This version of the form is not currently in use and is provided for reference only. Download this version of

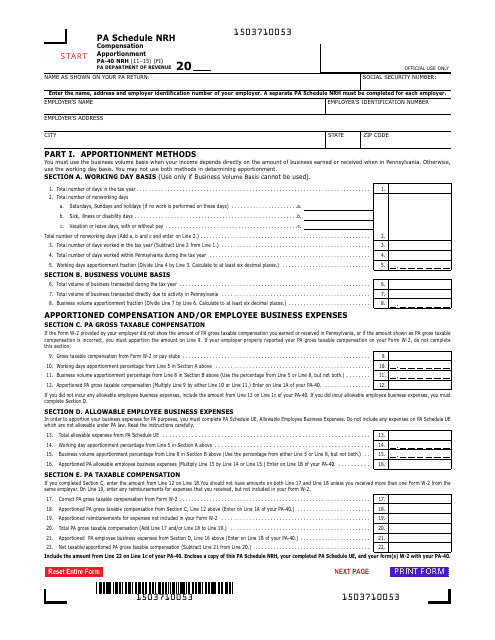

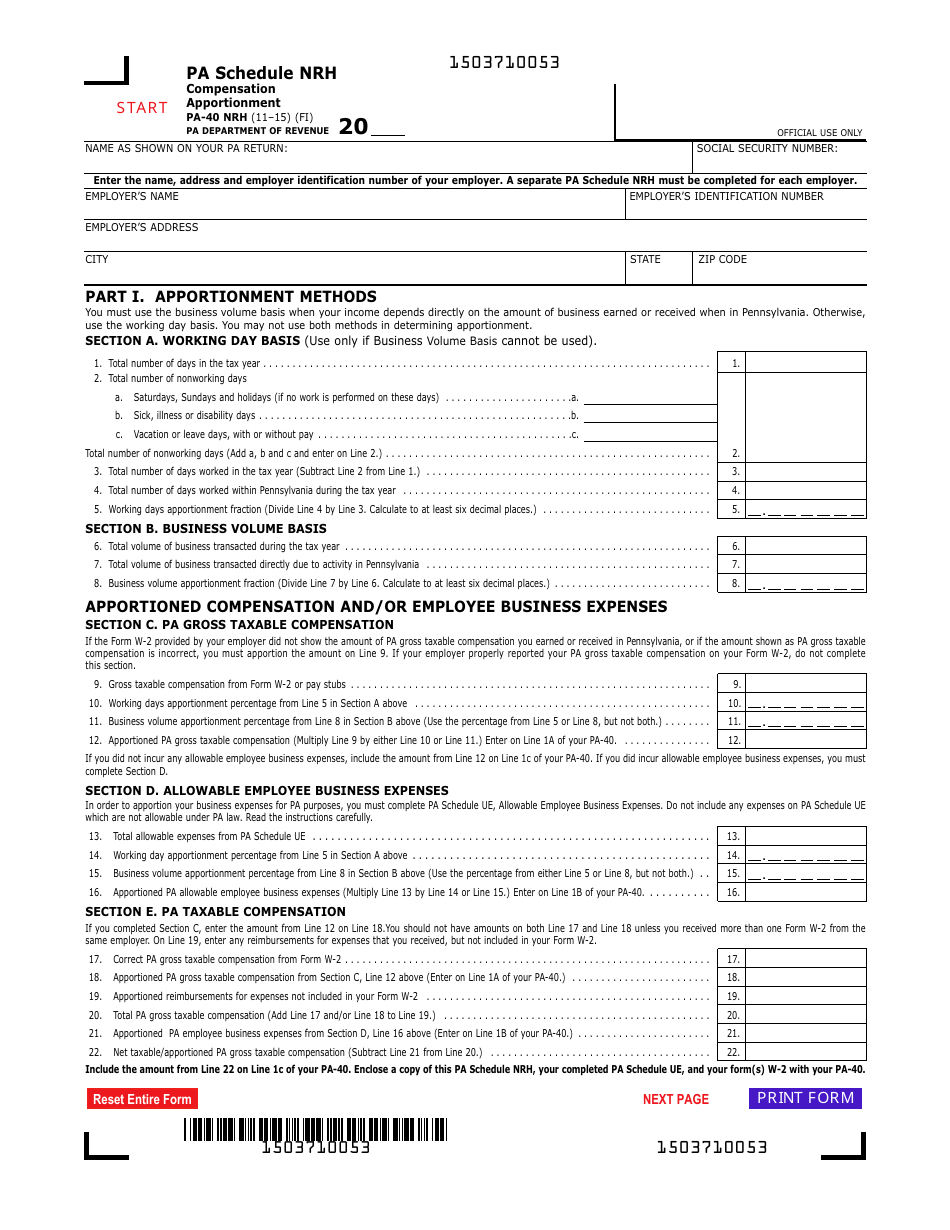

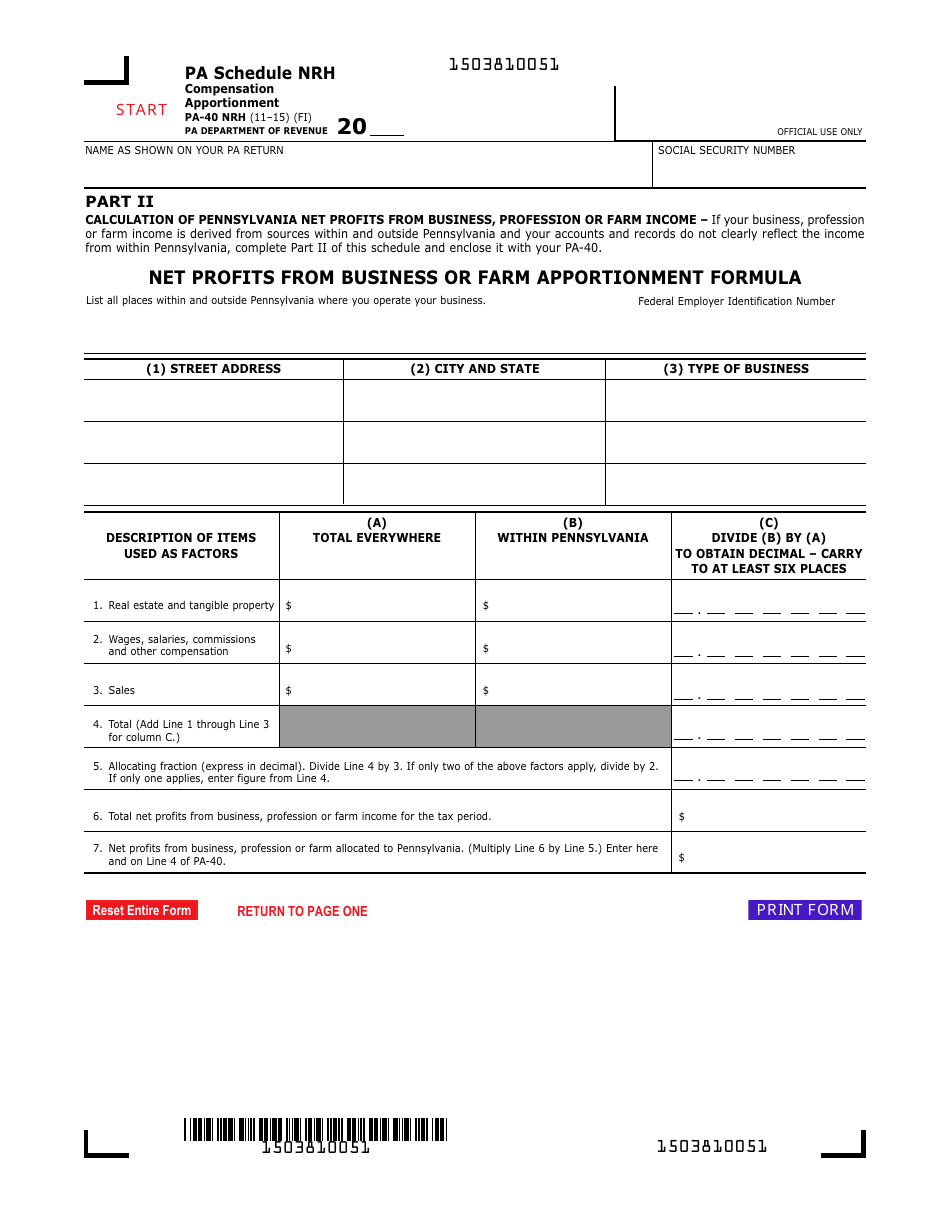

Form PA-40 Schedule NRH

for the current year.

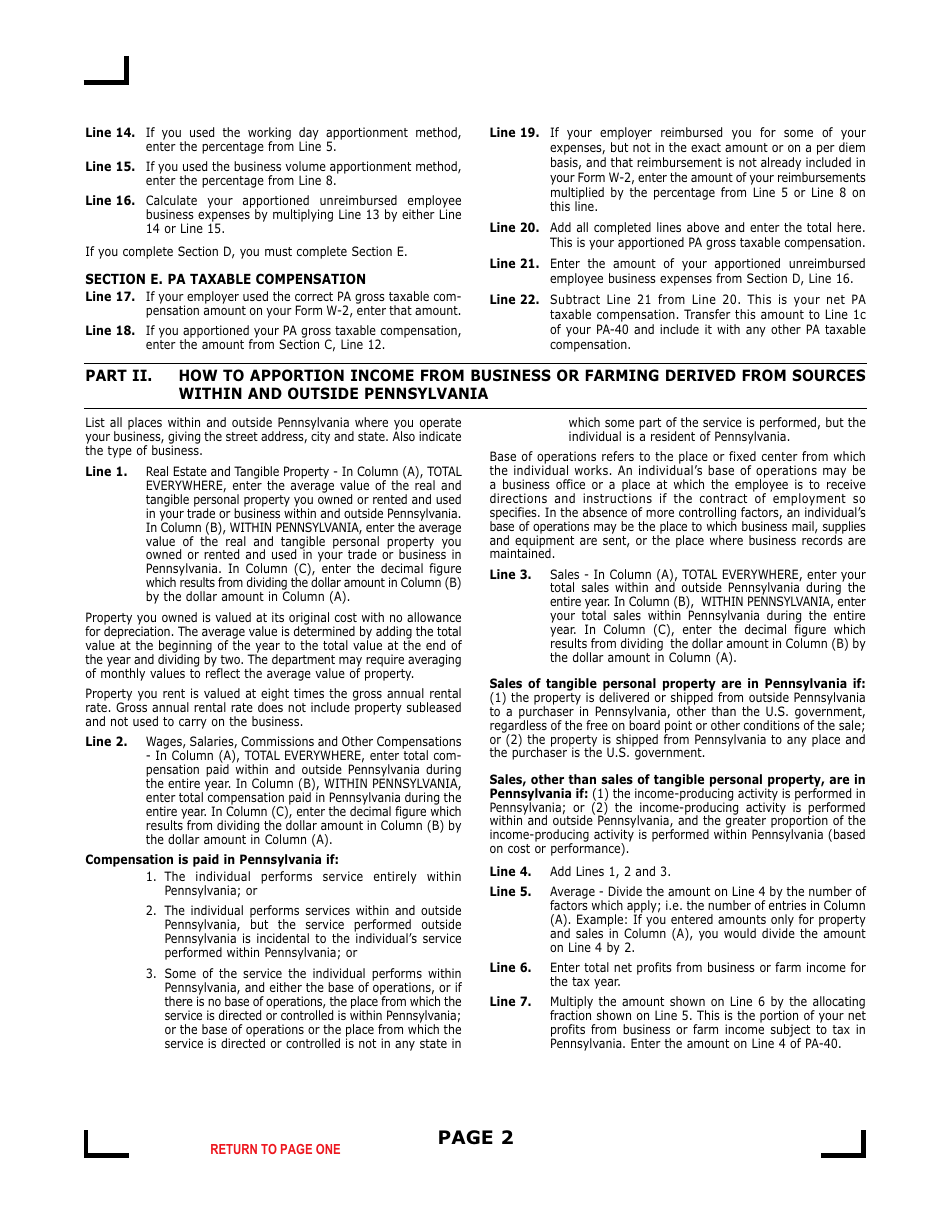

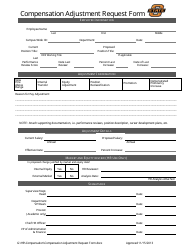

Form PA-40 Schedule NRH Compensation Apportionment - Pennsylvania

What Is Form PA-40 Schedule NRH?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule NRH?

A: PA-40 Schedule NRH is a form used in Pennsylvania to apportion compensation.

Q: What does compensation apportionment mean?

A: Compensation apportionment is the process of dividing and allocating income based on different factors, such as the location of work.

Q: Who needs to fill out PA-40 Schedule NRH?

A: PA-40 Schedule NRH should be filled out by taxpayers who have income from multiple states and want to apportion their compensation.

Q: Why is compensation apportionment necessary?

A: Compensation apportionment is necessary to determine the correct amount of income that should be attributed to each state for tax purposes.

Q: How does PA-40 Schedule NRH work?

A: PA-40 Schedule NRH calculates the apportionment of compensation based on the taxpayer's work location and the number of days worked in each state.

Form Details:

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule NRH by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.