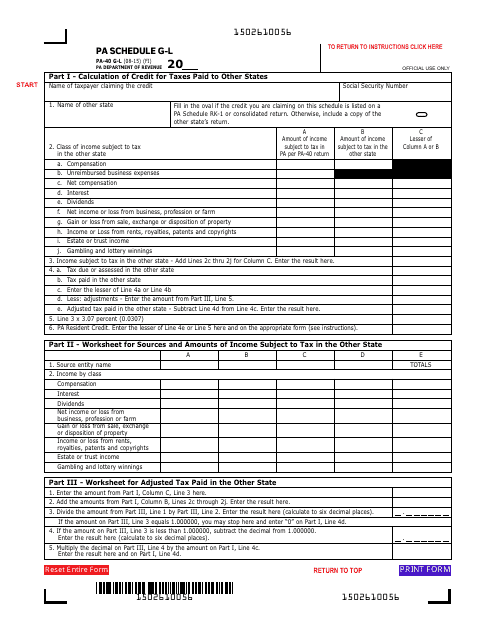

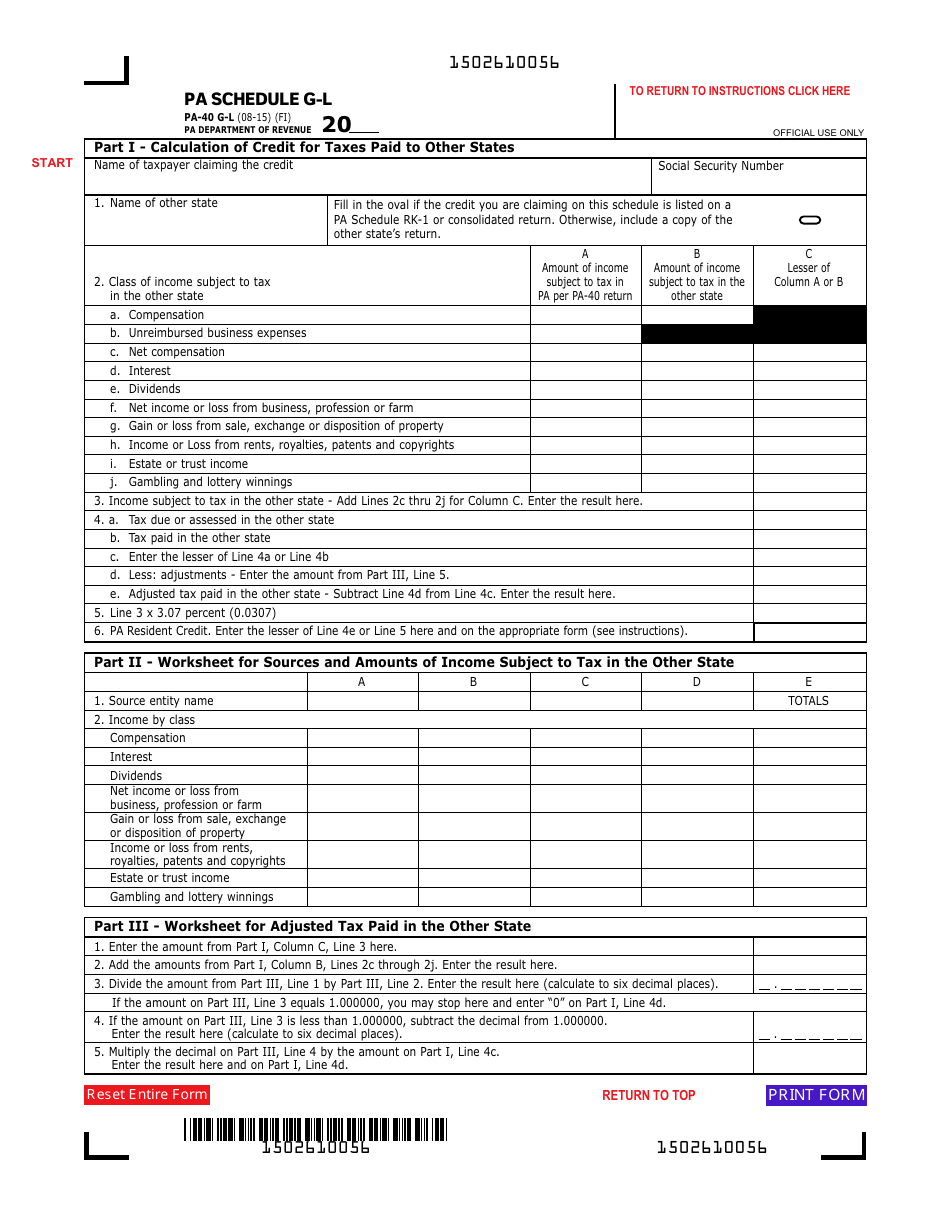

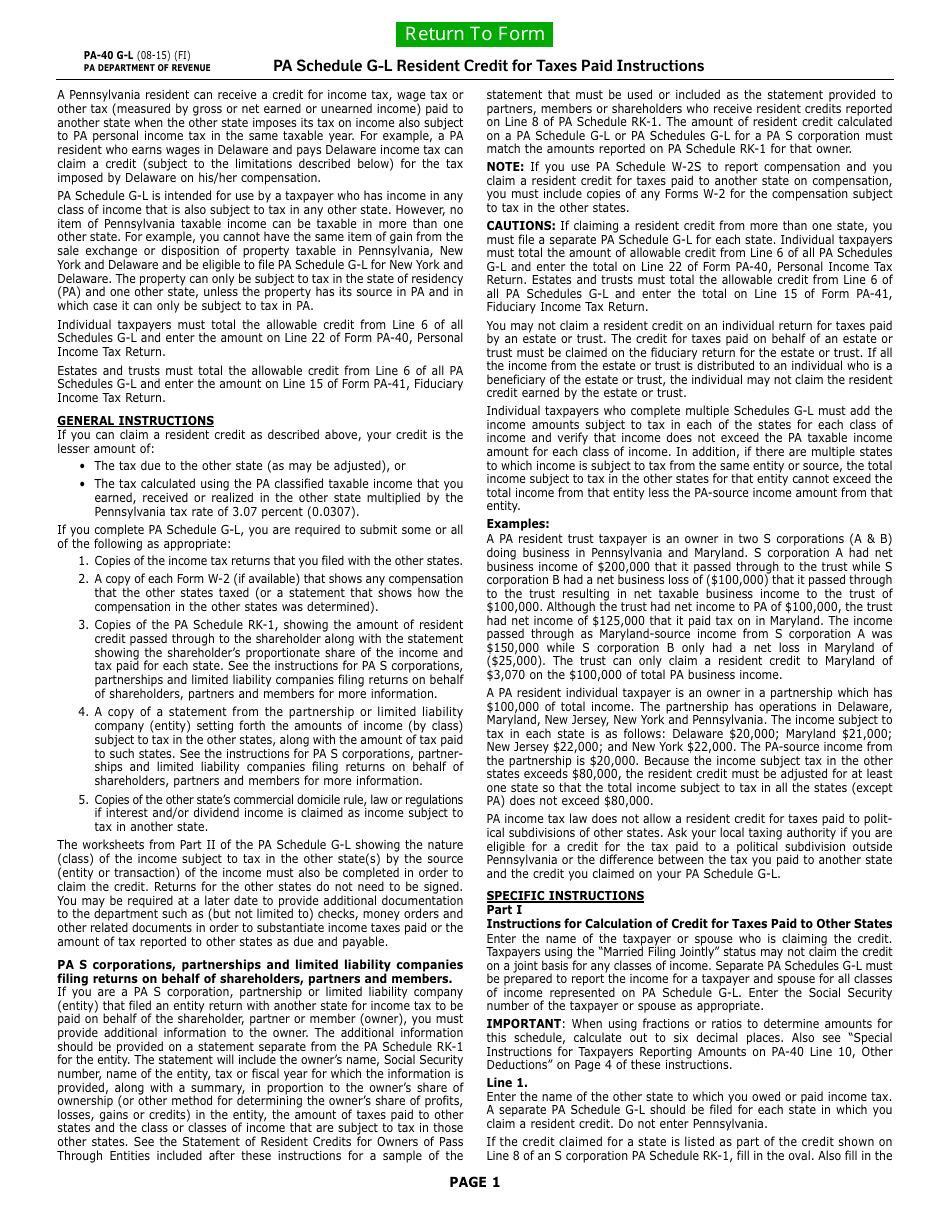

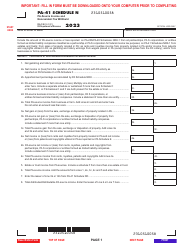

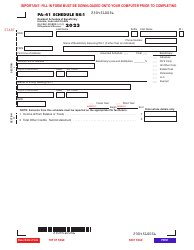

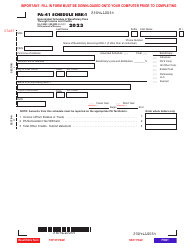

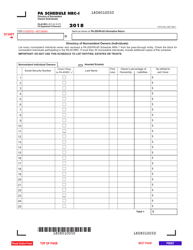

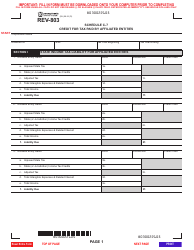

Form PA-40 Schedule G-L Resident Credit for Taxes Paid - Pennsylvania

What Is Form PA-40 Schedule G-L?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PA-40 Schedule G-L?

A: The PA-40 Schedule G-L is a form used to calculate the Resident Credit for Taxes Paid in Pennsylvania.

Q: What is the purpose of the Resident Credit for Taxes Paid?

A: The purpose of the Resident Credit for Taxes Paid is to provide a credit to Pennsylvania residents for income taxes paid to other states.

Q: Who is eligible for the Resident Credit for Taxes Paid?

A: Pennsylvania residents who have paid income taxes to another state are eligible for the Resident Credit for Taxes Paid.

Q: How do I calculate the Resident Credit for Taxes Paid?

A: To calculate the Resident Credit for Taxes Paid, you will need to complete the PA-40 Schedule G-L and enter the relevant information about your income taxes paid to another state.

Q: When is the deadline to file the PA-40 Schedule G-L?

A: The deadline to file the PA-40 Schedule G-L is the same as the deadline to file your Pennsylvania state income tax return, generally April 15th.

Q: Are there any limitations on the Resident Credit for Taxes Paid?

A: Yes, there are certain limitations on the Resident Credit for Taxes Paid. These limitations include a cap on the total amount of credit that can be claimed and restrictions on the types of taxes that qualify for the credit.

Q: Can I claim the Resident Credit for Taxes Paid if I didn't pay taxes to another state?

A: No, you can only claim the Resident Credit for Taxes Paid if you have actually paid income taxes to another state.

Q: What should I do if I made an error on my PA-40 Schedule G-L?

A: If you made an error on your PA-40 Schedule G-L, you should file an amended return with the correct information or contact the Pennsylvania Department of Revenue for assistance.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule G-L by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.