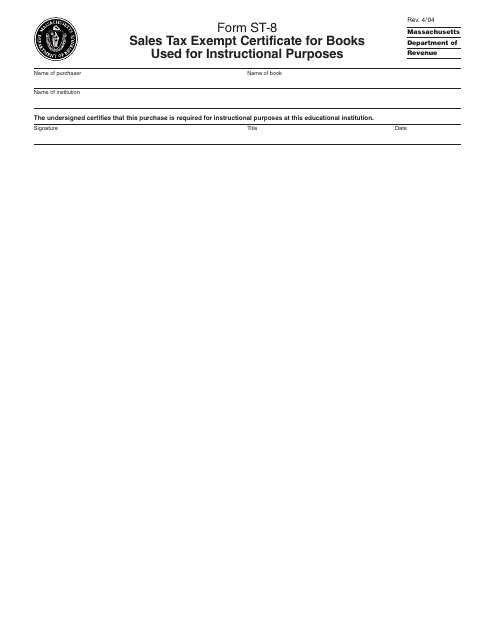

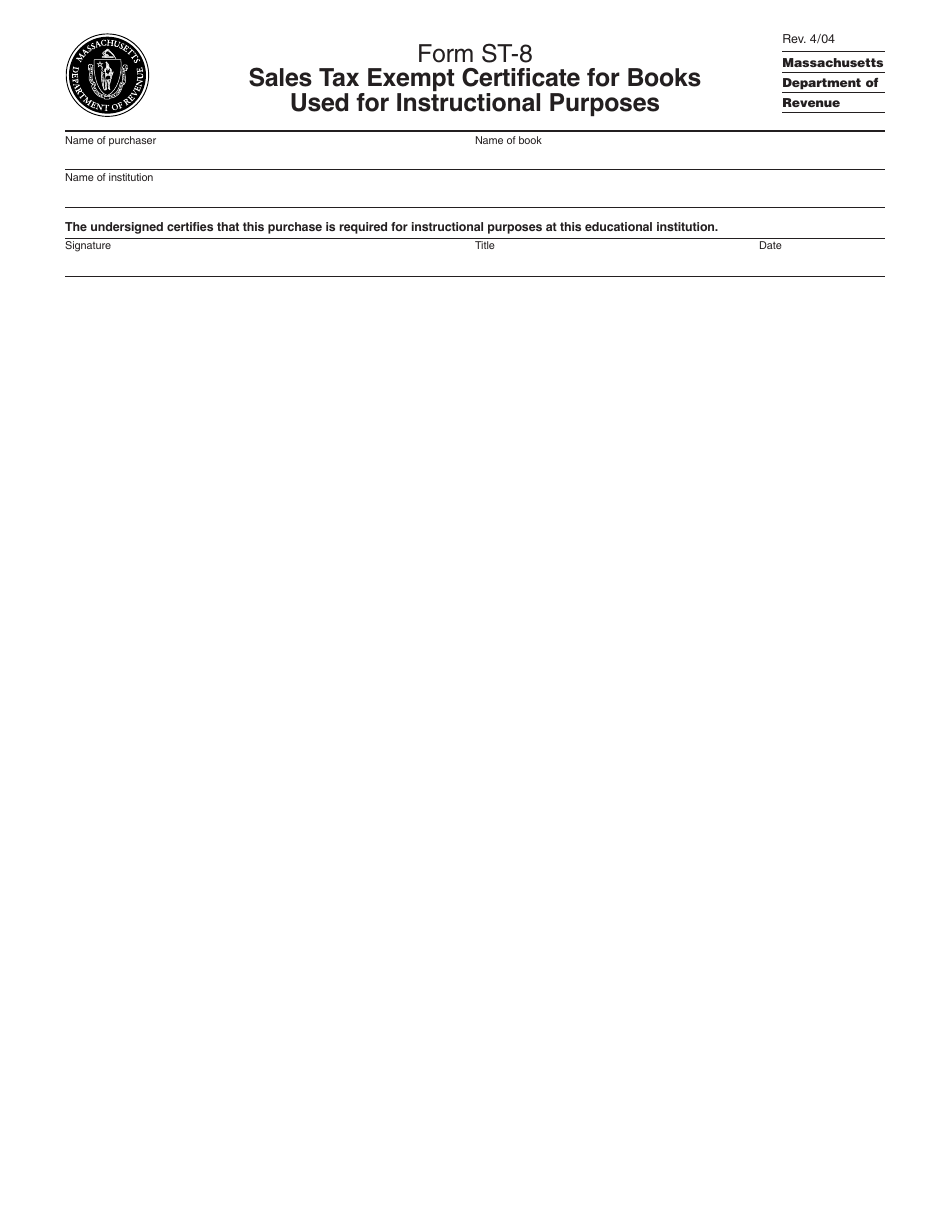

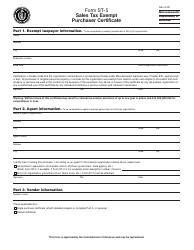

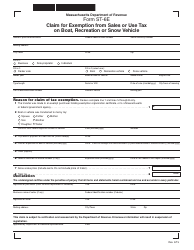

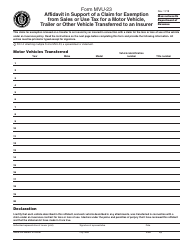

Form ST-8 Sales Tax Exempt Certificate for Books Used for Instructional Purposes - Massachusetts

What Is Form ST-8?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-8?

A: Form ST-8 is a sales tax exempt certificate for books used for instructional purposes in Massachusetts.

Q: Who can use the Form ST-8?

A: Educational institutions and organizations that purchase books for instructional purposes can use the Form ST-8.

Q: What is the purpose of the Form ST-8?

A: The purpose of the Form ST-8 is to provide a sales tax exemption for eligible books used for instructional purposes.

Q: What information should I include on the Form ST-8?

A: You should include your organization's name, address, taxpayer identification number, and a description of the books being purchased.

Q: Are all books exempt from sales tax with the Form ST-8?

A: No, only books used for instructional purposes are exempt from sales tax with the Form ST-8.

Q: Is there an expiration date for the Form ST-8?

A: No, the Form ST-8 does not have an expiration date.

Form Details:

- Released on April 1, 2004;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-8 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.