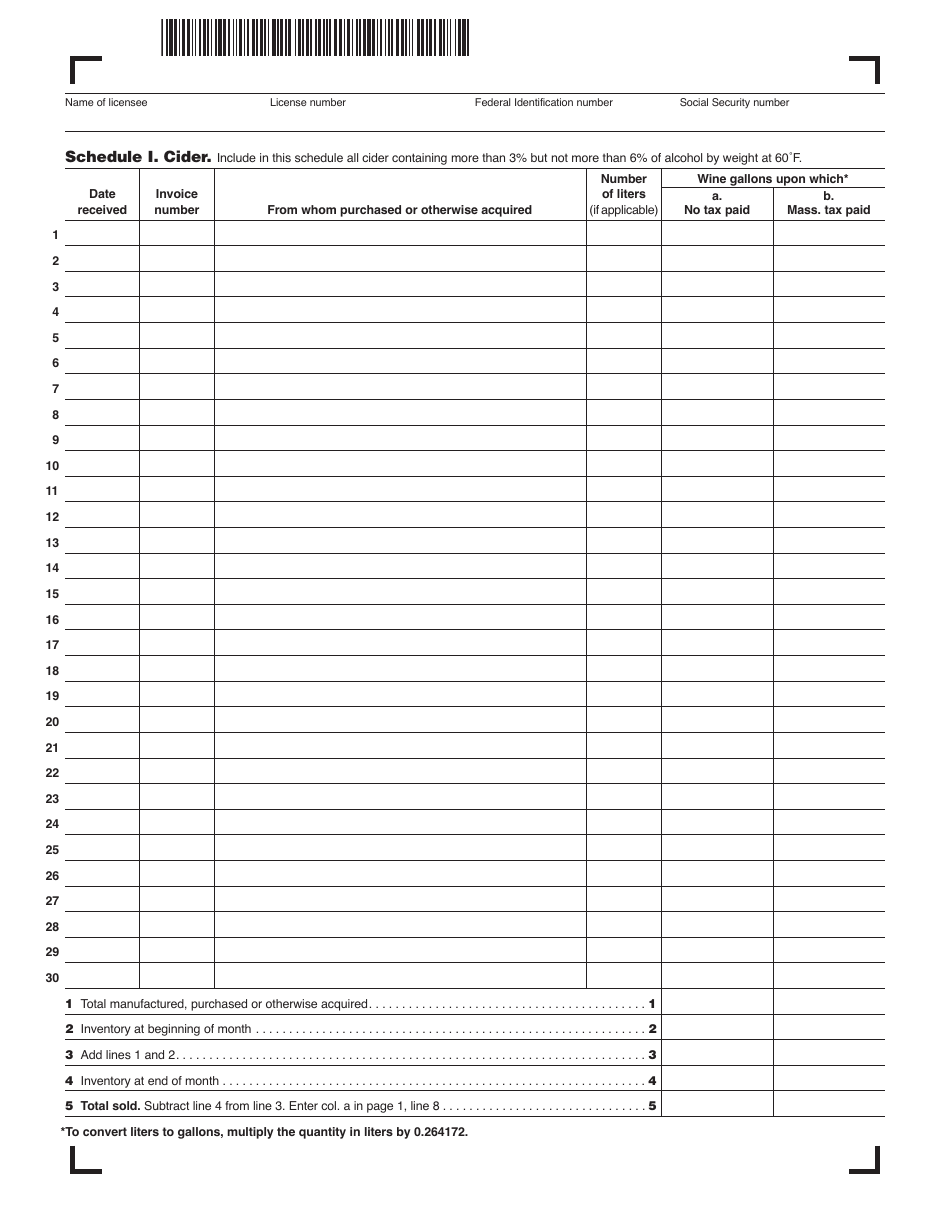

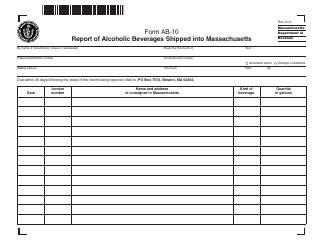

Form AB-1 Alcoholic Beverages Excise Return - Massachusetts

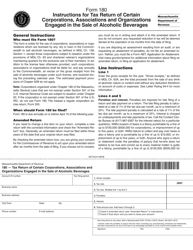

What Is Form AB-1?

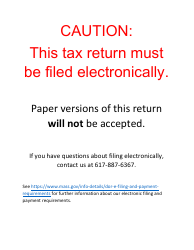

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AB-1?

A: Form AB-1 is the Alcoholic Beverages Excise Return in Massachusetts.

Q: Who is required to file Form AB-1?

A: Businesses engaged in the sale of alcoholic beverages in Massachusetts are required to file Form AB-1.

Q: What is the purpose of Form AB-1?

A: Form AB-1 is used to report and pay the excise tax on alcoholic beverages sold in Massachusetts.

Q: When is Form AB-1 due?

A: Form AB-1 is due quarterly, with the following due dates: April 30th, July 31st, October 31st, and January 31st.

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment of the excise tax. It is important to file and pay on time to avoid penalties and interest charges.

Q: Is Form AB-1 required for both alcoholic beverages sold for on-premises and off-premises consumption?

A: Yes, Form AB-1 is required for both alcoholic beverages sold for on-premises and off-premises consumption.

Q: Do I need to file Form AB-1 even if my business did not sell any alcoholic beverages during the quarter?

A: Yes, even if your business did not sell any alcoholic beverages during the quarter, you still need to file Form AB-1 and indicate zero sales.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

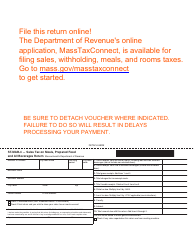

- Fill out the form in our online filing application.

Download a printable version of Form AB-1 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.