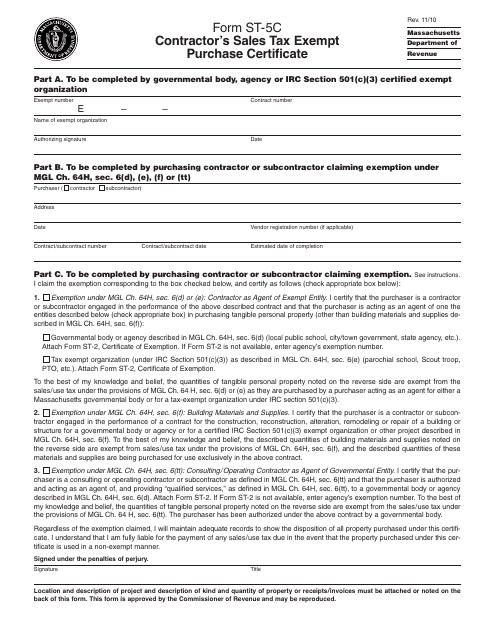

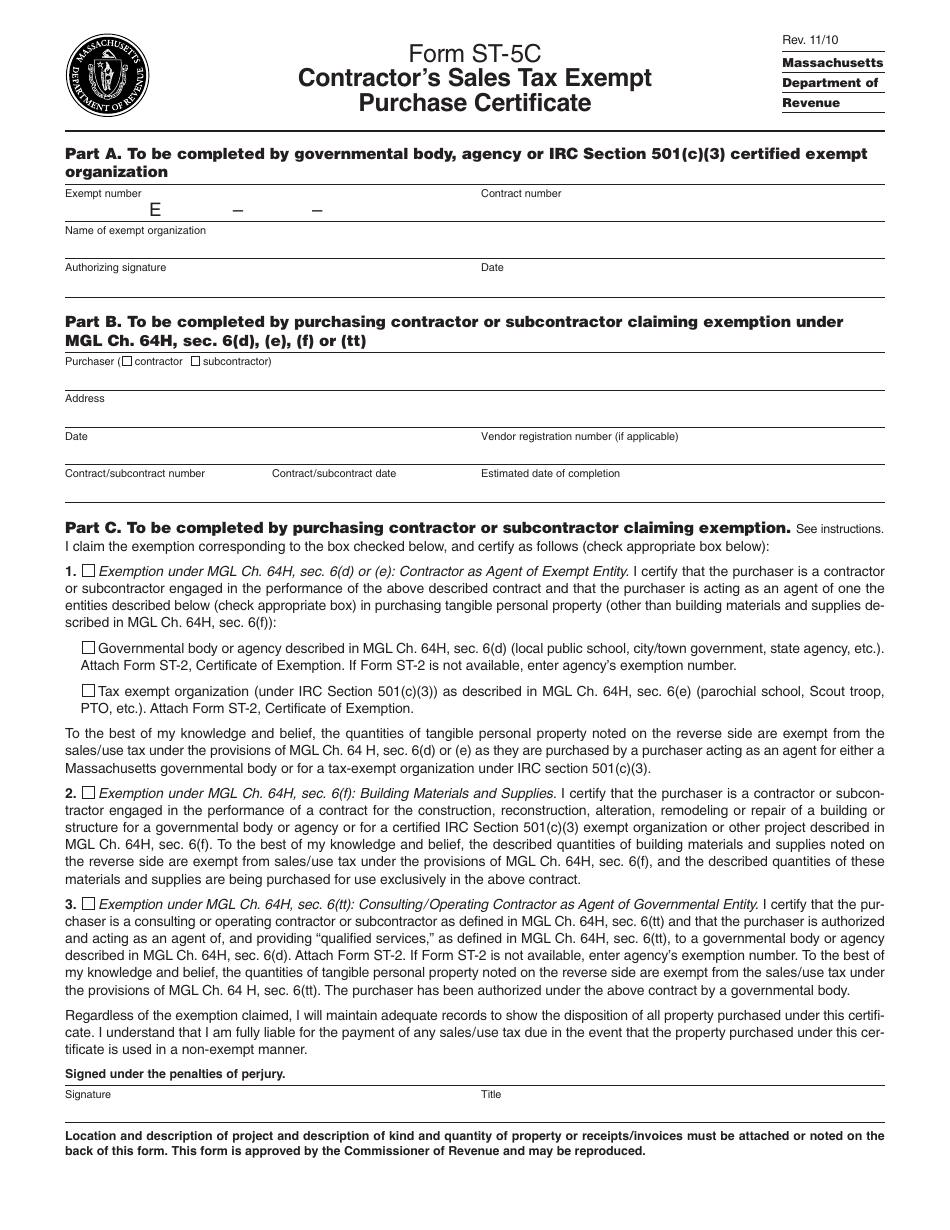

Form ST-5C Contractor's Sales Tax Exempt Purchase Certificate - Massachusetts

What Is Form ST-5C?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-5C?

A: Form ST-5C is a Contractor's Sales Tax Exempt Purchase Certificate.

Q: What is its purpose?

A: The purpose of Form ST-5C is to allow eligible contractors to make tax-exempt purchases in Massachusetts.

Q: What type of purchases can be made tax-exempt with this form?

A: Contractors can make tax-exempt purchases of building materials and supplies.

Q: Who is eligible to use this form?

A: Licensed contractors who are registered to collect and remit Massachusetts sales tax may use this form.

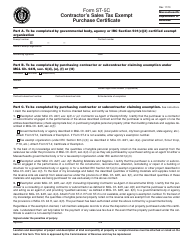

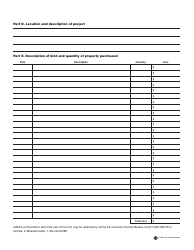

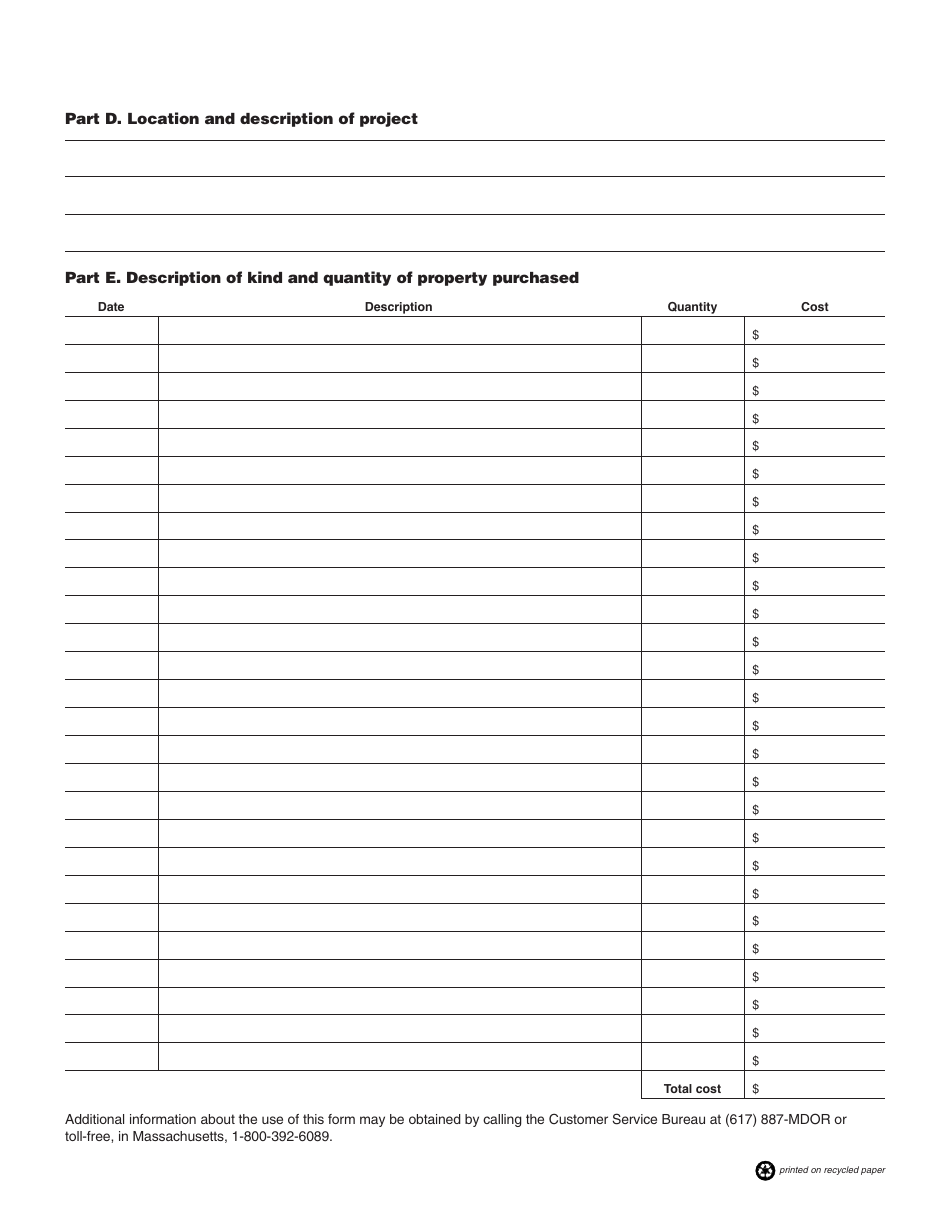

Q: What information is required on the form?

A: The form requires contractor's information, description of the project, and the contractor's signature.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-5C by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.