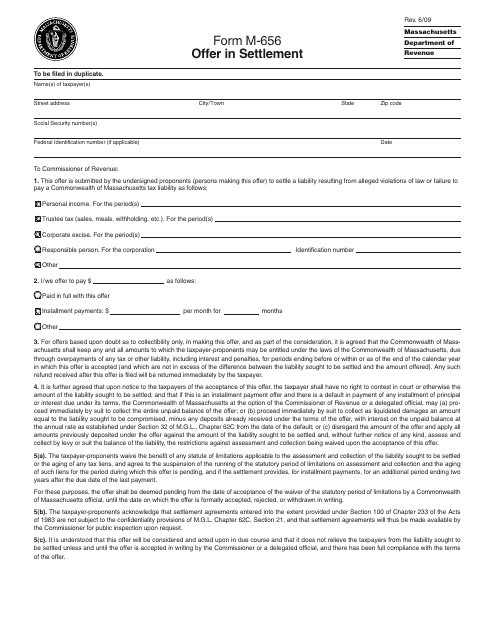

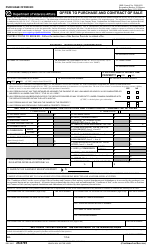

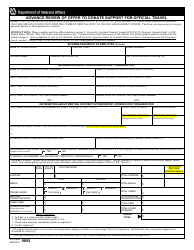

Form M-656 Offer in Settlement - Massachusetts

What Is Form M-656?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-656?

A: Form M-656 is an Offer in Settlement form used in Massachusetts.

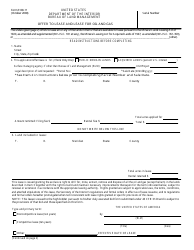

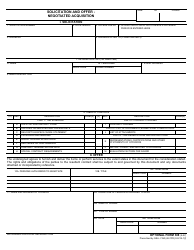

Q: What is the purpose of Form M-656?

A: The purpose of Form M-656 is to offer a settlement to resolve a tax liability with the Massachusetts Department of Revenue.

Q: Who can use Form M-656?

A: Any taxpayer who owes taxes to the Massachusetts Department of Revenue can use Form M-656 to offer a settlement.

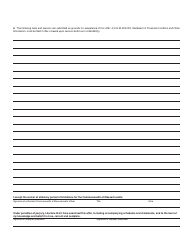

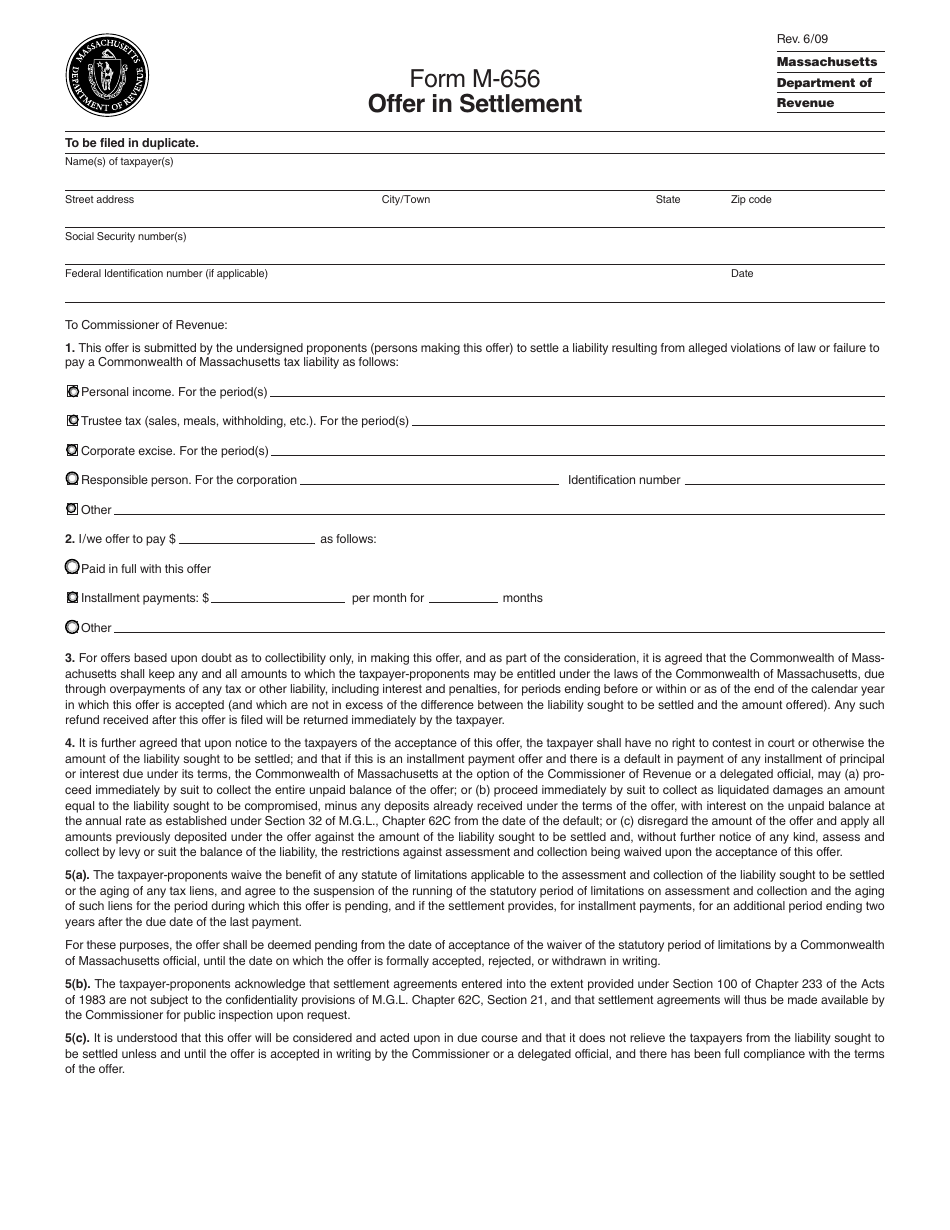

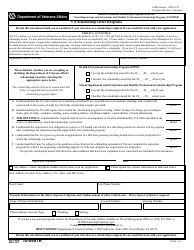

Q: What information is required on Form M-656?

A: Form M-656 requires information about the taxpayer's personal details, tax liability, and proposed settlement amount.

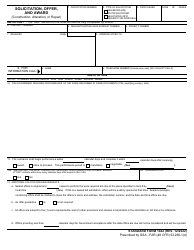

Q: Are there any fees associated with submitting Form M-656?

A: Yes, there is a non-refundable $100 fee for submitting Form M-656.

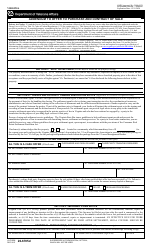

Q: What happens after submitting Form M-656?

A: After submitting Form M-656, the Massachusetts Department of Revenue will review the offer and make a decision on whether to accept or reject it.

Q: Is acceptance of an offer guaranteed with Form M-656?

A: No, the Massachusetts Department of Revenue has the discretion to accept or reject an offer made on Form M-656.

Q: Can I appeal a decision on my offer made with Form M-656?

A: Yes, if your offer is rejected, you can appeal the decision within 30 days of receiving the rejection notice.

Q: Can I make a partial payment with Form M-656?

A: Yes, you can choose to make a partial payment with your offer by indicating the amount on Form M-656.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-656 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.