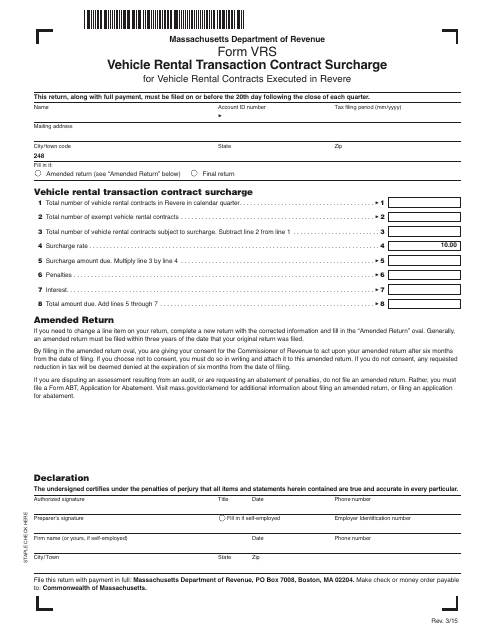

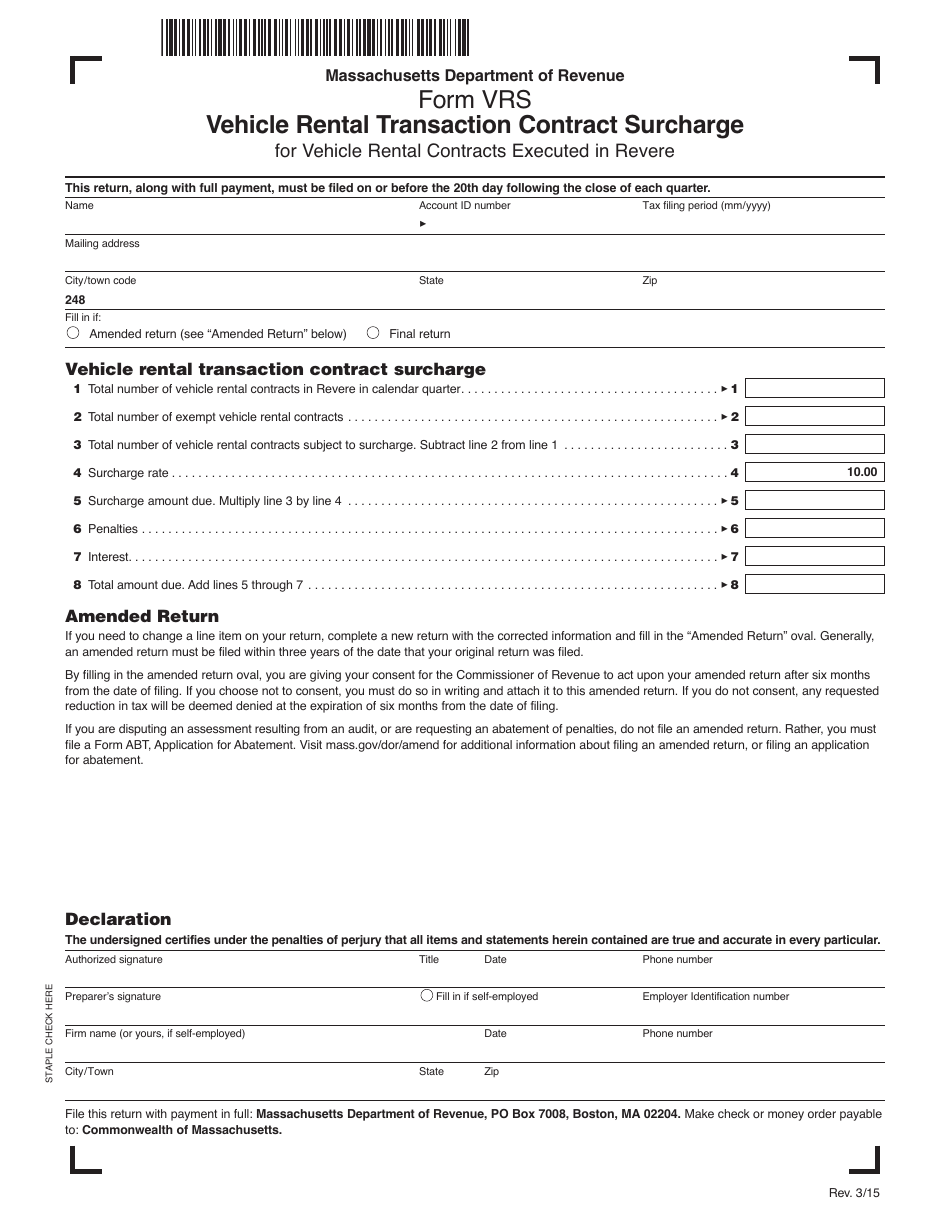

Form VRS Vehicle Rental Transaction Contract Surcharge - Massachusetts

What Is Form VRS?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form VRS Vehicle Rental Transaction Contract Surcharge in Massachusetts?

A: The Form VRS Vehicle Rental Transaction Contract Surcharge is a surcharge imposed on vehicle rentals in Massachusetts.

Q: Who is responsible for paying the surcharge?

A: The person renting the vehicle is responsible for paying the surcharge.

Q: How much is the surcharge?

A: The surcharge is $2 per day for passenger motor vehicles and $10 per day for commercial motor vehicles.

Q: Why is the surcharge imposed?

A: The surcharge is imposed to generate revenue to support transportation infrastructure projects in Massachusetts.

Q: Is the surcharge applicable to all vehicle rentals?

A: No, the surcharge is only applicable to vehicle rentals that have a duration of 31 days or less.

Q: Are there any exemptions to the surcharge?

A: Yes, there are exemptions for certain types of rental transactions, such as those involving federal, state, or municipal governments.

Q: How is the surcharge collected?

A: The surcharge is collected by the vehicle rental company and then remitted to the Massachusetts Department of Revenue.

Q: What are the consequences of non-payment of the surcharge?

A: Failure to pay the surcharge may result in penalties, including fines and interest.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form VRS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.