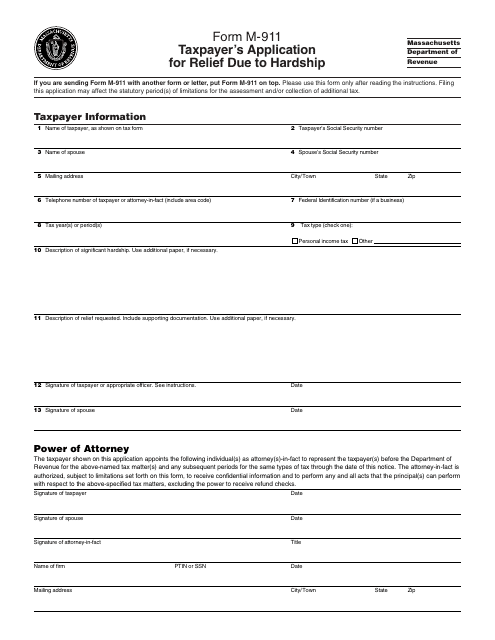

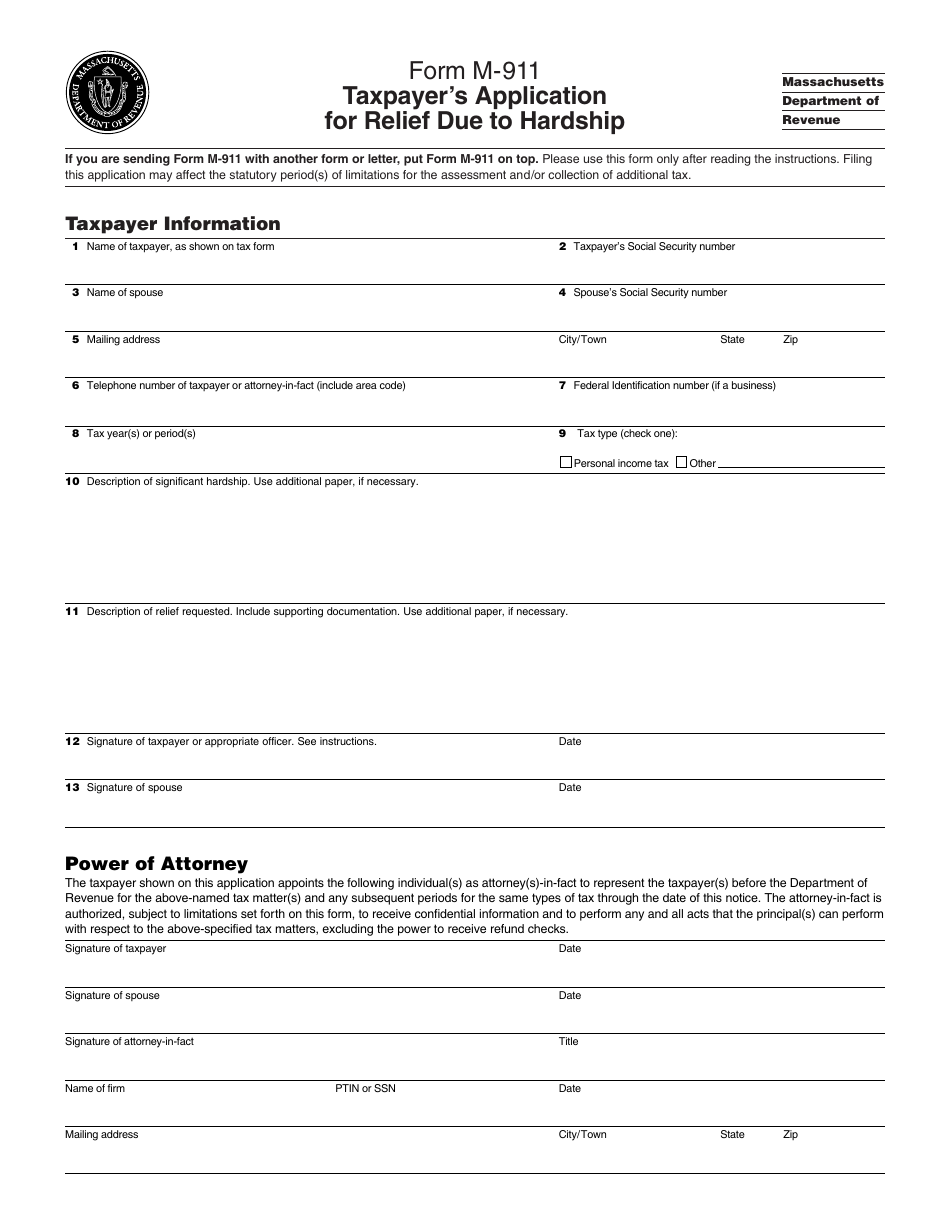

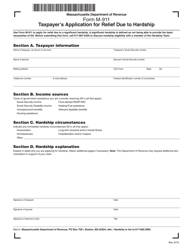

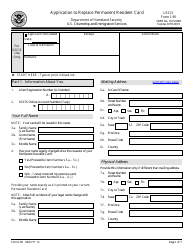

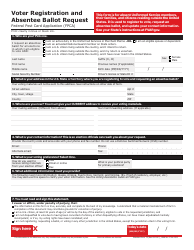

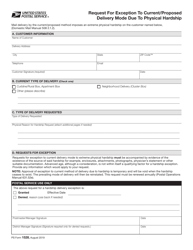

Form M-911 Taxpayer's Application for Relief Due to Hardship - Massachusetts

What Is Form M-911?

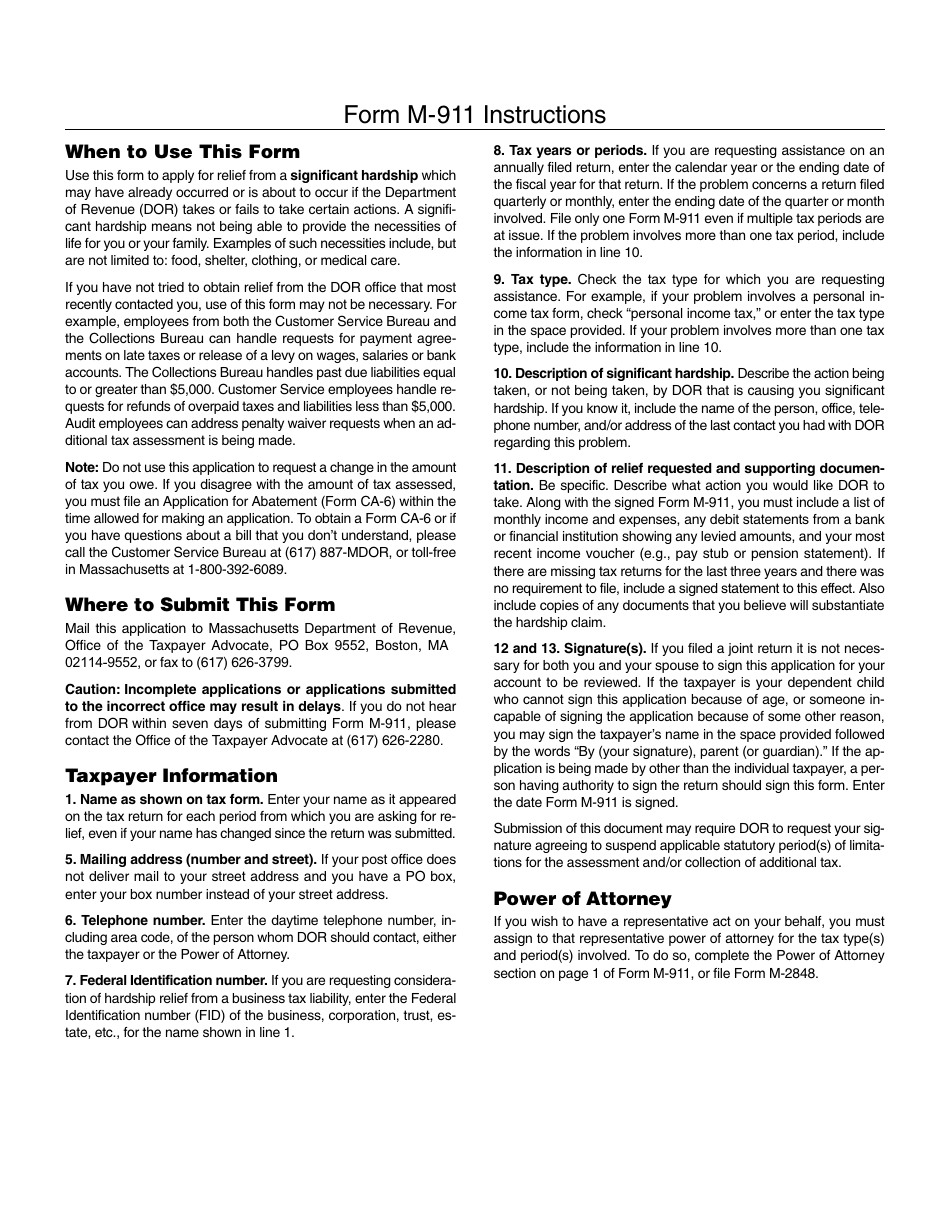

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-911?

A: Form M-911 is the Taxpayer's Application for Relief Due to Hardship in Massachusetts.

Q: Who can use Form M-911?

A: Form M-911 can be used by taxpayers in Massachusetts who are experiencing financial hardship.

Q: What is the purpose of Form M-911?

A: The purpose of Form M-911 is to request relief from certain taxes or penalties due to hardship.

Q: How do I qualify for relief using Form M-911?

A: To qualify for relief using Form M-911, you must demonstrate that you are experiencing financial hardship.

Q: What type of relief can be requested with Form M-911?

A: Form M-911 can be used to request relief from taxes, penalties, or interest.

Q: What supporting documentation do I need to submit with Form M-911?

A: You will need to provide documentation that demonstrates your financial hardship, such as income statements, bank statements, and proof of expenses.

Q: What happens after I submit Form M-911?

A: After you submit Form M-911, the Massachusetts Department of Revenue will review your application and determine if you qualify for relief.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-911 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.