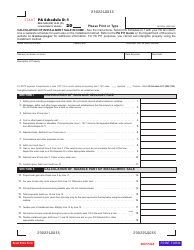

This version of the form is not currently in use and is provided for reference only. Download this version of

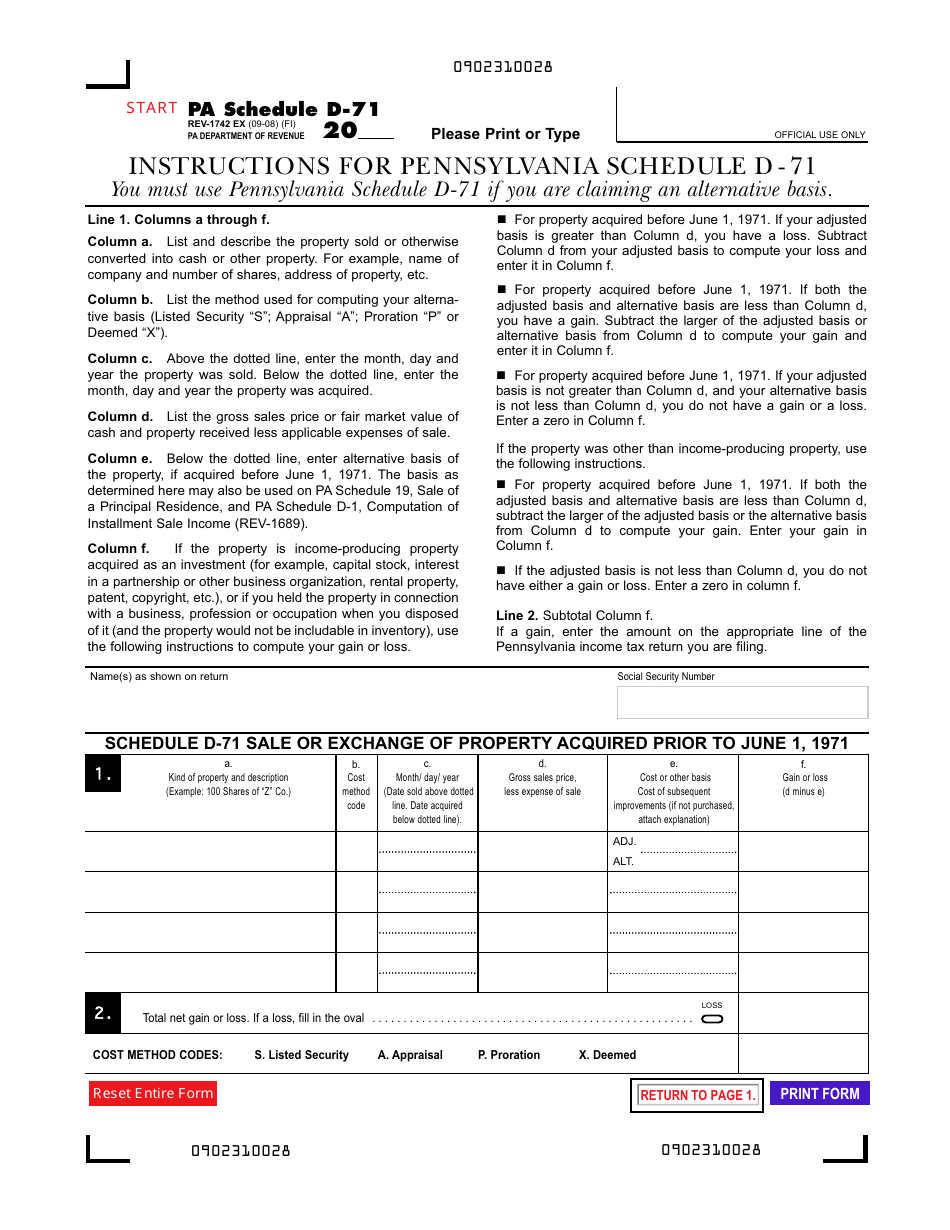

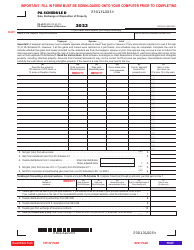

Form REV-1742 Schedule D-71

for the current year.

Form REV-1742 Schedule D-71 Sale or Exchange or Property Acquired Prior to June 1, 1971 - Pennsylvania

What Is Form REV-1742 Schedule D-71?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1742 Schedule D-71?

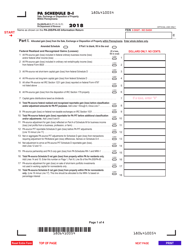

A: Form REV-1742 Schedule D-71 is a tax form used in Pennsylvania for reporting the sale or exchange of property acquired prior to June 1, 1971.

Q: What is the purpose of Form REV-1742 Schedule D-71?

A: The purpose of Form REV-1742 Schedule D-71 is to report any gains or losses from the sale or exchange of property acquired prior to June 1, 1971, for tax purposes in Pennsylvania.

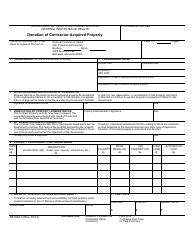

Q: Who needs to file Form REV-1742 Schedule D-71?

A: Anyone who has sold or exchanged property acquired prior to June 1, 1971, and is a resident of Pennsylvania needs to file Form REV-1742 Schedule D-71.

Q: What information is required on Form REV-1742 Schedule D-71?

A: Form REV-1742 Schedule D-71 requires information such as the description of the property, date of acquisition, sale or exchange details, and the calculation of gains or losses.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1742 Schedule D-71 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.