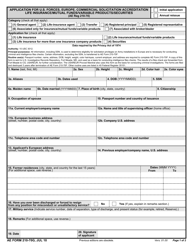

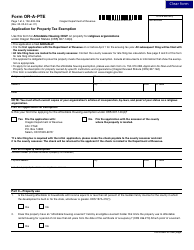

This version of the form is not currently in use and is provided for reference only. Download this version of

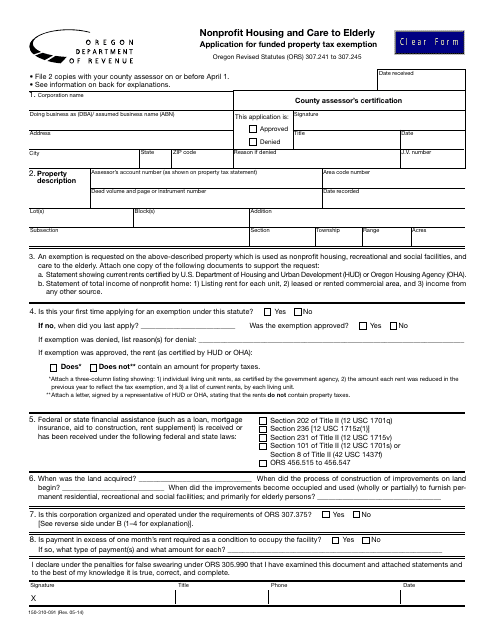

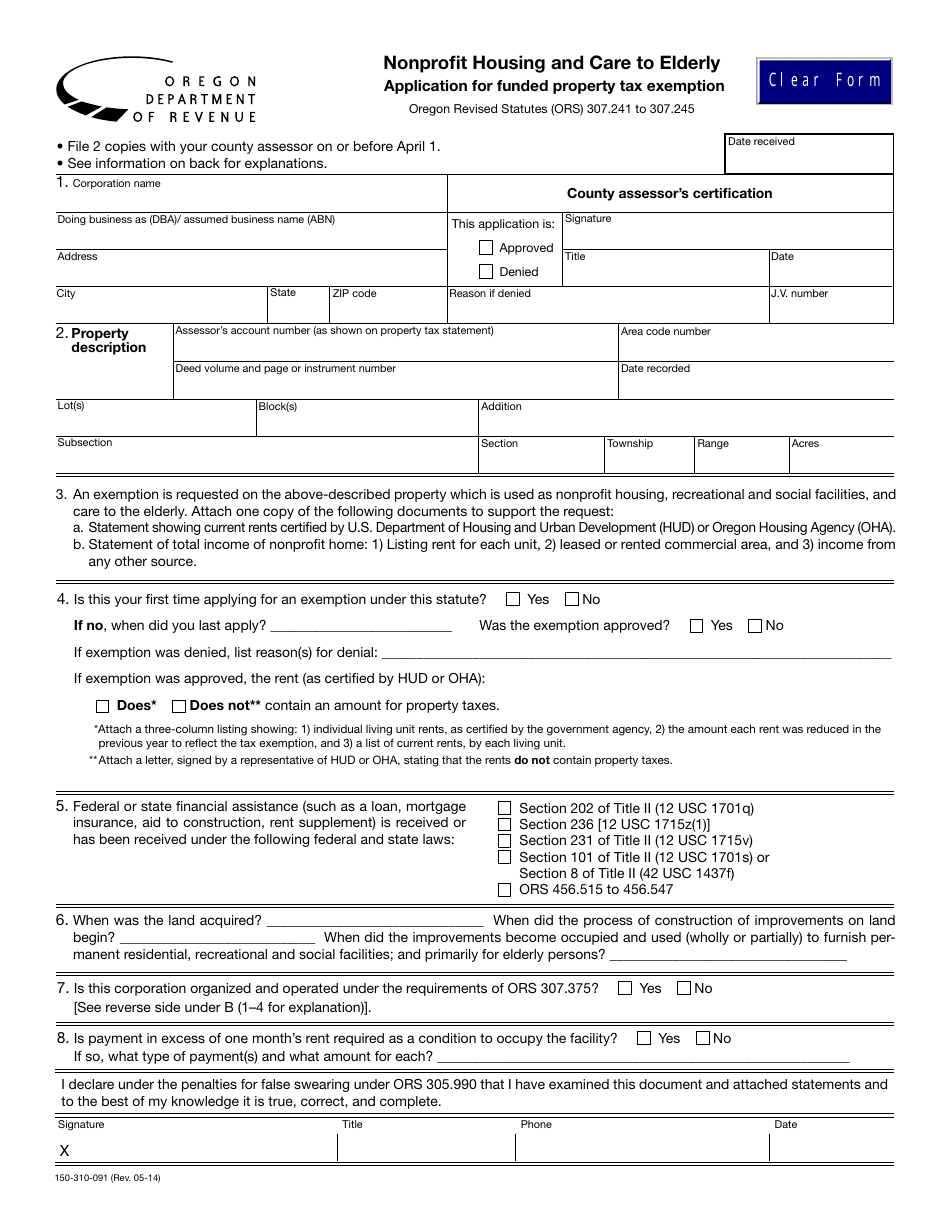

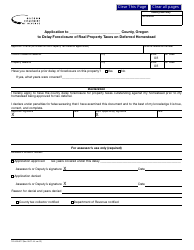

Form 150-310-091

for the current year.

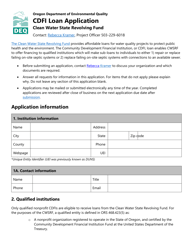

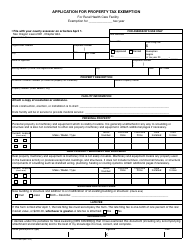

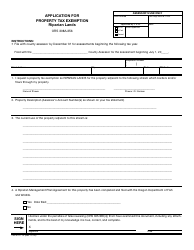

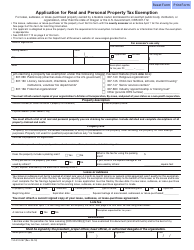

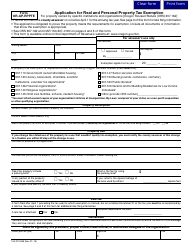

Form 150-310-091 Application for Funded Property Tax Exemption - Oregon

What Is Form 150-310-091?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-310-091?

A: Form 150-310-091 is the Application for Funded Property Tax Exemption in Oregon.

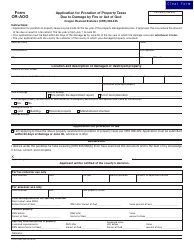

Q: What is the purpose of the funded property tax exemption?

A: The purpose of the funded property tax exemption is to provide relief to qualifying individuals or organizations from property taxes.

Q: Are there any deadlines for submitting Form 150-310-091?

A: Yes, there are specific deadlines for submitting Form 150-310-091. Please refer to the instructions provided with the form or contact your local county assessor's office for more information.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-310-091 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.