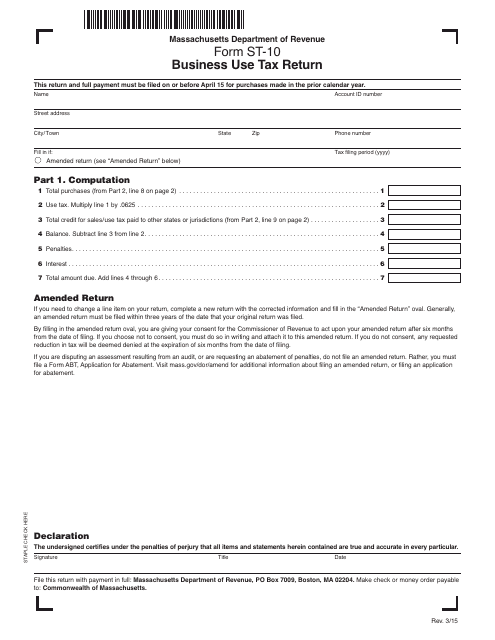

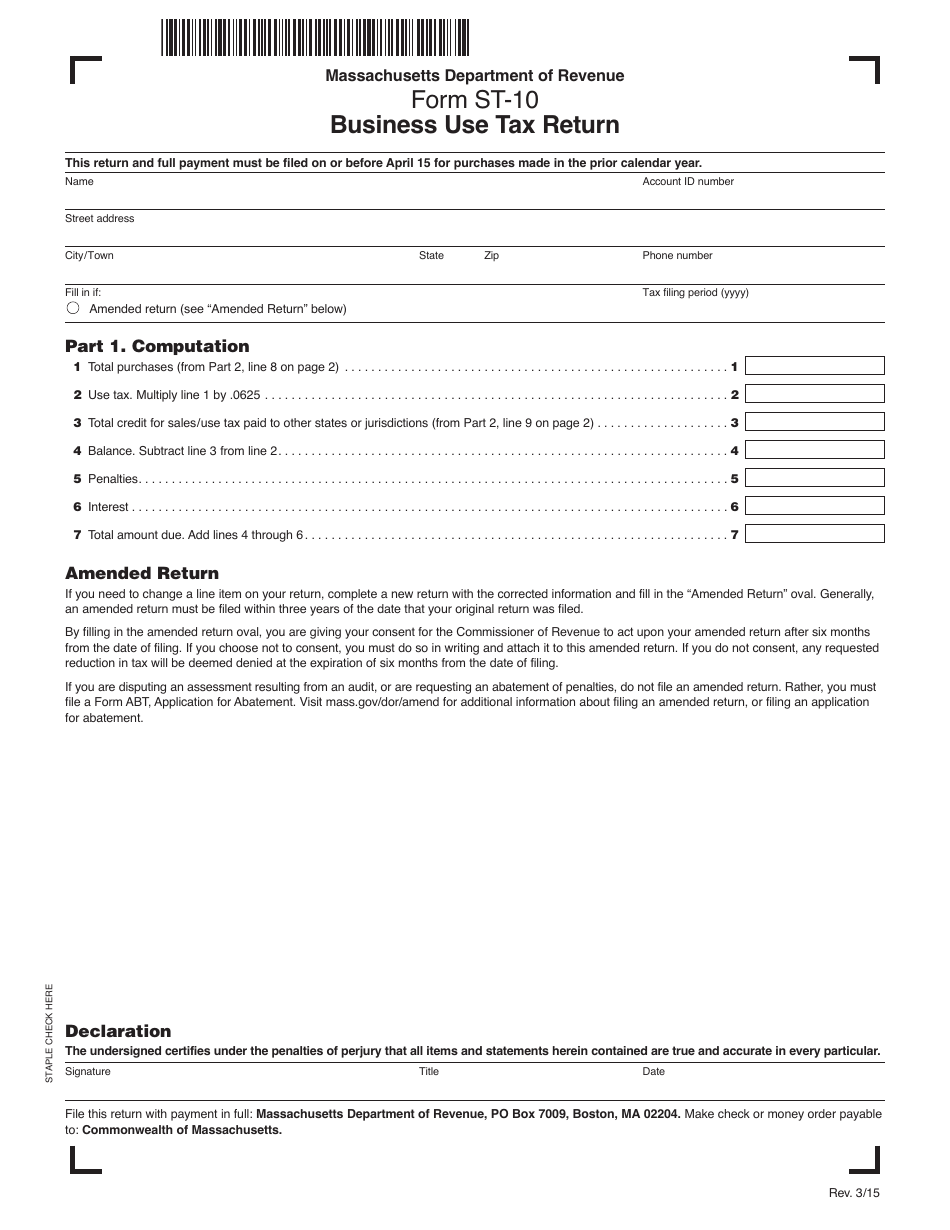

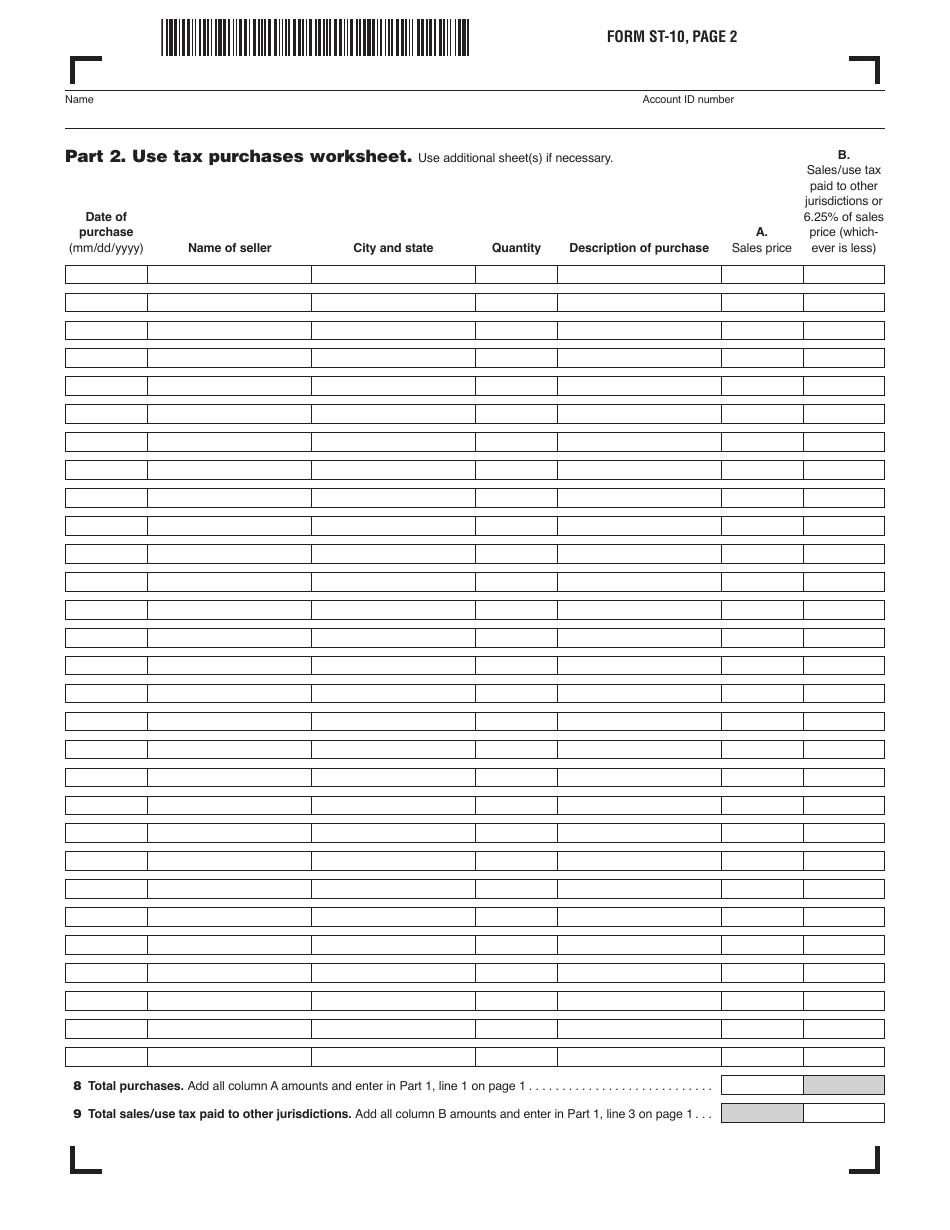

Form ST-10 Business Use Tax Return - Massachusetts

What Is Form ST-10?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-10?

A: The Form ST-10 is the Business Use Tax Return in Massachusetts.

Q: Who needs to file Form ST-10?

A: Businesses operating in Massachusetts may need to file Form ST-10 if they made taxable purchases for their business.

Q: What is the purpose of Form ST-10?

A: The purpose of Form ST-10 is to report and pay the sales or use tax owed on taxable purchases.

Q: When is Form ST-10 due?

A: Form ST-10 is due on a monthly, quarterly, or annual basis, depending on the business's reporting frequency.

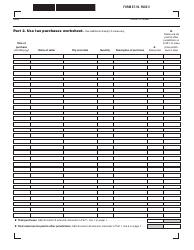

Q: How do I fill out Form ST-10?

A: Form ST-10 requires businesses to provide information about their taxable purchases and calculate the sales or use tax owed.

Q: Are there any exemptions or deductions available on Form ST-10?

A: Yes, there are exemptions and deductions available on Form ST-10. Businesses should refer to the instructions provided with the form for more information.

Q: What happens if I don't file Form ST-10?

A: Failure to file Form ST-10 or pay the sales or use tax owed may result in penalties and interest.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-10 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.