This version of the form is not currently in use and is provided for reference only. Download this version of

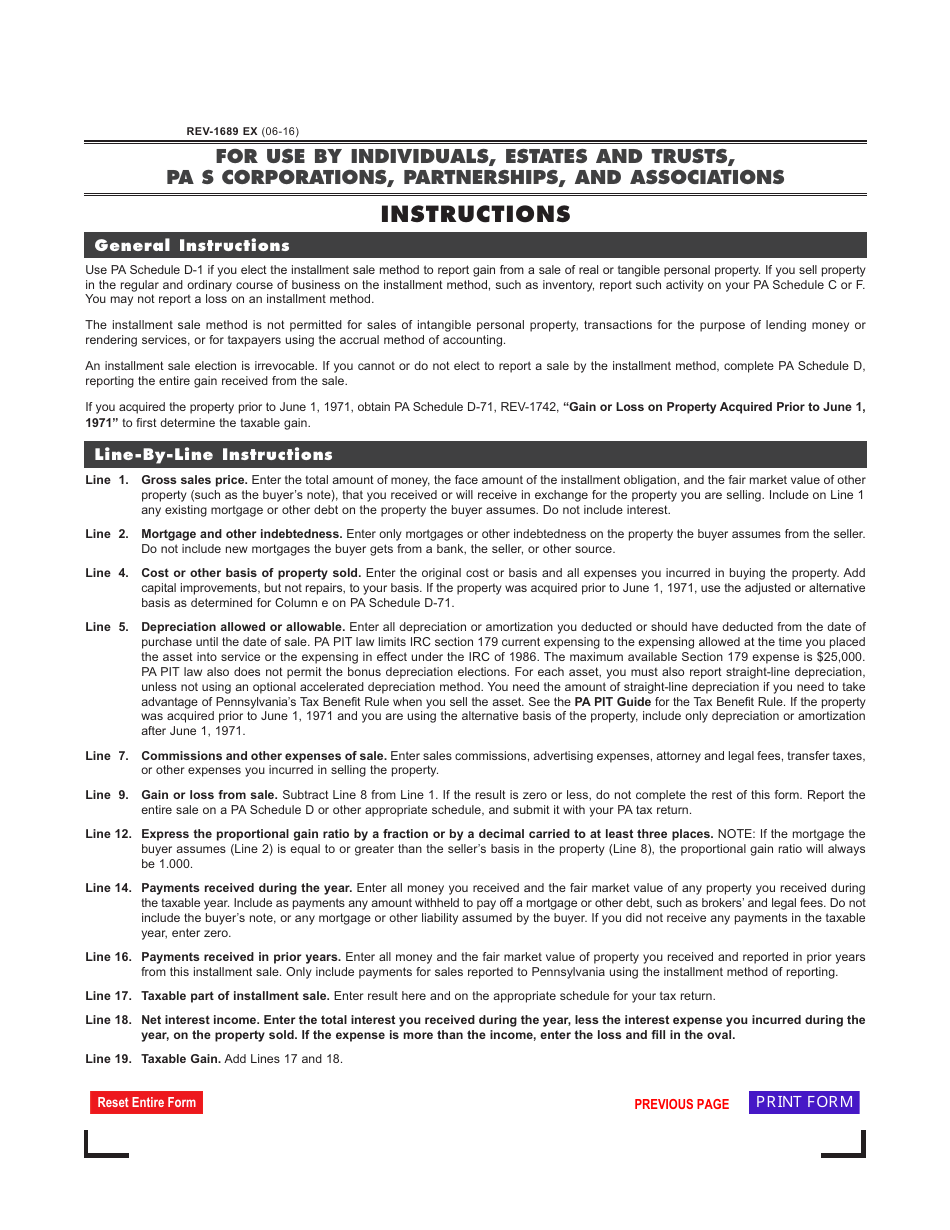

Form REV-1689 Schedule D-1

for the current year.

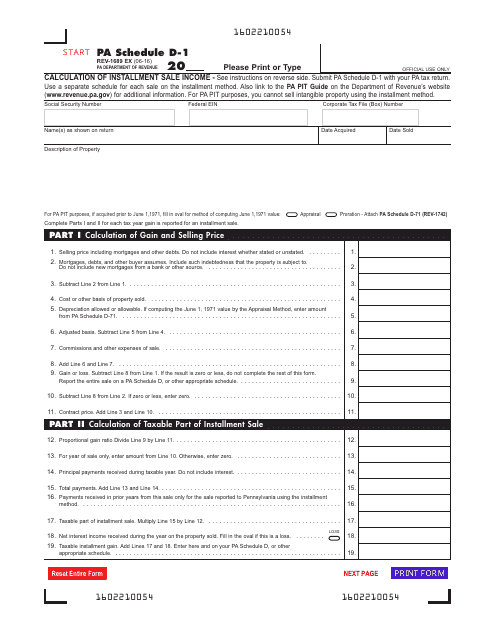

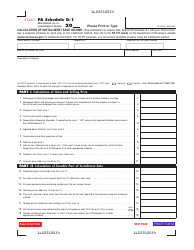

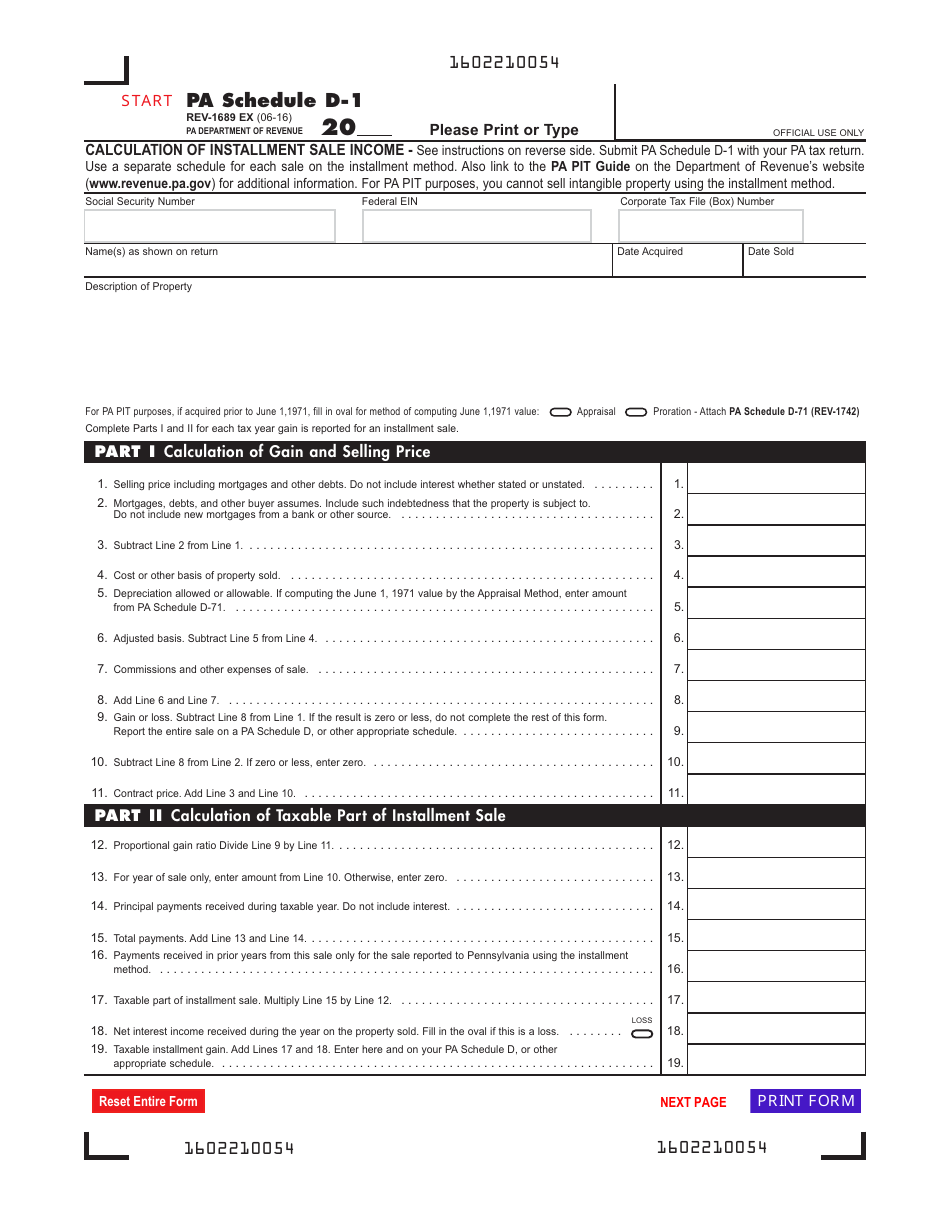

Form REV-1689 Schedule D-1 Calculation of Installment Sale Income - Pennsylvania

What Is Form REV-1689 Schedule D-1?

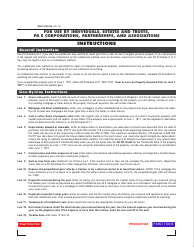

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1689 Schedule D-1?

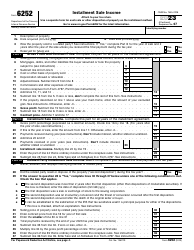

A: Form REV-1689 Schedule D-1 is a Pennsylvania tax form used to calculate installment sale income.

Q: What is installment sale income?

A: Installment sale income refers to the income received from the sale of property or assets in installments over a period of time.

Q: Why do I need to file Form REV-1689 Schedule D-1?

A: You need to file Form REV-1689 Schedule D-1 if you have received installment sale income and are a resident of Pennsylvania.

Q: How do I complete Form REV-1689 Schedule D-1?

A: You need to provide information about the installment sale on the form, including the date of sale, total selling price, and the amount received during the tax year.

Q: When is the deadline to file Form REV-1689 Schedule D-1?

A: The deadline to file Form REV-1689 Schedule D-1 is the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any other forms or schedules related to Form REV-1689 Schedule D-1?

A: Yes, you may need to complete other forms or schedules, such as Form PA-40, if you have other types of income or deductions to report.

Q: What happens if I do not file Form REV-1689 Schedule D-1?

A: If you are required to file Form REV-1689 Schedule D-1 and fail to do so, you may face penalties or interest on any unpaid tax owed.

Q: Can I e-file Form REV-1689 Schedule D-1?

A: No, currently, Pennsylvania does not support e-filing for Form REV-1689 Schedule D-1. You must file a paper return.

Q: Is Form REV-1689 Schedule D-1 only for residents of Pennsylvania?

A: Yes, Form REV-1689 Schedule D-1 is specifically for residents of Pennsylvania who have received installment sale income.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1689 Schedule D-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.