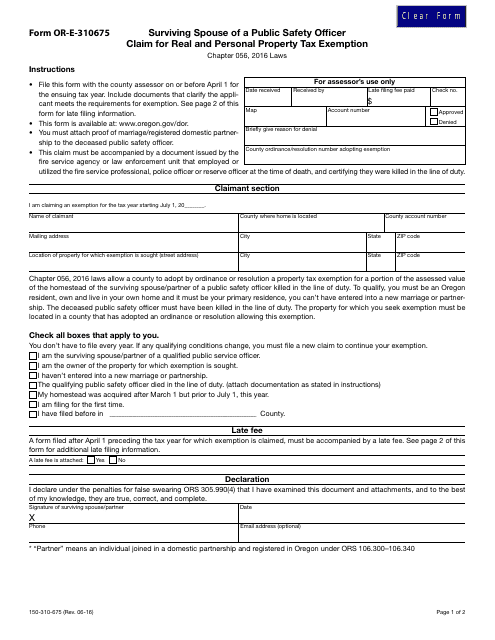

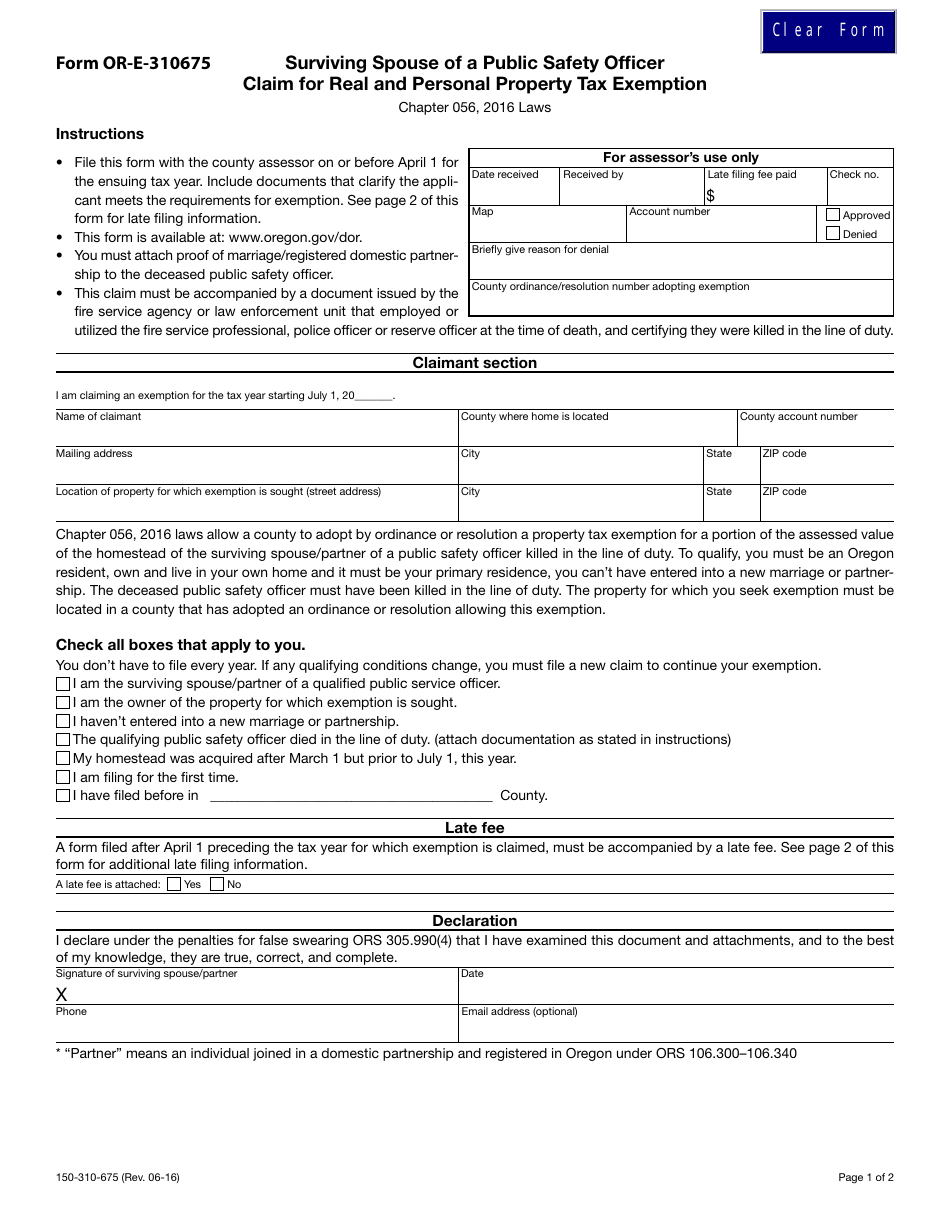

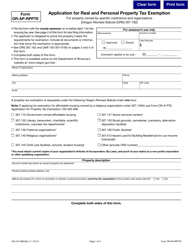

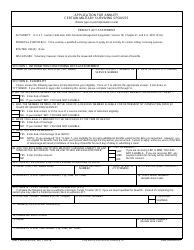

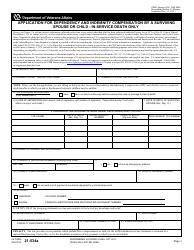

Form OR-E-310675 Surviving Spouse of a Public Safety Officer, Claim for Real and Personal Property Tax Exemption - Oregon

What Is Form OR-E-310675?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-E-310675?

A: Form OR-E-310675 is the Claim for Real and Personal Property Tax Exemption for Surviving Spouse of a Public Safety Officer in Oregon.

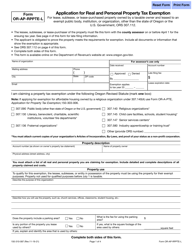

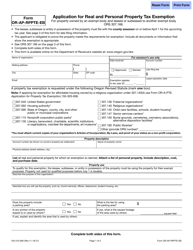

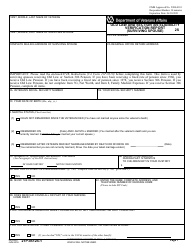

Q: Who is eligible to file Form OR-E-310675?

A: Surviving spouses of public safety officers who were killed in the line of duty are eligible to file Form OR-E-310675.

Q: What is the purpose of Form OR-E-310675?

A: The purpose of Form OR-E-310675 is to claim a real and personal property tax exemption for qualifying surviving spouses of public safety officers in Oregon.

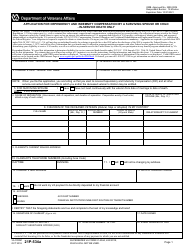

Q: What documents do I need to submit with Form OR-E-310675?

A: You will need to submit a copy of the death certificate of the public safety officer and any other supporting documents as required by the form.

Q: When should I file Form OR-E-310675?

A: You should file Form OR-E-310675 by April 15th of the tax year for which you are claiming the exemption.

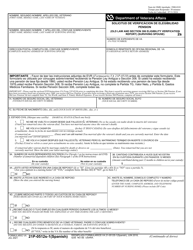

Q: Is there a fee to file Form OR-E-310675?

A: No, there is no fee to file Form OR-E-310675.

Q: Can I electronically file Form OR-E-310675?

A: Yes, you can electronically file Form OR-E-310675 if your county assessor's office supports electronic filing.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-E-310675 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.