This version of the form is not currently in use and is provided for reference only. Download this version of

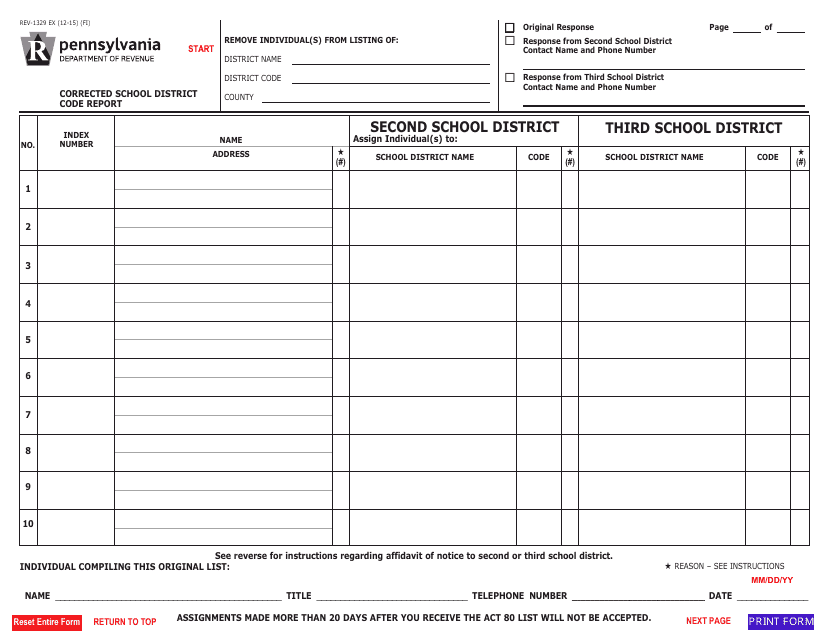

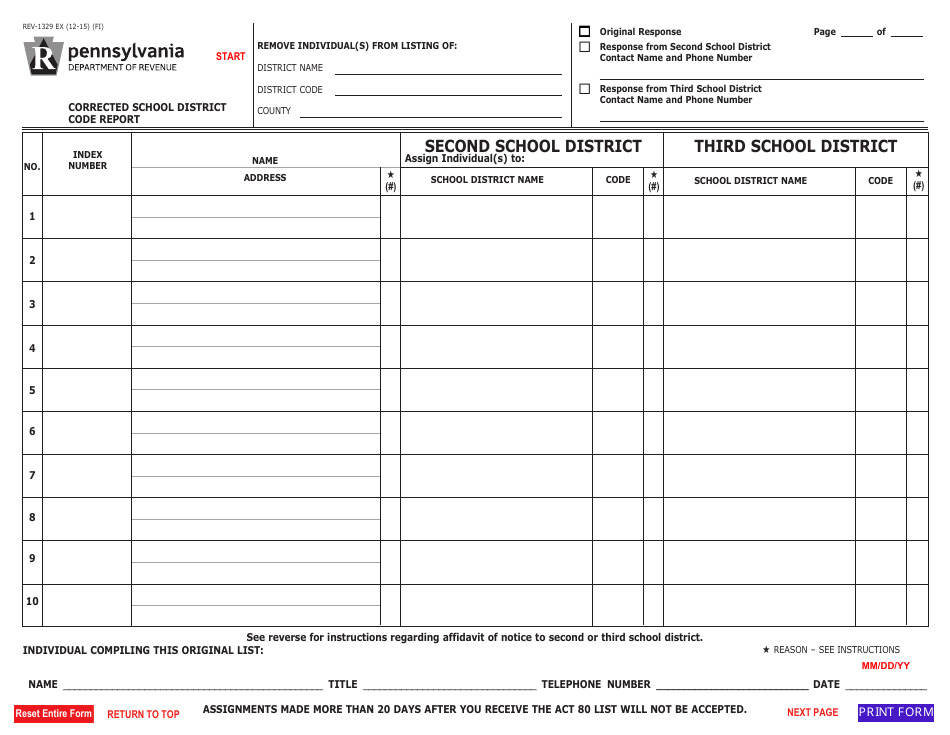

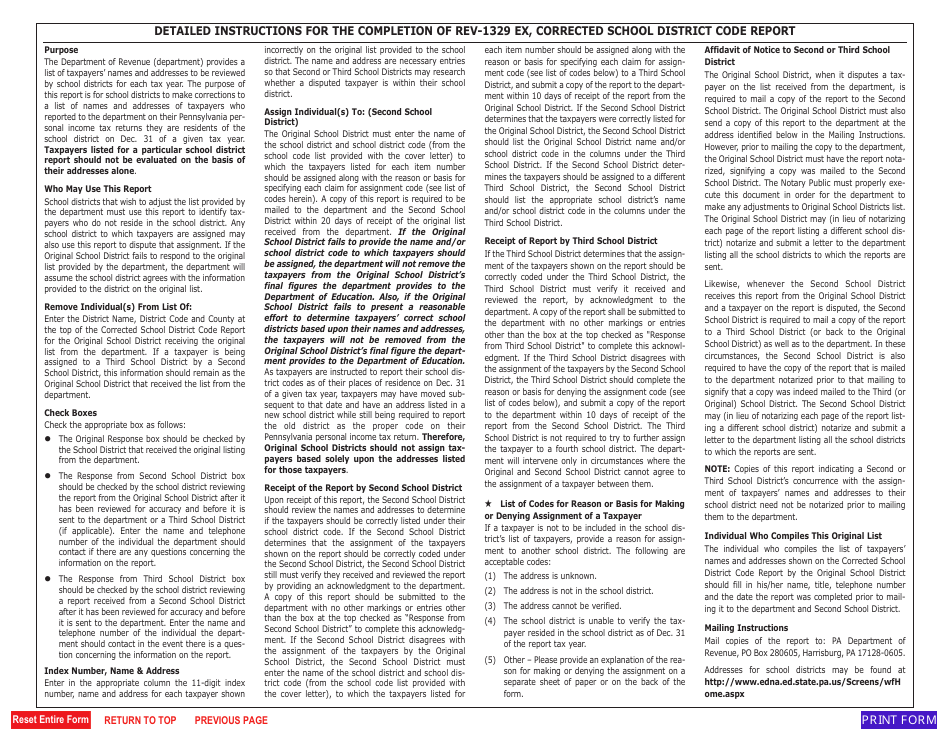

Form REV-1329

for the current year.

Form REV-1329 Corrected School District Code Report - Pennsylvania

What Is Form REV-1329?

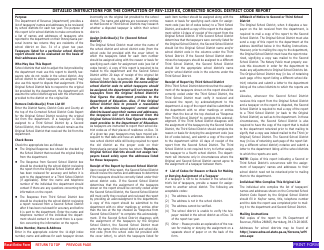

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1329?

A: Form REV-1329 is the Corrected School District Code Report used in Pennsylvania.

Q: What is the purpose of Form REV-1329?

A: The purpose of Form REV-1329 is to report corrected school district codes in Pennsylvania.

Q: Who needs to file Form REV-1329?

A: Taxpayers or businesses in Pennsylvania who need to correct their school district codes must file Form REV-1329.

Q: When should Form REV-1329 be filed?

A: Form REV-1329 should be filed as soon as a taxpayer or business discovers an error in their school district code in Pennsylvania.

Q: Is there a fee for filing Form REV-1329?

A: No, there is no fee for filing Form REV-1329.

Q: Can Form REV-1329 be filed electronically?

A: Yes, Form REV-1329 can be filed electronically through the Pennsylvania Department of Revenue's e-file system.

Q: What happens after I file Form REV-1329?

A: After filing Form REV-1329, the Pennsylvania Department of Revenue will review your correction and update your school district code accordingly.

Q: What are the consequences of not filing Form REV-1329?

A: Failure to file Form REV-1329 may result in incorrect allocation of tax payments and penalties.

Q: Can I file Form REV-1329 if I am not a taxpayer in Pennsylvania?

A: No, Form REV-1329 is specifically for taxpayers or businesses in Pennsylvania who need to correct their school district codes.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1329 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.