This version of the form is not currently in use and is provided for reference only. Download this version of

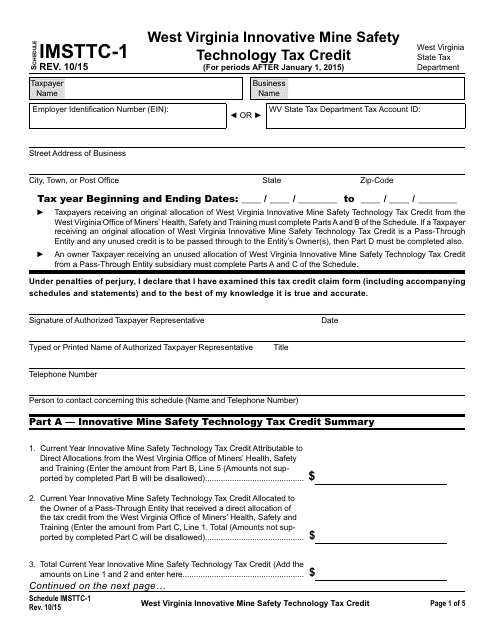

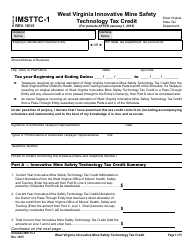

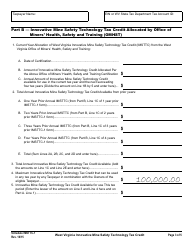

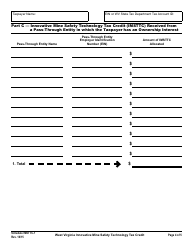

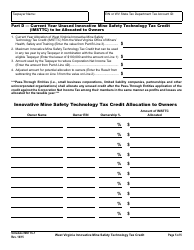

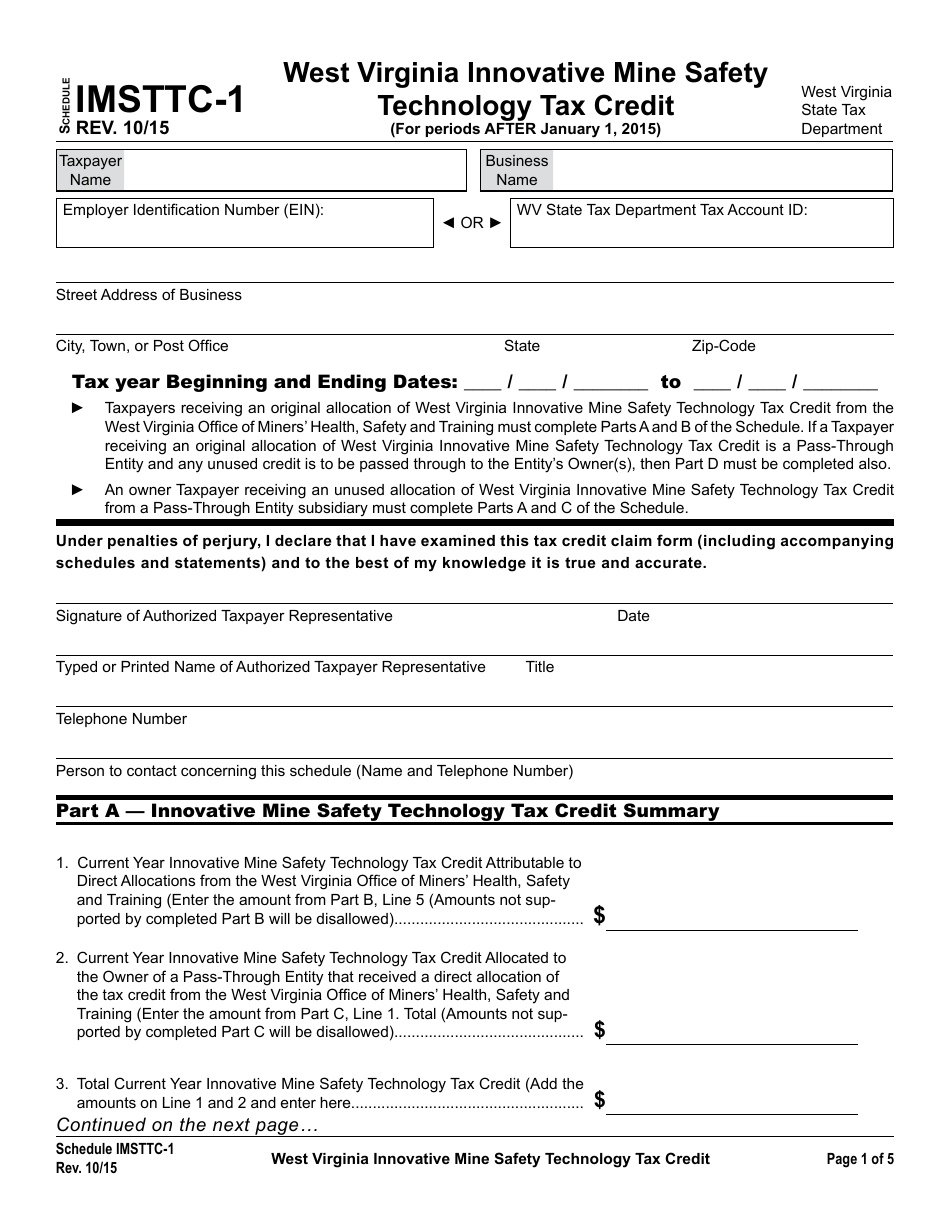

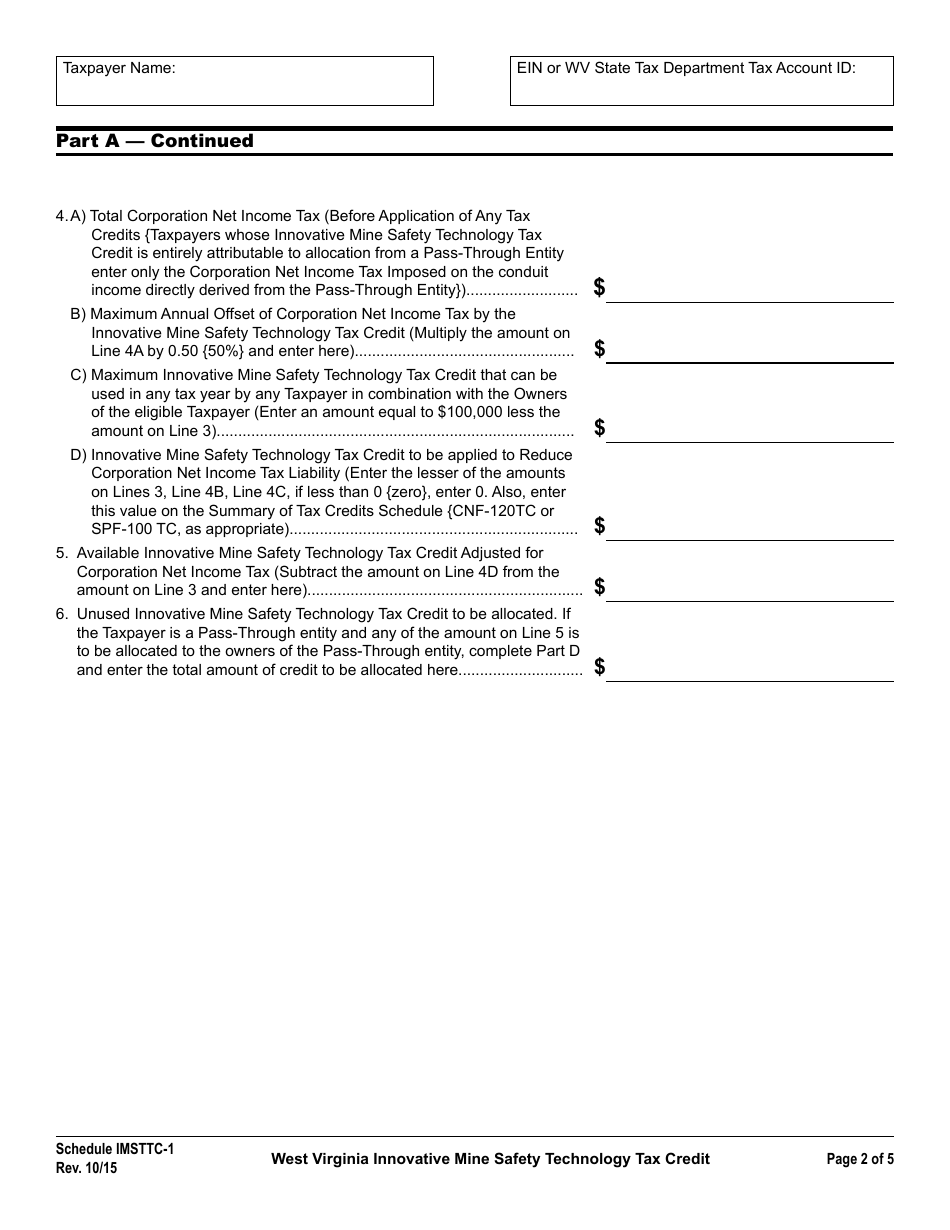

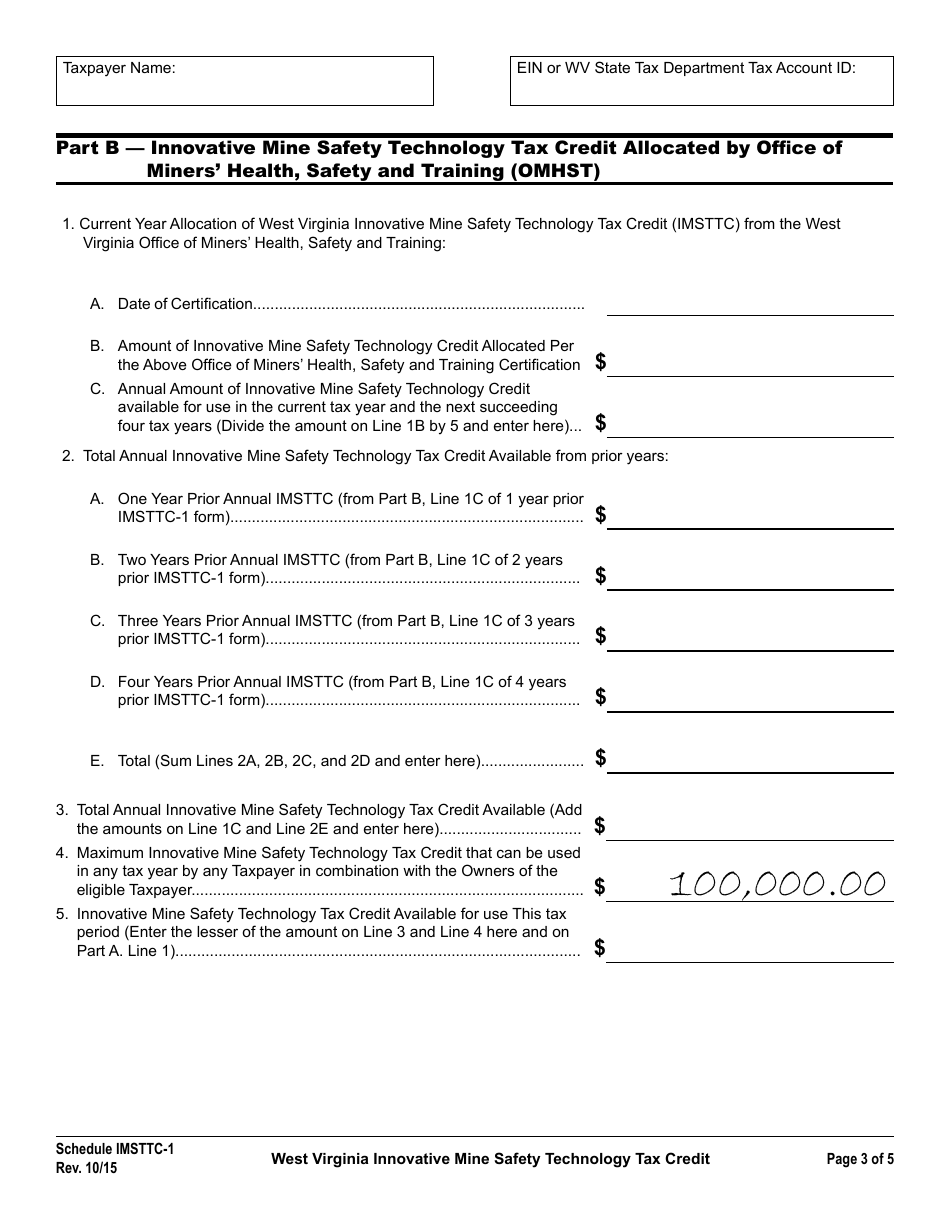

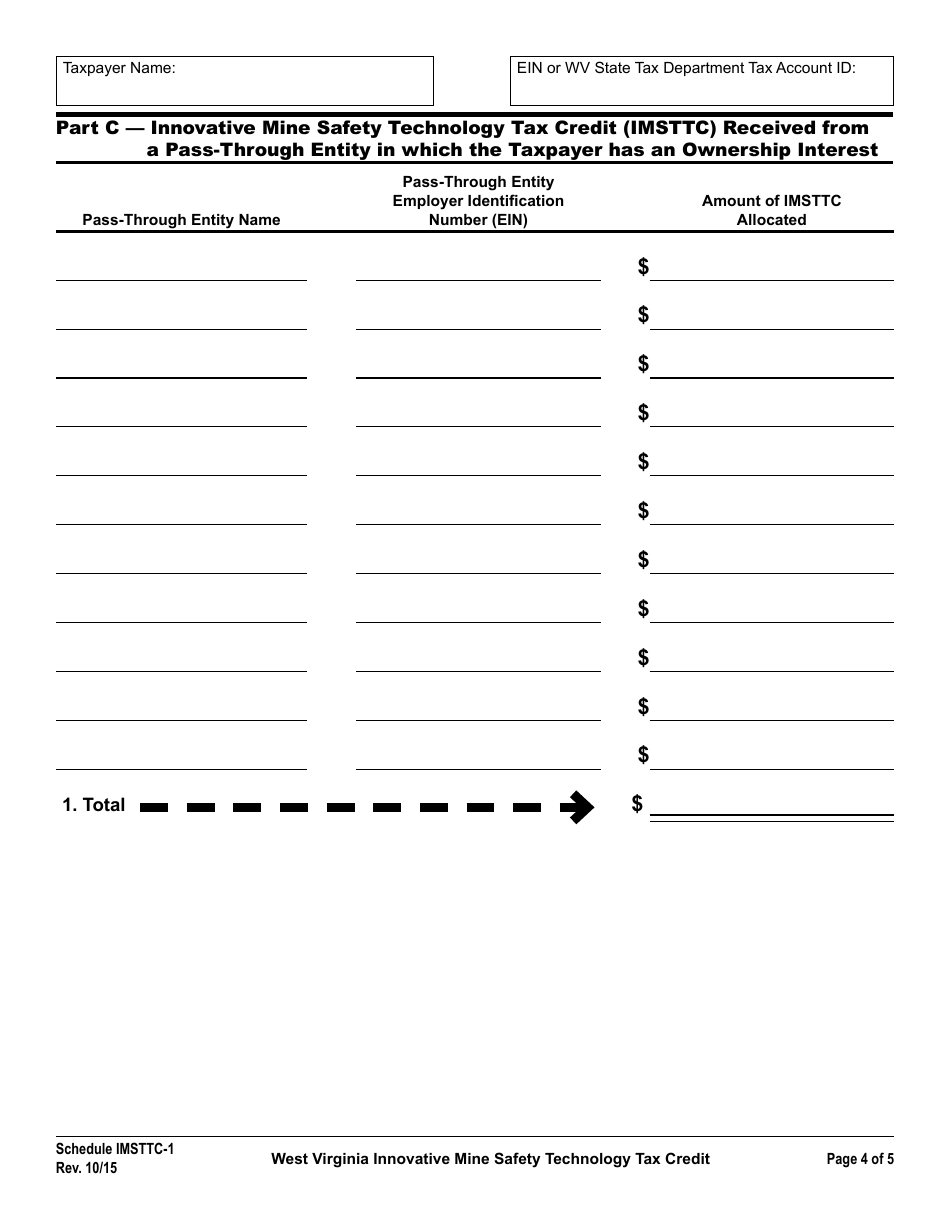

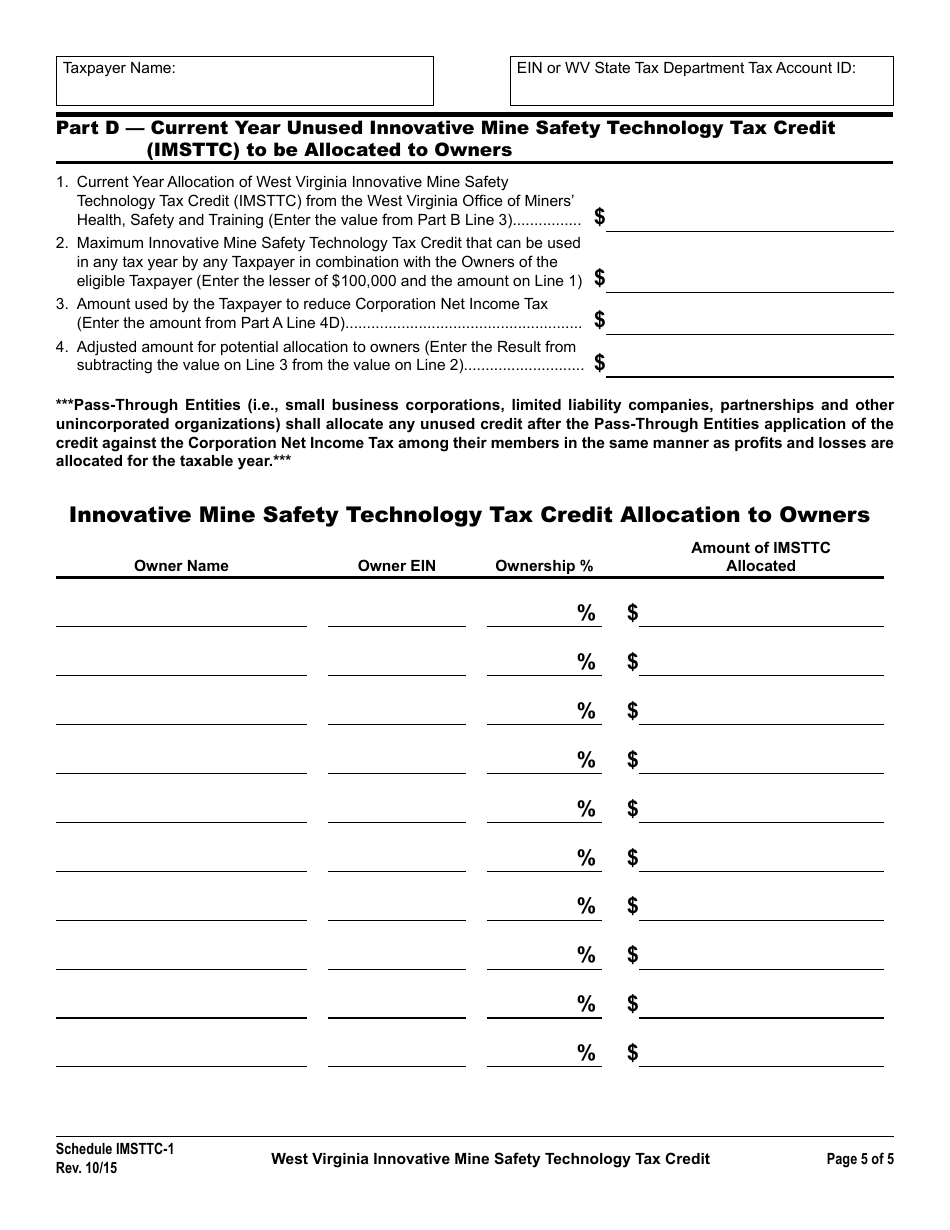

Schedule IMSTTC-1

for the current year.

Schedule IMSTTC-1 West Virginia Innovative Mine Safety Technology Tax Credit - West Virginia

What Is Schedule IMSTTC-1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IMSTTC-1?

A: IMSTTC-1 stands for West Virginia Innovative Mine Safety Technology Tax Credit.

Q: What is the purpose of the IMSTTC-1?

A: The purpose of IMSTTC-1 is to promote the development and use of innovative mine safety technology.

Q: What is the benefit of IMSTTC-1?

A: The benefit of IMSTTC-1 is that it provides tax credits to companies developing or using innovative mine safety technology in West Virginia.

Q: Who is eligible for IMSTTC-1?

A: Companies involved in the development or use of innovative mine safety technology in West Virginia are eligible for IMSTTC-1.

Q: How can companies apply for IMSTTC-1?

A: Companies can apply for IMSTTC-1 by following the application process specified by the West Virginia Department of Commerce.

Q: Is there a deadline for applying for IMSTTC-1?

A: Yes, there is a deadline for applying for IMSTTC-1. Companies need to submit their applications by a specified date, as determined by the West Virginia Department of Commerce.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule IMSTTC-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.