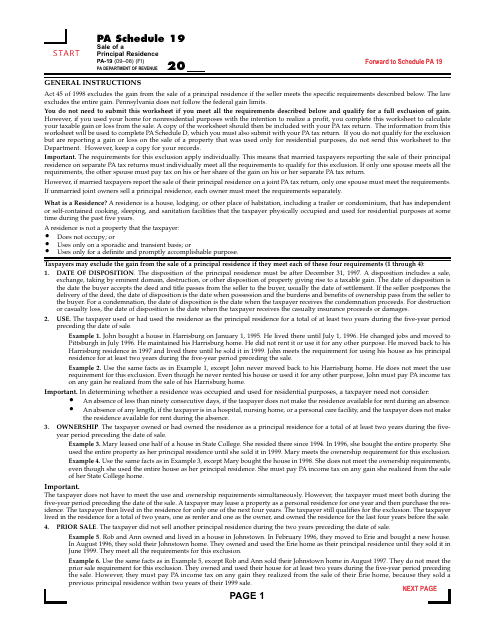

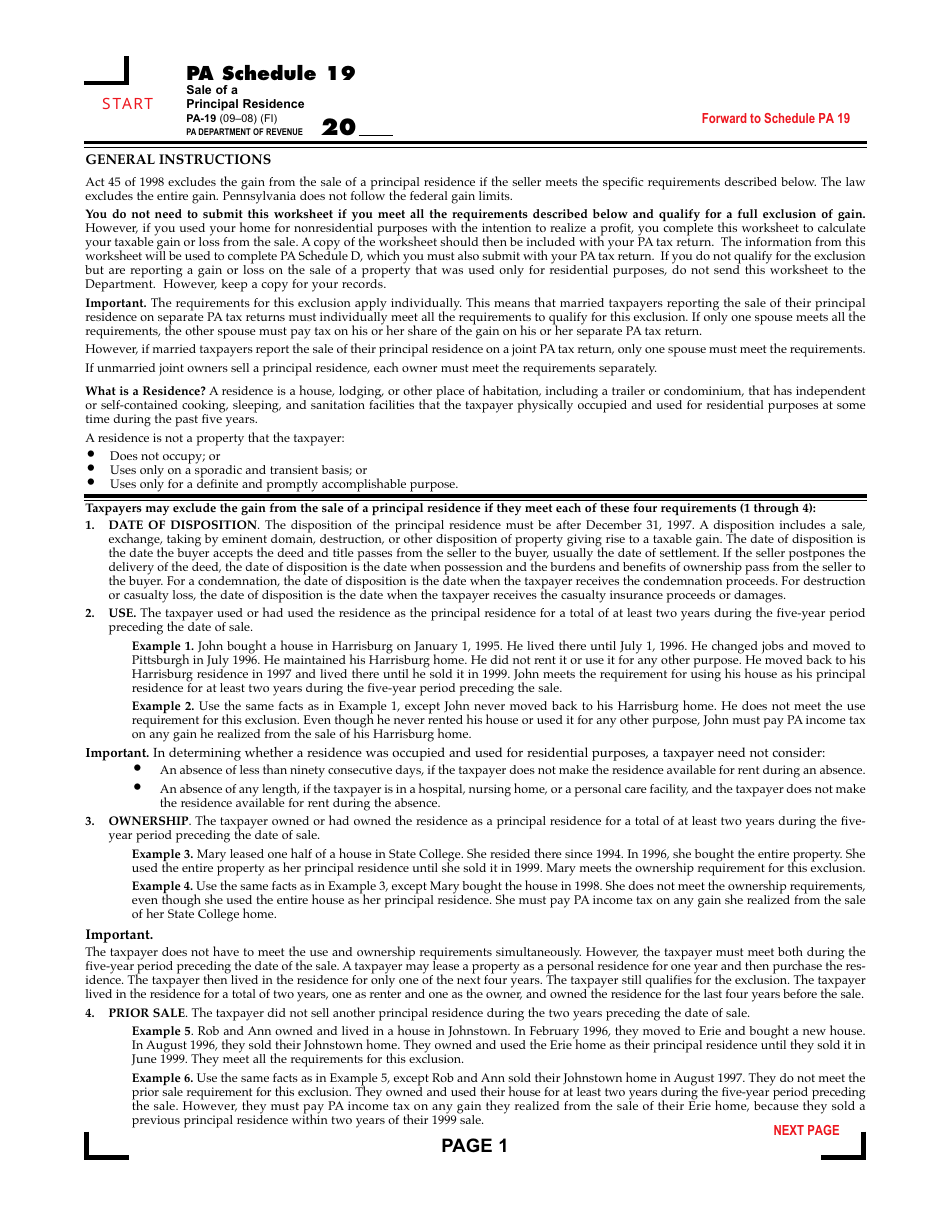

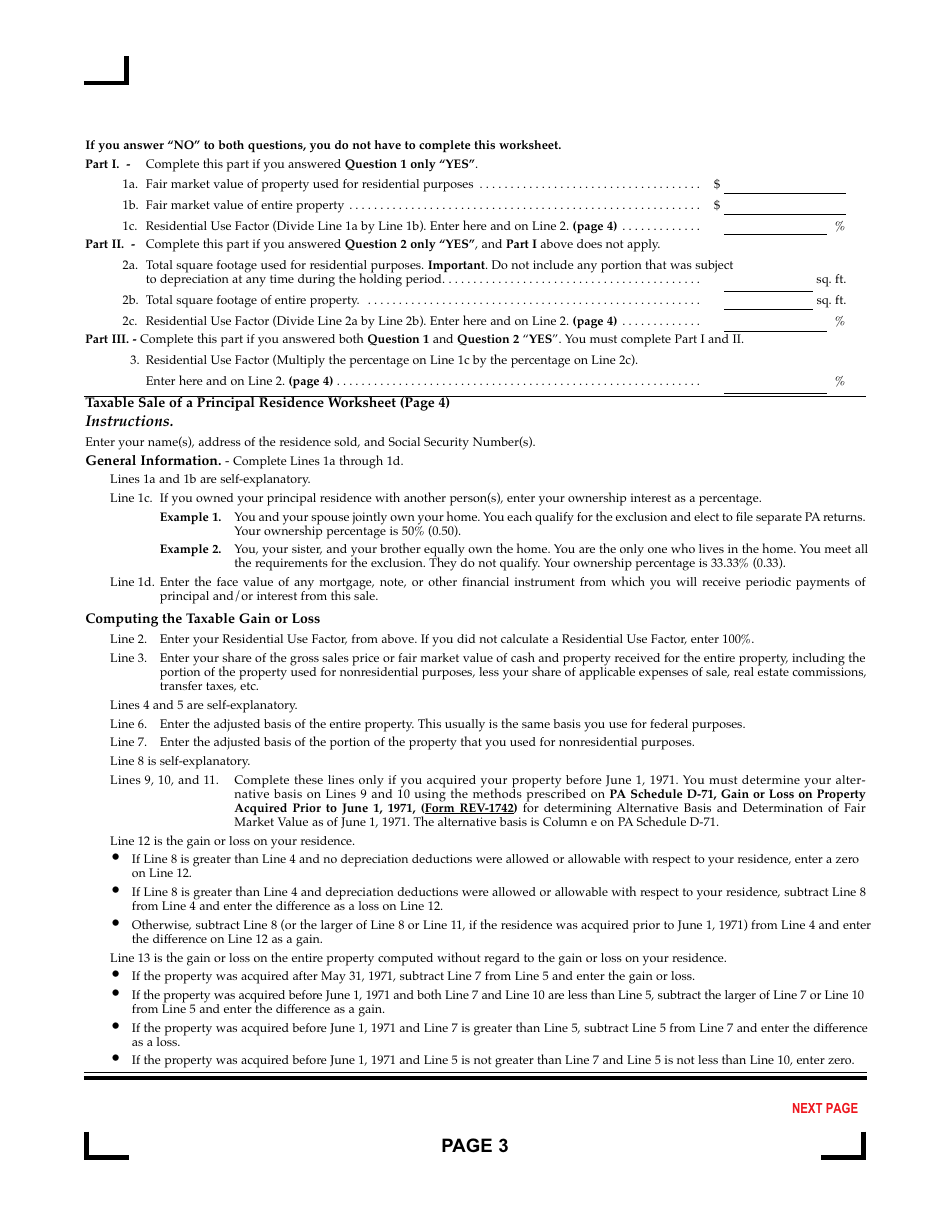

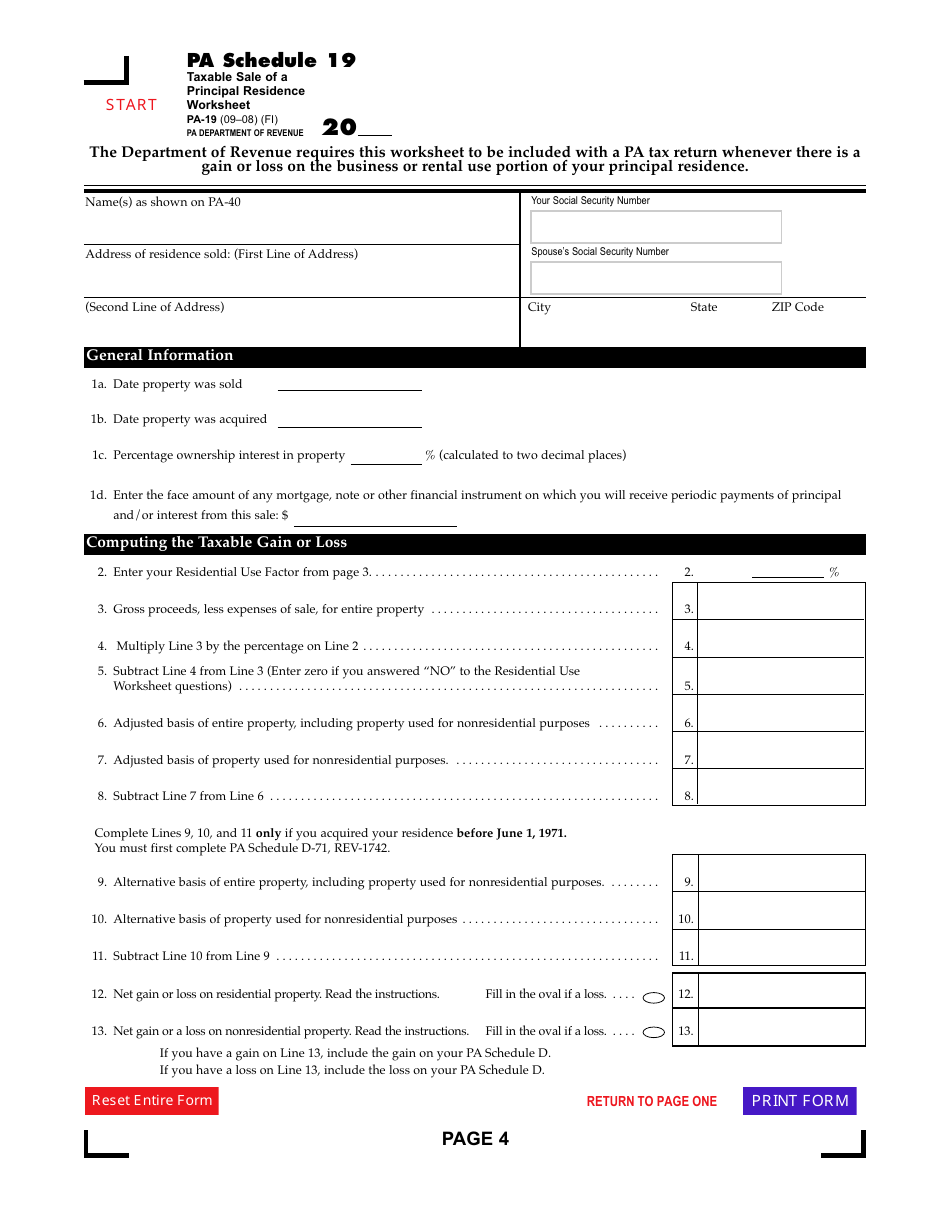

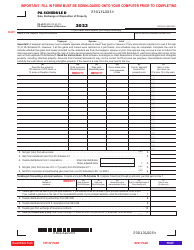

Pa Schedule 19 - Sale of a Principal Residence - Pennsylvania

Pa Schedule 19 - Sale of a Principal Residence is a legal document that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.

FAQ

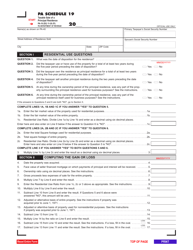

Q: What is Pa Schedule 19?

A: Pa Schedule 19 is a form used in Pennsylvania to report the sale of a principal residence.

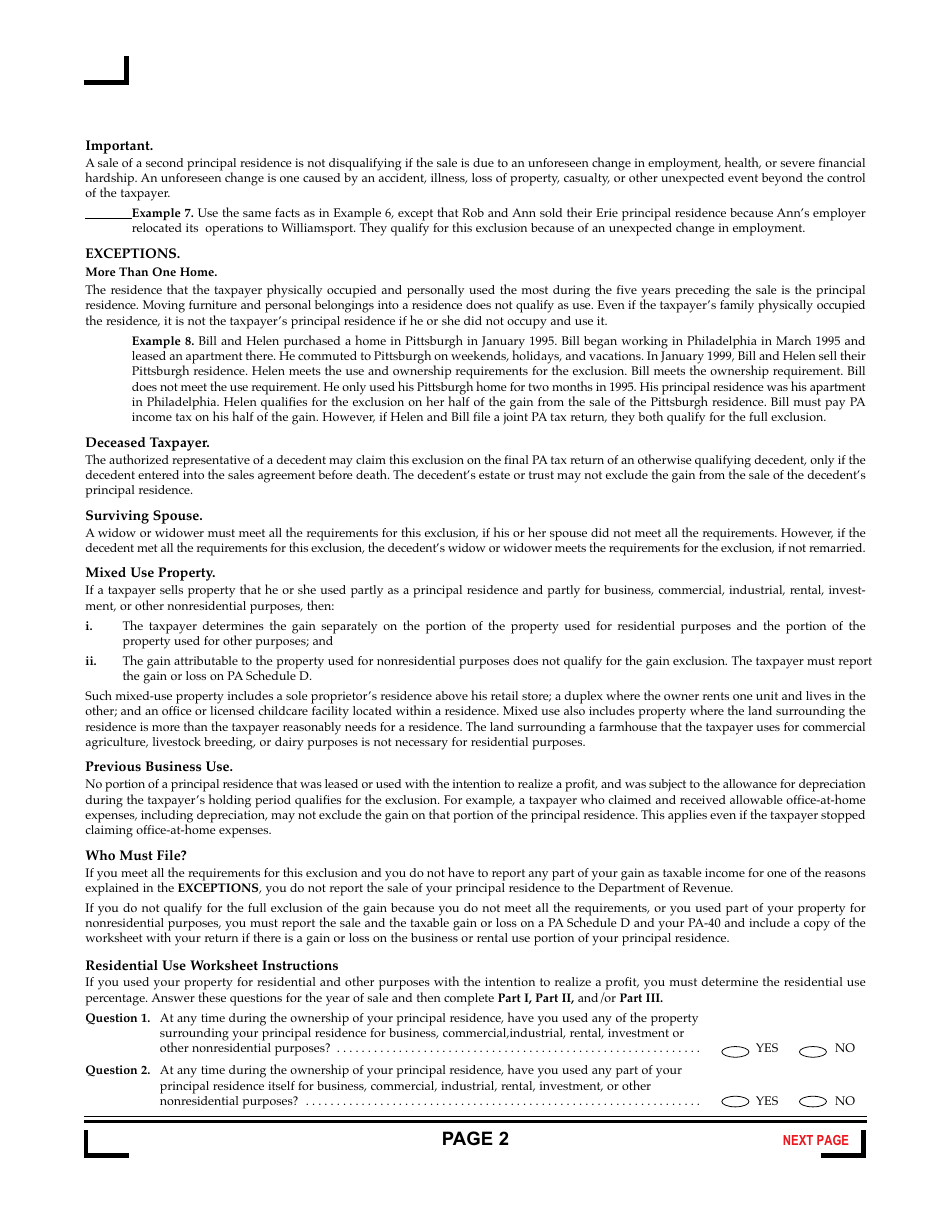

Q: What is a principal residence?

A: A principal residence is the main home where an individual or family lives.

Q: Why do I need to report the sale of my principal residence?

A: You need to report the sale of your principal residence for tax purposes.

Q: Do I have to pay taxes on the sale of my principal residence?

A: In most cases, you do not have to pay taxes on the sale of your principal residence.

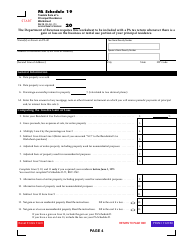

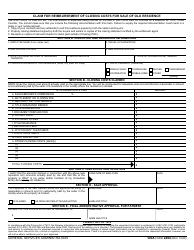

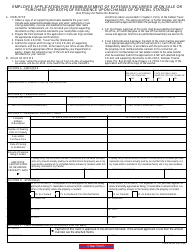

Q: What should I include in Pa Schedule 19?

A: You should include information about the sale price, acquisition cost, and improvements made to the property.

Q: How do I fill out Pa Schedule 19?

A: You can fill out Pa Schedule 19 by providing the necessary information about the sale of your principal residence.

Q: Do I need to file Pa Schedule 19 if I didn't make a profit on the sale of my principal residence?

A: Yes, you still need to file Pa Schedule 19 even if you didn't make a profit on the sale.

Q: When is the deadline to file Pa Schedule 19?

A: The deadline to file Pa Schedule 19 is usually April 15, or the same deadline as your Pennsylvania state tax return.

Q: What happens if I don't file Pa Schedule 19?

A: If you don't file Pa Schedule 19, you may face penalties and interest on any taxes owed.

Form Details:

- Released on September 1, 2008;

- The latest edition currently provided by the Pennsylvania Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.