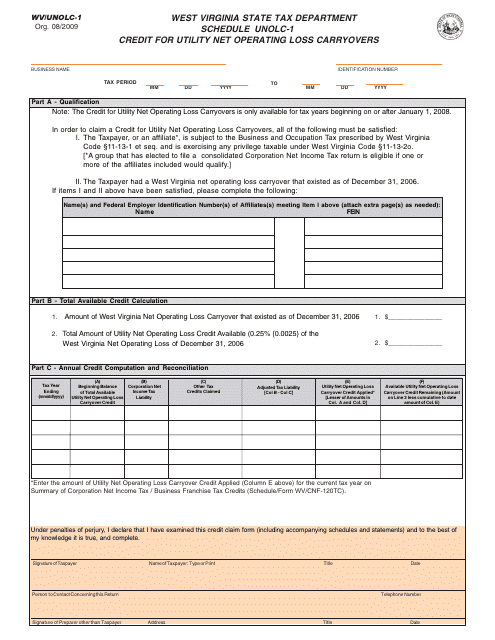

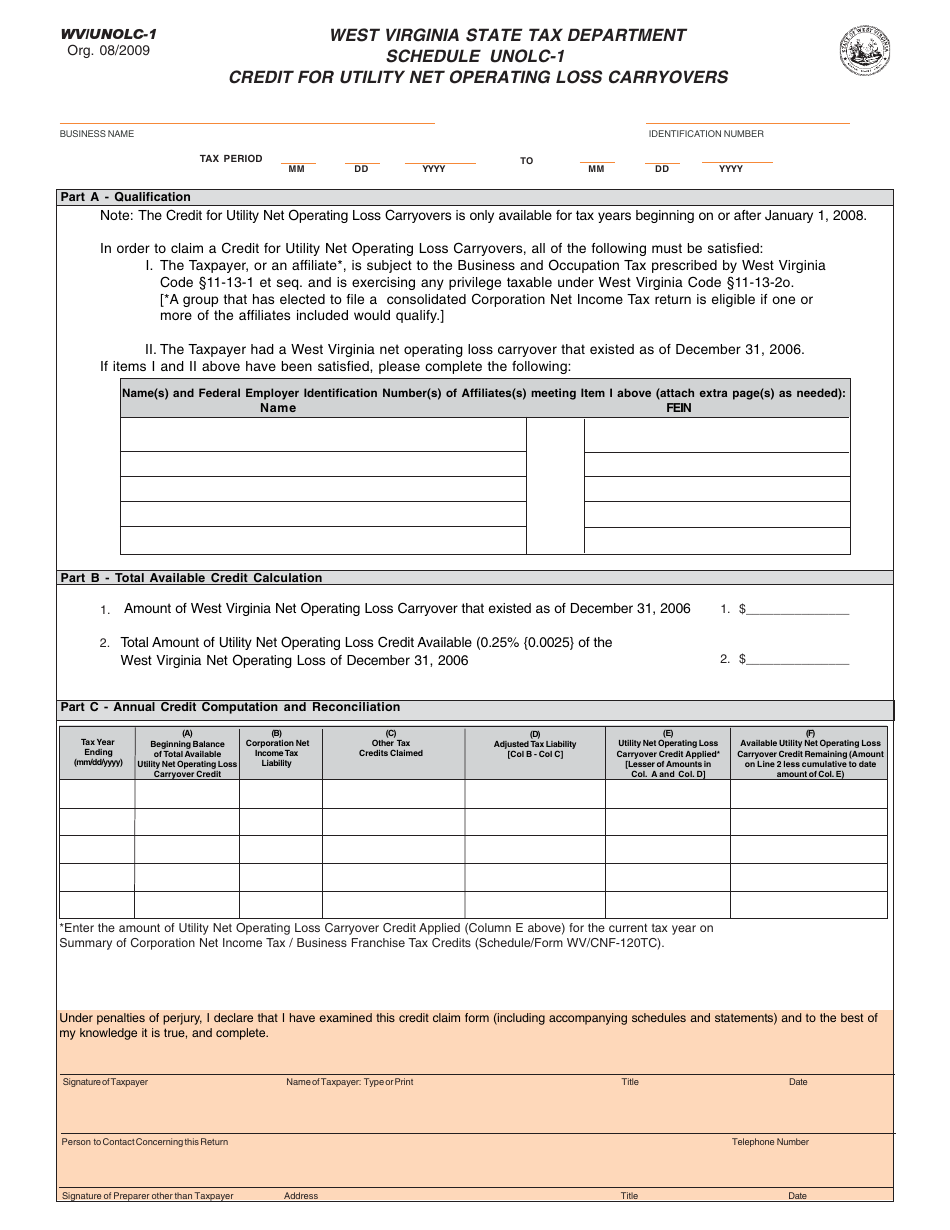

Form WV / UNOLC-1 Schedule UNOLC-1 Credit for Utility Net Operating Loss Carryovers - West Virginia

What Is Form WV/UNOLC-1 Schedule UNOLC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/UNOLC-1?

A: Form WV/UNOLC-1 is a schedule used to claim credit for utility net operating loss carryovers in West Virginia.

Q: What is a net operating loss carryover?

A: A net operating loss carryover is a tax provision that allows a business to use losses from previous years to offset future profits and reduce its tax liability.

Q: Who can use Form WV/UNOLC-1?

A: Form WV/UNOLC-1 is specifically for utility companies in West Virginia that have net operating loss carryovers.

Q: What is the purpose of Form WV/UNOLC-1?

A: The purpose of Form WV/UNOLC-1 is to provide utility companies in West Virginia with a way to claim credit for their net operating loss carryovers.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/UNOLC-1 Schedule UNOLC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.