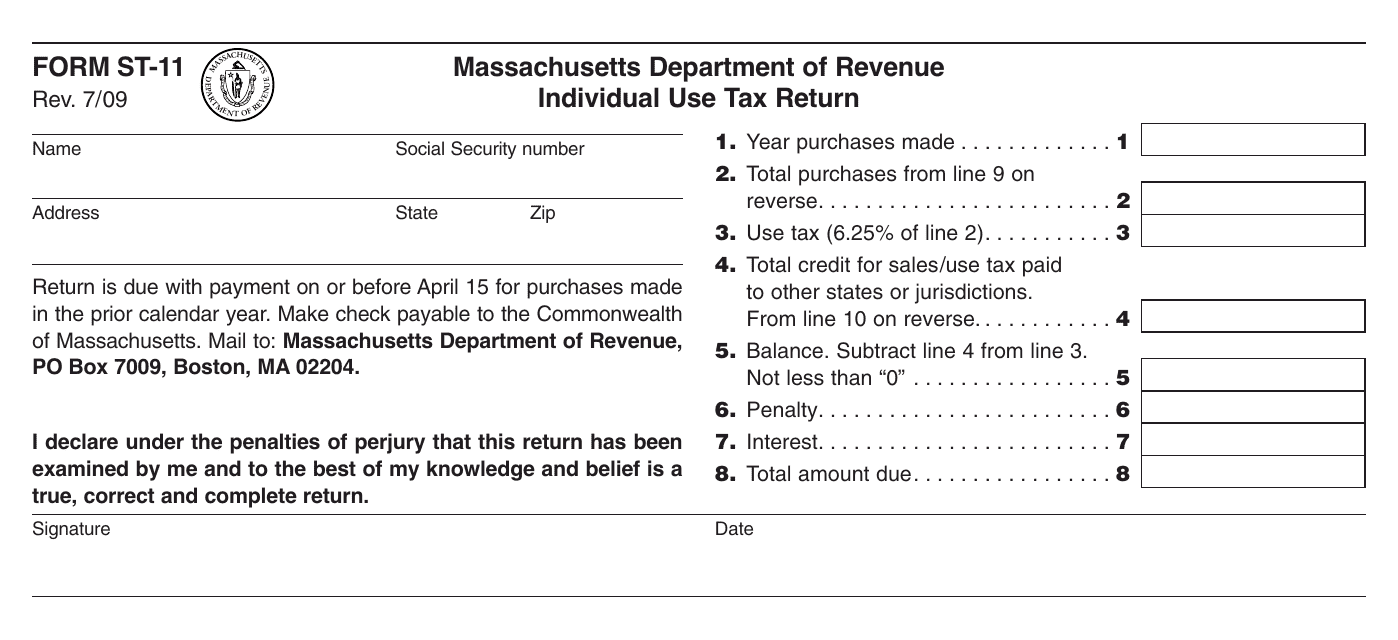

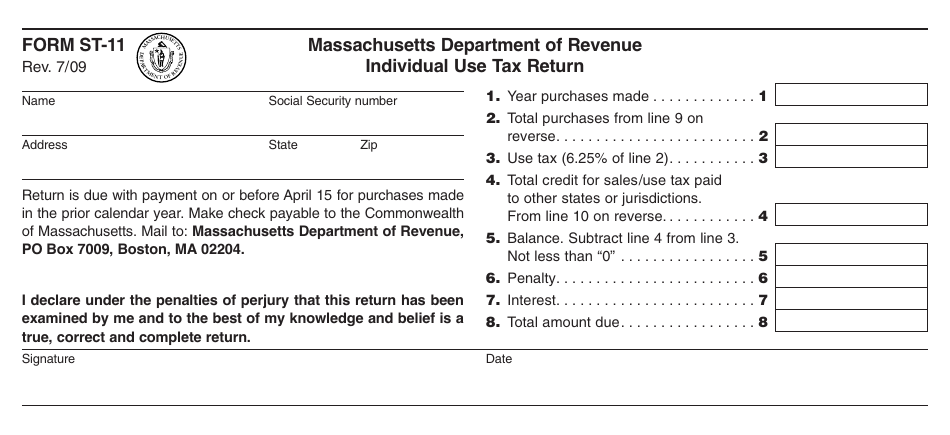

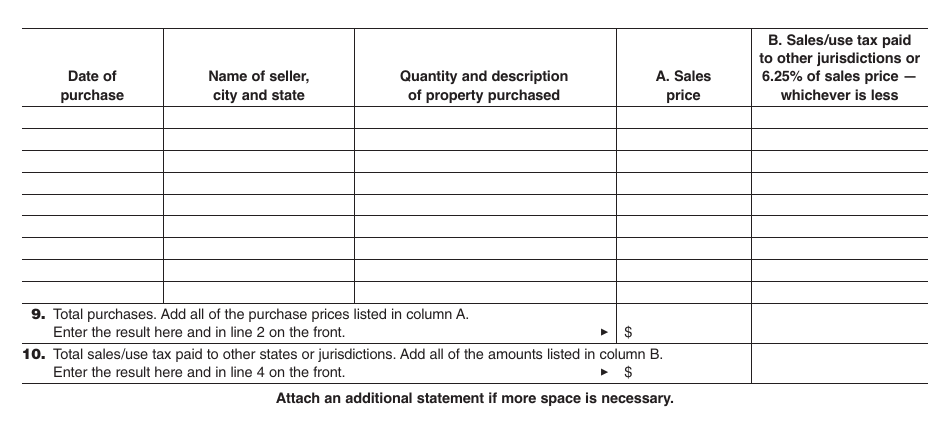

Form ST-11 Individual Use Tax Return - Massachusetts

What Is Form ST-11?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-11?

A: Form ST-11 is the Individual Use Tax Return for Massachusetts.

Q: Who should file Form ST-11?

A: Residents of Massachusetts who have made out-of-state purchases subject to use tax should file Form ST-11.

Q: What is use tax?

A: Use tax is a tax on goods purchased outside of Massachusetts but used in the state.

Q: Do I need to file Form ST-11 if I have already paid sales tax?

A: No, if you have already paid sales tax on your out-of-state purchases, you do not need to file Form ST-11.

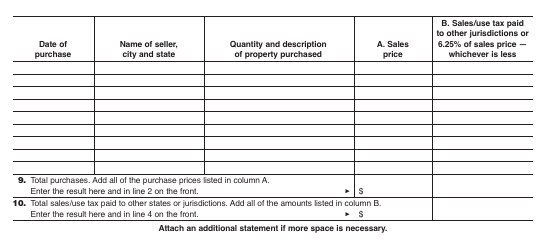

Q: How do I calculate the use tax owed?

A: You can calculate the use tax owed by multiplying the purchase price by the Massachusetts use tax rate.

Q: What is the due date for filing Form ST-11?

A: Form ST-11 is due by April 15th of the year following the year of the purchases.

Q: Are there any penalties for late filing of Form ST-11?

A: Yes, there may be penalties for late filing or failure to file Form ST-11.

Q: Are there any exemptions from the use tax?

A: Yes, some items are exempt from the use tax. Consult the instructions for Form ST-11 for a list of exempt items.

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-11 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.