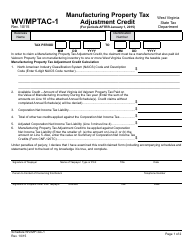

This version of the form is not currently in use and is provided for reference only. Download this version of

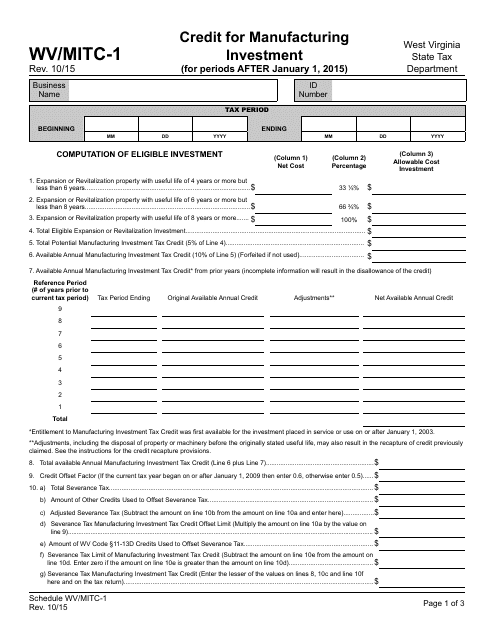

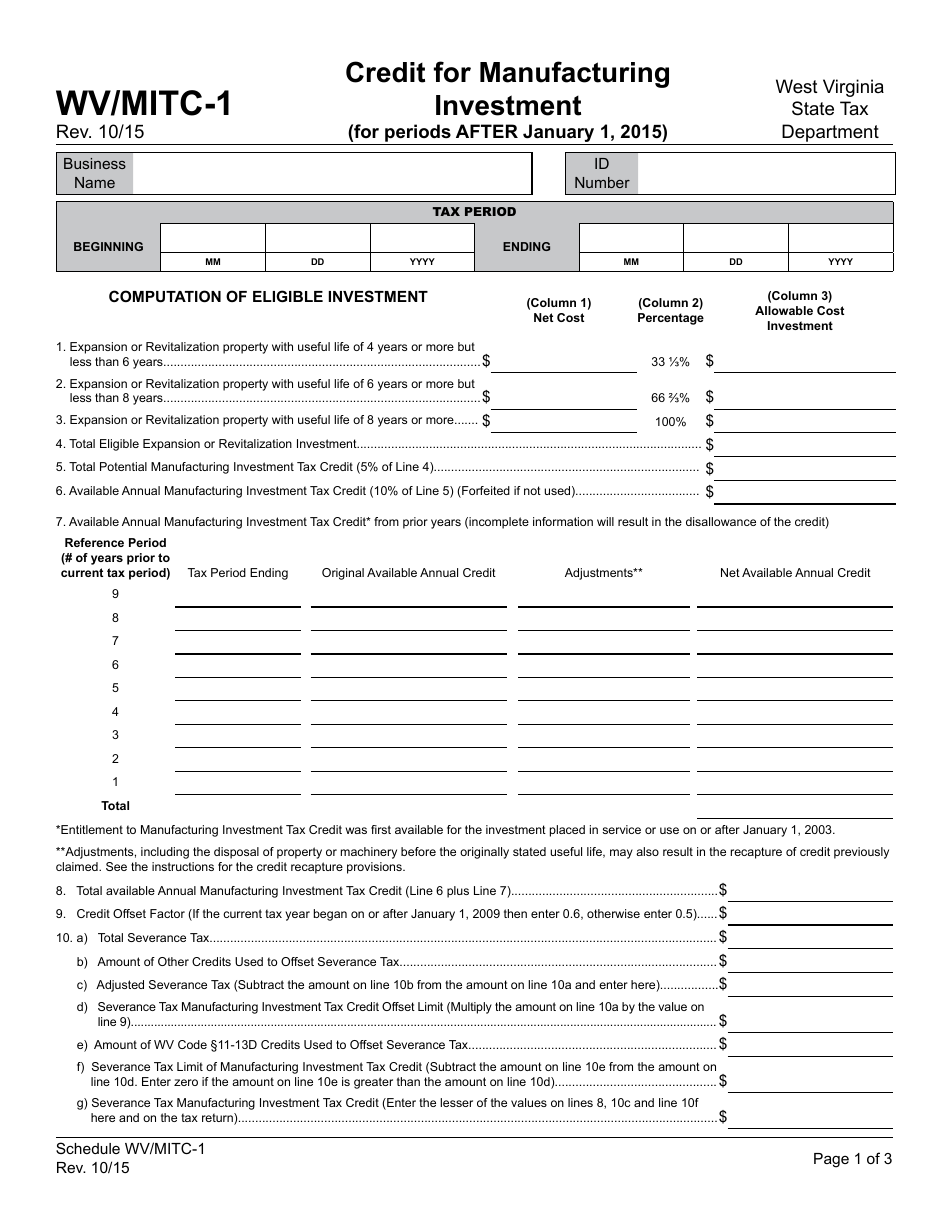

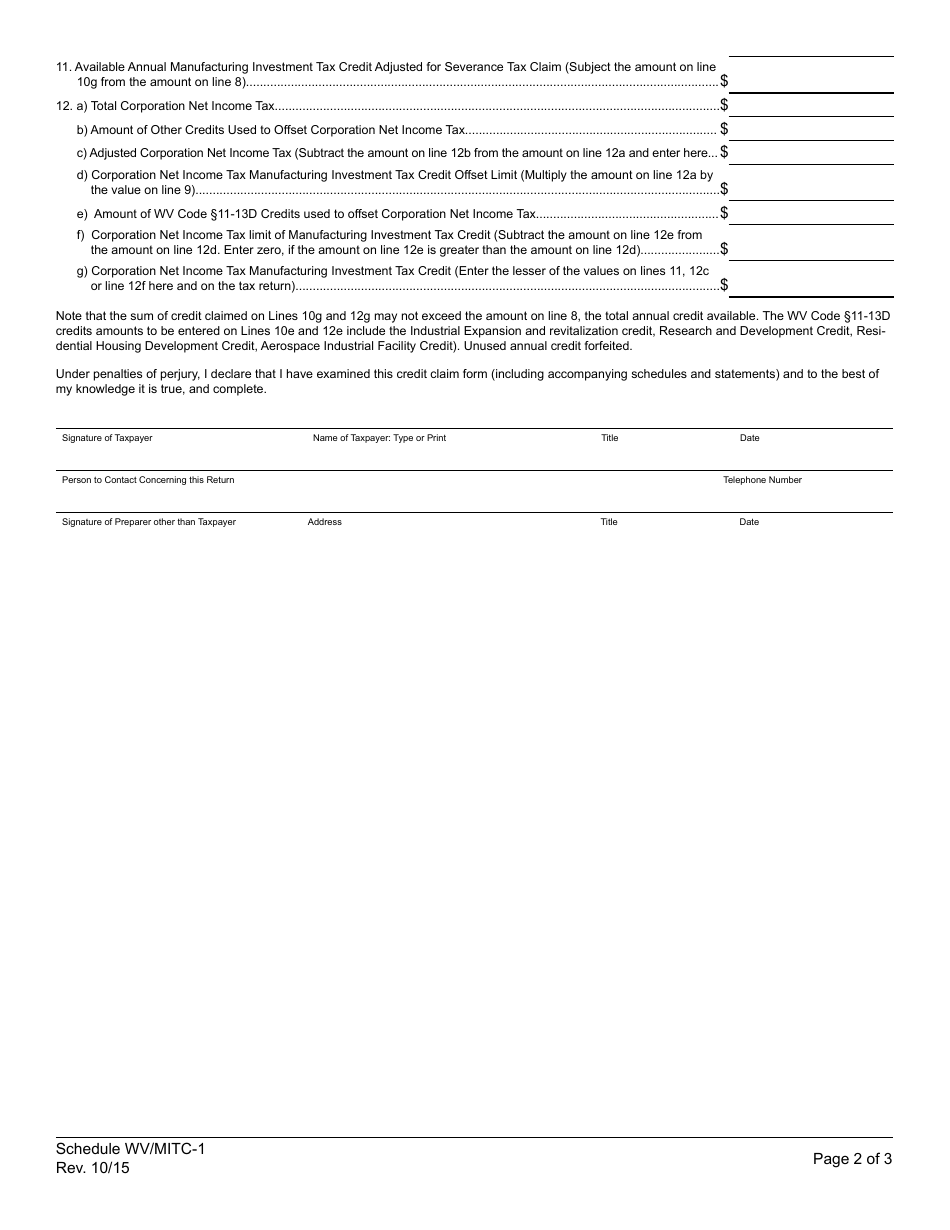

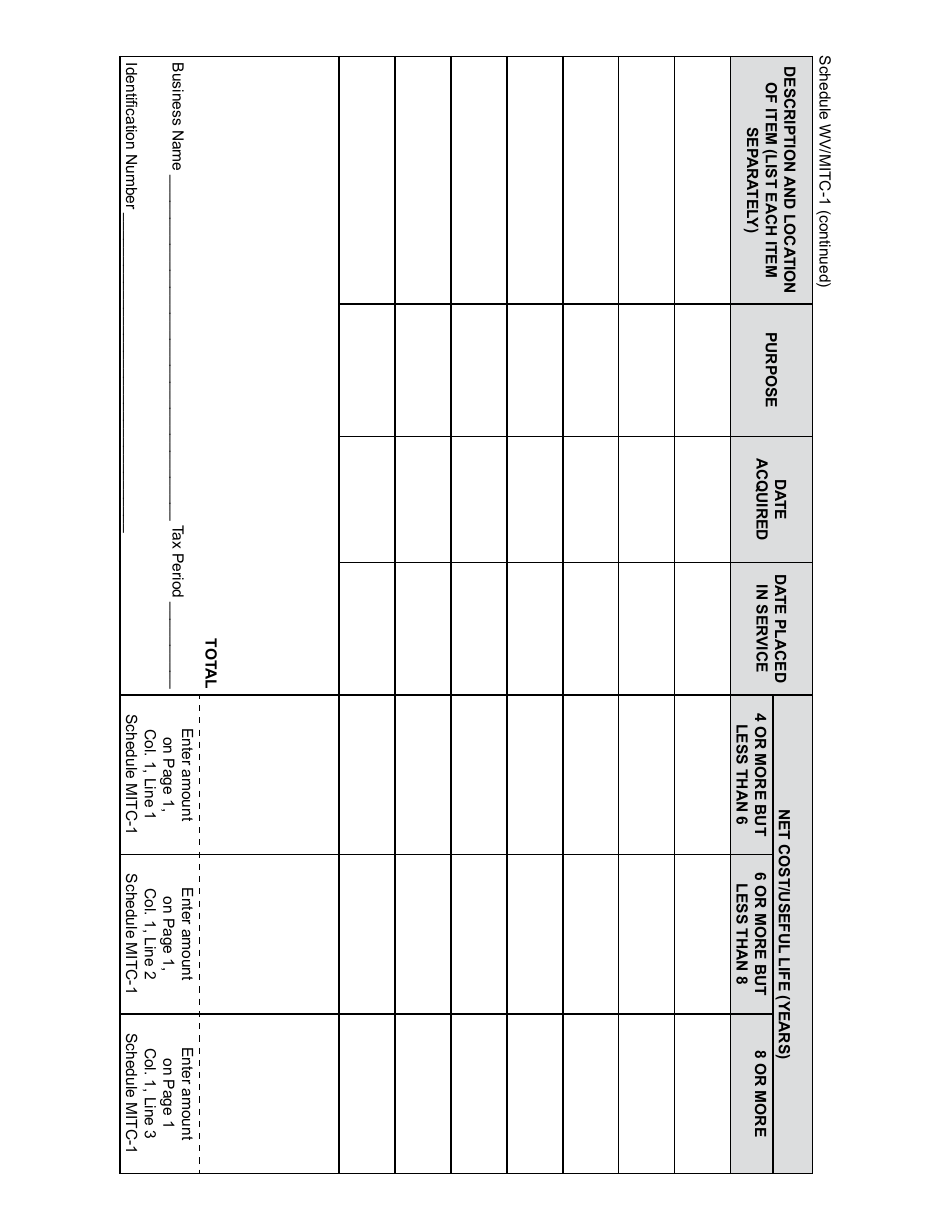

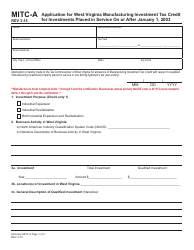

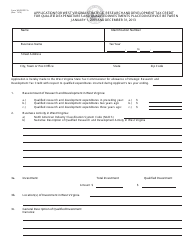

Schedule WV/MITC-1

for the current year.

Schedule WV / MITC-1 Credit for Manufacturing Investment (For Periods After January 1, 2015) - West Virginia

What Is Schedule WV/MITC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/MITC-1 Credit for Manufacturing Investment?

A: The WV/MITC-1 Credit for Manufacturing Investment is a tax credit available in West Virginia for qualifying manufacturing investments.

Q: When is the WV/MITC-1 Credit available?

A: The WV/MITC-1 Credit is available for periods after January 1, 2015.

Q: Who is eligible for the WV/MITC-1 Credit?

A: Manufacturers in West Virginia who make qualifying investments may be eligible for this credit.

Q: What is considered a qualifying investment for the WV/MITC-1 Credit?

A: Qualifying investments for the WV/MITC-1 Credit include expenditures on qualified depreciable property used in manufacturing.

Q: How much is the WV/MITC-1 Credit?

A: The WV/MITC-1 Credit is equal to 5% of the qualified investment made by the manufacturer.

Q: Are there any limitations on the WV/MITC-1 Credit?

A: Yes, the credit is subject to certain limitations and may not exceed the tax liability of the manufacturer.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule WV/MITC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.